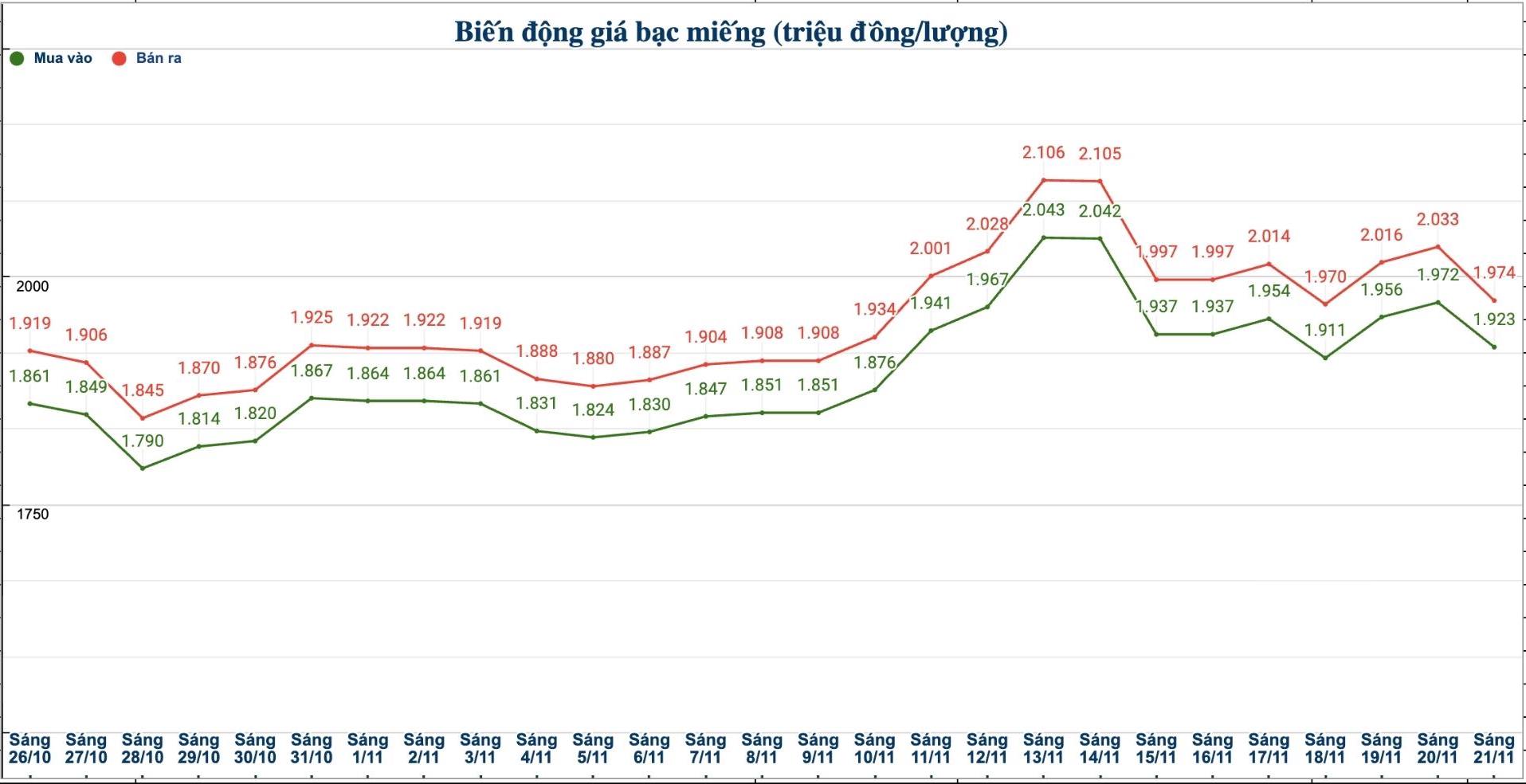

Domestic silver price

As of 10:00 a.m. on November 21, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1,933 - 1.975 million VND/tael (buy - sell); down 33,000 VND/tael in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) at Ancarat Petrochemical Company was listed at 50.776 - 52.216 million VND/kg (buy - sell); down 860,000 VND/kg for buying and down 880,000 VND/kg for selling compared to yesterday morning.

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) was listed at 1.923 - 1.974 million VND/tael (buy - sell); down 15,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1,933 - 1.993 million VND/tael (buy - sell); down 39,000 VND/tael for buying and down 40,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 51.546 - 53.146 million VND/kg (buy - sell); down 1.040 million VND/kg for buying and down 1.067 million VND/kg for selling compared to yesterday morning.

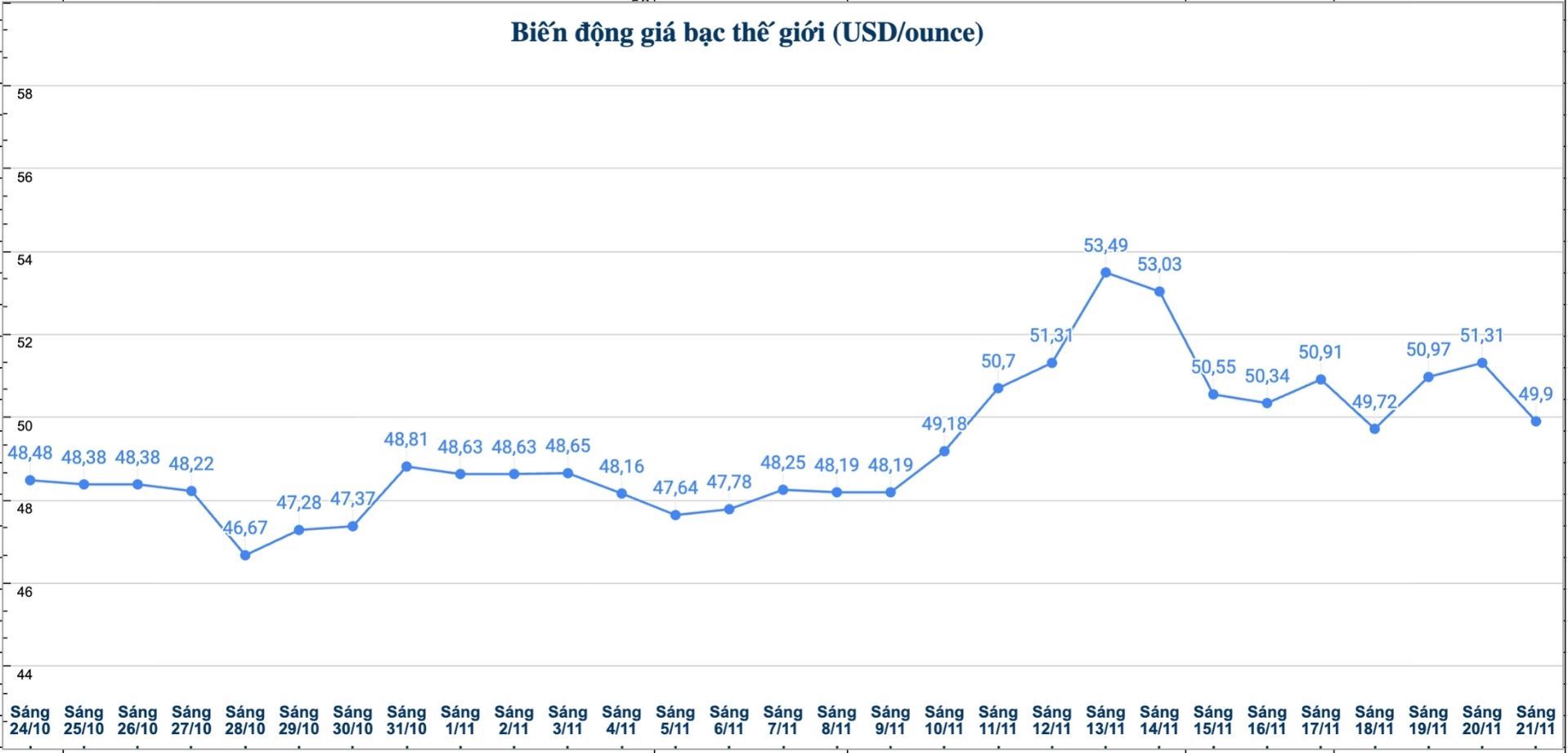

World silver price

On the world market, as of 10:00 a.m. on November 21 (Vietnam time), the world silver price was listed at 49.9 USD/ounce; down 1.41 USD compared to yesterday morning.

Causes and predictions

Silver prices fell as the US jobs report showed that the labor market remains stable, thereby making investors more cautious about the possibility of the US Federal Reserve (FED) loosening monetary policy soon.

The September Non-Farm Payrolls (NFP) report was released late, giving results beyond expectations. The new 119,000 jobs have prompted traders to adjust their silver price outlook, said FX Empire precious metals analyst James Hyerczyk, as strong data reduce the probability of the Fed cutting interest rates in December.

Mr. Hyerczyk commented that the prospect of weak interest rate cuts is reducing demand for silver - a metal sensitive to yield fluctuations - while gold prices are trading sideways, failing to create a support for the silver market.

"In the coming time, with labor data continuing to show the strength of the US labor market and expectations of interest rate cuts not being consolidated, the short-term trend of silver prices is likely to continue to decrease" - James Hyerczyk expressed his opinion.

See more news related to silver prices HERE...