The category was awarded on the afternoon of December 9 within the framework of the 17th Vietnam M&A Forum 2025 organized by the Finance - Investment Newspaper, under the sponsorship of the Ministry of Finance. This is an annual event that brings together leading domestic and international economic and financial experts.

To evaluate a business with a typical M&A strategy, the Voting Council based on the criteria of scale, nature, transaction rate, level of impact on the industry or the public; analyzed and evaluated the effectiveness and impact on business operations after the deals. The results were evaluated by a Council of leading experts in economics and finance.

GELEX's strategy is to grow through targeted and effective M&A, applying good governance practices and modern production management, investing in Capex with focus and implementing timely restructuring to improve the operational efficiency of member units and the Group's investment portfolio, marking one of the largest private economic groups in Vietnam.

GELEX has used the M&A strategy as an effective tool, forming comprehensive core capabilities: investment efficiency, sustainable governance, momentum in the face of change and the ability to create an ecosystem.

Sharing at the Forum about the necessary capabilities for businesses to succeed in M&A activities, Mr. Nguyen Hoang Long - Deputy General Director of GELEX Group emphasized three factors.

First, businesses need to have a strategic and long-term mindset, seeing M&A (buying) as a process of integration into the ecosystem, not trading activities.

Second, there needs to be a deal-making skills especially when working with foreign partners, where negotiation methods and cooperation standards are very different.

Finally, post-M&A is a key stage: businesses must be ready with capacity to manage new businesses, restructure and develop substantially to realize resonant values.

Regarding the approach to international cooperation, Mr. Long said that the Win-Win thinking is a core factor. Businesses must understand their partners and put both sides in a position of mutual benefit. Next, we need to aim for long-term and sustainable value. And finally, creating an equal position and mutual respect is also a factor leading to successful cooperation.

According to experts, the effectiveness of GELEX's M&A strategy in recent years has been clearly demonstrated in the post-M&A period, when most member companies have grown remarkably. This result comes from the drastic restructuring process, innovating corporate governance and promoting digital transformation, creating a more effective operating foundation for units.

GELEX's steps became more notable when placed in the context of the Vietnamese and regional M&A market going through a deep screening cycle. More cautious capital flows, expectations of buying-selling prices and geopolitical risks have cured investors' psychology.

In that context, businesses that maintain strategic discipline and pursue M&A to create real value like GELEX stand out in the market.

In Vietnam, in the first 10 months of 2025, there were about 220 M&A deals, with a total value of 2.3 billion USD, with an average value of 29.4 million USD per deal, lower than the peak in 2024.

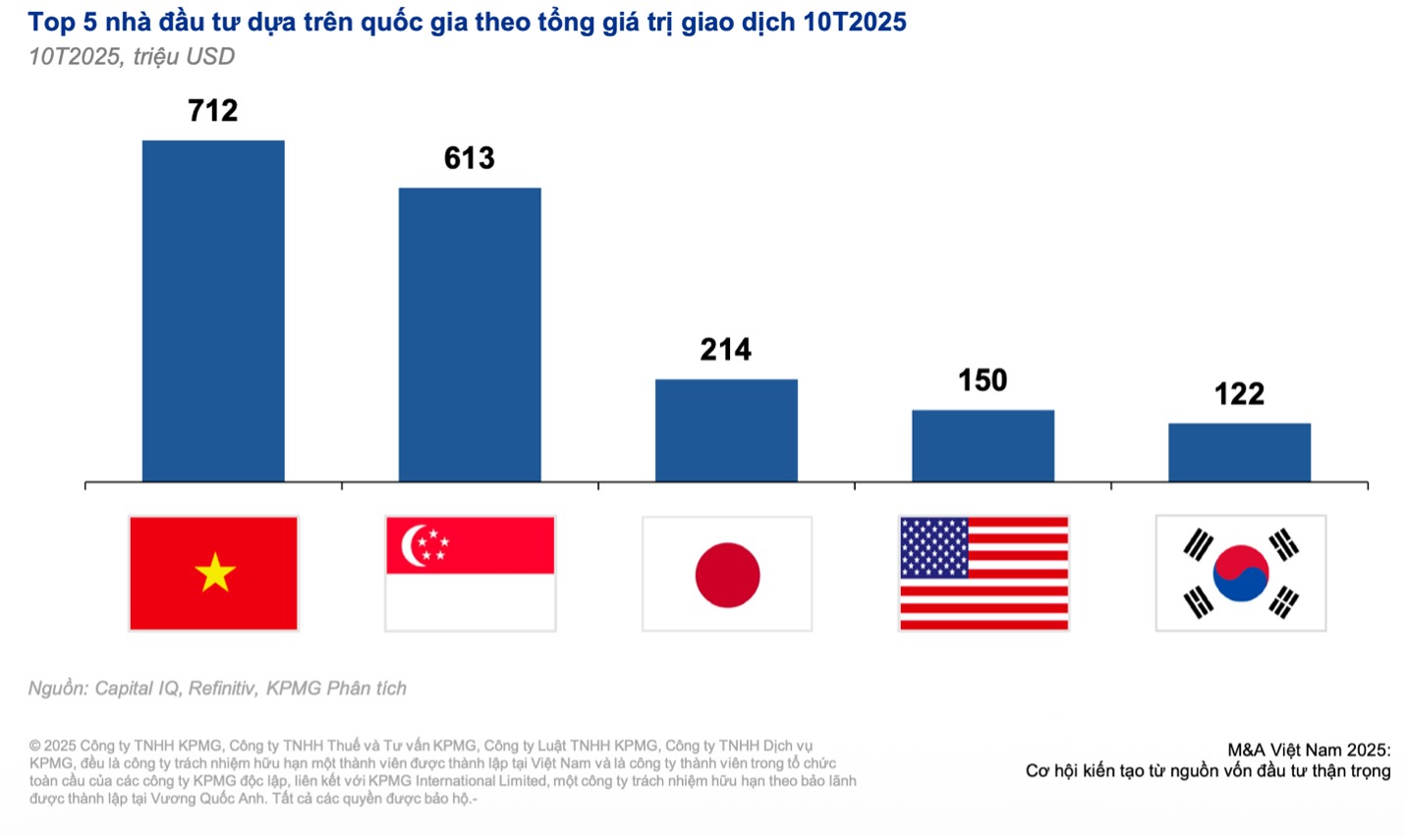

However, Vietnam is still a bright spot in the region when attracting selective M&A activities, especially with the leadership of domestic investors, accounting for more than 30% of the total transaction value (712 million USD), surpassing Singapore, Japan, the US and South Korea. This reflects the lasting confidence of investors in the region in the medium and long-term outlook.

Looking to 2026, the Vietnamese M&A market is assessed by experts and international investors as entering a new breakthrough phase of global capital flows. Strong reforms, a stable legal environment and market confidence are recovering, opening an M&A cycle that is considered the most beautiful in many years.

Regarding the M&A trend in the coming time, KPMG forecasts that the market will be led by four main trends: First is to return to core values, focusing on the industry to create stable cash flow; Second is to find quality; Third is the market to favor buyers and cautious valuation; Fourth is to restart mandatory stagnant and transaction processes.

In the context of a more transparent legal framework, improved liquidity and many large deals waiting to be completed, Vietnam continues to be positioned as one of the most attractive M&A markets in Southeast Asia - with a solid foundation, a clear roadmap for value creation and many long-term investment opportunities at home and abroad.