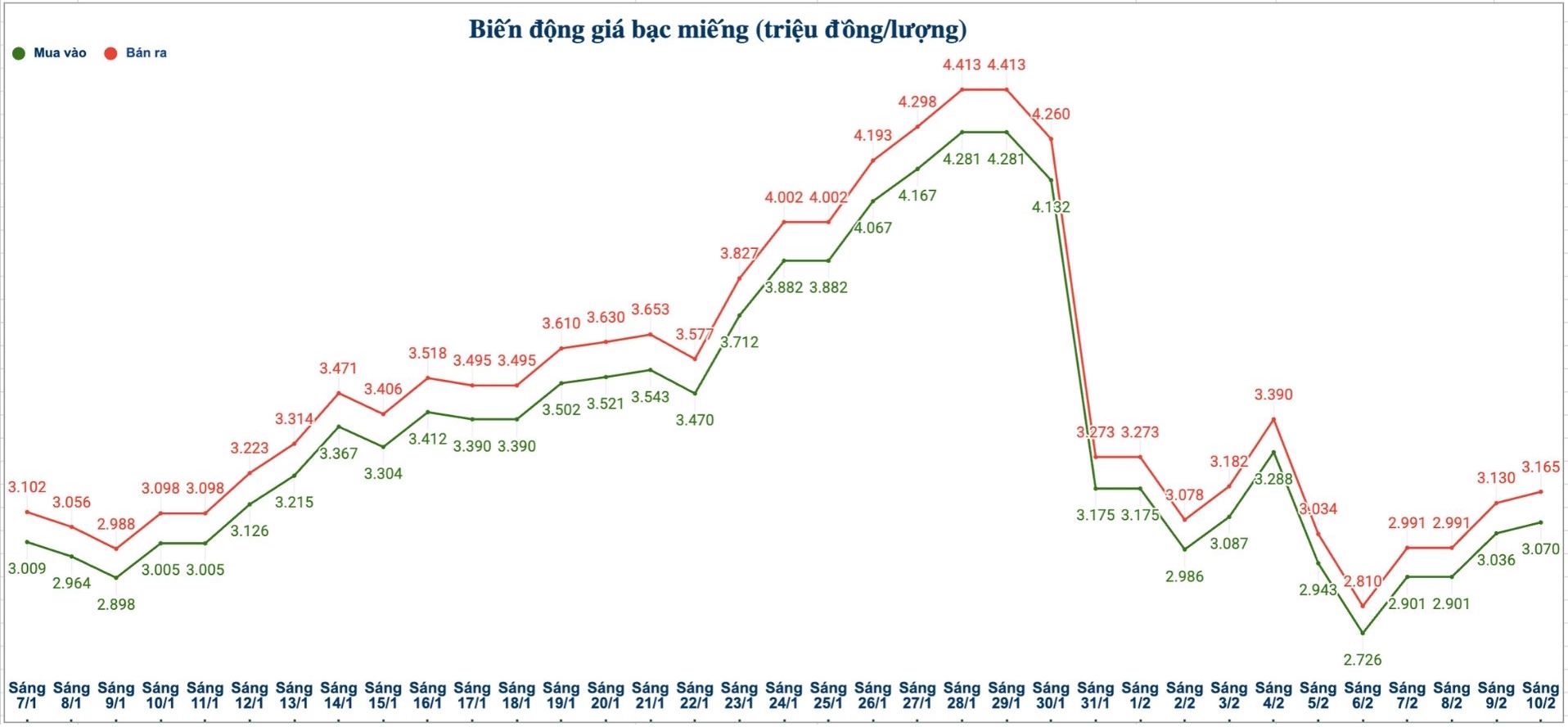

Domestic silver prices

As of 10:15 am on February 11, the price of silver bars 2024 Ancarat 999 (1 tael) at Ancarat Gem Company was listed at 3.066 - 3.141 million VND/tael (buying - selling); an increase of 4,000 VND/tael in both directions compared to yesterday morning.

The price of silver ingots 2025 Ancarat 999 (1kg) at Ancarat Gem Company is listed at 80,800 - 83,260 million VND/kg (buying - selling); an increase of 96,000 VND/kg on the buying side and an increase of 106,000 VND/kg on the selling side compared to yesterday morning.

The price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Commercial Joint Stock Company Limited (Sacombank-SBJ) is listed at the threshold of 3.357 - 3.465 million VND/tael (buying - selling); an increase of 6,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 3.068 - 3.163 million VND/tael (buying - selling).

The price of 999 silver ingots (1kg) at Phu Quy Jewelry Group is listed at 81.813 - 84.346 million VND/kg (buying - selling).

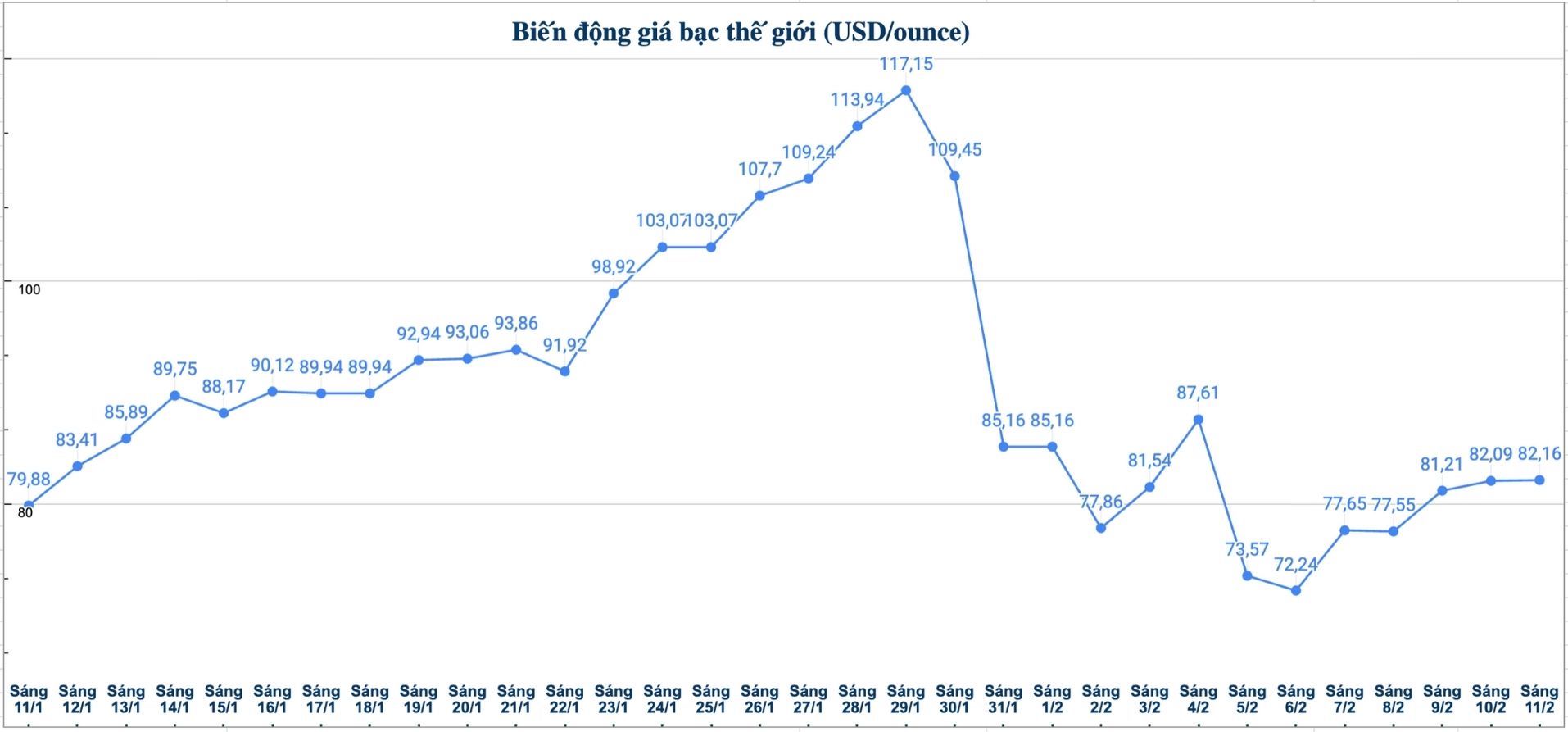

World silver price

On the world market, as of 10:15 am on February 11 (Vietnam time), the world silver price was listed at 82.16 USD/ounce; up 0.07 USD compared to yesterday morning.

Causes and forecasts

According to precious metals analyst James Hyerczyk of FX Empire, the silver market is looking for a temporary support zone while waiting for important economic information to be released soon.

Crude oil prices increased due to tensions between the US and Iran, while gold and silver - assets often considered "safe havens" - did not increase correspondingly. The USD weakened, a factor that often supports precious metals, but silver has not yet rebounded significantly. The decline in US bond yields is also not enough to boost the market in the short term.

This lack of consensus shows that investors are in a cautious state and waiting for important economic data this week," he said.

James Hyerczyk said that this week, investors are particularly interested in three important US reports including: Retail Sales, the Non-Farm Payrolls (NFP) report and the Consumer Price Index (CPI).

According to James Hyerczyk, the jobs report expected to be released on Wednesday and the inflation data released on Friday are assessed as having the greatest impact. These figures will directly impact the expectations for monetary policy of the US Federal Reserve (Fed), especially when interest rate cuts begin in 2026. The market is currently predicting that the Fed may cut interest rates for the first time in June 2026.

Reality shows that silver prices in the past have been strongly influenced by monetary policy expectations. The remarkable price increase at the end of January 2025 took place right after the Fed's policy announcement and before information related to senior personnel at this agency. This shows that the Fed's interest rate orientation plays a major dominant role in the precious metals market" - James Hyerczyk said.

He said that if the upcoming data continues to reinforce the possibility that the Fed will have two interest rate cuts in 2026, the upward trend of silver is likely to be maintained. Conversely, if economic data is too positive, causing the Fed to postpone or reduce the scale of interest rate cuts, silver prices may be under adjustment pressure.

The diễn biến of silver prices in the coming days will depend heavily on how the market interprets these figures and their impact on the Fed's monetary policy" - James Hyerczyk gave his opinion.

See more news related to silver prices HERE...