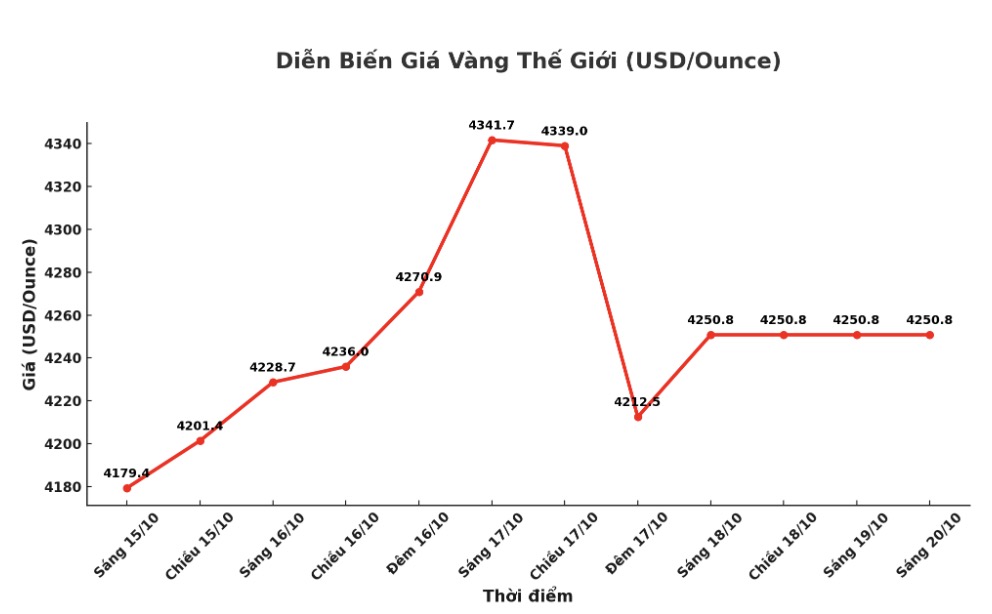

This is the fifth time since the 1970s that gold prices have maintained a consecutive increase in the 9-week period - the most recent time occurring in the period from early June to early August 2020.

Last week, spot gold prices hit a new inter-session record, approaching the 4,400 USD/ounce mark. However, profit-taking and technical selling pressures appeared in the trading session on Friday in North America, causing prices to fall nearly 165 USD compared to the peak.

As of 0:00 on October 20, spot gold was at $4,250.8/ounce, up $234.4 a week ago.

Over the past 9 weeks, gold has gained more than 25%, far exceeding the 19% increase in the same series in 2020. Although the increase is still strong, some experts warn investors to be cautious in high price areas.

Mr. Alex Kuptsikevich - Chief Strategist at FxPro commented: "There has never been a period of consecutive 10 consecutive years of gold price increase". He said gold is being overbought and needs a technical correction.

Paul Ciana, a technical analyst at Bank of America, warned that every time gold has increased for a consecutive 7 weeks, prices typically decreased for the next 4 weeks.

Meanwhile, Mr. Phillip Streible - Chief Strategist at Blue Line Futures - said that the current fluctuations are normal: Although gold fell 2% on Friday, in the context of the strong increase over the past time, this is only a short-term adjustment. The demand for shelter is still huge as the risk of recession and the risk of regional banking crisis return.

Mr. Robert Minter - ETF Strategy Director at abrdn - said that although gold is considered "too hot", its value is still reasonable. Investors have reacted strongly to the depreciation of money over the past five years and gold has become a channel to relieve that psychological need, he said.

Minter also noted that a Bank of America survey shows that gold buying is one of the most crowded trades today, but gold has only accounted for 2.4% of the funds investment portfolio.

While the share of gold in the global portfolio is only 2.4%, while Chinas gold reserves are only 6.7% of total foreign exchange reserves (compared to 77% in the US), the underlying foundation of gold remains very solid despite the strong price increase, he said.

Ricardo Evangelista, senior expert at ActivTrades, said that gold continues to be supported by safe-haven demand as the US Congress has not yet approved a budget package, causing the government to fall into a state of closure, raising concerns about slowing economic growth.

In addition, harmonious statements from US Federal Reserve (FED) officials, including Chairman Jerome Powell, continue to create a push for gold.

In this context, with increased speculative activity, the most likely direction for gold is still up; any decline can be considered a buying opportunity - Mr. Evangelista commented.

While the US government is on hold, the market is relying on private sector data. Next week, the economy will monitor existing home sales reports and preliminary production index.

The only exception is inflation data, when the Department of Labor Statistics has summoned a small group of employees back to work to announce the consumer price index (CPI) for September - necessary for calculating the annual living expenses adjustment for social security pensioners, according to regulations, it must be announced before November 1.

Economic data to watch

Thursday: Current home sales (US).

Friday: US CPI, S&P Flash PMI.

See more news related to gold prices HERE...