Updated SJC gold price

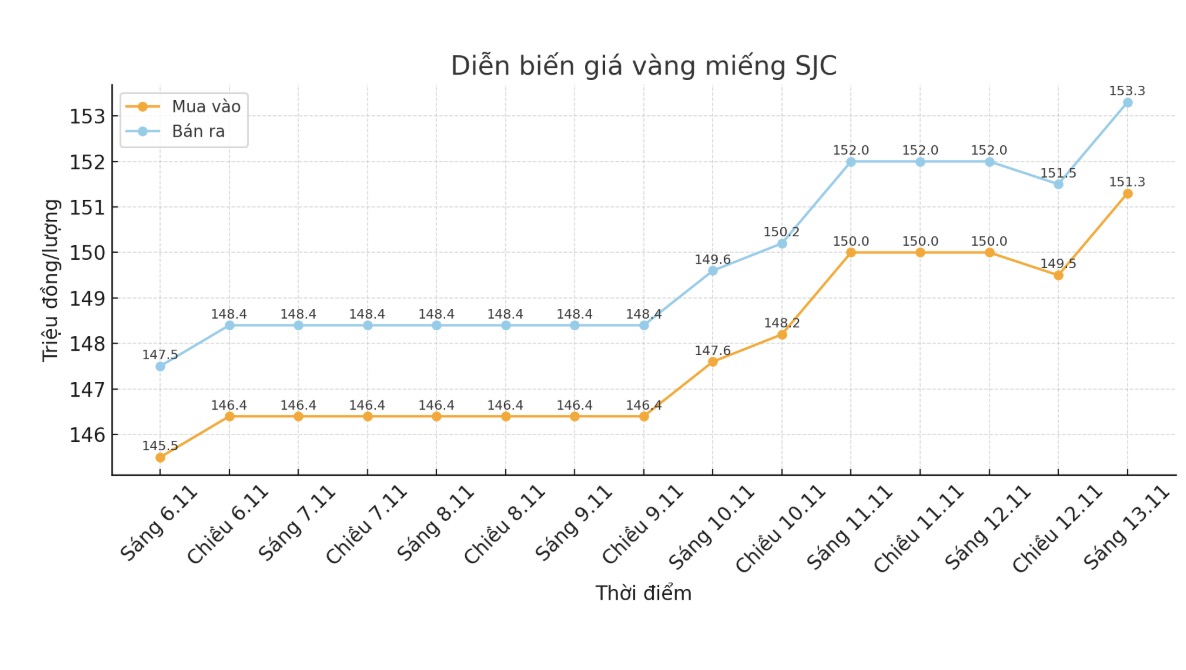

As of 9:10 a.m., DOJI Group listed the price of SJC gold bars at 151.3-153.3 million VND/tael (buy - sell), an increase of 1.3 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 151.8-153.3 million VND/tael (buy - sell), an increase of 1.3 million VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 150.3-153.3 million VND/tael (buy - sell), an increase of 1.3 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

9999 round gold ring price

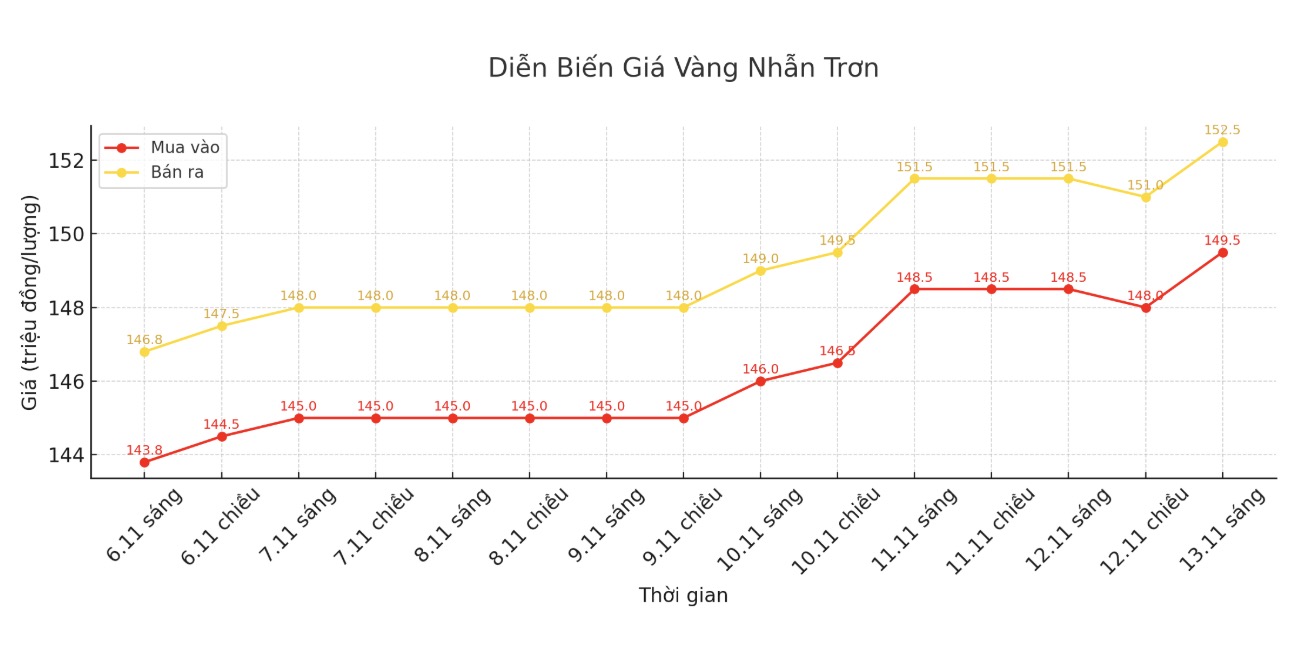

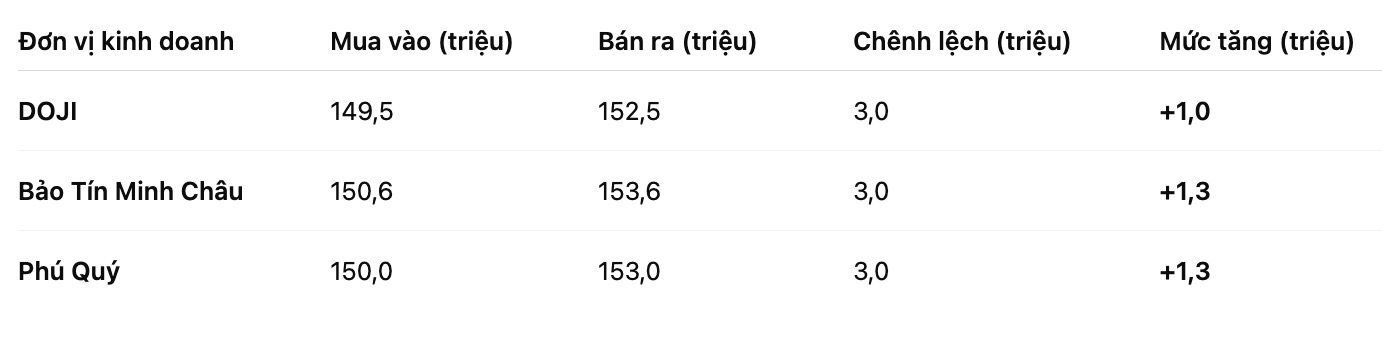

As of 9:20 a.m., DOJI Group listed the price of gold rings at 149.5-152.5 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150.6-153.6 million VND/tael (buy - sell), an increase of 1.3 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150-153 million VND/tael (buy - sell), an increase of 1.3 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

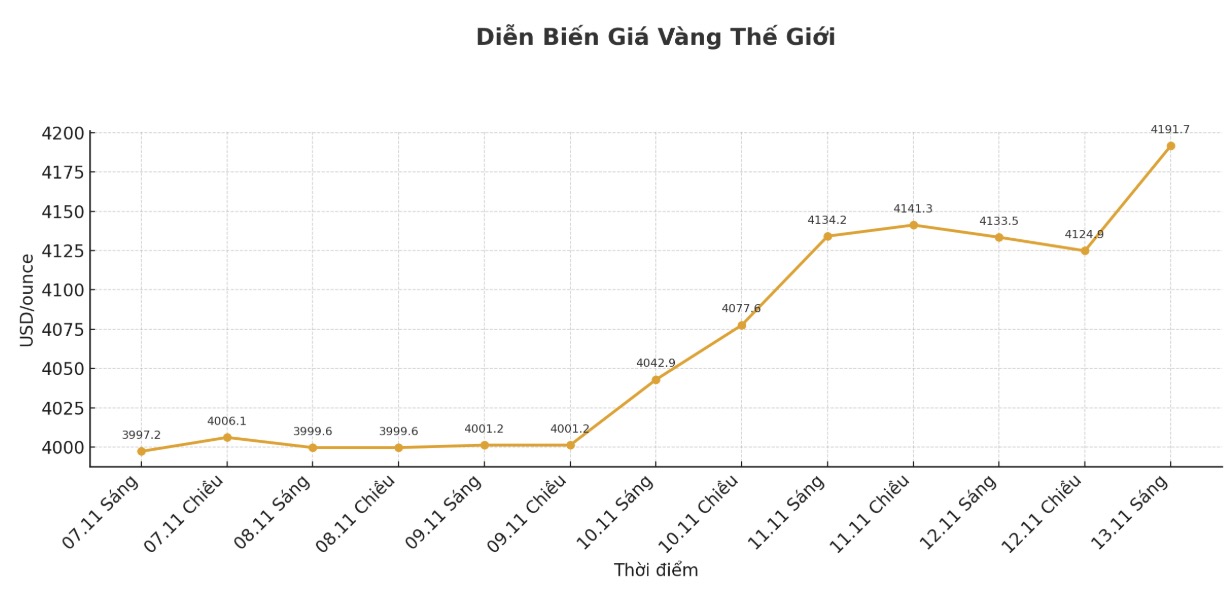

At 9:21, the world gold price was listed around 4,191.7 USD/ounce, up 58.2 USD compared to a day ago.

Gold price forecast

Gold price approaches 4,200 USD, buying pressure returns, analysts are optimistic. Last week, Alex Kuptsikevich - Head of Market Analysis at FxPro - expressed optimism about gold, saying that the sharp decline from the record level last month has caused significant damage to the technical structure in the short term.

However, in the update on Tuesday, Kuptsikevich commented that "rumors about gold's decline have been exaggerated".

Kuptsikevich said that gold's short-term overtaking of important resistance levels has created new bullish momentum in the market. He also stressed that the risk of price increases is still strengthened by global geopolitical and economic instability.

The outlook for the precious metal is not as optimistic as it was a week ago. Increased political uncertainty stemming from the possibility of the Supreme Court lifting tariffs, along with the Federal Reserves soft stance is creating a push for gold, he said.

At the same time, although gold prices are still high, the two-week correction has helped the market cool down from overbought conditions.

Nick Cawley - Market Analyst at Solomon Global also maintains an optimistic view, saying that gold is still going up along with the stock market.

Cawley said that both gold and stocks are benefiting from growing expectations that the Fed will continue to cut interest rates next month, although Chairman Jerome Powell recently warned that further easing in December is still uncertain.

According to CME's FedWatch tool, the market currently rates the probability of the Fed cutting interest rates before the end of the year at more than 65%.

With the expected continued loose monetary policy and solid demand from physical investors, the fundamentals of gold and silver remain strong. Unless there are major fluctuations, both metals are likely to continue to rise in the coming weeks, he said.

According to Zaye Capital Markets, the dual role of gold - both a protective asset and a profitable asset - will continue to strengthen the precious metal's leading position until the end of the fourth quarter of 2025, as policies, soft macro metrics and long-term demand continue to keep gold prices stable above the threshold of 4,100 USD/ounce.

Technically, with December gold contracts, buyers set a next target of closing above the solid resistance level of $4,250/ounce. On the contrary, the sellers want to push the price below the strong support level of 4,000 USD/ounce.

The first resistance level was determined at 4,175.00 USD/ounce, followed by 4,200 USD/ounce. The first support level was the night low of $4,104.4 an ounce, followed by $4,100 an ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...