Domestic silver price

As of 10:35 a.m. on November 23, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1.917 - 1.959 million VND/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 50.370 - 51.790 million VND/kg (buy - sell).

In the trading session of the previous 2 months (morning of September 23, 2025), the price of Ancarat 999 (1kg) silver bars at Ancarat Petrochemical Company was listed at 43,844 - 44.994 million VND/kg (buy - sell).

Thus, if buying 999 999 Ancarat 999 (1kg) of 2025 silver bars at Ancarat Golden Rooster Company on September 23 and selling them this morning (November 23), buyers will make a profit of VND 5.376 million/kg.

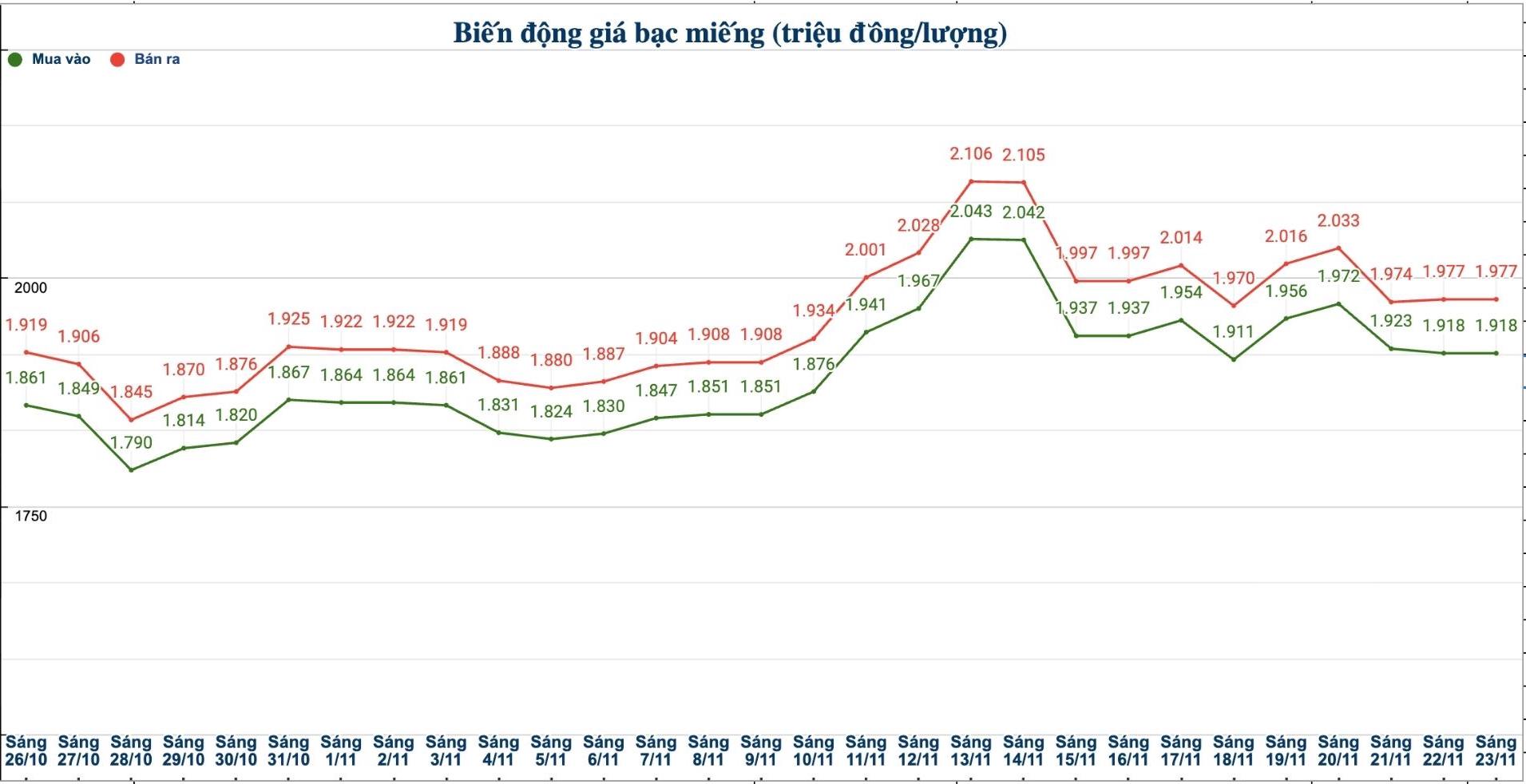

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.918 - 1.977 million VND/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 51,146 - 52,719 million VND/kg (buy - sell).

In the trading session of the previous 2 months (morning of September 23, 2025), the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 44,586 - 45.973 million VND/kg (buy - sell).

Thus, if buying 999 taels of silver (1kg) at Phu Quy Jewelry Group on September 23 and selling it this morning (November 23), buyers will make a profit of VND5.173 million/kg.

World silver price

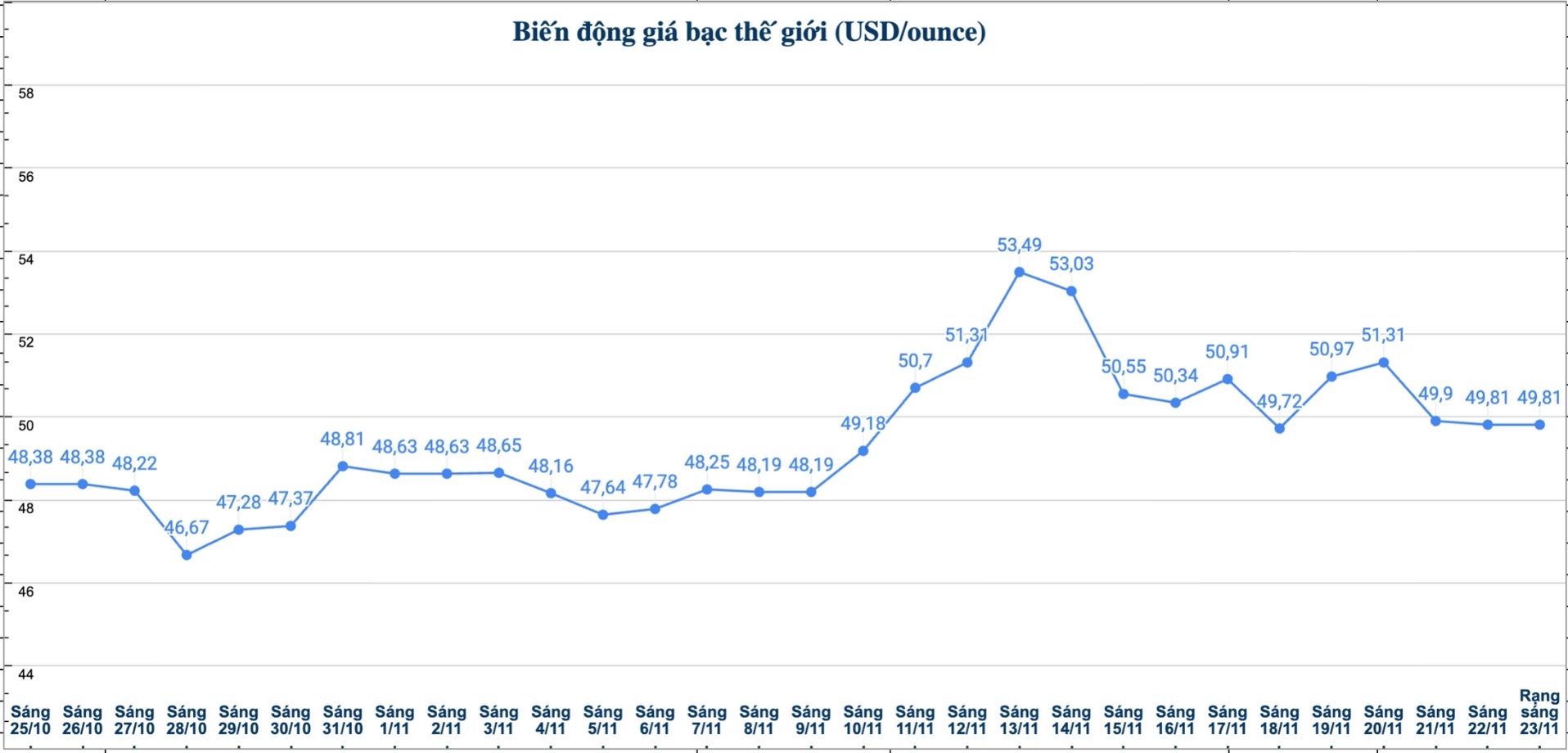

On the world market, as of 10:35 a.m. on November 23 (Vietnam time), the world silver price was listed at 49.81 USD/ounce; unchanged from yesterday morning.

Causes and predictions

Silver prices have risen more than 80% since the beginning of 2025 amid increased economic uncertainty and US trade policy, supported by long-term demand. After surpassing the $40/ounce mark in early September, silver continued to climb above $54/ounce in mid-October.

However, according to FxStreet, selling pressure has increased last week as the majority of traders believe that the US Federal Reserve (FED) will keep interest rates unchanged at its December meeting.

In addition, the US jobs report shows that the labor market remains stable, thereby making investors more cautious about the possibility of the FED loosening monetary policy soon.

According to CME's FedWatch tool, the possibility of the FED cutting interest rates by another 25 basis points to 3.50% - 3.75% is only about 35.5%. This means the market is leaning more towards the scenario of the FED keeping interest rates unchanged. If that happens, it is a negative signal for non-yielding assets like silver.

Although the price of precious metals is under pressure to decrease in the short term, Ms. Renisha Chainani - Head of Research at Augmont - commented that the long-term support trend is still very strong, thanks to many fundamental factors. These include global geopolitical tensions and fluctuations, high US public debt, the trend of countries diversifying reserves away from the US dollar, along with continuous buying by central banks around the world.

See more news related to silver prices HERE...