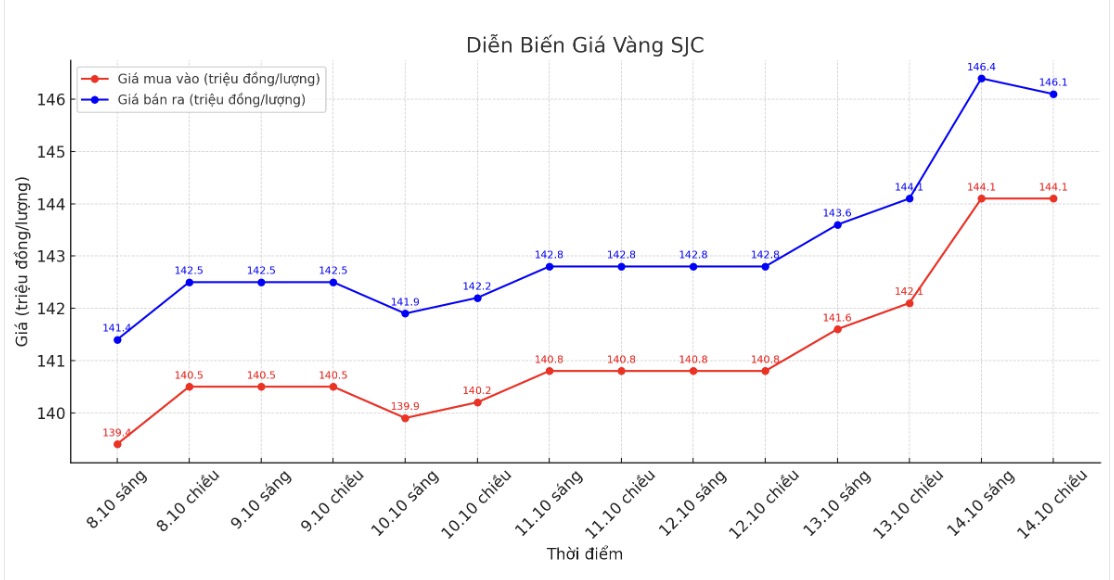

SJC gold bar price

As of 5:45 p.m., DOJI Group listed the price of SJC gold bars at VND144.1-146.1 million/tael (buy in - sell out), an increase of VND2 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 144.9-146.4 million VND/tael (buy - sell), an increase of 2.8 million VND/tael for buying and an increase of 2.3 million VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 143.5-146.1 million VND/tael (buy - sell), an increase of 2.2 million VND/tael for buying and an increase of 2 million VND/tael for selling. The difference between buying and selling prices is at 2.6 million VND/tael.

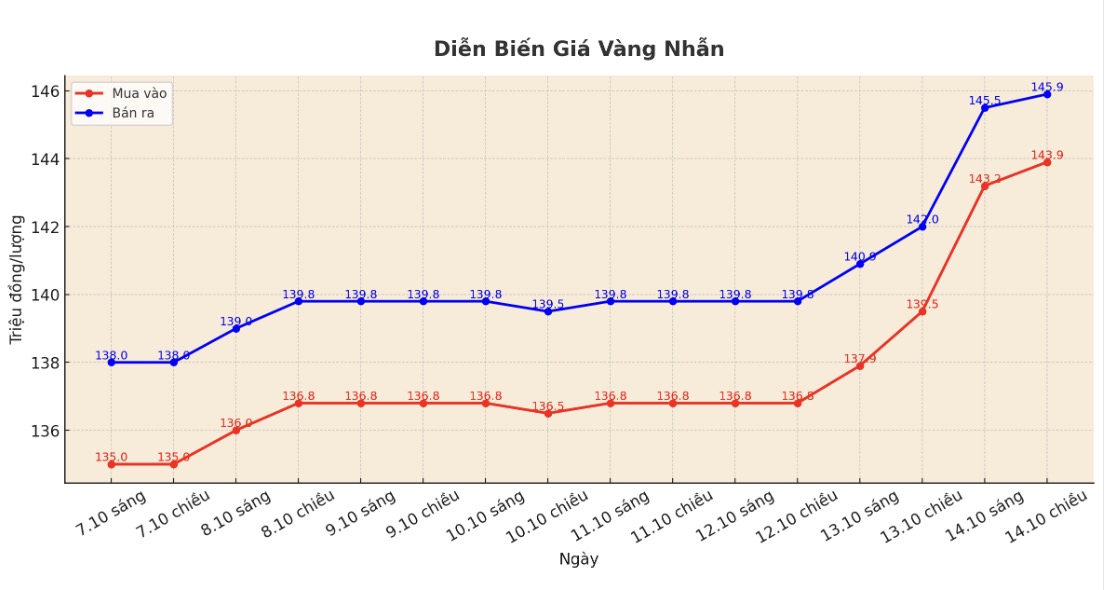

9999 gold ring price

As of 5:45 p.m., DOJI Group listed the price of gold rings at 143.9-145.9 million VND/tael (buy - sell), an increase of 4.4 million VND/tael for buying and an increase of 3.9 million VND/tael for selling. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 143.6-146.6 million VND/tael (buy - sell), an increase of 2.6 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 143-146 million VND/tael (buy - sell), an increase of 3.5 million VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

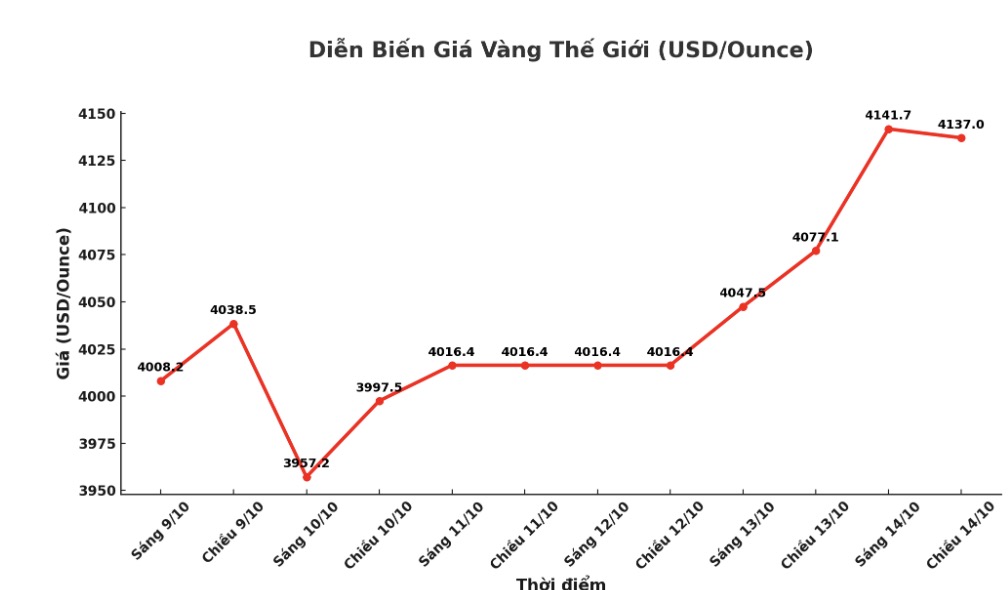

World gold price

The world gold price was listed at 5:45 p.m. at 4,137 USD/ounce, up 59.9 USD compared to a day ago.

Gold price forecast

World gold prices increased thanks to growing expectations that the US Federal Reserve (FED) will soon cut interest rates. The return of US-China trade tensions also boosted safe-haven demand, leading to a strong increase in silver - this precious metal also recorded a new historical peak.

OANDA analyst Kelvin Wong said: Trade tensions are not the main driver for todays rally. More importantly, the market is betting heavily on the Fed continuing its interest rate cutting cycle, thereby reducing long-term capital costs and opportunity costs of holding gold.

Anna Paulson, Fed president of Philadelphia, said the increased risks to the labor market have further strengthened the basis for upcoming interest rate cuts.

Investors are now waiting for Fed Chairman Jerome Powell's speech at the NABE annual meeting on October 14 for more signals on monetary policy orientation.

According to the FedWatch tool, traders predict the probability of the Fed cutting 25 basis points in October and December will be 99% and 94%, respectively.

The latest report from experts at Heraeus shows that the precious metals market is giving warning signals as gold, silver, platinum and palladium are all in a state of serious overbought according to key technical indicators.

Gold, platinum and palladium are all in the serious overbought zone, far exceeding the 200-day moving average, Heraeus said.

Gold is currently trading nearly 20% higher than the long-term trend, while platinum has remained above this threshold for the past two weeks. Palladium also just broke out and entered the same region last week. Such overbought levels are often followed by corrections, even deeper declines, they note.

Bank of America and Societe Generale both predict gold could reach $5,000 an ounce by 2026, while Standard Chartered raised its forecast for 2026 to $4,488/ounce.

Notable economic data next week

Tuesday: FED Chairman Jerome Powell attends a discussion at the National Association for Business Economics (NABE) Annual Meeting.

Wednesday: New York FED manufacturing survey.

Thursday: survey of FED Philadelphia's business performance.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...