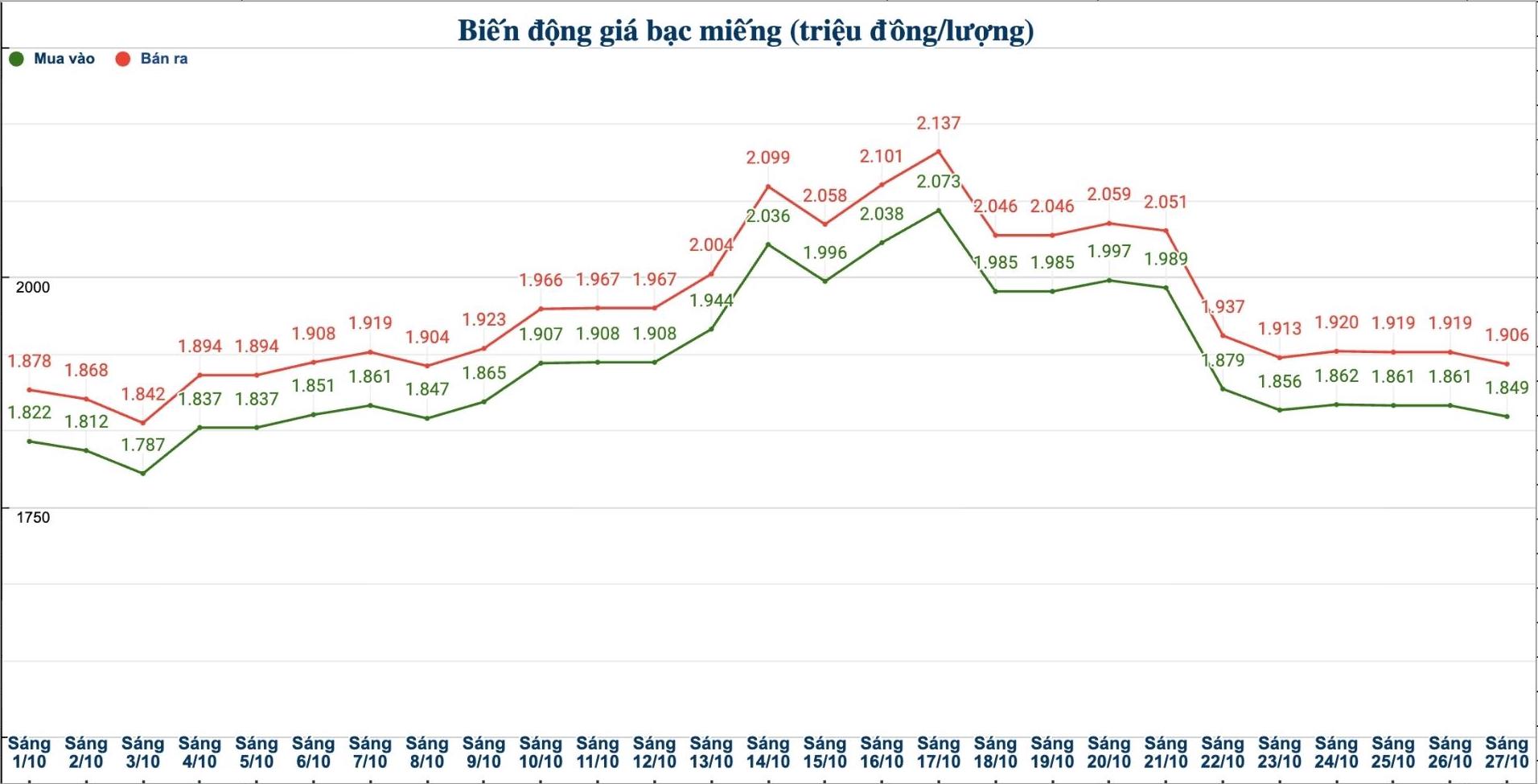

Domestic silver price

As of 9:45 a.m. on October 27, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1.848 - 1.890 million VND/tael (buy - sell); down 16,000 VND/tael in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) at Ancarat Metallurgy Company was listed at 48.530 - 49.950 million VND/kg (buy - sell); down 426,000 VND/kg in both directions compared to yesterday morning.

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) was listed at 1.869 - 1.917 million VND/tael (buy - sell); down 12,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.849 - 1.906 million VND/tael (buy - sell); down 12,000 VND/tael for buying and down 13,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 49,306 - 50,826 million VND/kg (buy - sell); down 320,000 VND/kg for buying and down 347,000 VND/kg for selling compared to yesterday morning.

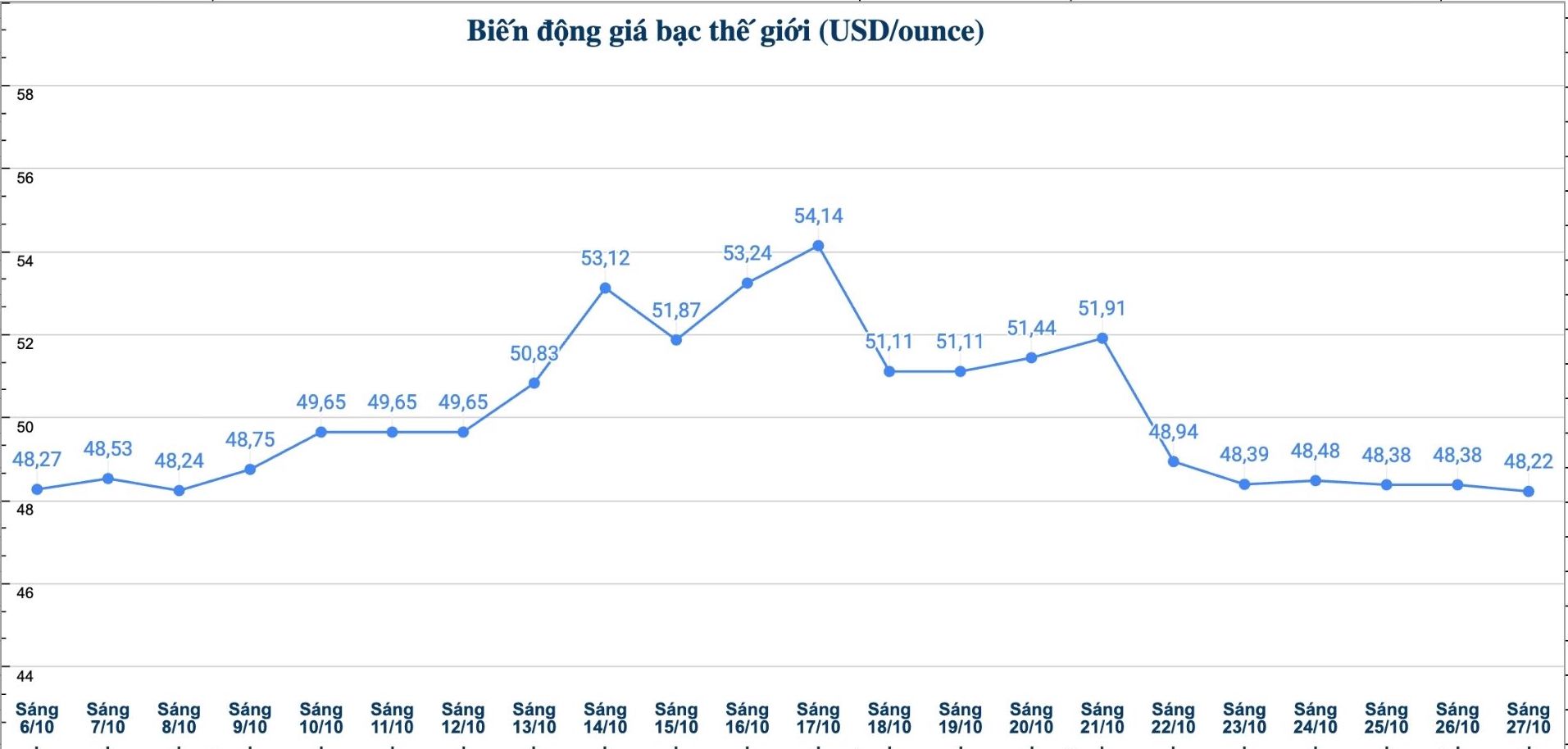

World silver price

On the world market, as of 9:45 a.m. on October 27 (Vietnam time), the world silver price was listed at 48.22 USD/ounce; down 0.16 USD compared to yesterday morning.

Causes and predictions

Silver prices continue to fall sharply. FX Empire precious metals analyst James Hyerczyk predicted that silver prices could fall to $41.40/ounce, or retreat to $38.31/ounce as the market awaits the next interest rate decision by the US Federal Reserve (FED) and the loosening of liquidity.

"The fact that the supply of physical silver in London has returned to normal has eliminated the main bullish momentum in recent times. Silver prices have therefore turned to a more cautious trend," he said.

James Hyerczyk said that liquidity in London has clearly recovered when more than 1,000 tons of silver from the US and China have been transferred to additional depleted reserves.

"Lending costs and spot fees have fallen sharply, causing speculators to simultaneously take profits and withdraw from previous buying positions, increasing downward pressure" - the expert commented.

He added that silver's movements are also being affected by gold's correction. Spot gold prices have created a record high reversal, while the FED has not yet given a clear direction for the rate cut roadmap. This has led to reduced demand for safe haven in precious metals and cautious market sentiment, according to James Hyerczyk.

"In general, the short-term trend of silver is leaning down due to weakened upward momentum and the focus of the market is on the Fed meeting. If the Fed signals caution or does not commit to continuing to cut interest rates, silver prices may continue to adjust. Only when there is a more dovish message from the Fed, will the market have a chance to recover" - James Hyerczyk expressed his opinion.

See more news related to silver prices HERE...