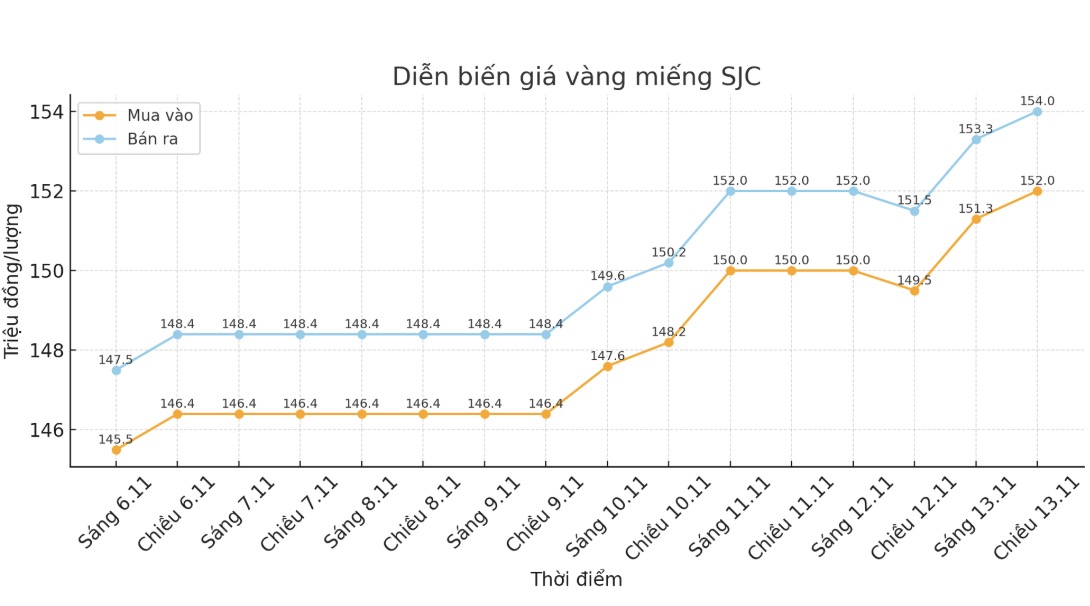

SJC gold bar price

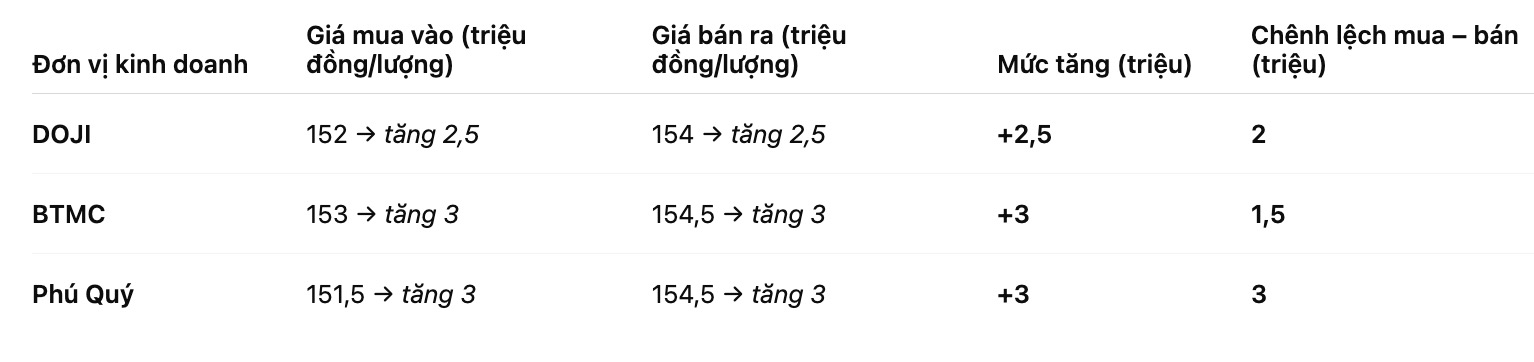

As of 5:17 p.m., DOJI Group listed the price of SJC gold bars at 152-154 million VND/tael (buy - sell), an increase of 2.5 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 153-154.5 million VND/tael (buy - sell), an increase of 3 million VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 151.5-154.5 million VND/tael (buy - sell), an increase of 3 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

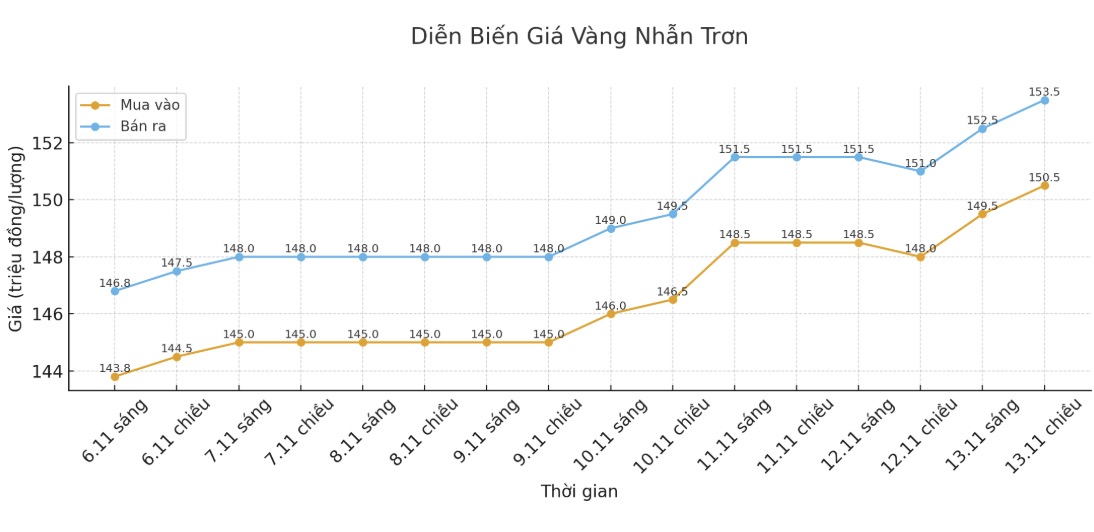

9999 gold ring price

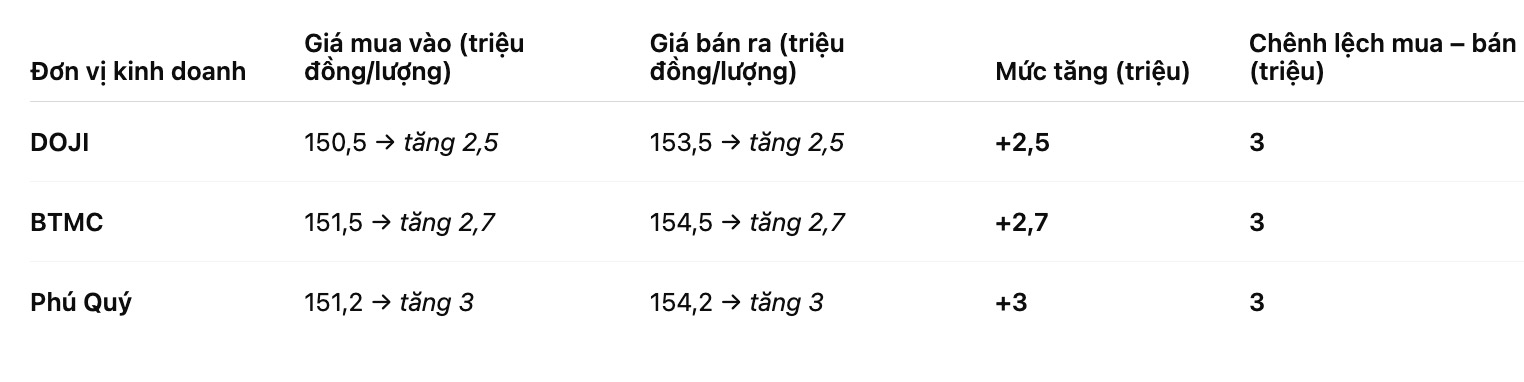

As of 5:18 p.m., DOJI Group listed the price of gold rings at 150.5-153.5 million VND/tael (buy - sell), an increase of 2.5 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 151.5-154.5 million VND/tael (buy - sell), an increase of 2.7 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 151.2-154.2 million VND/tael (buy - sell), an increase of 3 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

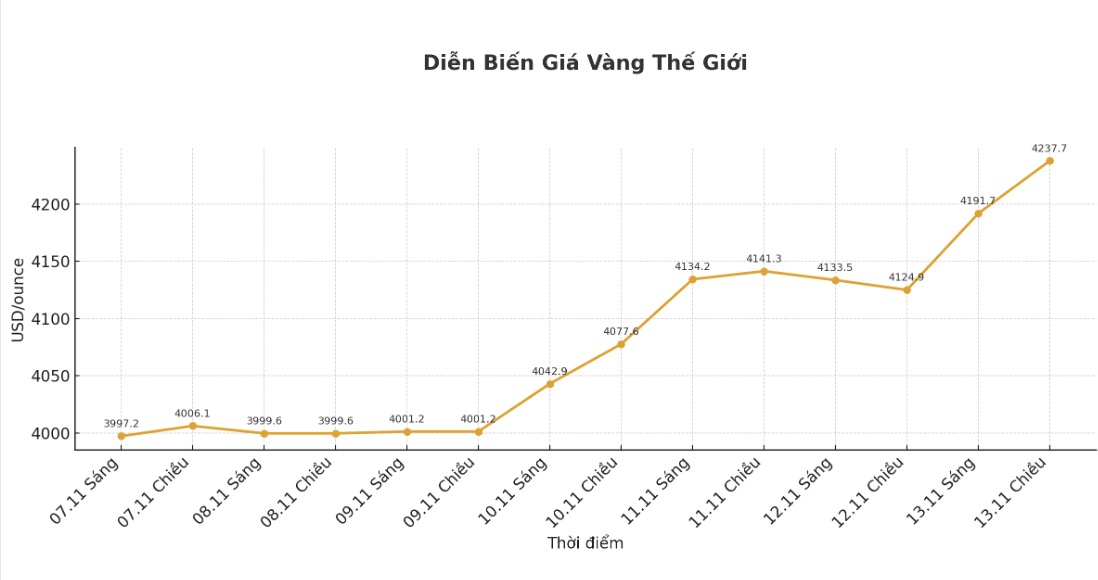

World gold price

The world gold price was listed at 5:26 p.m., at 4,237.7 USD/ounce, up sharply by 112.8 USD compared to a day ago.

Gold price forecast

Gold prices rose for the fifth consecutive session on Thursday and hit a more than three-week high, supported by expectations that the US government's reopening will resume economic data flows and strengthen betting on further interest rate cuts.

Gold is extending its upward trend thanks to a weaker US dollar, expectations of a rate cut by the Federal Reserve and persistent buying by central banks, said Jigar Trivedi, senior analyst at Reliance Securities.

According to a Reuters survey, 80% of economists predict the Fed will continue to cut interest rates by another 25 basis points next month to support the weakening labor market, up slightly compared to the survey results last month.

Gold prices have risen 60% since the beginning of the year, hitting a record high of $4,381.21/ounce on October 20, fueled by geopolitical tensions, trade risks and expectations of a further Fed rate cut.

Experts say related legal developments The FED Governor is expected to spark an additional $500 increase in gold prices.

Concerns about the independence of the Federal Reserve continue to be a factor that has kept gold prices at record highs, and according to some experts, legal developments around the position of Fed Governor Lisa Cook could create significant fluctuations in the market.

The US House of Representatives has announced that it will hold a hearing on January 21 to consider the president's authority to dismiss a member of the Fed Board of Governors. This issue arose from a legal dispute over Lisa Cook's position. Cook has not yet been prosecuted for civil or criminal liability in connection with the allegations.

In the context of the FED operating a cautious monetary policy, analysts believe that any change related to the central bank's leadership apparatus could impact market expectations about interest rates.

In a report released on Wednesday, Ms. Rhona O'Connell - Director of Market Analysis at StoneX - commented that the gold market will closely monitor this legal process:

If the results raise concerns about the Feds independence, gold prices could receive an increase of around $500. Conversely, if the stability of this agency is consolidated, the upward pressure on prices may decrease" - she said.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...