Agribank has set a 5-clear" action program: clear people, clear work, clear responsibilities, clear progress, clear efficiency to realize the goal of making science, technology, digital transformation and innovation the main development driving force of the bank. A digital revolution is being implemented by all Agribank leaders and staff, determined to help the bank go faster and go further with its customers.

Pioneering the application of technology, realizing rural digitalization strategies

As a key bank in investing in supporting the development and provision of credit financial services for the agricultural and rural areas, Agribank identifies its consistent goal in operations as promoting network advantages, diversifying, providing high-quality retail banking products and services based on a modern information technology platform, meeting the increasingly diverse needs of customers, maintaining its position as a leading bank in providing banking services for agricultural, rural and farming areas.

Agribank is a leading bank in deploying automated payment machines (ATMs) since 2003 across the country with nearly 1,500 machines located in agricultural and rural areas out of a total of more than 3,300 ATMs nationwide.

In addition, Agribank Digital and Agribank Autobank (CDM) services operate as a model of miniature banking branches, serving all customers, making it easy for customers to access financial services instead of having to go to traditional banking branches, contributing to reducing time and effort. Agribank currently has more than 3,500 ATM/CDM (of which nearly 2,000 are located in rural areas), nearly 25,000 POS machines and 68 specialized car mobile transaction points operating in rural areas.

In its rural digitalization strategy, Agribank aims to use technology to simplify procedures, making it easier for people to access the most basic services. To realize this goal, Agribank plans to deploy the installation according to the Agribank Digital automatic banking transaction machine roadmap in rural, remote and isolated areas, especially places with limited access to common financial products and services so that people can use digital banking utilities for public service activities as well as daily transactions.

Continuously innovating, raising the level of digital banking applications

As a large bank, present everywhere on the S-shaped strip of land, Agribank fully recognizes its mission on the national digital transformation journey. Agribank currently has nearly 20 million customers with payment deposit accounts, nearly 16 million customers using ATM cards, and nearly 15 million customers using payment services via the Mobile Banking channel. Automatic payment methods account for about 81% of all payment transactions of customers at Agribank.

Along with the flow of technology in the banking system, Agribank always encourages employees to promote the spirit of innovation, creativity, proactively research, apply science and technology, propose initiatives to improve work, deploy policies and solutions to develop products and services, improve new functions and utilities in payment, use modern technology to meet the increasing needs of customers, and make practical contributions to the digital transformation journey.

Not only implementing programs to promote digital transformation in its system, with the motto "customer-centric", from 2016 to present, Agribank has also developed digital utilities to help customers easily access and use "digital banking".

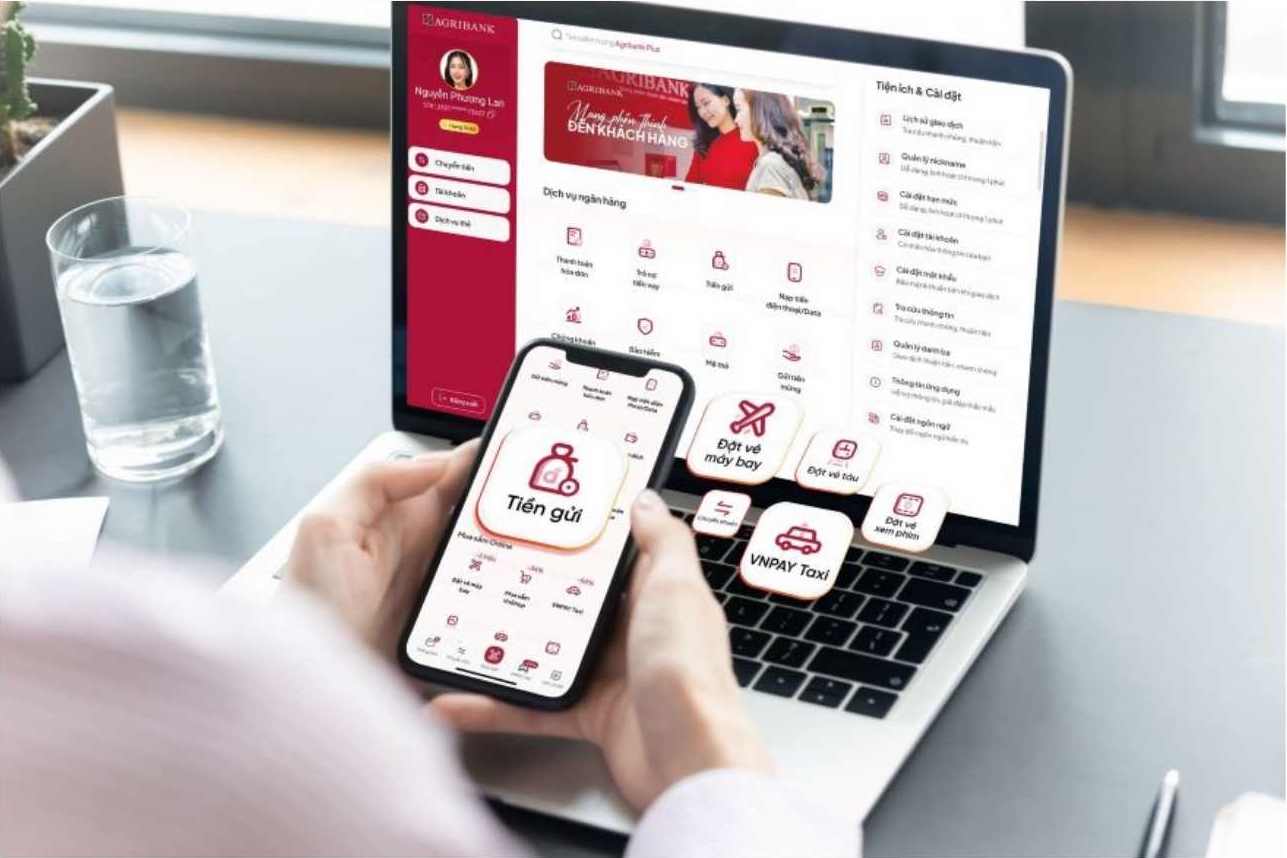

One of the outstanding products is the launch of the Agribank Plus application in mid-2024. This is the latest version of the e-banking application, designed according to 4 "PLUS" criteria: Excellence (Prime), Leadership (Leading), United, and Smart. Agribank Plus brings many new features including quick money transfers to many people, booking money transfers, automatic bill payments, etc. In addition, with improving the interface, simplifying the login process with a single login name and password on moblie and PC versions, Agribank Plus has helped customers save time and improve convenience when using banking services.

After Agribank Plus, Agribank continues to launch the Open Smart Bank digital banking solution, using modern technology to optimize transactions and improve security. Open Smart Bank helps Agribank not only provide traditional financial services but also create a smarter transaction environment for customers. This solution applies advanced technologies such as artificial intelligence, blockchain and big data to optimize transaction processes, automate tasks and enhance security.

This is one of the important steps in Agribank's digital transformation process. In particular, Agribank is also one of the pioneering banks in applying eKYC security technology (electronic customer identification) and collecting biometric data, helping to increase security and accuracy in transactions. Recently, Agribank deployed electronic authentication service via VNeID on the Agribank Plus application, helping to optimize customer experience.

Agribank's continuous efforts in digital transformation have been recognized with prestigious awards such as: Certificate of Merit from the Governor of the State Bank, TOP 10 Strong Brands of Vietnam and most recently the award for the Agribank Open API platform at the Vietnam Digital Transformation Awards 2024. To date, Agribank has had 12 consecutive IT applications/systems honored at the sao Khue Award for outstanding IT systems in the fields of finance - banking and digital banking. This is a clear demonstration of Agribank's strong development and continuous innovation in applying modern science and technology to banking operations.

At the Digital Transformation and Innovation Conference at the Head Office in 2025, Comrade Pham Toan Vuong - Deputy Secretary in charge of the Party Committee, Member of the Board of Directors, General Director of Agribank emphasized: As a major financial institution, innovation, digital transformation is no longer an option but a mandatory task for Agribank to break through and develop. Therefore, leaders at all levels of Agribank must unify awareness and action, promote innovation, and focus all their efforts on digital transformation; identifying this as the vital task of the entire Agribank system.

Also at this Conference, Agribank Deputy General Director Hoang Minh Ngoc announced and launched a breakthrough action program to develop science, technology innovation and digital transformation at Agribank; thoroughly grasp the spirit of Resolution No. 57 of the Politburo and Resolution No. 03 of the Government, focusing all efforts on promoting innovation activities, developing science and technology and digital transformation at Agribank.

Dr. Le Hung Cuong - Deputy General Director of FPT Digital, an expert in the field of digital transformation, assessed: Agribank has a solid financial foundation, a long history of operation and a large number of customers in the area. When the digital transformation program for the period 2021 - 2025, the 2030 orientation is combined with high political determination from the head to the entire system to be implemented drastically, the face of banking digitalization will certainly change dramatically.

Strong steps, the spirit of determination to make breakthroughs in the development of science and technology, constantly innovate in the development of digital banking products and services, promote cashless payments and protect the safety of customer information are proof that Agribank is making solid impressions in the banking industry and making an important contribution to the development of the national digital economy.