The Ministry of Home Affairs has just issued Circular 002/2025 on amending and supplementing a number of articles of Circular No. 01/2025 dated January 17, 2025 of the Minister of Home Affairs.

This Circular guides the implementation of policies and regimes for cadres, civil servants, public employees, and workers (including those working in key organizations) in agencies, organizations, and units specified in Article 1 of Decree 178/2024/ND-CP (amended and supplemented in Decree 67/2025/ND-CP) in the process of reorganizing the apparatus and administrative units at all levels, streamlining the payroll, restructuring and improving the quality of cadres, civil servants, and public employees in the political system, including:

How to determine the time and monthly salary to calculate policies and regimes; how to calculate policies for people retiring early;

How to calculate the severance pay for commune-level cadres, civil servants and public employees;

How to calculate the severance pay for civil servants and employees;

How to calculate policy benefits for people working in key organizations and implementing training and fostering policies to improve the qualifications of cadres, civil servants and public employees after the arrangement.

Circular 002/2025/TT-BNV clearly states that cadres, civil servants, public employees and workers specified in Article 2 of Circular No. 01/2025 (amended and supplemented in Clause 2, Article 1 of this Circular) who meet the conditions and are decided by competent authorities to retire early compared to the retirement age specified in Appendix I or Appendix II issued with Decree No. 135/2020/ND-CP, will receive immediate pension according to the provisions of the law on social insurance without having the pension rate deducted due to early retirement;

At the same time, they are entitled to a one-time pension; a subsidy according to the number of years of early retirement and a subsidy according to the working period with compulsory social insurance payment as prescribed in Articles 7, 7a and 7b of Decree No. 178/2024 (amended and supplemented in Clause 6, Clause 7 and Clause 8, Article 1 of Decree No. 67/2025).

In case of remaining 2 years to 5 years until the retirement age prescribed in Point a and Point c, Clause 2, Article 7 of Decree No. 178/2024/ND-CP, they are entitled to 3 allowances:

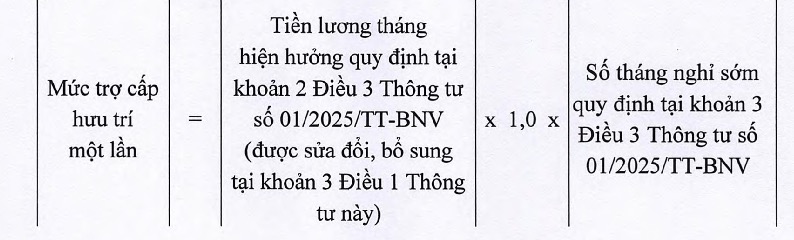

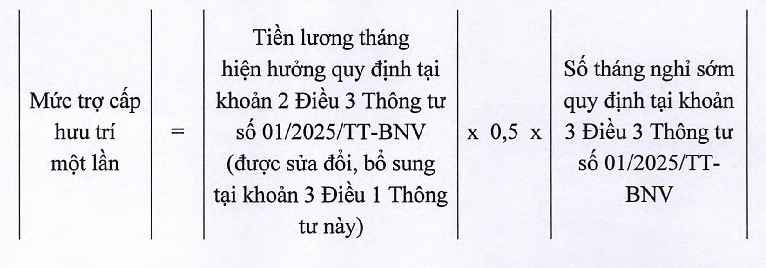

One-time pension for months of early retirement

For those who retire within the first 12 months:

For those who retire from the 13th month onwards:

Allowance for the number of years of early retirement: For each year of early retirement (12-month) receive 5 months of current salary

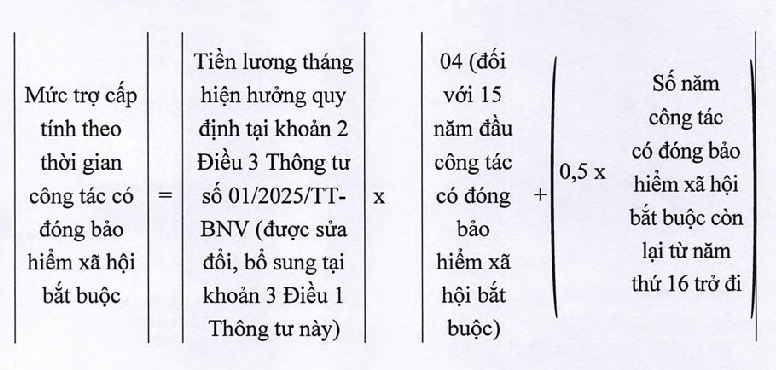

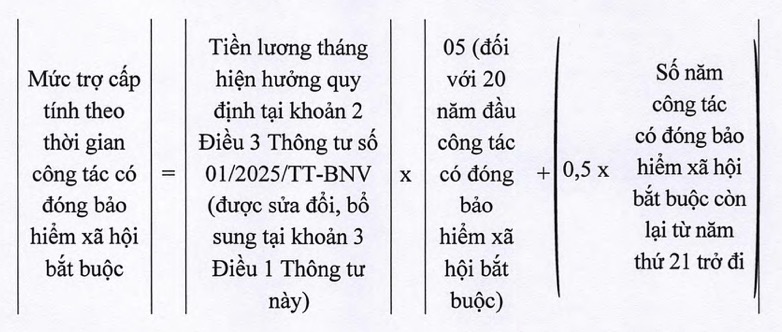

Allowance according to the working period with compulsory social insurance (SI)

For those who retire before the effective date of the Social Insurance Law 2024 (except for female commune-level cadres and civil servants), the allowance level is calculated as follows: For the first 20 years of work with compulsory social insurance contributions, they will receive a subsidy of 05 months of current salary; for the remaining years (from the 21st year onwards), each year will be subsidized with 0.5 months of current salary.

For female commune-level cadres and civil servants who retire from January 1, 2025 onwards and those who retire from the effective date of the Social Insurance Law 2024, the allowance level is calculated as follows: For the first 15 years of work with compulsory social insurance contributions, they will receive a subsidy of 4 months of current salary; for the remaining years (from the 16th year onwards), each year will be subsidized with 0.5 months of current salary.