Update SJC gold price

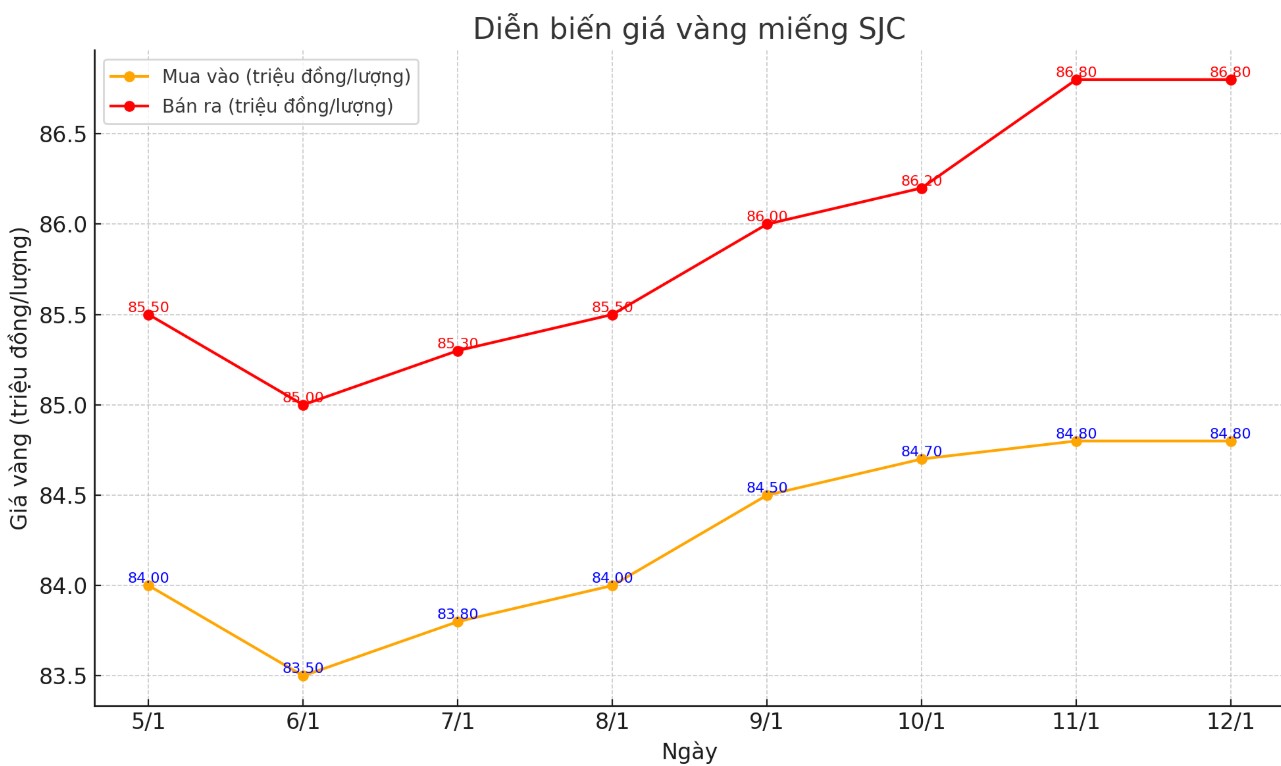

At the end of the week's trading session, DOJI Group listed the price of SJC gold at 84.8-86.8 million VND/tael (buy - sell).

Compared to the closing price of last week's trading session, the price of SJC gold bars at DOJI increased by VND800,000/tael for buying and VND1.3 million/tael for selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 84.8-86.8 million VND/tael (buy - sell).

Compared to the closing price of last week's trading session, the price of SJC gold bars at Saigon Jewelry Company increased by VND800,000/tael for buying and increased by VND1.3 million/tael for selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

If buying SJC gold at DOJI Group and Saigon Jewelry Company SJC in session 5.1 and selling in today's session (January 12), investors will lose 700,000 VND/tael.

Currently, the difference between the buying and selling price of gold is listed at around 2 million VND/tael. Experts say this difference is very high, causing investors to face the risk of losing money when investing in the short term.

Price of round gold ring 9999

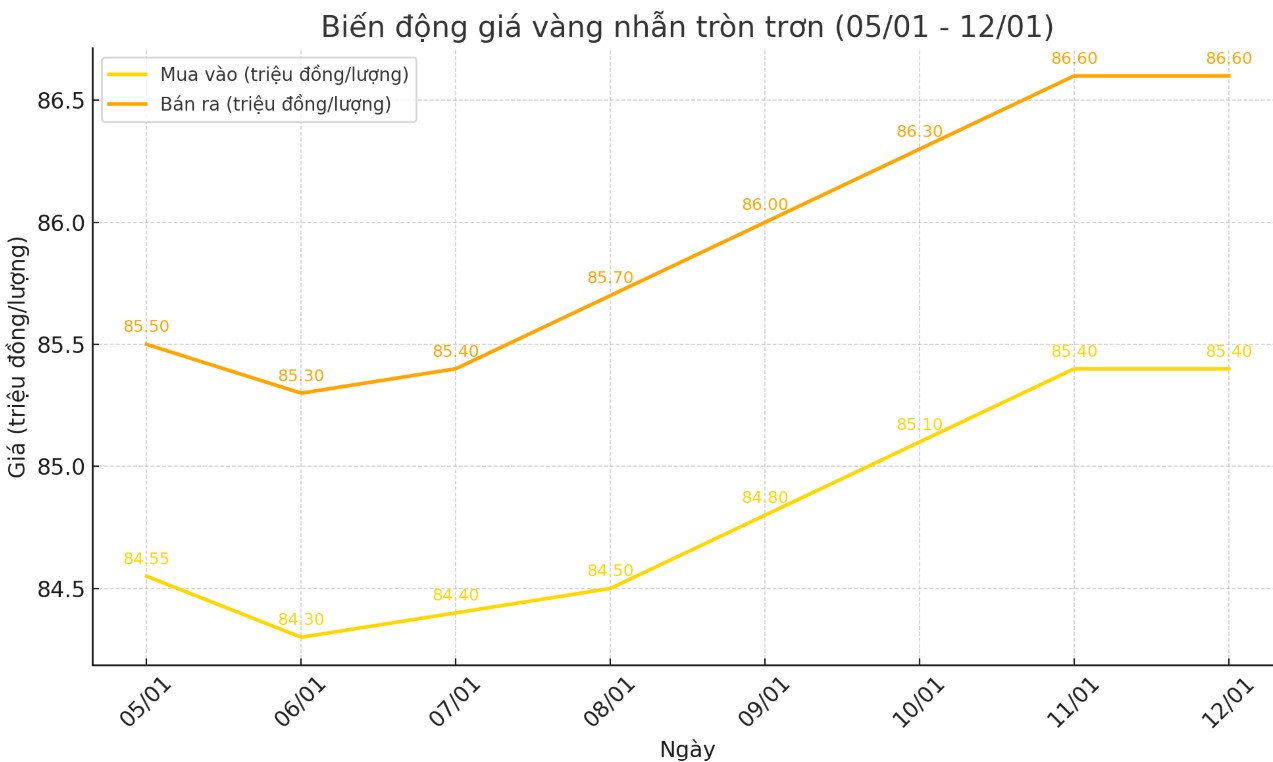

As of 6:30 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 85.4-86.6 million VND/tael (buy - sell); an increase of 850,000 VND/tael for buying and an increase of 1.05 million VND/tael for selling compared to the closing price of last week's trading session.

Bao Tin Minh Chau listed the price of gold rings at 85.5-86.9 million VND/tael (buy - sell); an increase of 900,000 VND/tael for buying and 1.2 million VND/tael for selling compared to the closing price of last week's trading session.

If buying gold rings in session 5.1 and selling in today's session (12.1), the loss investors will have to accept when buying at DOJI and Bao Tin Minh Chau is 150,000 VND/tael and 200,000 VND/tael, respectively.

In recent sessions, the price of gold rings has often fluctuated in the same direction as the world market. Investors can refer to the world market and expert opinions before making investment decisions.

World gold price

As of 6:00 p.m., the world gold price listed on Kitco was at 2,689.3 USD/ounce, up 49.6 USD/ounce compared to the close of last week's trading session.

Gold Price Forecast

World gold prices increased at the end of the week despite the increase in the USD index. Recorded at 19:00 on January 12, 2025, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 109,490 points (up 0.45%).

Financial markets experienced a sharp move on Friday as both gold and the US dollar showed remarkable resilience, defying initial reactions to the US December non-farm payrolls report. Despite an initial sell-off, both assets closed higher, defying conventional market expectations.

The latest Kitco News survey shows that retail traders remain confident in gold's ability to outperform amid global uncertainty, while industry experts also see potential for silver in the second half of the year.

This past week, Kitco News collected opinions from 208 investors for the Kitco News Top Metals 2025 survey. The results showed that more than half of the participants predicted that gold would continue to outperform all other metals in 2025.

106 traders, or 51 percent, believe gold will lead the way this year. Meanwhile, 74 investors, or 36 percent, predict silver will be the best performing metal in 2025. 17, or 8 percent, say copper will be the best performer. The remaining 11, or 5 percent, believe platinum and palladium will outperform other metals this year.

Like investors, most Wall Street experts also have a bias towards gold. However, a large number of major banks and industry experts predict that silver could surpass gold by the end of the year.

Ole Hansen, head of commodity strategy at Saxo Bank, believes that silver could surpass gold in 2025.

“This year’s silver rally is fundamentally no different from previous rallies. Silver still mirrors gold’s moves, but with greater intensity. Often referred to as “power gold,” silver tends to move up and down more aggressively than its stable sibling,” Hansen said.

In the same view, analysts at Heraeus Precious Metals also commented that the silver rally in 2024 will continue into 2025, with silver prices expected to outperform gold, while platinum group metals (PGM) prices will be restrained.

See more news related to gold prices HERE...