Domestic silver prices

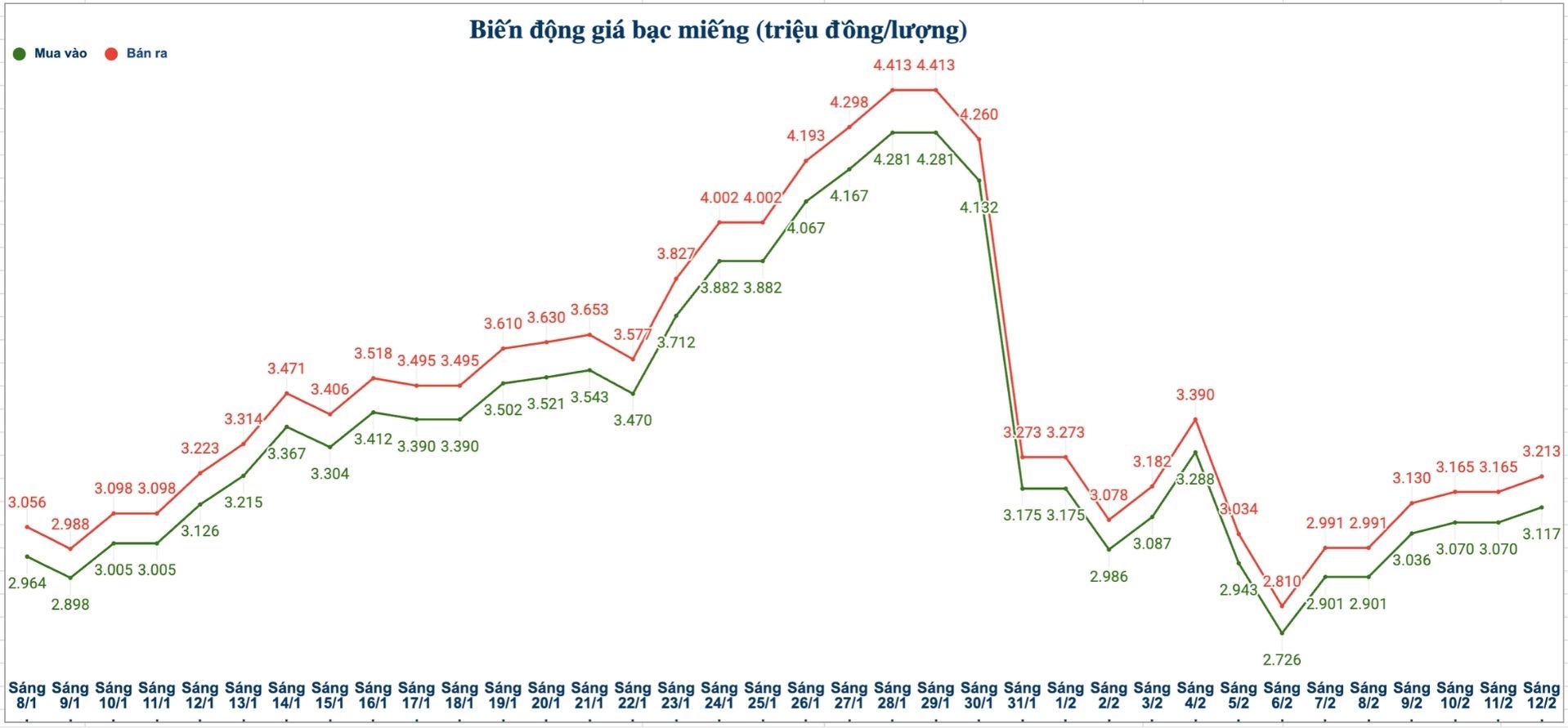

As of 9:35 am on February 12, the price of silver bars 2024 Ancarat 999 (1 tael) at Ancarat Gem Company was listed at 3.108 - 3.184 million VND/tael (buying - selling); an increase of 42,000 VND/tael on the buying side and an increase of 43,000 VND/tael on the selling side compared to yesterday morning.

The price of silver ingots 2025 Ancarat 999 (1kg) at Ancarat Gem Company is listed at 81.916 - 84.406 million VND/kg (buying - selling); an increase of 1.116 million VND/kg on the buying side and an increase of 1.146 million VND/kg on the selling side compared to yesterday morning.

The price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Commercial Joint Stock Company Limited (Sacombank-SBJ) is listed at 3.423 - 3.531 million VND/tael (buying - selling); an increase of 66,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at 3.117 - 3.213 million VND/tael (buying - selling); an increase of 49,000 VND/tael on the buying side and an increase of 50,000 VND/tael on the selling side compared to yesterday morning.

The price of 999 silver ingots (1kg) at Phu Quy Jewelry Group is listed at 83.119 - 85.679 million VND/kg (buying - selling); an increase of 1.306 million VND/kg on the buying side and an increase of 1.333 million VND/kg on the selling side compared to yesterday morning.

World silver price

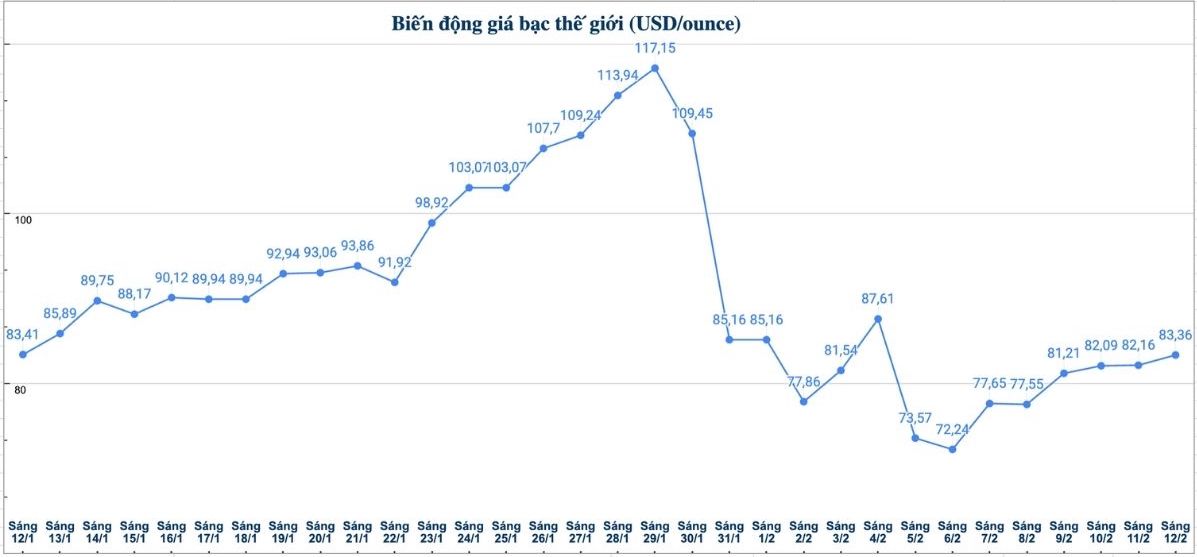

On the world market, as of 9:35 AM on February 12 (Vietnam time), the world silver price was listed at 83.36 USD/ounce; an increase of 1.2 USD compared to yesterday morning.

Causes and forecasts

The silver market continues to experience strong fluctuations, although the US jobs report does not cause much controversy, price fluctuations will still certainly affect market trends.

According to precious metals analyst Christopher Lewis at FX Empire, silver prices rebounded as the US jobs report exceeded expectations, showing that the economy still maintains good recovery momentum.

This could prolong the Federal Reserve (Fed)'s waiting time for interest rate cuts, a factor that many experts believe could negatively affect the silver market," he said.

The expert said that the current price of silver is assessed as stable, with support at 70 USD/ounce and resistance at 90 USD/ounce.

If the price exceeds the threshold of 90 USD/ounce, it may open up a strong recovery opportunity for silver. However, this may also create risks when the market has had excessive growth waves in the past, causing many investors to suffer losses due to too high expectations" - Christopher Lewis noted.

Christopher Lewis said that the big question now is whether silver prices can surpass the 90 USD/ounce mark. If possible, he believes this will be a very positive signal, opening up opportunities for growth momentum. Conversely, if this level is not surpassed, the market will continue to fluctuate in a narrow range, creating a sideways trend.

In the current situation, investors are recommended to be patient and consider buying strategies when silver prices fall, as long as the price remains above the support level of 70 USD/ounce. The longer the accumulation time in this price range, the better, because stability will help avoid strong fluctuations and minimize risks" - Christopher Lewis said.

See more news related to silver prices HERE...