Domestic silver prices

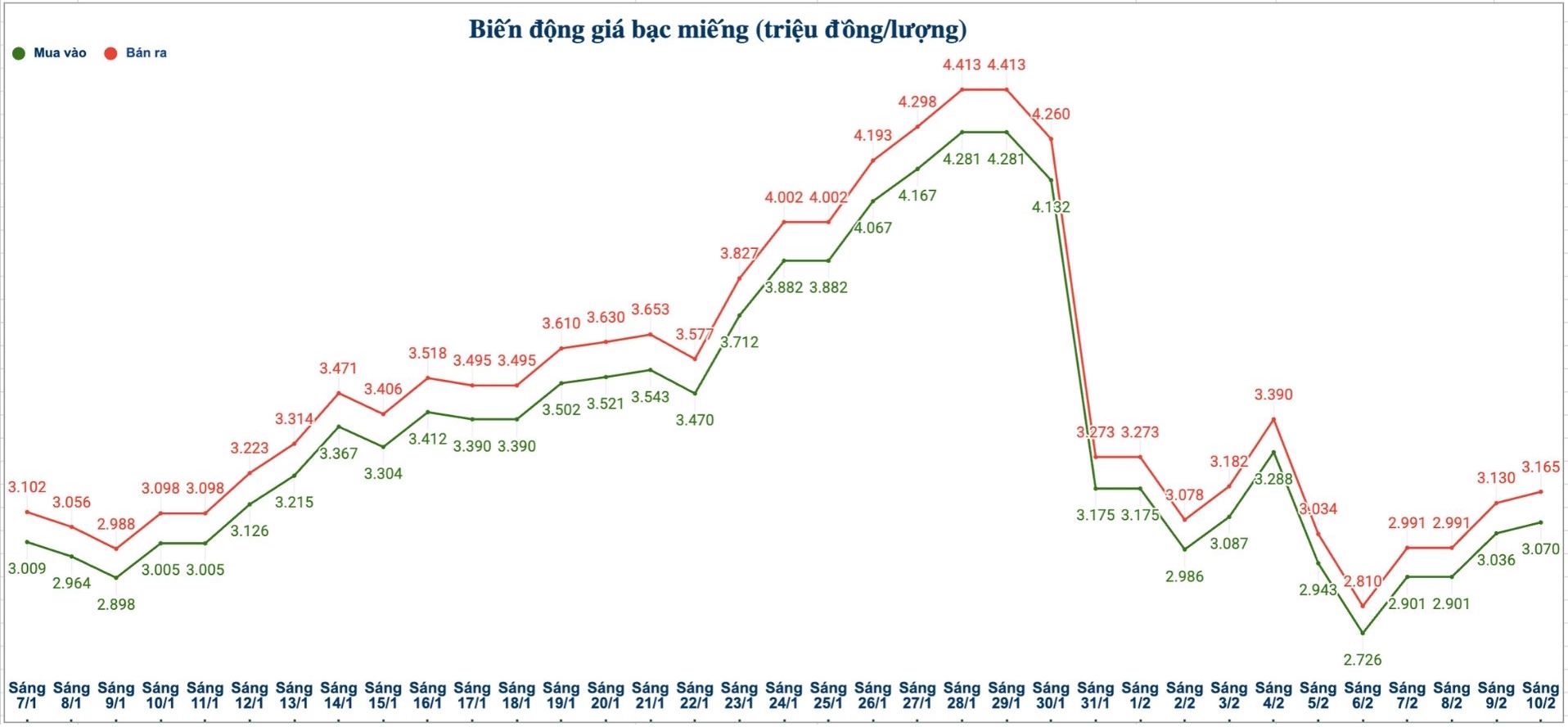

As of 9:45 am on February 10, the price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Commercial Joint Stock Bank Gold and Silver Company Limited (Sacombank-SBJ) is listed at the threshold of 3.351 - 3.459 million VND/tael (buying - selling).

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of VND 3.070 - 3.165 million/tael (buying - selling); an increase of VND 34,000/tael on the buying side and an increase of VND 35,000/tael on the selling side compared to yesterday morning.

The price of 999 silver ingots (1kg) at Phu Quy Jewelry Group is listed at the threshold of 81,866 - 84,399 million VND/kg (buying - selling); an increase of 907,000 VND/kg on the buying side and an increase of 933,000 VND/kg on the selling side compared to yesterday morning.

World silver price

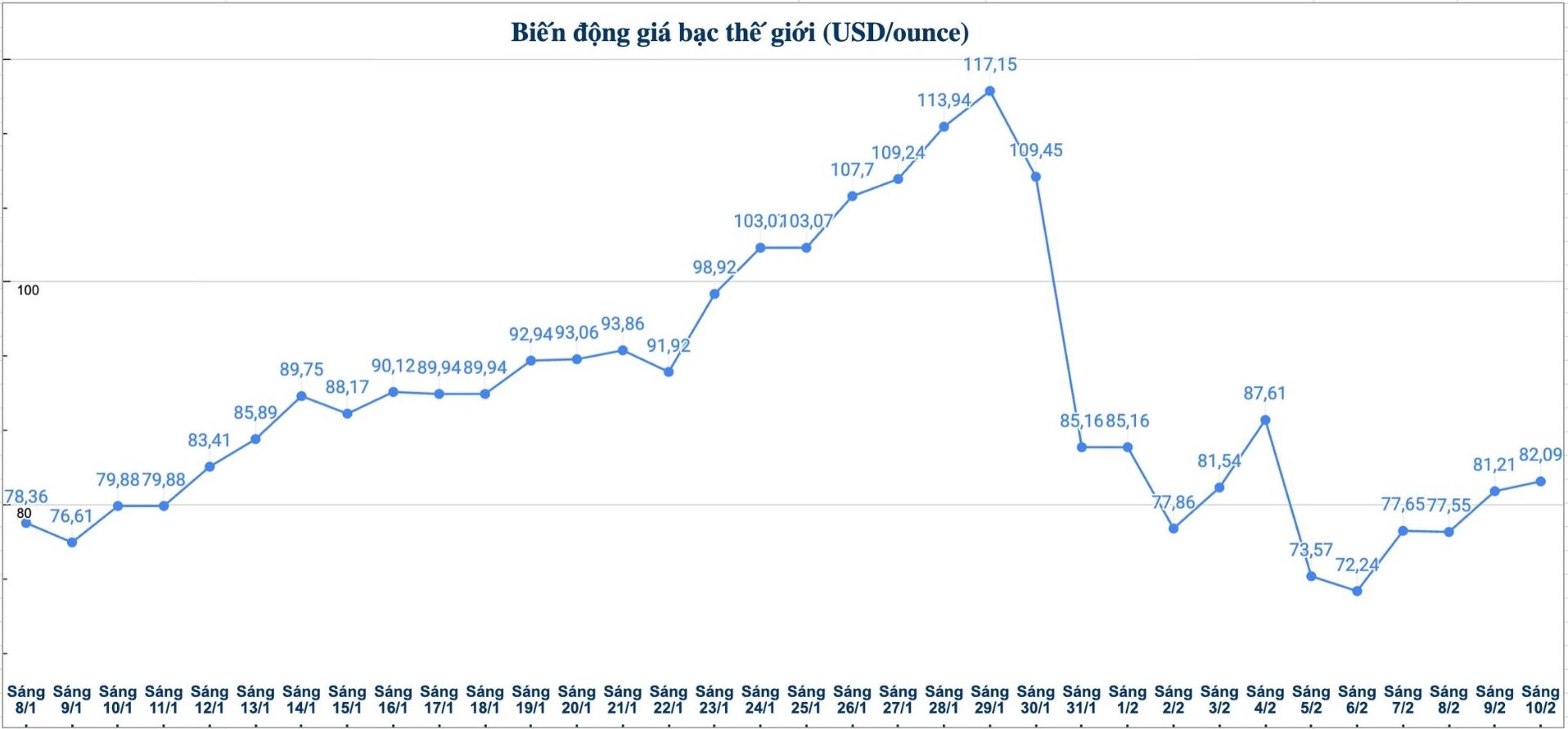

On the world market, as of 9:45 am on February 10 (Vietnam time), the world silver price was listed at 82.09 USD/ounce; up 0.88 USD compared to yesterday morning.

Causes and forecasts

Spot silver prices jumped nearly 10% in the first trading session of the week, marking one of the strongest gains in recent times. According to precious metals analyst James Hyerczyk of FX Empire, this increase did not originate from a single factor, but was the result of many positive developments at the same time, causing traders to react quickly.

James Hyerczyk said that global stock markets simultaneously increased, gold prices rose and the general sentiment of investors shifted to a "risk-taking" state, instead of looking for safe haven assets. This is a rather unusual development for a strong increase session for precious metals such as silver.

One of the key factors driving silver prices is the weakening of the US dollar. The decline in the USD index has made dollar-valued metals, including silver and gold, more attractive to investors using other currencies," he said.

According to James Hyerczyk, a weak USD brings double benefits to the silver market: Stimulating buying demand from international investors, while reducing pressure on short-selling positions or traders waiting for prices to fall. This combination contributed to pushing silver prices up rapidly during the session.

Meanwhile, the stock and cryptocurrency markets also recorded a clear recovery. Many major stock indices in the world increased the most in many months, while Bitcoin rebounded significantly. This shows that investors' risk appetite is improving broadly.

The expert added that gold prices also had an impressive increase session, thanks to buying activities at low prices and the impact of the weakening USD. In conditions of thinner liquidity, silver usually reacts stronger than gold, making the increase in silver amplified.

Currently, buyers are taking the initiative in the market. Silver prices are increasing not only because investors buy back to close short selling positions, but also thanks to new cash flow actually participating, so the short-term silver price outlook is considered quite positive" - James Hyerczyk said.

See more news related to silver prices HERE...