Domestic silver prices

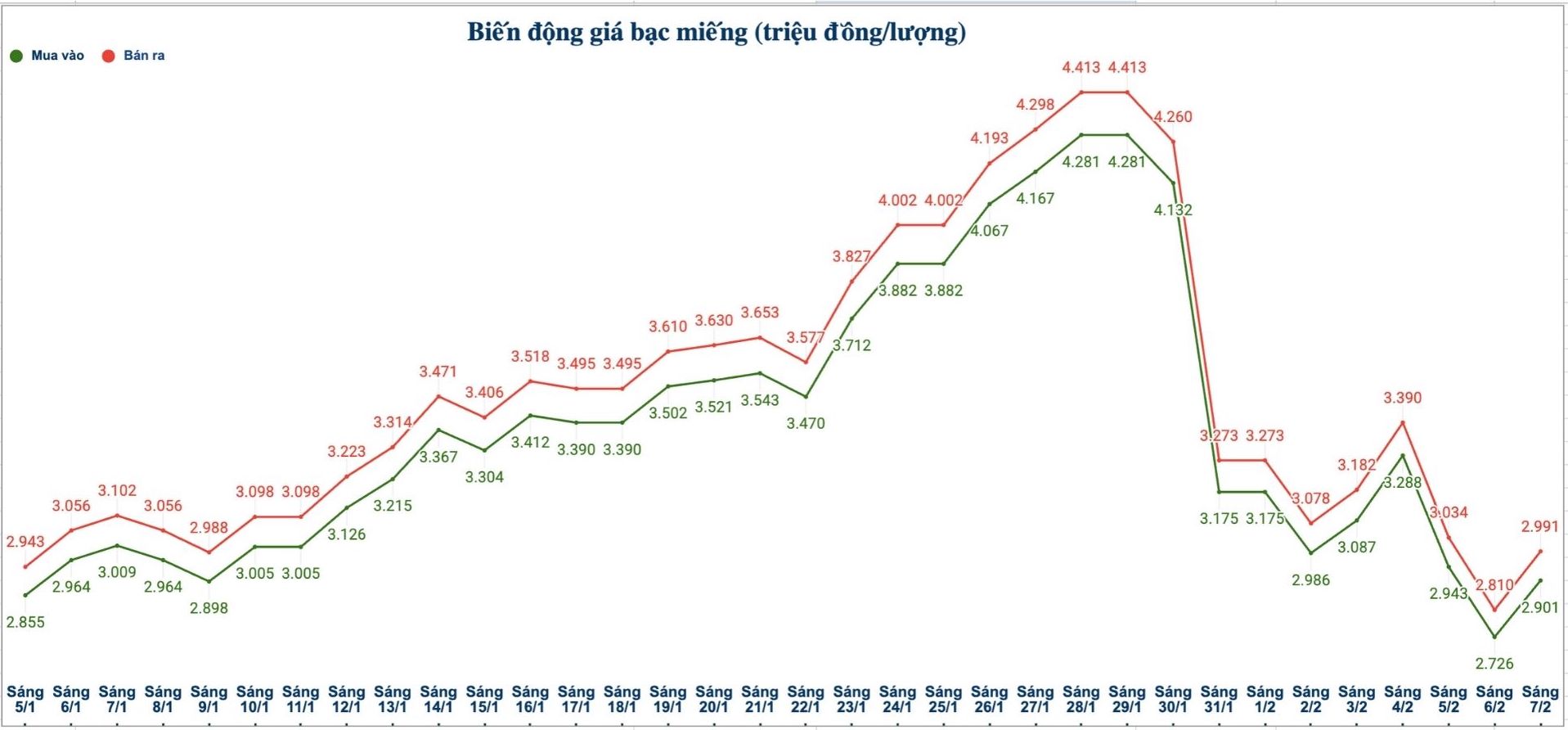

As of 10:15 am on February 7, the price of silver bars 2024 Ancarat 999 (1 tael) at Ancarat Gem Company was listed at 2.921 - 2.993 million VND/tael (buying - selling); an increase of 182,000 VND/tael on the buying side and an increase of 187,000 VND/tael on the selling side compared to yesterday morning.

The price of silver ingots 2025 Ancarat 999 (1kg) at Ancarat Gem Company is listed at 76,974 - 79,314 million VND/kg (buying - selling); an increase of 4.838 million VND/kg on the buying side and an increase of 4.988 million VND/kg on the selling side compared to yesterday morning.

The price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Commercial Joint Stock Company Limited (Sacombank-SBJ) is listed at 3.183 - 3.291 million VND/tael (buying - selling); an increase of 81,000 VND/tael in both buying and selling directions compared to yesterday morning.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 2.901 - 2.991 million VND/tael (buying - selling); an increase of 175,000 VND/tael on the buying side and an increase of 181,000 VND/tael on the selling side compared to yesterday morning.

The price of 999 silver ingots (1kg) at Phu Quy Jewelry Group is listed at 77.359 - 79.759 million VND/kg (buying - selling); an increase of 4.666 million VND/kg on the buying side and an increase of 4.826 million VND/kg on the selling side compared to yesterday morning.

World silver price

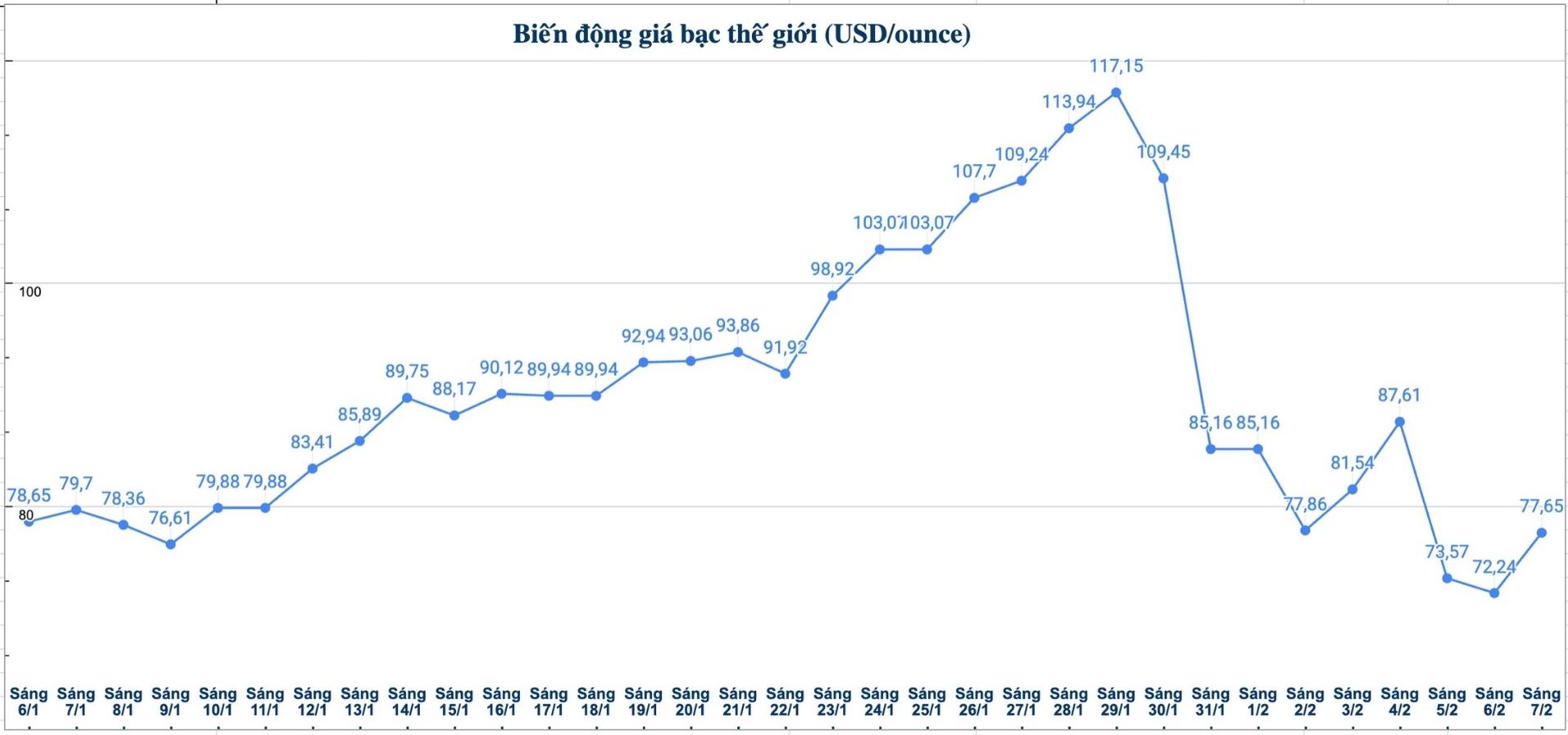

On the world market, as of 10:15 am on February 7 (Vietnam time), the world silver price was listed at 77.65 USD/ounce; up 5.41 USD compared to yesterday morning.

Causes and forecasts

The silver market has just experienced a volatile trading session when prices suddenly plummeted below the 70 USD/ounce mark, before reversing to increase again.

Precious metals analyst Christopher Lewis at FX Empire said that this development is attracting the attention of investors, because it shows mixed technical signals and market sentiment is still unstable.

Specifically, the initial silver price decreased very sharply, causing many investors to worry that the market would enter a bad trend. However, immediately after that, the price rebounded in the same trading session. This development created a candlestick "hammer" pattern, a sign that the price could reverse.

Thanks to this, the pessimistic sentiment in the market has eased, and at the same time shows that silver prices are likely to find a support zone to accumulate in the near future" - the expert said.

However, Christopher Lewis believes that market risks are still high. "Continuous strong market volatility can bring short-term profit opportunities, but also increase risks. High volatility often makes investors more cautious, thereby potentially creating further downward pressure in the medium term," he said.

He added that the room for silver prices to rise in the short term is not too large. The market needs more sideways time, with more stable trading sessions, to confirm a clear trend. Reality shows that previous sideways efforts all ended with strong declines.

In summary, despite signs of technical recovery, the silver market is still under significant pressure. Investors should closely monitor daily developments before making decisions, in the context that the medium-term trend has not yet been truly established" - Christopher Lewis emphasized.

See more news related to silver prices HERE...