Silver prices continue to increase strongly as demand far exceeds supply, pushing the global precious metals market into an unprecedented period of strong fluctuations.

According to Bloomberg, the steady increase in silver is "supported" by both technical factors and the physical shortage of silver in London. This tense situation raises concerns that the silver market could fall into a state of disarray if supply does not improve.

Despite a nearly 70% increase since the beginning of 2025, silver prices have shown no signs of cooling down. Experts predict that the increase could become more extreme in the coming time.

Bank of America (BofA - one of the largest banks in the US and the world) recently released an optimistic report on the outlook for precious metals, targeting a silver price of 65 USD/ounce in 2026. Despite the possibility of a short-term correction and physical demand could fall by 11% next year, the BofA analysis team still believes that the market will continue to have a supply deficit, thereby reinforcing expectations of a 30% price increase.

Expert David Jensen believes that the demand for physical silver is far exceeding supply, while silver loan interest rates have skyrocketed by more than 100%. "The only solution to a market recovery is to increase prices," he wrote in an analysis on Substack.

According to Jensen, the London Silver Market Association (LBMA) - the world's largest silver exchange - is "nearly paralyzed" because there is not enough money to hand over billions of dollars in signed contracts. "The London market is in a state of chaos because the amount of silver circulating freely is too small compared to current demand," he stressed.

Saxo Bank said in its weekend report that the London spot market is under serious stress due to sharp decline in inventory. To date, London's silver reserves have fallen by about a third compared to 2021. This makes the spot silver price in London significantly higher than the price of a contract futures on the comex exchange (USA).

Saxo Bank commodity strategist Ole Hansen said that the disorder in the silver market is not unprecedented. However, the level this time is the most serious ever.

According to Ole Hansen, the current "fake investor price increase" is not only a short-term fluctuation but stems from factors accumulated throughout 2025 - including a wave of investment in precious metals to prevent inflation, a weakening of the USD and strong demand from the solar and high-tech energy industries.

The current gold- silver price ratio is 81 times higher than the 20-year average of 70 times - showing that silver still has room to increase strongly.

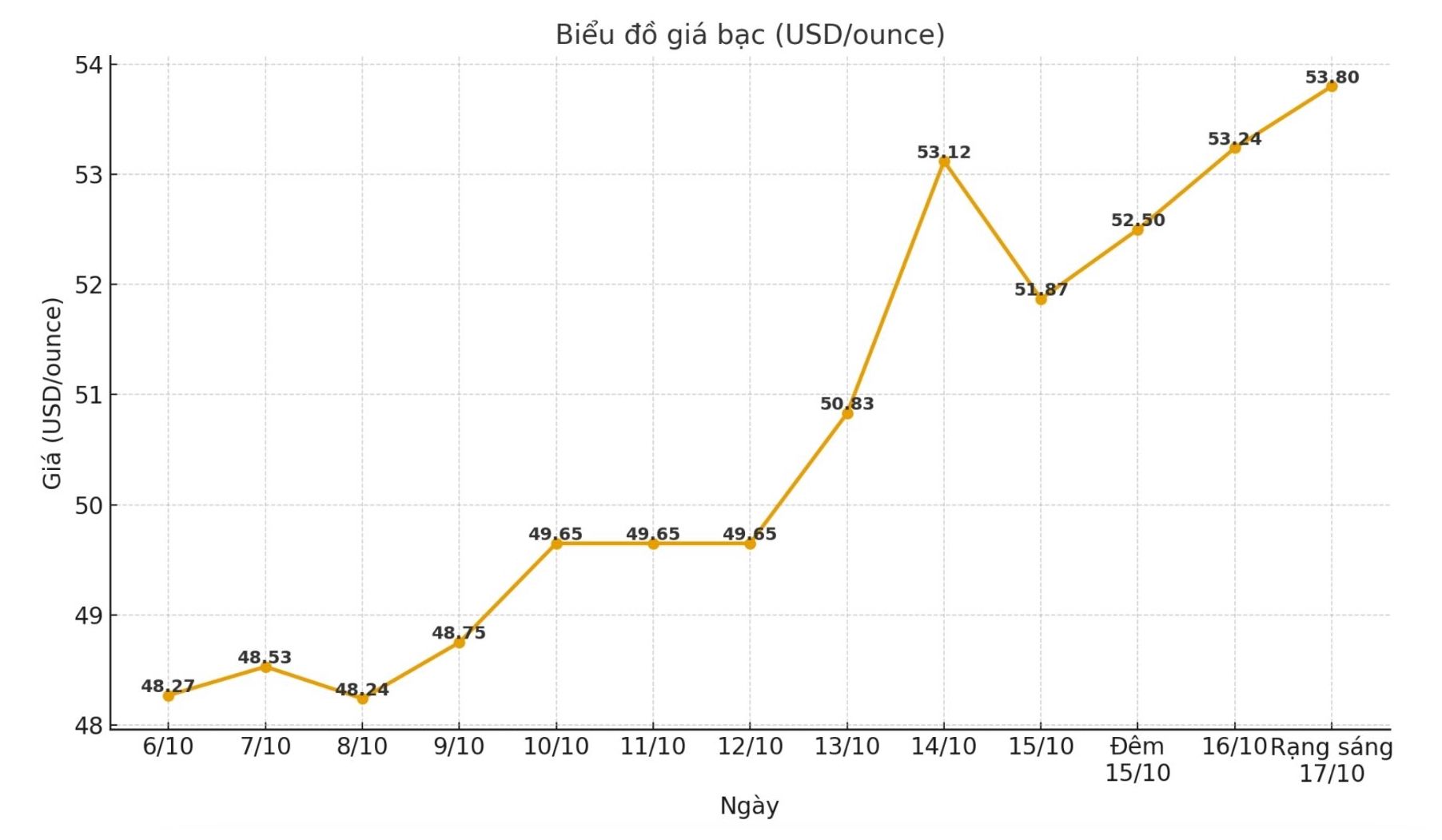

As of 00:10 on October 17, the world silver price was listed at 53.8 USD/ounce.

See more news related to silver prices HERE...