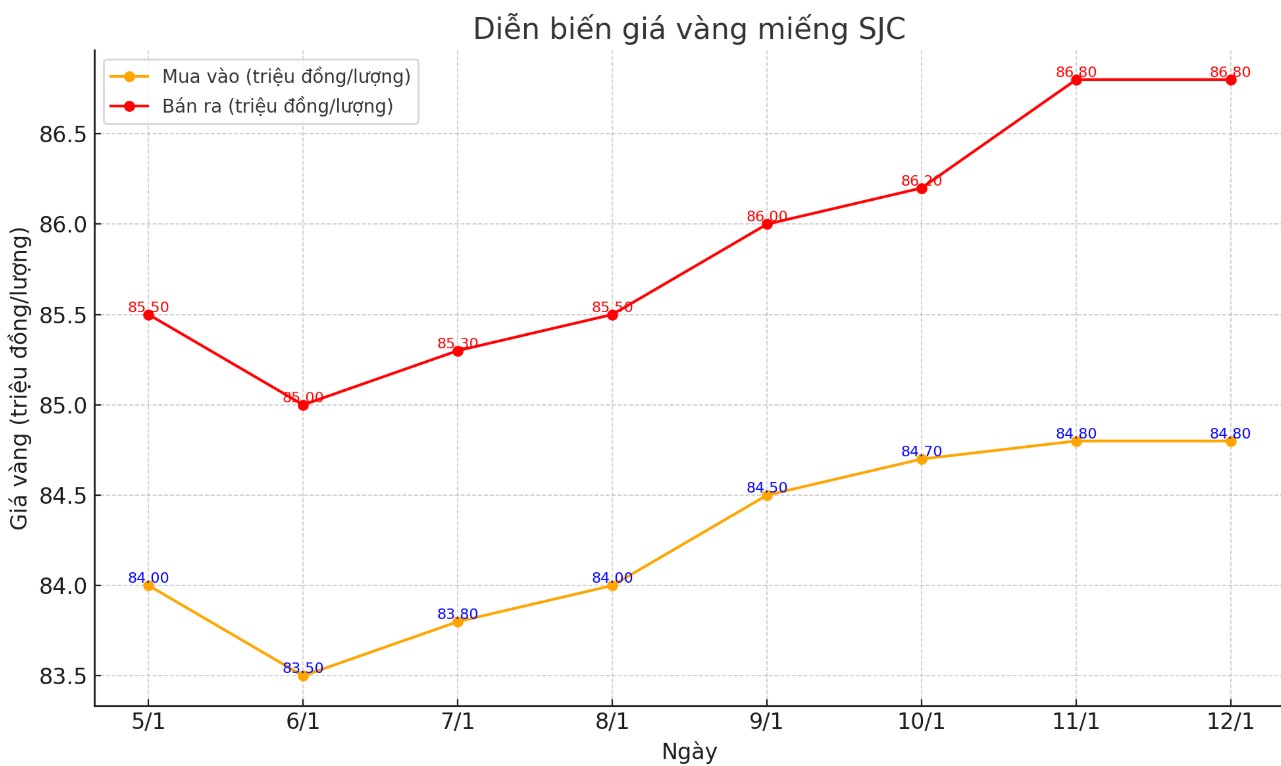

Update SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND84.8-86.8 million/tael (buy - sell); an increase of VND100,000/tael for buying and an increase of VND600,000/tael for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 84.8-86.8 million VND/tael (buy - sell); an increase of 100,000 VND/tael for buying and an increase of 600,000 VND/tael for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.8-86.8 million VND/tael (buy - sell); increased by 100,000 VND/tael for buying and increased by 600,000 VND/tael for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

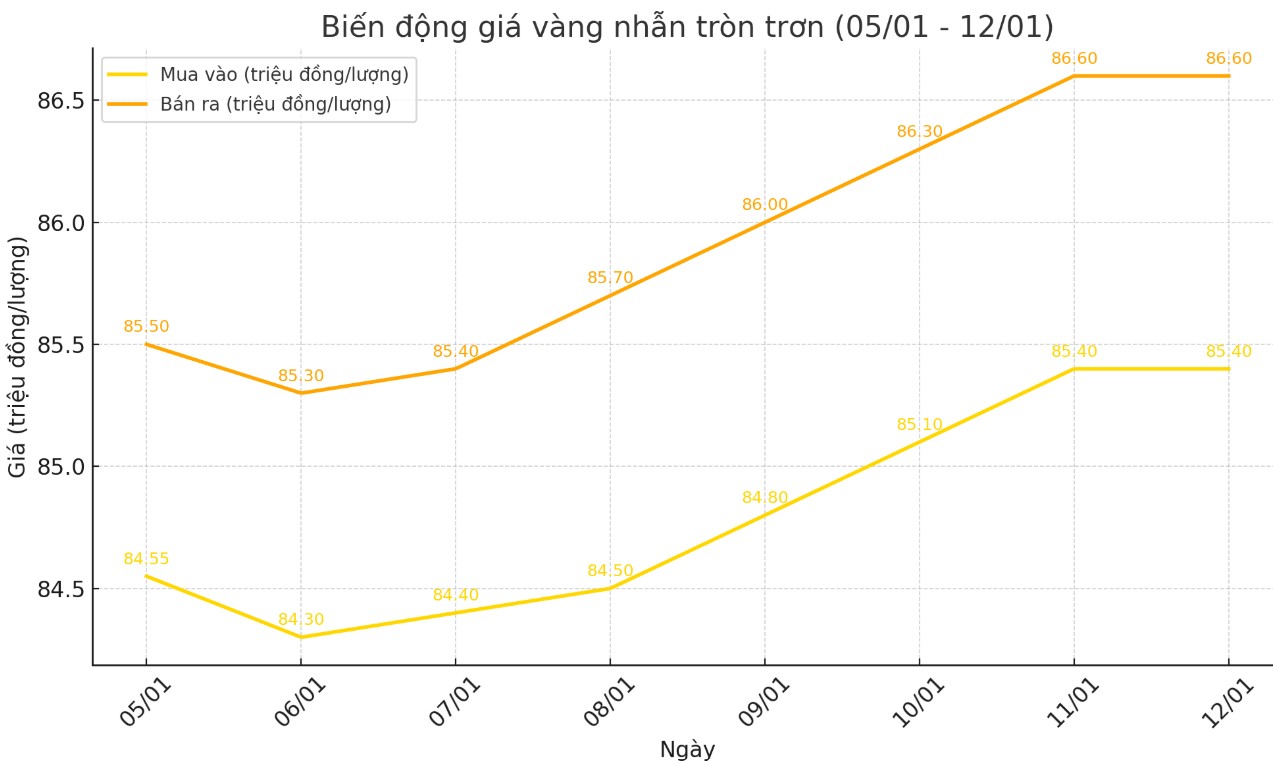

Price of round gold ring 9999

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 85.4-86.6 million VND/tael (buy - sell); an increase of 300,000 VND/tael for both buying and selling compared to the beginning of the trading session yesterday afternoon.

Bao Tin Minh Chau listed the price of gold rings at 85.5-86.9 million VND/tael (buy - sell), an increase of 400,000 VND/tael for buying and 500,000 VND/tael for selling compared to the beginning of the trading session yesterday afternoon.

World gold price

As of 2:51 a.m. on January 12 (Vietnam time), the world gold price listed on Kitco was at 2,689.3 USD/ounce, up 2.3 USD/ounce compared to the beginning of the trading session yesterday morning.

Gold Price Forecast

World gold prices increased despite the USD's increase. Recorded at 2:50 a.m. on January 12, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 109.490 points (up 0.45%).

Gold's gains defied expectations of many traders who said a strong U.S. jobs report on Friday would weigh on the metal, as the data increased the probability that the Federal Reserve would not cut interest rates in January to 97.3 percent, with a 74 percent probability that the Fed would maintain the current federal funds rate between 4.25 percent and 4.5 percent at its March FOMC meeting.

FXTM market analyst Lukman Otunuga said that gold prices have recorded strong gains over the past week, showing that investors are looking to protect their assets in a risky market context.

“Investors appear to be flocking to the precious metal due to concerns about tariffs and inflation. While higher interest rates are typically negative for gold, tariff uncertainty continues to fuel the safe-haven trend,” he said.

Gold prices have risen nearly 2% this week, bringing their year-to-date gains to nearly 3%. Technically, gold is turning bullish, with the next key resistance level at $2,715 an ounce, Otunuga said. He also noted that gold will be sensitive to inflation data next week, as higher consumer prices could put pressure on the Fed to keep interest rates steady through 2025.

While high interest rates are generally seen as negative for gold, some analysts say that if the Fed keeps rates unchanged, real interest rates will be lower, creating a favorable environment for the precious metal.

Ole Hansen, head of commodity strategy at Saxo Bank, said gold was one of the commodities assets that benefited this week due to its role as an inflation hedge.

Analysts point out that the rise in gold prices in tandem with the US dollar is not surprising, as the precious metal is also strengthening against other major currencies. In particular, gold has increased significantly against the British pound, in the context of the country facing a new bond crisis. UK bond yields have increased due to concerns that the government will not be able to control the fiscal deficit as spending increases.

Hansen stressed that the UK is not the only country with debt problems. He warned investors to keep a close eye on developments in the UK and ask themselves, “If the UK is first, who will be next?”

See more news related to gold prices HERE...