Gold prices soared last night and quickly plummeted after the US Bureau of Labor Statistics (BLS) released preliminary adjustment data showing that US employment decreased by nearly 1 million, three times higher than the 10-year average and the worst figure in history.

According to BLS, the preliminary estimate of the standard adjustment (benchmark revision) for the National Non-Farm Employment Statistics (CES) for March 2025 is -911,000 jobs (-0.6%).

The agency said the figure was 300% worse than the average over the past decade. In the last 10 years, the annual adjustment has an absolute value of only about 0.2% of total non-agricultural employment.

Previously, 2009 recorded the strongest decline with 902,000 jobs, but now it has been surpassed and become the worst figure in statistical history.

Normally, job data adjustments rarely create fluctuations, but this year is different due to the large reductions from the previous quarter. That has attracted special attention from the market.

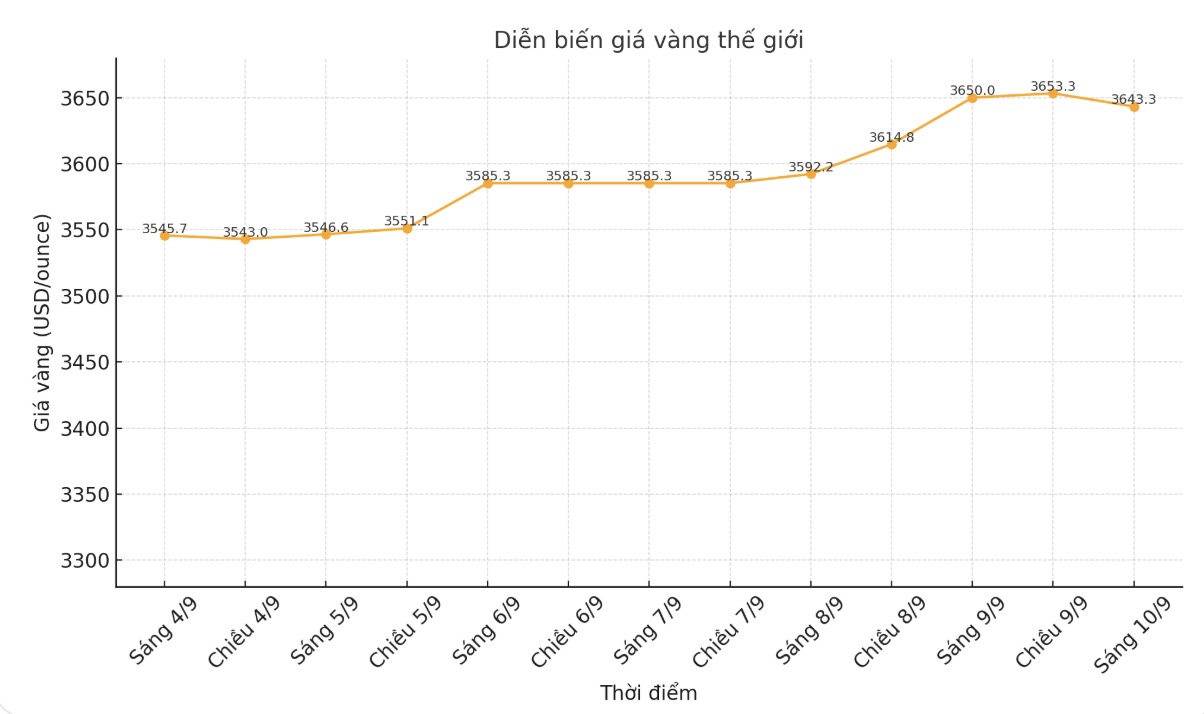

After the data was released at 10:00 a.m. ( EDT), spot gold prices jumped to a session high of $3,674.69/ounce, but fell sharply to $3,643/ounce less than 10 minutes later. By the end of the session, spot gold was trading at $3,651.42/ounce.

Every year, CES employment estimates are standardized based on overall data from the Quarterly Employment and Salary survey (QCEW), which is largely based on states' unemployment insurance tax records.

The BLS explains: Preliminary estimates show a gap between two independent data sources, each with its own errors. It reflects the overall correlation in CES employment estimates from March 2024 to March 2025.

According to preliminary research, BLS believes that the cause of estimated job swelling comes from two factors:

Response error: Enterprises reporting the number of employees to CES is higher than the actual data recorded in QCEW.

Nonresponse error: Enterprises selected to participate in the CES survey but do not respond then report to QCEW that the number of employees is lower than the group of enterprises that responded to the CES survey.

BLS said the official adjustment will be included in the statistics when it releases the January 2026 Employment Report, expected to be released in February 2026.

Chris Zaccarelli - Investment Director of Northlight Asset Management - told Kitco News that these adjustments could harm the overall market growth. The picture of jobs is getting worse, and while that could make it easier for the Fed to cut rates this fall, it could also cool down the recent rally, he said.

He added: Worse, if the consumer price index (CPI) released on Thursday shows a worsening inflation trend, the market will start to worry about the risk of stagflation.

According to him, the bull market this year has shown an incredible rebound, but it may be at a turning point to continue to be tested.

Technically, December gold futures still show buyers have a strong near-term technical advantage. The next upside target for buyers is to close above solid resistance at $3,750/ounce. On the contrary, the target for the sellers is to pull the price below the solid technical support zone at 3,550 USD/ounce.

See more news related to gold prices HERE...