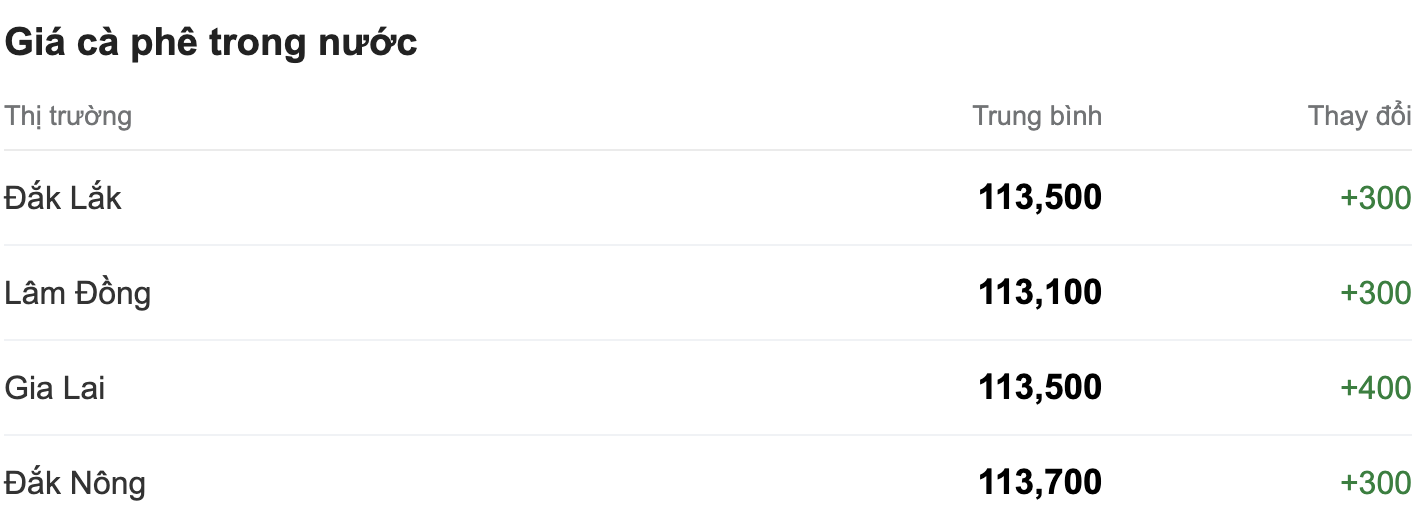

As of 1:00 p.m. today (November 18), the domestic coffee market has slightly increased, increasing by an average of VND300/kg, causing prices to fluctuate between VND113,100 - VND113,700/kg. The average coffee purchase price in the Central Highlands provinces is VND113,600/kg.

Gia Lai province today purchased coffee at 113,500 VND/kg, reversing the strongest increase of 400 VND/kg.

In the same direction, Dak Lak province recorded an increase of 100 VND less than Gia Lai region, currently listed at 113,500 VND/kg.

Lam Dong is still the province with the lowest coffee purchase price in the Central Highlands. Compared to yesterday's closing price, the coffee price in this region stood at 113,100 VND/kg.

Notably, coffee prices in Dak Nong province still maintain the top position in the country despite only increasing by 300 VND/kg, approaching the 114,000 VND/kg mark.

At the end of last week's session, domestic coffee prices decreased slightly but immediately reversed and increased far above the 110,000 VND/kg mark this week.

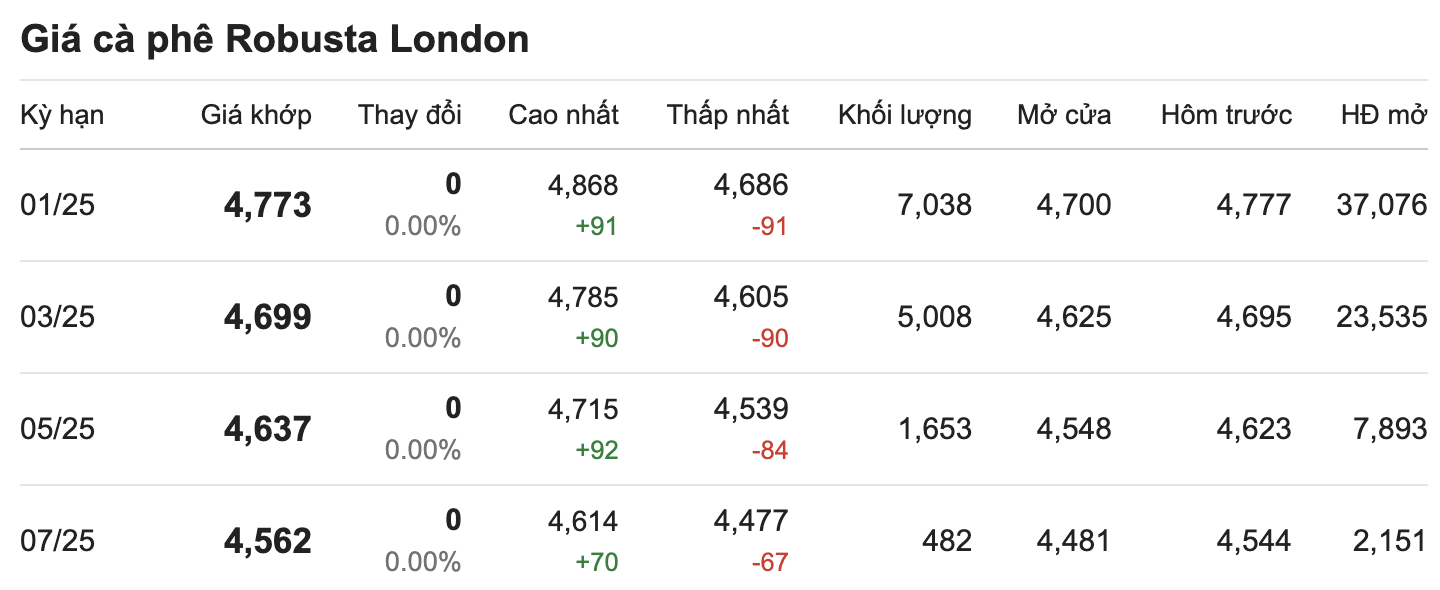

On the London and New York exchanges, the coffee market did not record any changes in all terms. The January 2025 contract and the March 2025 contract were both unchanged, listed at $4,773/ton and $4,699/ton, respectively.

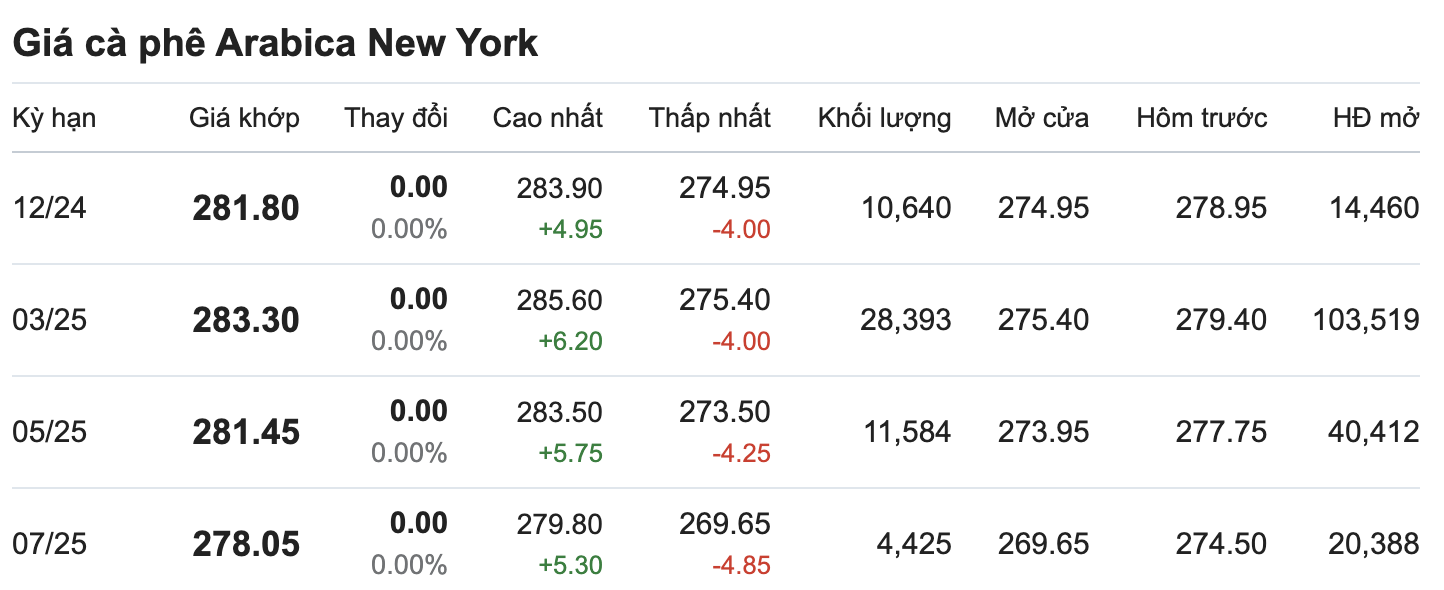

Similarly, the developments in the New York Arabica coffee market for December 2024 and March 2025 delivery terms also recorded a sideways trend compared to yesterday's closing session, currently standing at 281.80 cents/lb and 283.30 cents/lb.

According to experts, Robusta coffee is recovering and growing. The new harvest from Vietnam is expected to reach the global market in the first half of 2025. Meanwhile, the new Robusta harvests from Indonesia, Brazil and Uganda will have to wait until the second half of 2025. This continues to be one of the driving forces for higher coffee prices.

The European Parliament’s decision to change deforestation rules, requiring importers to ensure that coffee is not grown on deforested land after 2020, has pushed Arabica prices to a 13-year high and Robusta to a one-month high. If the EU fails to reach a final deal by next month’s deadline, the law will be enforced. The new regulation (EUDR) could reduce supplies from Brazil and Indonesia, contributing to higher prices on the market.