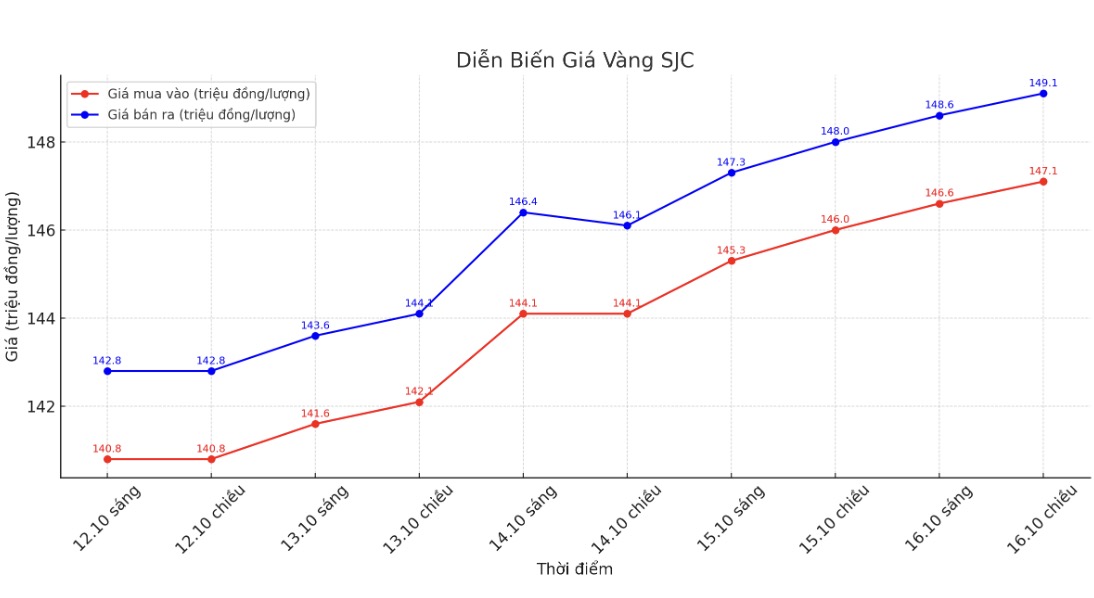

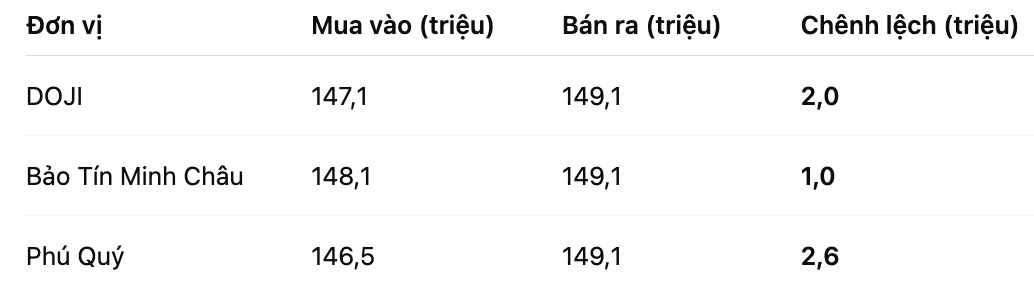

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 147.1-149.1 million VND/tael (buy in - sell out), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 148.1-149.1 million VND/tael (buy - sell), an increase of 2.1 million VND/tael for buying and an increase of 1.1 million VND/tael for selling. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 146.5-149.1 million VND/tael (buy in - sell out), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling prices is at 2.6 million VND/tael.

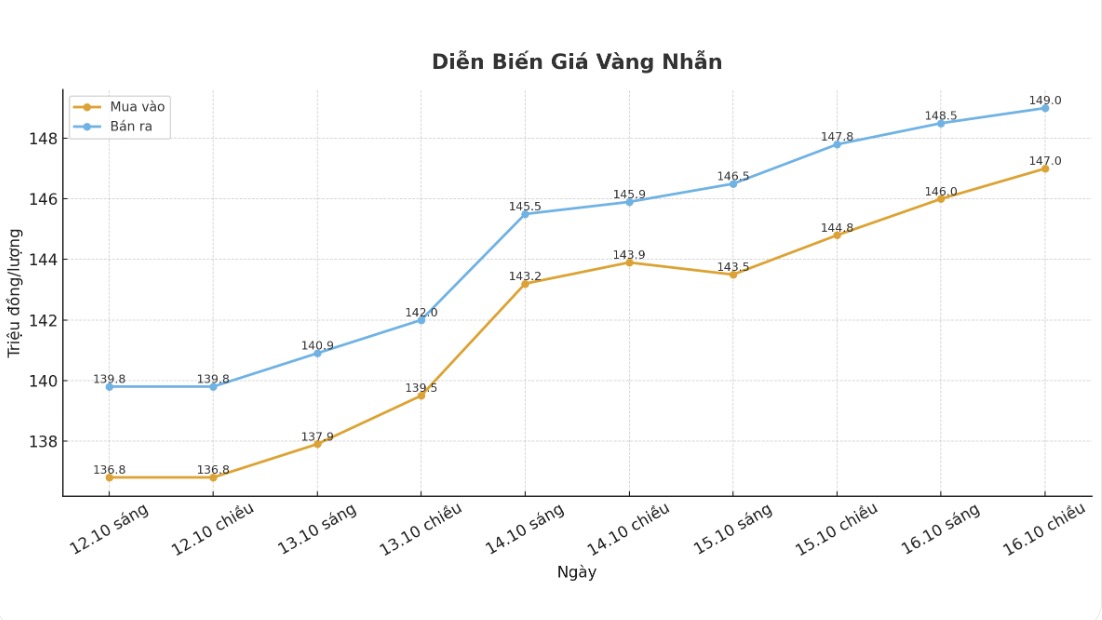

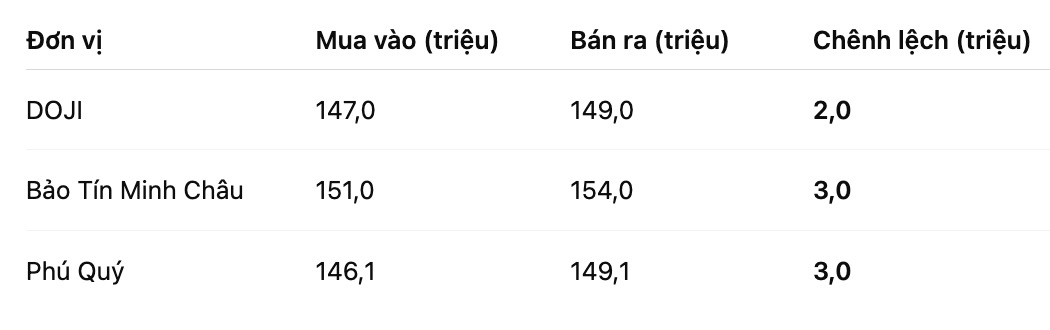

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 147-149 million VND/tael (buy - sell), an increase of 2.2 million VND/tael for buying and an increase of 1.2 million VND/tael for selling. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 151-154 million VND/tael (buy - sell), an increase of 1.7 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 146.1-149.1 million VND/tael (buy - sell), an increase of 1.3 million VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

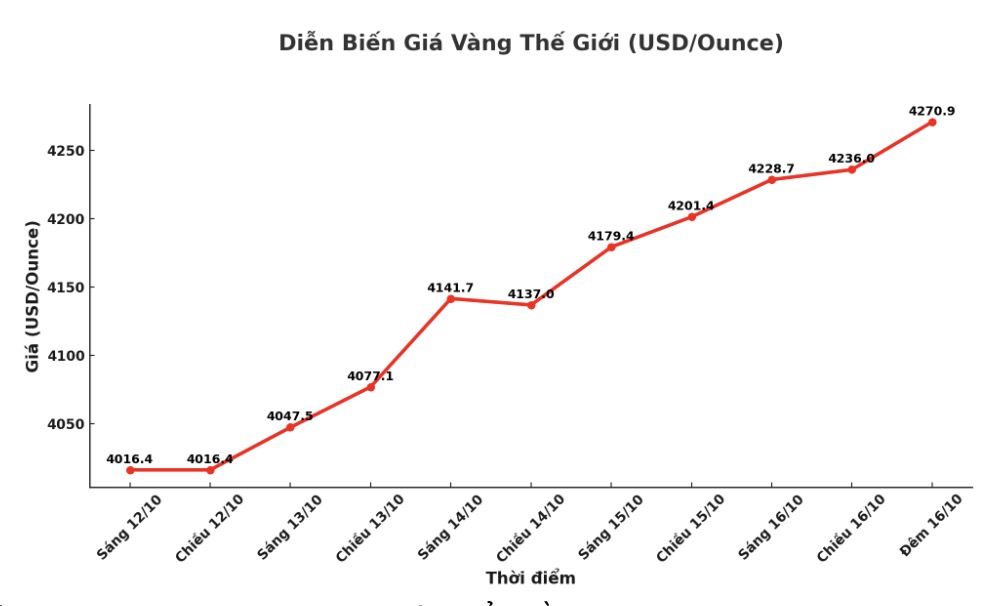

World gold price

Recorded at 10:34 p.m. on October 16 (Vietnam time), the world spot gold price was listed at 4,270.9 USD/ounce, up 75.3 USD.

Gold price forecast

The gold market continues to show solid fundamentals, supporting prices to remain firmly above the record of 4,200 USD/ounce. However, what the market is lacking is sellers, as most investors are in no rush to take profits in the context of continued strong growth.

In a recent interview with the press, Mr. John Merrill - Founder, Chairman and Investment Director of Tanglewood Total Wealth Management - said that gold currently accounts for about 12% of his investment portfolio, higher than the target of 10%.

Mr. Merrill said that he has been optimistic about gold since 2023, initially allocating only 5-6% of the portfolio. Over the past two years, he has repeatedly rebalanced his portfolio due to unprecedented strong gold prices. However, looking forward, he said there was no reason to sell at this time.

We will continue to hold gold. Normally we only rebalance at the end of the year, so we will review it at that time, whether the price increases or decreases, he said.

Even with a profit, Merrill has remained committed to maintaining a certain proportion of gold, as he believes we will always own gold. I don't know how much that rate will be in the next 20 years, but we will definitely keep it, because nothing can replace gold."

According to Mr. Merrill, the biggest factor driving current gold demand is rising global public debt. Investors are looking to protect their assets as the world's legal currencies are gradually losing purchasing power. At the same time, the debt burden has made long-term Treasury bonds - once considered a safe haven asset - more risky.

We have recognized since 2023 that there are new drivers for gold prices. Previously, we did not consider gold as a hedge against inflation, because history shows poor efficiency. But gold is a hedge against crises, and now it has become a hedge against currency, he said.

Jim Wyckoff - senior analyst at Kitco said that technically, the upward trend of gold is still very strong. The next target for buyers is to close above the resistance level of 4,300 USD/ounce, while the seller aims to push prices below the support zone of 4,000 USD/ounce.

The most recent support level was recorded at 4,214.5 USD/ounce and 4,200 USD/ounce, while the next resistance was at 4,275 USD/ounce and 4,300 USD/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...