Domestic silver price

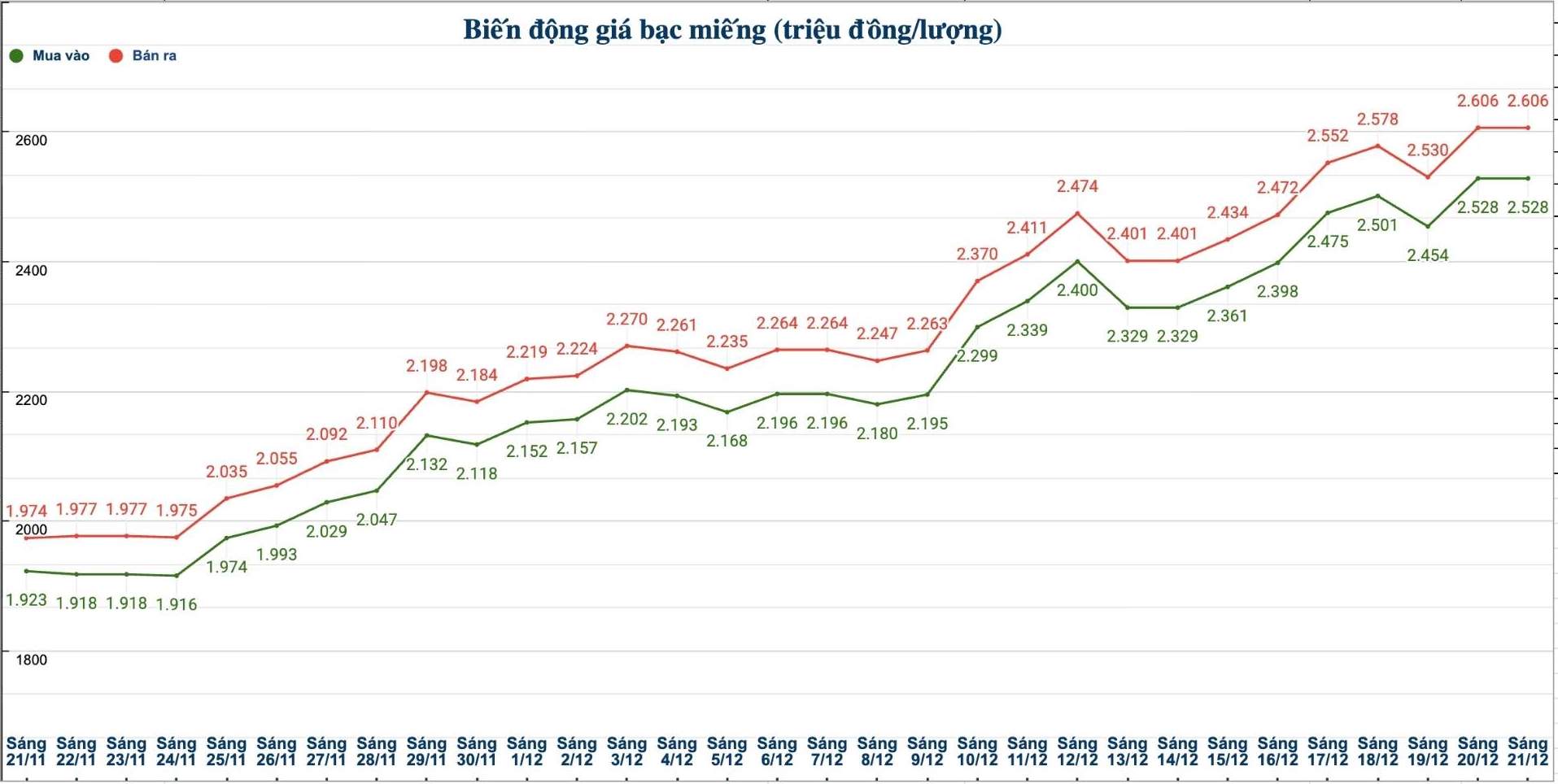

As of 9:40 a.m. on December 21, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 2.524 - 2.586 million VND/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 66.440 - 68.460 million VND/kg (buy - sell).

In the trading session last week (morning of December 14, 2025), the price of 999 Ancarat 999 (1kg) at Ancarat Petrochemical Company was listed at 61.266 - 63.126 million VND/kg (buy - sell).

Thus, if buying 999 999 Ancarat 999 (1kg) of Ancarat silver bars at Ancarat Golden Rooster Company on December 14 and selling them this morning (December 21), buyers will make a profit of VND3.314 million/kg.

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 2.528 - 2.606 million VND/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 67.413 - 69.493 million VND/kg (buy - sell).

In the trading session last week (morning of December 14, 2025), the price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at VND62.106 - 64.026 million/kg (buy - sell).

Thus, if buying 999 taels of silver (1kg) at Phu Quy Jewelry Group on December 14 and selling it this morning (December 21), buyers will make a profit of VND3.387 million/kg.

World silver price

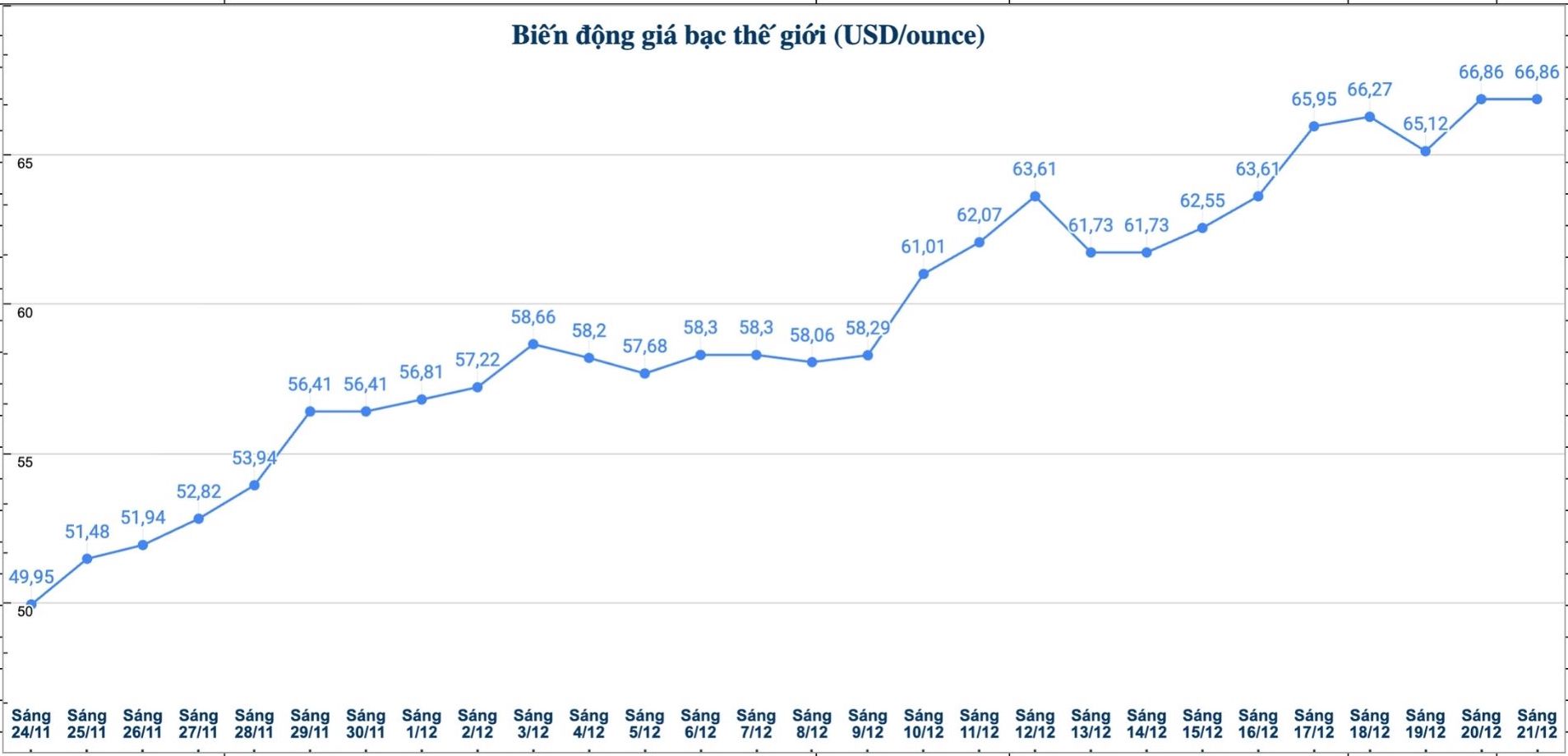

On the world market, as of 9:40 a.m. on December 21 (Vietnam time), the world silver price was listed at 66.86 USD/ounce.

Causes and predictions

Silver prices continue to increase thanks to many factors, including expectations of interest rate cuts and industrial demand.

US inflation in November fell but fell below forecasts, reinforcing the view that monetary conditions are gradually easing. According to data from the US Bureau of Labor Statistics, general consumer inflation fell to 2.7%, while core inflation was at 2.6%.

Arslan Ali - currency and commodity analyst at FX Empire - commented that lower inflation reinforces the argument about loosening long-term monetary policy, although the possibility of a short-term interest rate cut is still uncertain.

"Low interest rates help investors seek safe assets, thereby supporting stable gold and silver prices," he said.

In addition to interest rates, demand is still an important factor helping precious metals maintain prices. Central banks continue to buy gold at a high historical average, while demand for individual investment remains strong, despite uncertainties in global growth and fiscal policy.

"For silver, in addition to its role as a defensive asset, this metal is also supported by industrial demand, especially in energy transition applications. Thanks to this dual role, silver is less volatile even as macro expectations change," Arslan Ali emphasized.

He also noted that geopolitical tensions related to energy and the global supply chain continue to make investors interested in gold and silver as reliable defensive assets.

See more news related to silver prices HERE...