Pushing borrowers into a spiral of overlapping interest

Reporting to Lao Dong Newspaper, Ms. Ly Thi Thuy (birth name changed, born in 1993), a worker at Thang Long Industrial Park (Dong Anh, Hanoi), said that her family was constantly harassed by calls and messages from unknown numbers, even photos of her and her relatives were posted on malicious websites.

According to Ms. Thuy, in April 2022, she received a call asking to pay the loan that she did not know. At this time, she or her husband used a photo of their ID card to borrow 500,000 VND through an application on the phone. When the debt collector contacted, the amount was pushed up to 875,000 VND.

Despite the small loan, her whole family was "terrorized" by hundreds of strange numbers on their phones for more than a month. "If it had not been discovered early, the interest would have reached an unimaginable level" - she was upset.

During a difficult time because she did not have a salary, her husband saw a quick loan advertisement online and tried to borrow, but unexpectedly fell into the trap of disguised black credit.

Similarly, Ms. Vuong Thi Nhung (character's name has been changed, born in 1999), a worker at Phu Ha Industrial Park (Phu Tho), was also slandered for borrowing money on the application even though she had never registered. Her personal photos and information were spread on many websites with threats.

"In addition to the ID card photo, the phone number and account number they posted did not match me. But they still call to collect debts, harassing my friends with fake Facebook accounts" - Ms. Nhung said.

According to research, the borrowing conditions of apps are quite simple, just need to have a photo of an ID card, be of working age, then fill in the information according to the instructions and send the account number to get a disbursement.

However, these apps are tied by accessing borrowers' accounts. If the borrower intends to extort the debt, they will call or send terrorist messages to people in the borrower's phone book. The lending party can also know information about the location and address of the borrower.

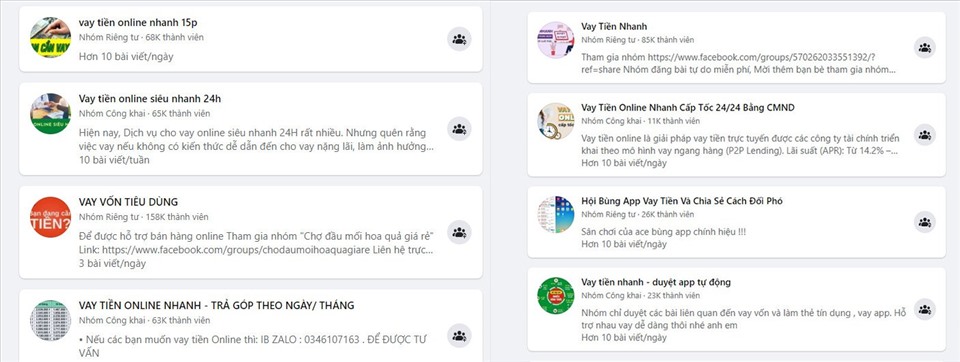

Another recorded trick is that the subjects set up closed groups, texted in large numbers with invitations to "disburse money within the day", and posted photos of fake documents to create trust. This sophisticated trick makes many people think it is real, then quickly falls into the trap.

With the trick of "no mortgage needed, quick procedures", after just a few hours, borrowers received money but it was accompanied by an underlying contract, "cut-off" interest rates, pushing borrowers into a spiral of overlapping interest.

Dismantling an inter-provincial black credit ring

Recently, the police have continuously dismantled many loan rings with high interest rates. On December 4, the Criminal Police Department (Ministry of Public Security) informed that it had dismantled a large-scale loan-taking ring operating inter-lineally and inter-provincially, with the nature of black social gangs.

Up to now, the Investigation Police Agency of the Ministry of Public Security has prosecuted the case, prosecuted 28 defendants, temporarily detained 26 ringleaders and key players to investigate many related crimes, and handle them according to the law.

According to the investigation, the black credit ring is led by Nguyen Van Hai, Nguyen Van Quang, Nguyen Ngoc Huong and Bui Van Hai.

This is a group of criminals living in the northern provinces, moving into Ho Chi Minh City and some southern provinces to organize unsecured loans with "exorbitant" interest rates, from 240% to 670%/year, ready to use weapons and violence to collect debts.

According to the authorities, the subjects recruited juniors and assigned clear roles such as finding borrowers, verifying information, directly lending, collecting interest and principal.

To approach victims, gangs advertise via apps, post on social networking groups, conceal grocery stores or distribute leaflets at markets and industrial parks.

The group mainly targets small traders, small business households, people with stable housing and jobs, loans from 5 million VND to 1.5 billion VND/time. Borrowers only need to provide ID cards, addresses, film facial videos and be disbursed quickly in forms such as installment loans, standing loans, and interest cuts in advance.

When the debt is due, the group's leaders direct the juniors to call, go to the places to curse, threaten, throw dirty substances, even arrest, beat the debt to force them to pay. gangs also cooperate to support each other in finding customers, cross- lending, debt collection, and profit sharing.

In particular, the group of Nguyen Van Hai and Nguyen Van Quang is lending money to hundreds of people in An Giang and Ca Mau.

The case was dismantled at the end of October. During the expansion process, the authorities discovered many subjects in the ring who also committed illegal detention, robbery, organized gambling, bought and sold, and organized the use of synthetic drugs.

The police seized many exhibits such as cars, motorbikes, citizen identification cards, weapons, phones, computers and thousands of loan advertisements.

Workers must be alert

Lieutenant Colonel Dao Trung Hieu (criminal expert, Ministry of Public Security) has proposed solutions to limit the situation of workers falling into the trap of black credit.

First, each worker needs to improve their understanding of security issues, the risks and dangers of black credit.

Second, workers need to restrain their activities and avoid pushing themselves into financial confusion. Workers need to adjust their spending levels commensurate with their income levels. This is a fundamental solution to prevent black credit falling into the hands of the police.

"When falling into the situation of being forced to borrow on applications, each person needs to carefully check whether the lending application is reputable or not? Look for reputable lending institutions and businesses. In particular, workers need to pay close attention if the loan interest rate is higher than 20%/year, this is a violation of the law" - Mr. Hieu emphasized.

Mr. Hieu also noted that there are currently lenders with interest rates below 20%/year, which are still in accordance with the provisions of the law. However, these subjects have additional fees, plus all fees, which is still a loan at high interest rates.

In addition, if the lending subject requires employees to synchronize their phone records, allow access to social media accounts, etc., this will be a form of threat, with the risk of insecurity and security of borrower information. From there, many other consequences arise, affecting the lives of borrowers in the future.

Mr. Hieu advised that workers who are unfortunately caught up in illegal credit by prohibiting legal tricks need to report to the authorities, seek intervention and support from these agencies.

Eliminate junk SIM cards and fake accounts

Regarding black credit activities, the Department of Administrative Police for Social Order (C06, Ministry of Public Security) said that C06 will continue to review, propose amendments and supplements to the system of relevant legal documents to close loopholes and create a legal basis in preventing and combating black credit activities; coordinate with functional units to promote the implementation of solutions to limit the causes and conditions of "black credit".

Deploy the National Population Database application, compare data of the banking industry, clean up customer information data, remove "virtual" accounts, serve consumer credit lending: Provide data cleaning services between 3 network operators (Vinaphone, Viettel, Mobifone) online with a total of 98 million mobile subscriber information data.

At the same time, compare data, clean mobile subscriber information, and remove "dash" SIM cards. Prevent websites and applications (apps) that operate credit without specific registration and show signs of "black credit" activities: detect 90 websites and 93 apps (apps) on the App store (IOS platform) and CH Play ( Android platform) for smartphones for financial business activities, lending, showing signs of "black credit" activities.

C06 cooperates with Hanoi University of Science and Technology to research reliability scoring software, and at the same time, works with banks to support lending, review and collect data on subjects eligible for unsecured loans based on population databases.