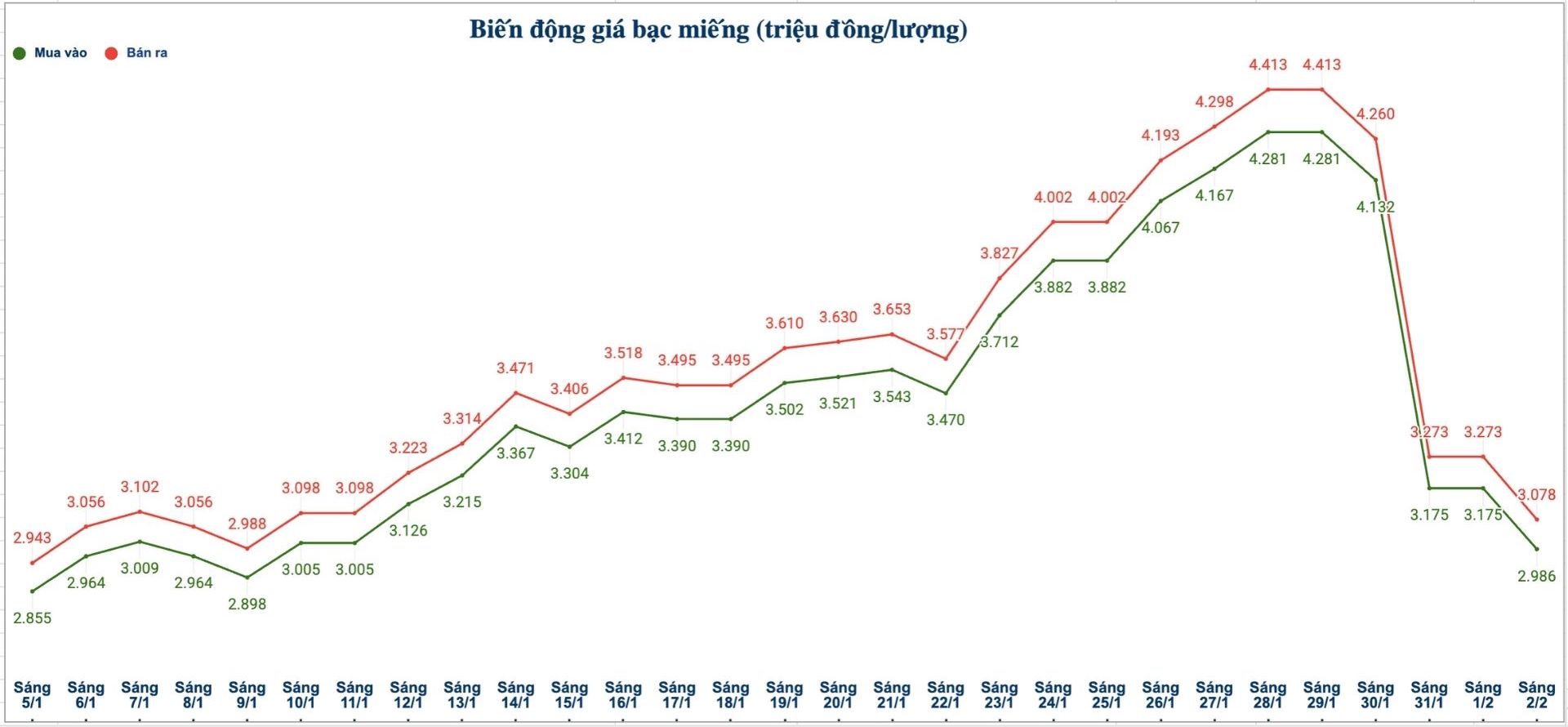

Domestic silver prices

As of 10:35 am on February 2nd, the price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Commercial Joint Stock Company Limited (Sacombank-SBJ) was listed at 3.315 - 3.432 million VND/tael (buying - selling); down 732,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 2.986 - 3.078 million VND/tael (buying - selling); down 189,000 VND/tael on the buying side and down 195,000 VND/tael on the selling side compared to yesterday morning.

The price of 999 silver ingots (1kg) at Phu Quy Jewelry Group is listed at 79.626 - 82.079 million VND/kg (buying - selling); down 5.04 million VND/kg on the buying side and down 5.2 million VND/kg on the selling side compared to yesterday morning.

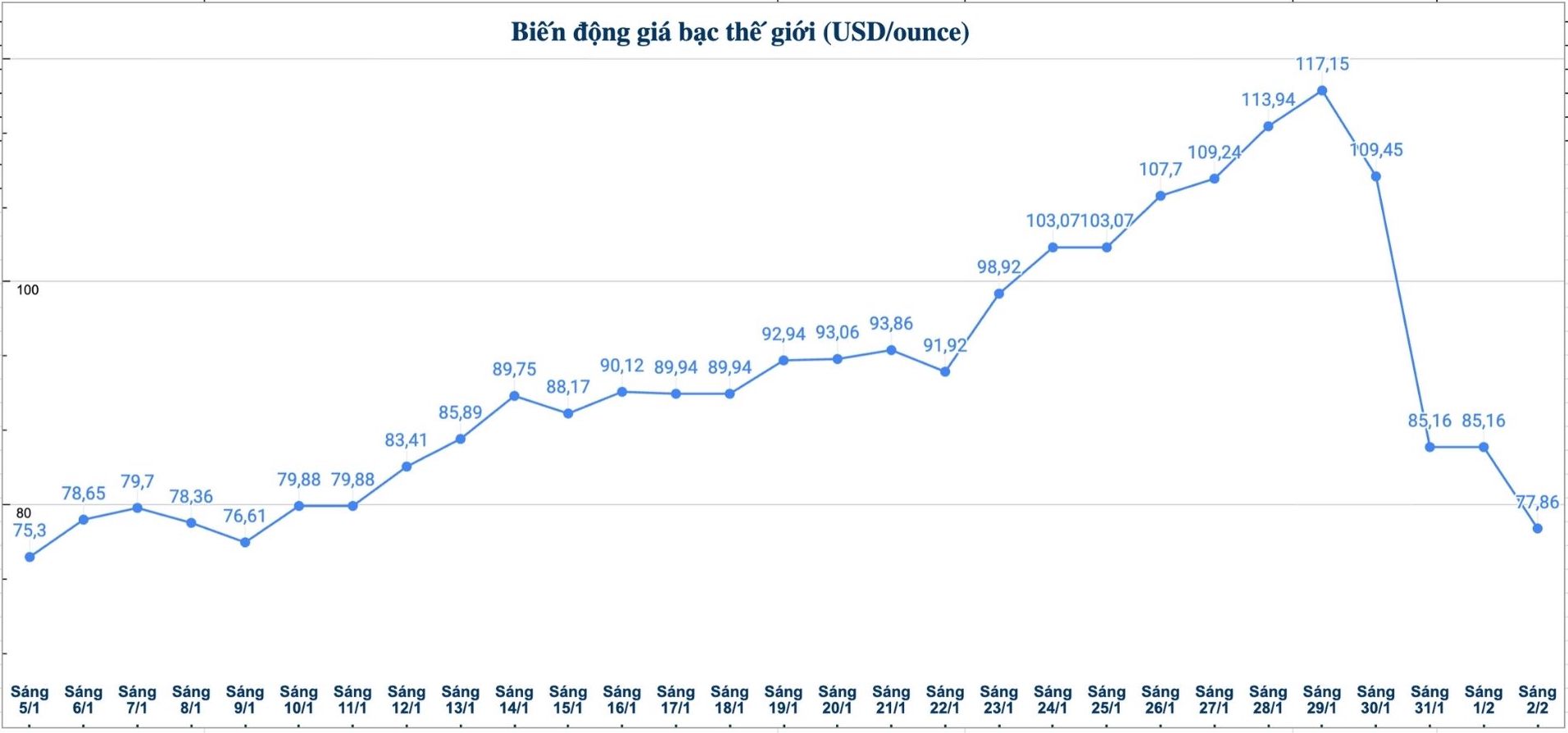

World silver price

On the world market, as of 10:50 am on February 2nd (Vietnam time), the world silver price was listed at 77.86 USD/ounce; down 7.3 USD compared to yesterday morning.

Causes and forecasts

Spot silver prices continued to decline deeply as profit-taking activities took place massively. The sharp decline shows that selling pressure has not shown signs of stopping, forcing investors to closely monitor important technical thresholds to assess the possibility of reversal.

Precious metals analyst James Hyerczyk at FX Empire said that this deep correction does not stem from fundamental market changes such as the discovery of large silver mines or a sudden increase in supply.

The main reason comes from the fact that speculative demand has far exceeded actual usage demand for a long time. When profit-taking sentiment spread, the supply-demand rule quickly regained its dominant role, pulling prices down sharply," he said.

James Hyerczyk added that when the market fluctuates strongly, professional investors are usually not in a hurry to buy in. They wait for prices to fall and stabilize again, when selling pressure has weakened, and then consider participating.

Meanwhile, small investors often expect support levels to hold their prices, so they are easily swept away by short-term fluctuations," the expert said.

In the short term, James Hyerczyk believes that the big question is whether silver prices can stand firm around the 83.61 USD/ounce mark or will continue to fall deeply to the 74 - 75 USD/ounce zone.

Buying or selling at this time should be based on actual price fluctuations and market trend strength, instead of waiting for unexpected news. When the trend becomes clear, cash flow will return, and currently investors should prioritize caution" - James Hyerczyk gave his opinion.

See more news related to silver prices HERE...