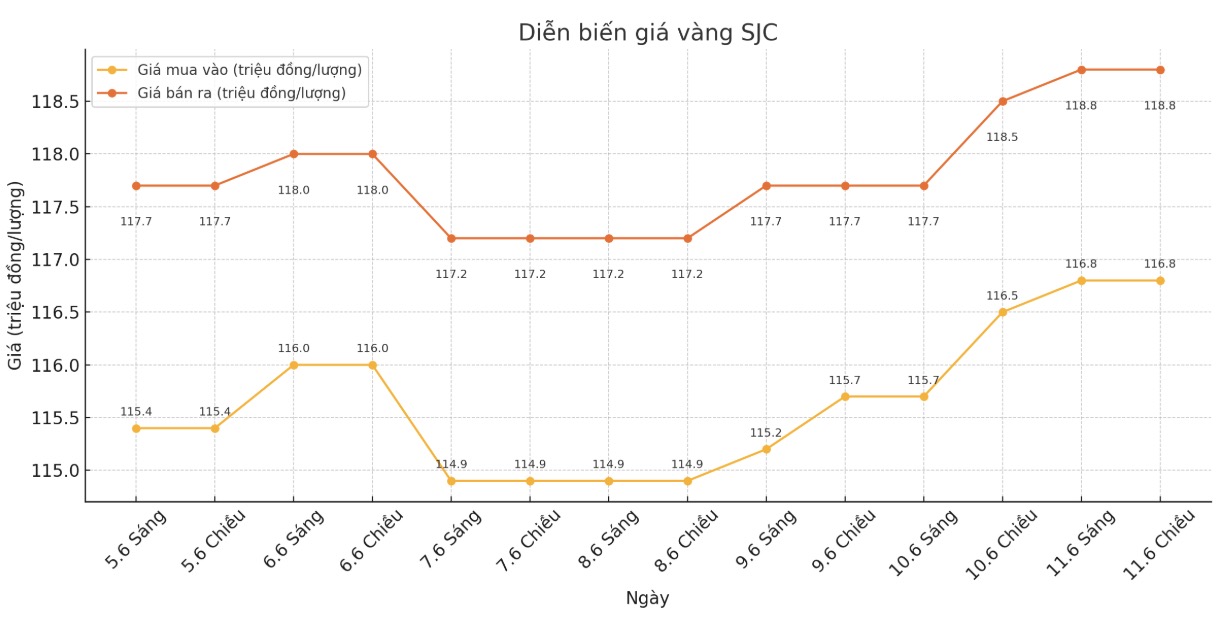

SJC gold bar price

As of 6:40 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 116.8-118.8 million/tael (buy in - sell out); increased by VND 300,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 116.8-118.8 million VND/tael (buy in - sell out); increased by 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 116.5-118.5 million VND/tael (buy in - sell out); increased by 800,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 116-118.8 million VND/tael (buy - sell); increased by 200,000 VND/tael for buying and increased by 300,000 VND/tael for selling. The difference between buying and selling prices is at 2.8 million VND/tael.

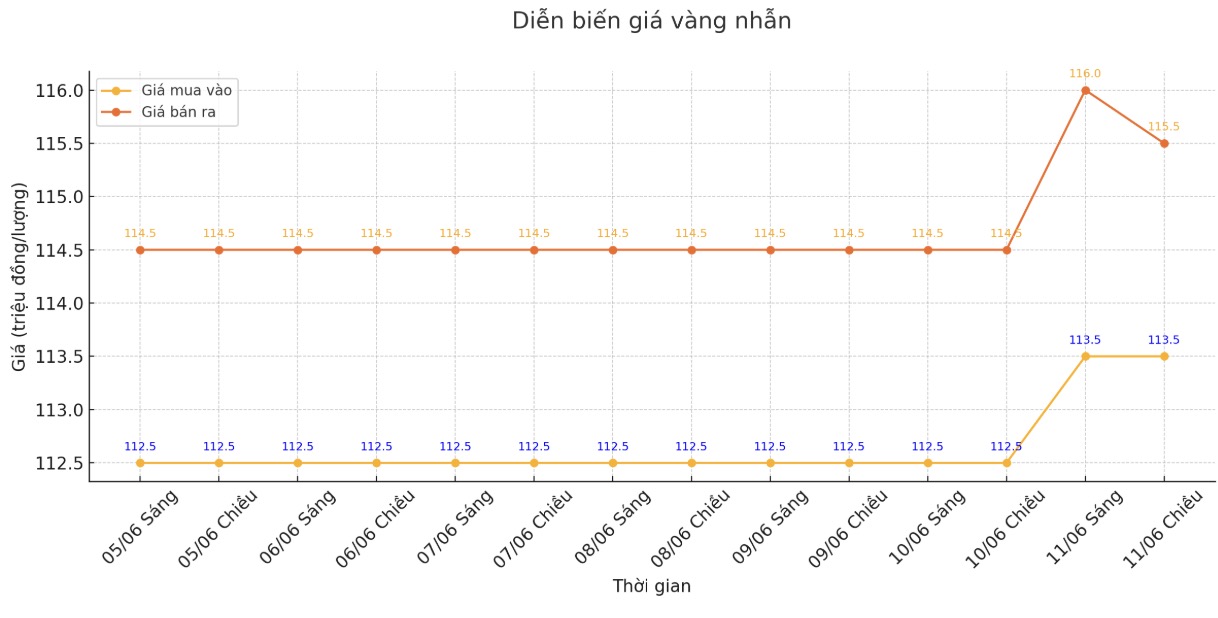

9999 gold ring price

As of 6:40 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 113.5-125.5 million VND/tael (buy - sell), an increase of 500,000 VND/tael for buying and kept the same for selling. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.5-117.5 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 112.5-125.5 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

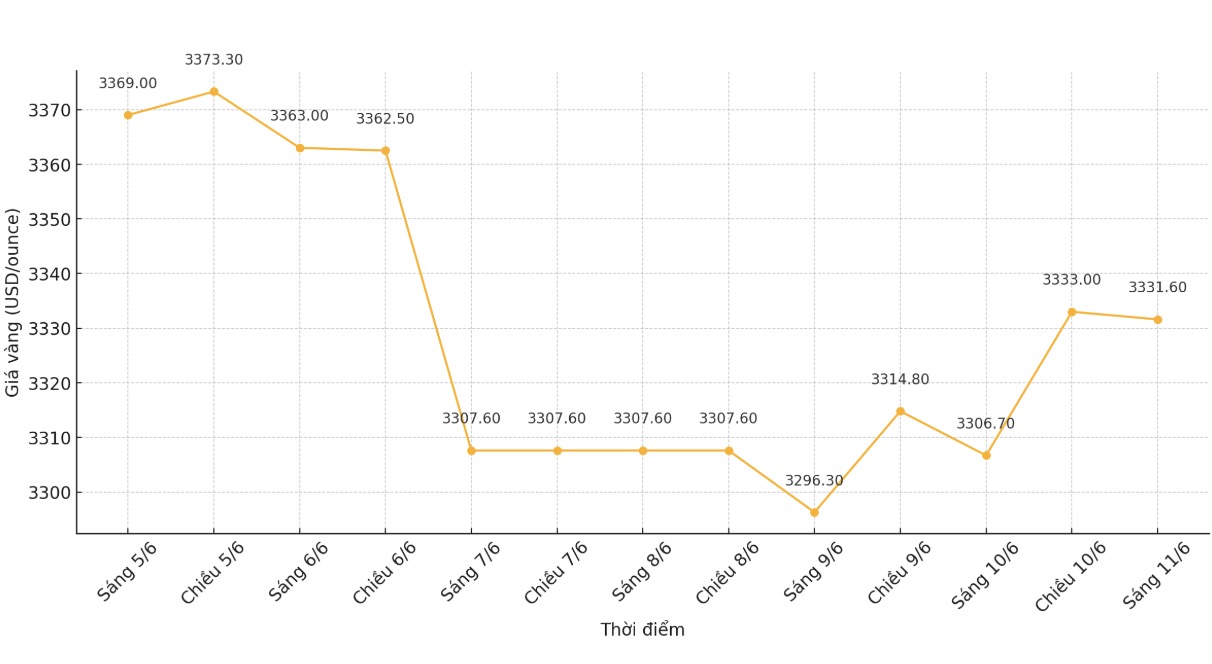

World gold price

The world gold price was listed at 6:40 p.m. at 3,331.6 USD/ounce, down 1.4 USD.

Gold price forecast

World gold prices fell into a tug-of-war as investors continued to be cautious about persistent uncertainties surrounding the US-China trade deal and waited for US inflation data to find clues on the interest rate direction of the US Federal Reserve (FED).

US and Chinese officials said on Tuesday that the two sides have reached a framework to get the trade deal back on track and remove restrictions on China's rare earth exports, but there are still no clear signs of a sustainable solution to long-term disagreements.

In April, the US and China imposed tit-for-tat tariffs on each other, fueling a trade war. After negotiations in Geneva last month, the two countries agreed to cut the tax from three digits.

Han Tan - market analyst at Exinity Group commented: "The market clearly understands that the path to an agreement between major economies is not smooth. Gold prices will continue to be supported as long as global trade tensions are at risk of escalating or remaining high for a long time.

The US Consumer Price Index (CPI) report, scheduled to be released at 7:30 p.m. (Vietnam time), is considered the next guiding factor for the Fed's interest rate policy.

The market expects the CPI to increase slightly, which could reduce the possibility of the Fed cutting interest rates in the short term, Tan added.

Some surveys show that the majority of economists expect the Fed to keep interest rates unchanged for at least the next few months, as the risk of inflation rising again due to the continued existence of US President Donald Trump's tariff policies.

In other developments, spot silver fell 0.9% to 36.2 USD/ounce, but still fluctuated near its highest level in more than 13 years.

We expect silver to reach $38/ounce in the next few months. The factor of supply shortage and a weaker US dollar is the key to silver prices rising further a check of the $40/ounce mark is entirely possible, UBS said.

platinum prices rose 2.8% to $1,256.29 an ounce, their highest since May 2021. Palladium also rose 1.1%, to $1,072.25 an ounce.

See more news related to gold prices HERE...