Accordingly, all citizens who have installed and identified level 2 on the VNeID application will have an additional option for a simple, fast, and safe account opening method in addition to the previous method of registering at the counter or registering on the digital banking application.

Thereby, bringing maximum convenience to citizens in opening accounts and using banking services, promoting cashless payments and digital transformation.

Specifically, citizens who want to open a bank account just need to log in to the VNeID application on their phone, select "Other services", select "Banking services" and follow the instructions.

All subsequent steps including electronic identification when opening an account (also known as eKYC) and biometric authentication will be performed automatically and quickly without the need for a physical citizen ID card, without having to spend a lot of time operating or going directly to a bank branch/transaction office.

To date, NCB is the first bank to deploy this feature. This is the result of the close connection of the features of the VNeID electronic identification application and the NCB iziMobile digital bank for individual customers between NCB and RAR, aiming to contribute to the national digital transformation process.

At the same time, develop products, services, and utilities that apply population data, citizen identification cards, and digital services to bring a convenient, safe, and superior banking experience to the community.

NCB representative said that this is also an effort of NCB team to realize the commitment to constantly create, innovate, increase value for customers and reach new standards.

Thereby, increasing and upgrading the different experience for customers on NCB's NCB iziMobile application and contributing more to the development of society.

It is expected that in the near future, Centre RAR and NCB will continue to coordinate to research and launch many other features, meeting the diverse needs of people and promoting book conversion, cashless payments such as: Paying bills, Receiving Social Security or opening credit cards/bank loans... via VNeID on the NCB iziMobile application.

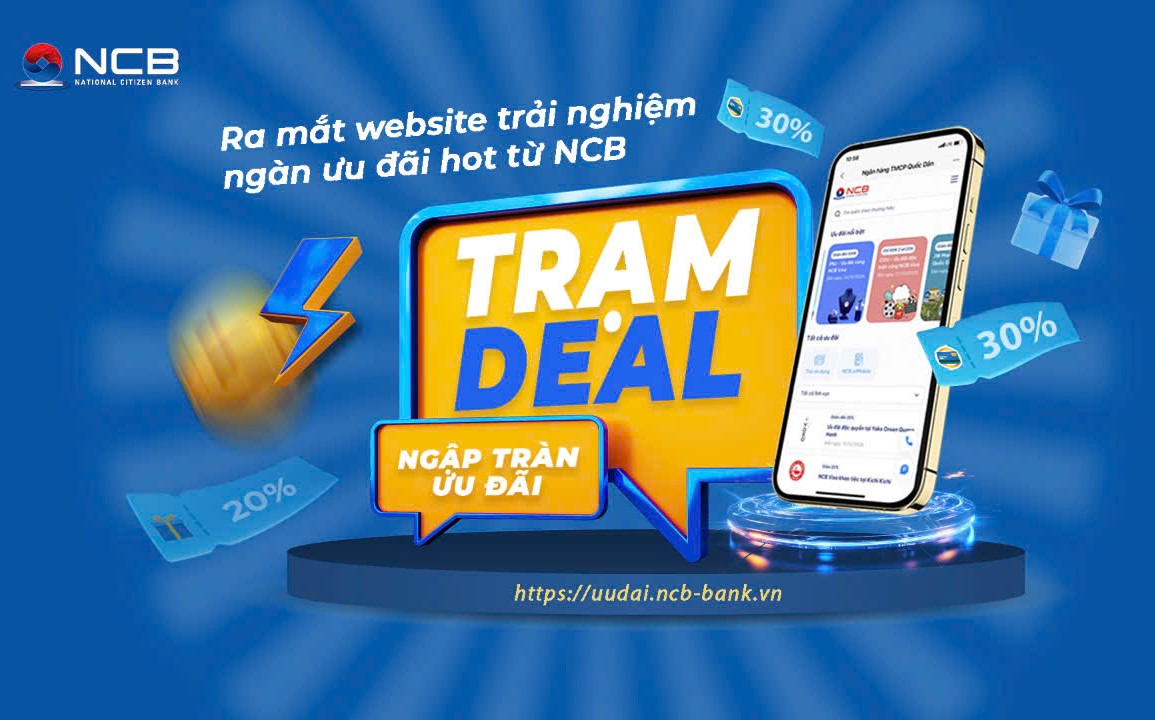

NCB also made a distinct mark in the banking market when it officially launched a specialized website on incentives exclusively for NCB customers with superior experiences.