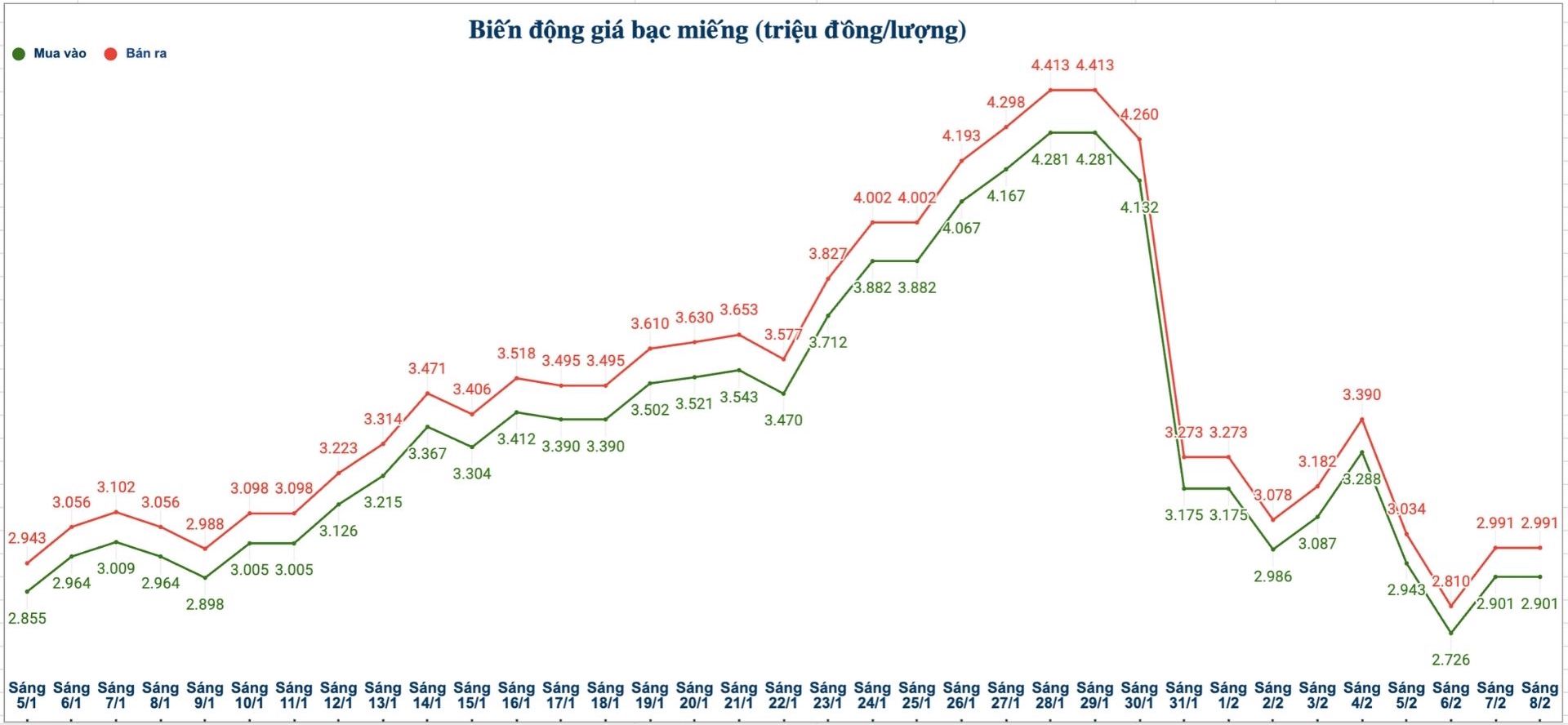

Domestic silver prices

As of 10:15 am on February 8, the price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Commercial Joint Stock Bank Gold and Silver Company Limited (Sacombank-SBJ) is listed at the threshold of 3.183 - 3.291 million VND/tael (buying - selling).

The price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Gem Company is listed at the threshold of 2.921 - 2.993 million VND/tael (buying - selling).

The price of 2025 Ancarat 999 (1kg) silver ingots at Ancarat Gem Company is listed at 76.974 - 79.314 million VND/kg (buying - selling).

In the previous week's trading session (morning of February 1, 2026), the price of silver ingots 2025 Ancarat 999 (1kg) at Ancarat Gem Company was listed at 86.320 - 88.940 million VND/kg (buying - selling).

Thus, if you buy 2025 Ancarat 999 silver ingots (1kg) at Ancarat Gemstone Company on February 1, 2026 and sell them on this morning's session (February 8, 2026), the buyer will lose 11.966 million VND/kg.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 2.901 - 2.991 million VND/tael (buying - selling).

The price of 999 silver ingots (1kg) at Phu Quy Jewelry Group is listed at 77.359 - 79.759 million VND/kg (buying - selling).

In the previous week's trading session (February 1, 2026), the price of 999 silver bars (1kg) at Phu Quy Jewelry Group was listed at 84.666 - 87.279 million VND/kg (buying - selling).

Thus, if you buy 999 silver ingots (1kg) at Phu Quy Jewelry Group in the February 1st session of 2026 and sell them in this morning's session (February 8th, 2026), buyers will lose 9.92 million VND/kg.

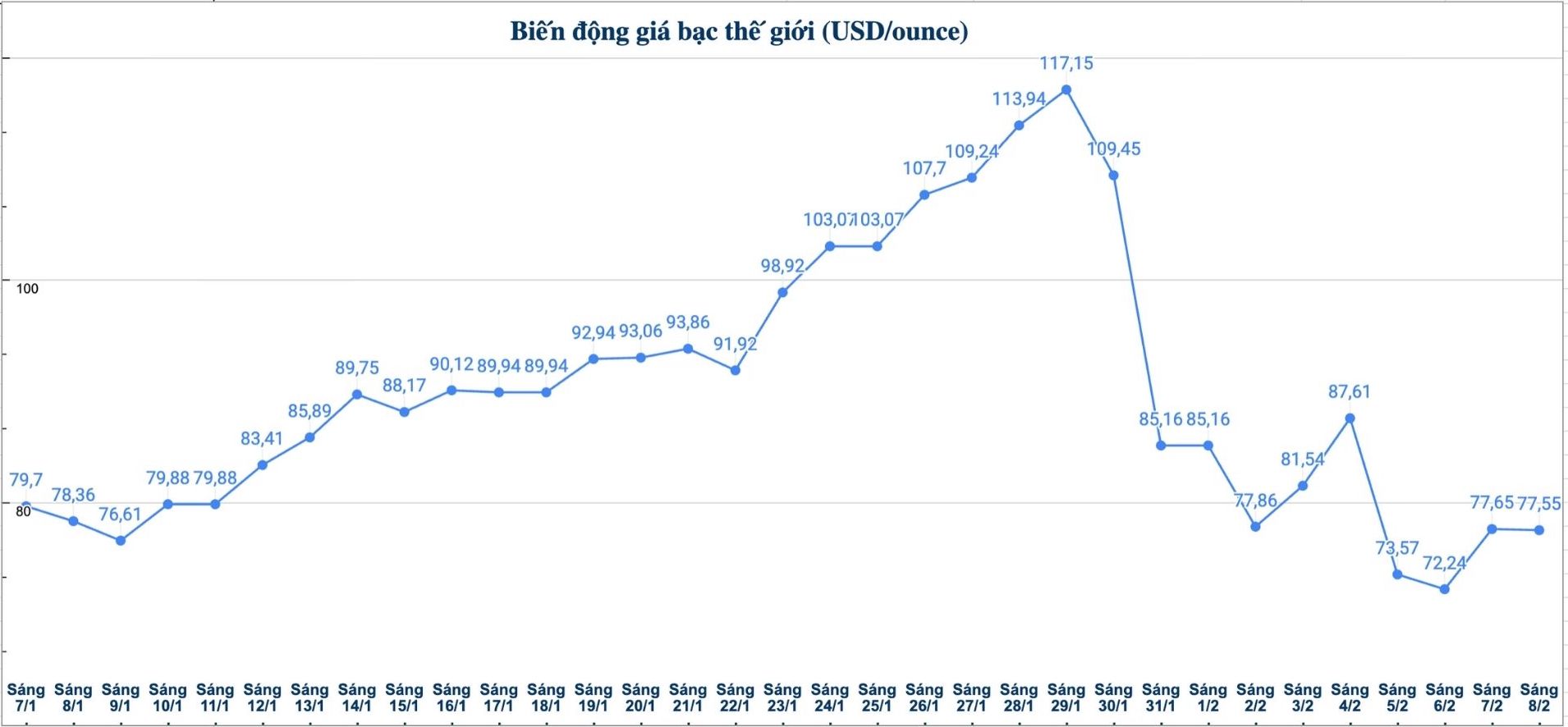

World silver price

On the world market, as of 10:15 am on February 8 (Vietnam time), the world silver price is listed at 77.55 USD/ounce.

Causes and forecasts

Silver prices have just recorded a sharp week of decline in the context of the US dollar rising and global stock markets undergoing downward pressure. Faced with these fluctuations, many investors have sold precious metals to compensate for losses in the stock market, putting silver prices under further pressure in the short term.

According to The Economic Times, this price reduction is mainly adjusted after silver reached a recent record high. The strengthening of the US dollar often reduces the attractiveness of the precious metal, while risk avoidance sentiment causes temporary cash flow to leave silver. However, if market fluctuations cool down, silver prices are still likely to recover in the near future.

In the current context, analysts at The Economic Times recommend that investors should approach silver cautiously. Short-term trading may contain high risks due to large fluctuations, while portfolio diversification to gold, platinum or other metals may help minimize risks.

Closely monitoring the diễn biến of the US dollar and the stock market is considered a key factor before making investment decisions. Although short-term corrections may continue, in the long term, the fundamentals of the silver market are still assessed as relatively stable.

Regarding medium and long-term prospects, JP Morgan (popular name of JPMorgan Chase & Co., one of the world's largest financial and banking corporations, headquartered in the US) said that silver is still being valued at a high level, so strong corrections may continue to appear in volatile trading sessions.

This bank forecasts that the short-term floor price of silver may be in the range of 75 - 80 USD/ounce and is likely to recover to the 90 USD/ounce mark in 2026 if market conditions are more favorable.

See more news related to silver prices HERE...