Domestic silver prices

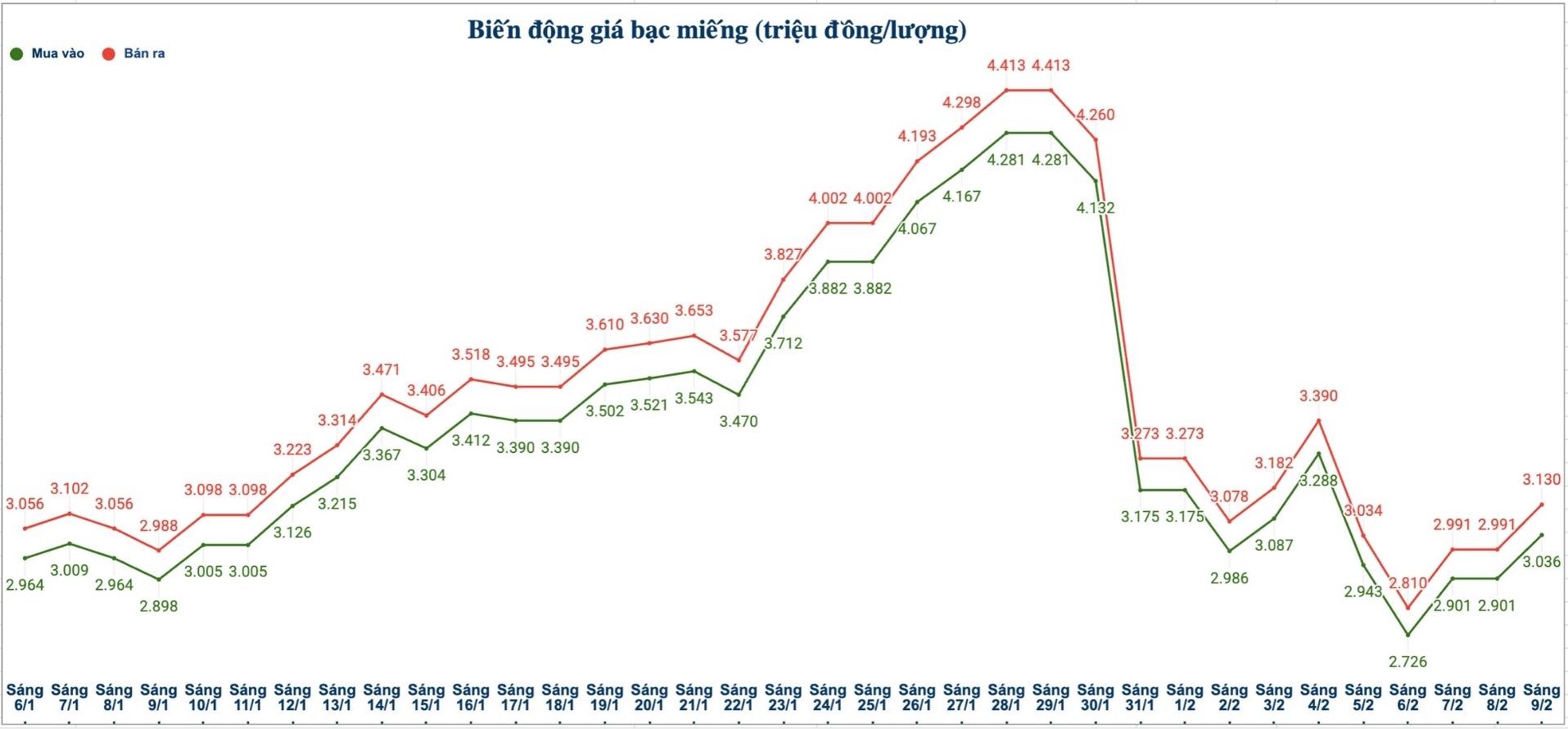

As of 10:45 am on February 9, the price of silver bars 2024 Ancarat 999 (1 tael) at Ancarat Gem Company was listed at 3.038 - 3.113 million VND/tael (buying - selling); an increase of 117,000 VND/tael on the buying side and an increase of 120,000 VND/tael on the selling side compared to yesterday morning.

The price of silver ingots 2025 Ancarat 999 (1kg) at Ancarat Gem Company is listed at 80.084 - 82.514 million VND/kg (buying - selling); an increase of 3.11 million VND/kg on the buying side and an increase of 3.2 million VND/kg on the selling side compared to yesterday morning.

The price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Commercial Joint Stock Company Limited (Sacombank-SBJ) is listed at 3.363 - 3.471 million VND/tael (buying - selling); an increase of 180,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 3.036 - 3.130 million VND/tael (buying - selling); an increase of 135,000 VND/tael on the buying side and an increase of 139,000 VND/tael on the selling side compared to yesterday morning.

The price of 999 silver ingots (1kg) at Phu Quy Jewelry Group is listed at 80.959 - 83.466 million VND/kg (buying - selling); an increase of 3.6 million VND/kg on the buying side and an increase of 3.707 million VND/kg on the selling side compared to yesterday morning.

World silver price

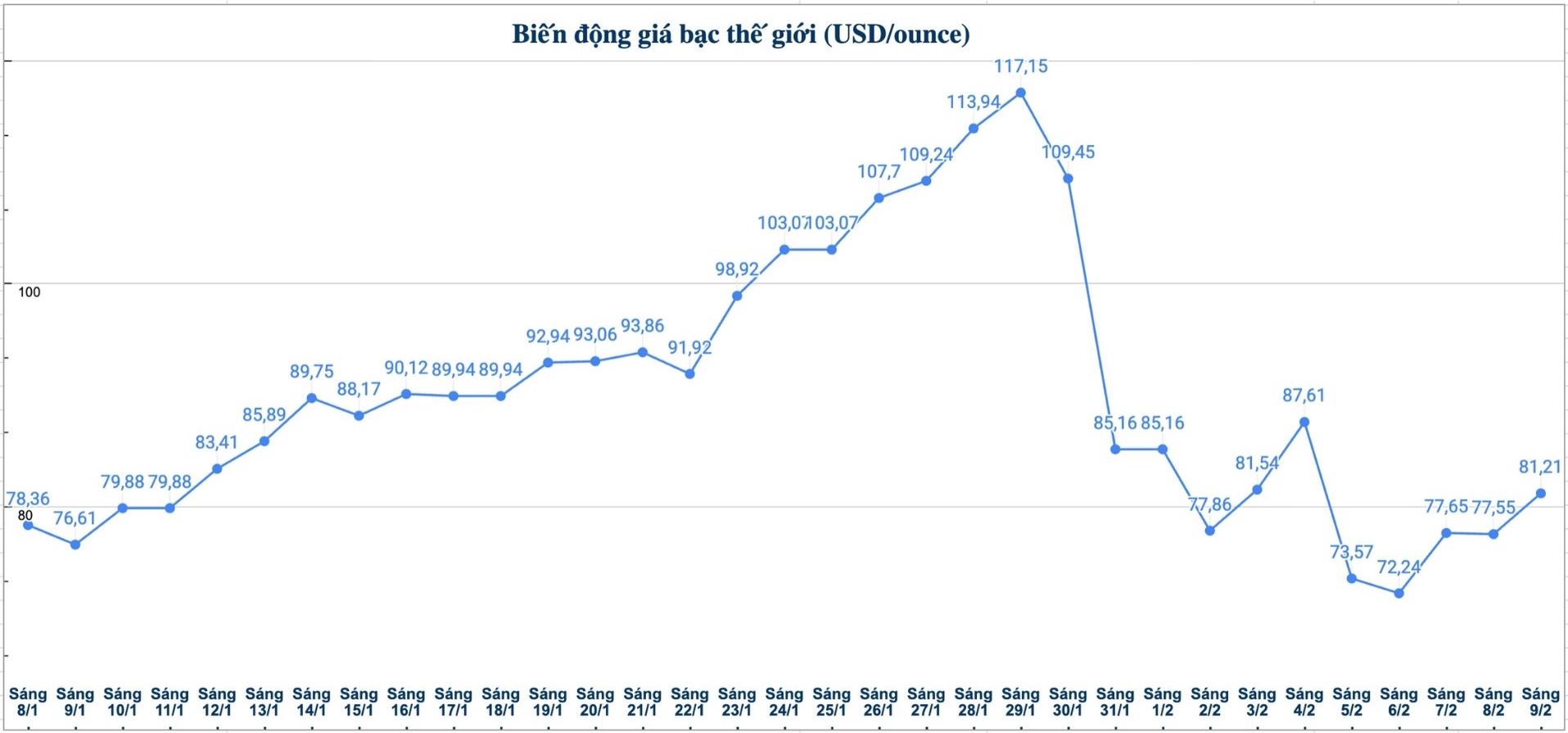

On the world market, as of 10:45 am on February 9 (Vietnam time), the world silver price was listed at 81.21 USD/ounce; up 3.66 USD compared to yesterday morning.

Causes and forecasts

After a period of hot increase, the silver market is entering a remarkable correction phase. Silver prices once jumped to 120 USD/ounce before falling sharply to around 64 USD/ounce last week, causing many investors to worry.

However, according to currency and precious metals analyst Muhammad Umair at FX Empire, this is not a sign of trend reversal but a necessary "cooldown" in the context that the market has fallen into a state of over-buying.

Overall, he believes that macro, technical and inter-market factors are still supporting the upward outlook for silver prices in the medium and long term.

Muhammad Umair said that silver prices are rising in the context of risk-avoidance sentiment spreading across the global financial market. Escalating geopolitical tensions and instability in US foreign relations have made investors more cautious, gradually withdrawing capital from risky assets to find safe channels.

Meanwhile, gold continues to be the top choice, but silver is also attracting strong cash flow thanks to its "double" role: Both a safe-haven precious metal and an important raw material in industrial production. This makes silver more attractive as the global economy faces many instabilities.

The developments of the cryptocurrency market also clearly reflect this sentiment. Bitcoin's recent sharp decline shows that capital is leaving volatile assets, thereby increasing the attractiveness to tangible assets such as precious metals" - Muhammad Umair said.

Another important factor strongly affecting silver prices is delivery pressure at the COMEX commodity exchange (USA). Spot silver reserves are currently only about 103 million ounces, while the total volume of open contracts is up to 429 million ounces.

Limited physical supply while increasing demand is creating great pressure on silver prices, while increasing market volatility" - Muhammad Umair said.

See more news related to silver prices HERE...