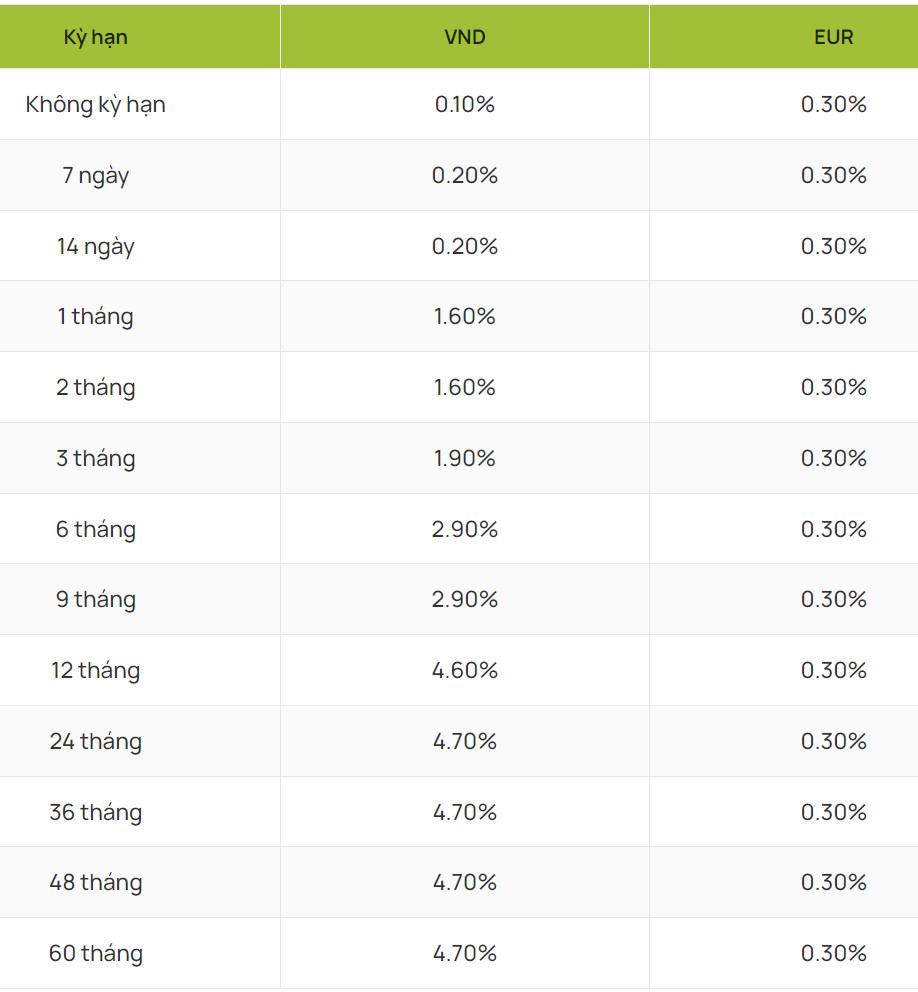

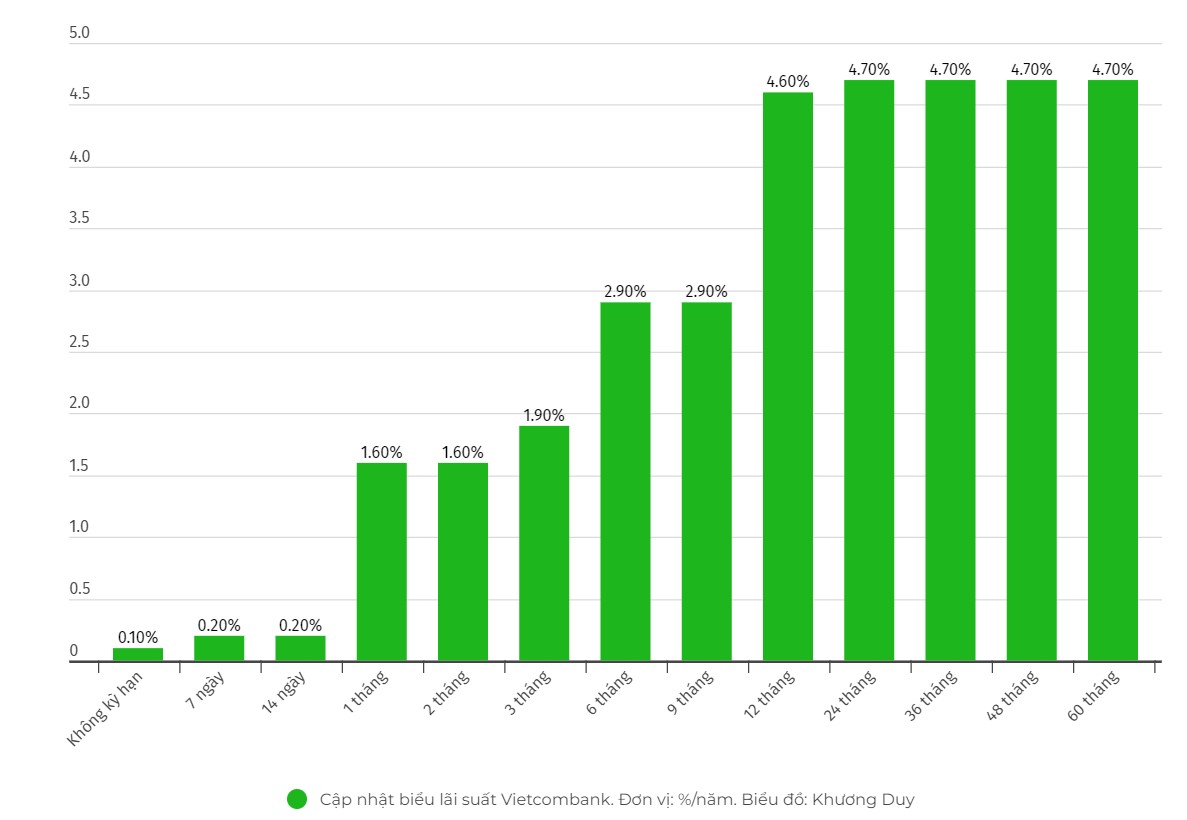

Full set of current Vietcombank interest rates

Interest Rate for savings deposits at Vietcombank currently fluctuates around 1.6 - 4.7%.

Of which, Vietcombank listed interest rates for 24-month, 36-month, 48-month and 60-month deposits at 4.7%.

The interest rate for 12-month deposits is lower at 4.6%. Meanwhile, for 6-month and 9-month deposits, Vietcombank's interest rate is 2.9%.

3-month deposit term, lower interest rate at 1.9% and 1-month, 2-month term interest rate is 1.6%.

Currently, Vietcombank's lowest non-term interest rate is 0.1%.

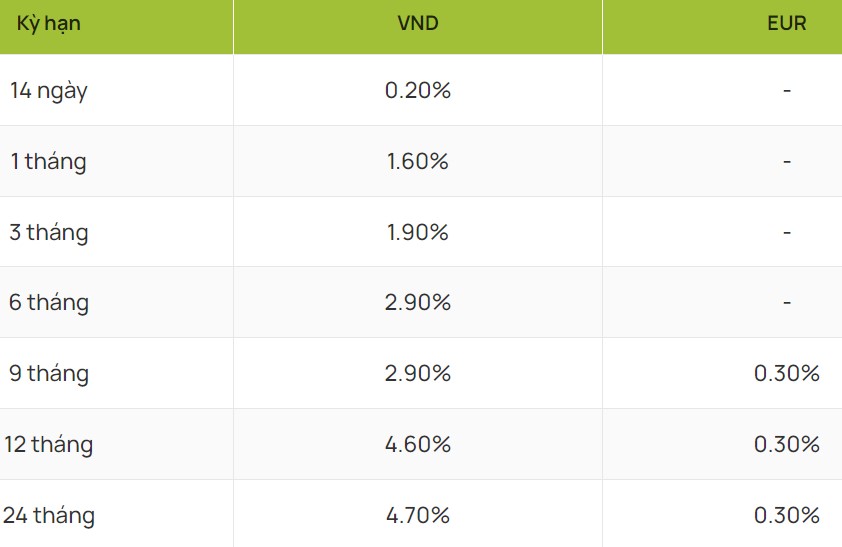

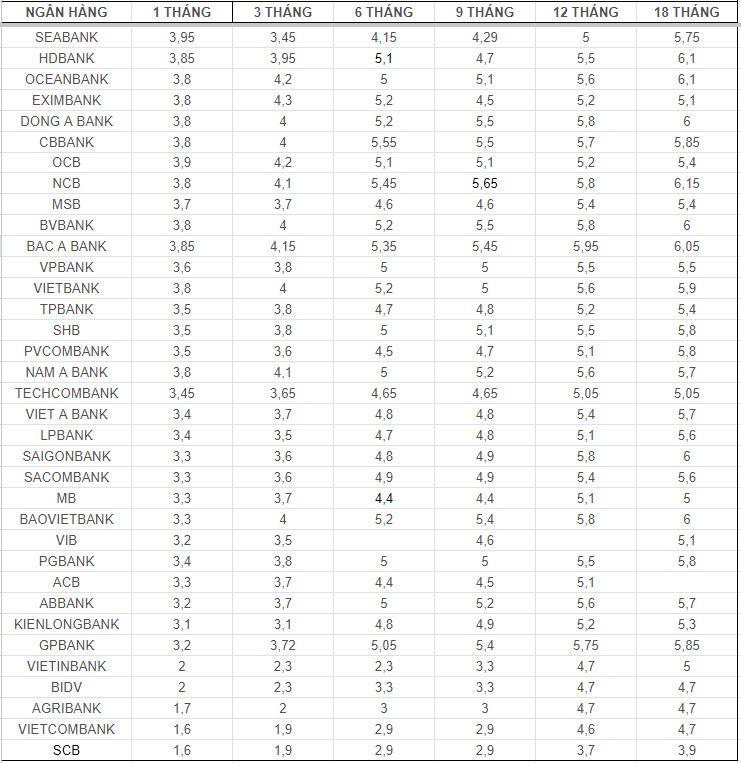

In addition, readers can update interest rates of other banks through the table below:

How to receive interest if saving 200 million VND at Vietcombank?

Formula for calculating bank deposit interest:

Interest = Deposit x interest rate (%)/12 months x deposit term.

For example, you deposit 200 million VND in Vietcombank, depending on the deposit term with different interest rates, the interest you receive is as follows:

+ 3-month term: 950,000 VND.

+ 6 month term: 2.9 million VND.

+ 9-month term: 4.35 million VND.

+ 12-month term: 9.2 million VND.

+ 24-month term: 18.8 million VND.

+ 36-month term: 28.2 million VND.

+ 48-month term: 37.6 million VND.

+ 60-month term: 47 million VND.

Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.