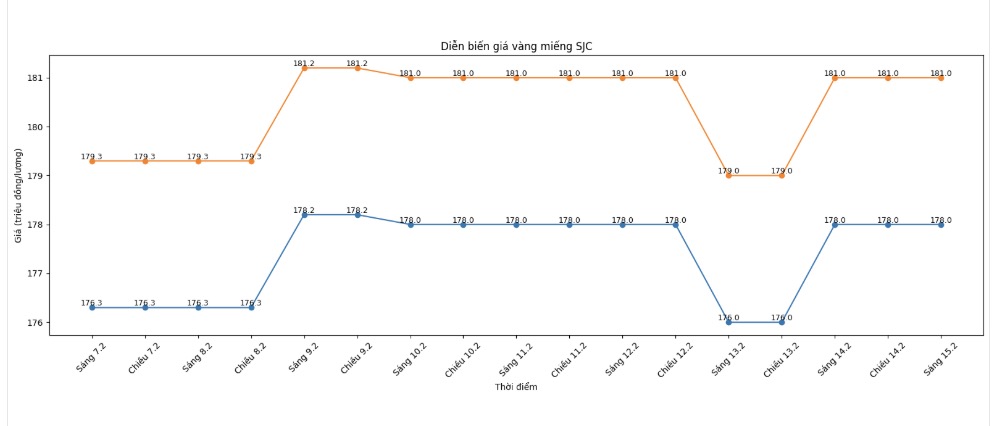

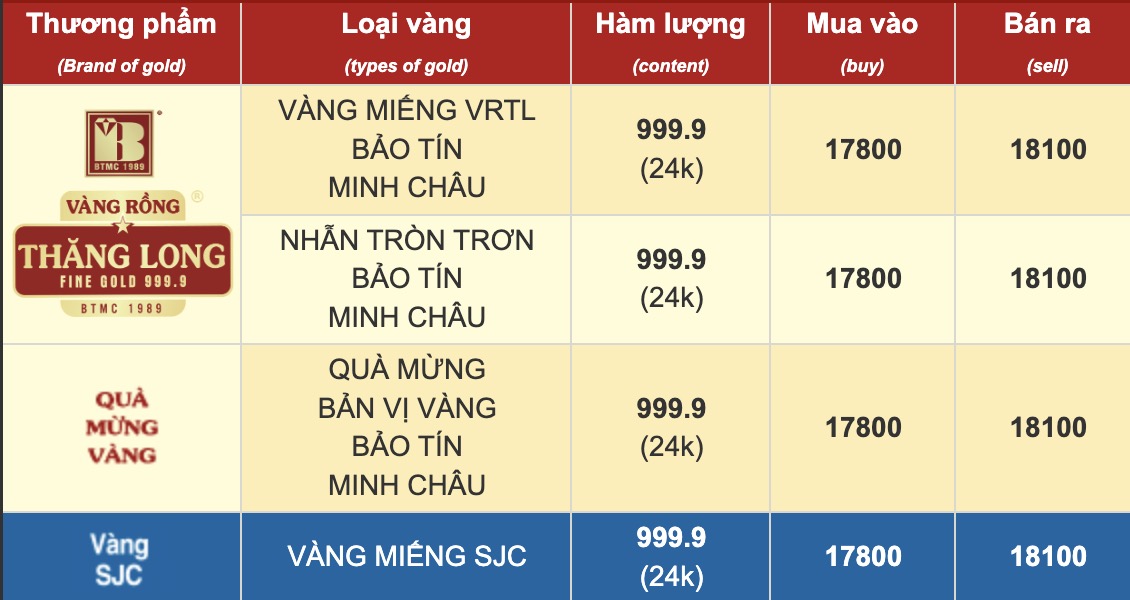

SJC gold bar price

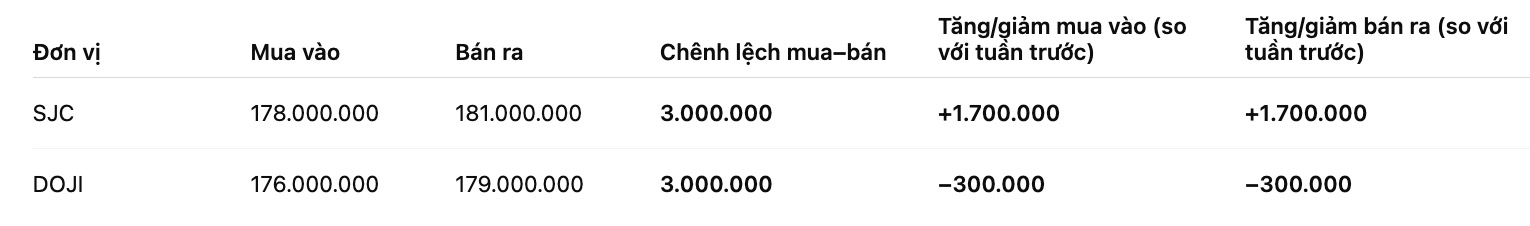

Closing the week's trading session, Saigon SJC Jewelry Company listed SJC gold prices at 178-181 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Compared to the closing session of last week (February 8th), the price of SJC gold bars at Saigon SJC Jewelry Company increased by 1.7 million VND/tael in both directions.

Meanwhile, DOJI listed SJC gold price at 176-179 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Compared to the closing session of last week (February 8), the price of SJC gold bars at DOJI decreased by 300,000 million VND/tael in both directions.

Thus, if buying SJC gold bars on February 8th and selling them on today's session (February 15th), buyers at Saigon SJC Jewelry Company will lose 1.3 million VND/tael; while the loss when buying at DOJI is 3.3 million VND/tael.

There is a large difference between business units due to the time of Tet Nguyen Dan holiday closure of the parties.

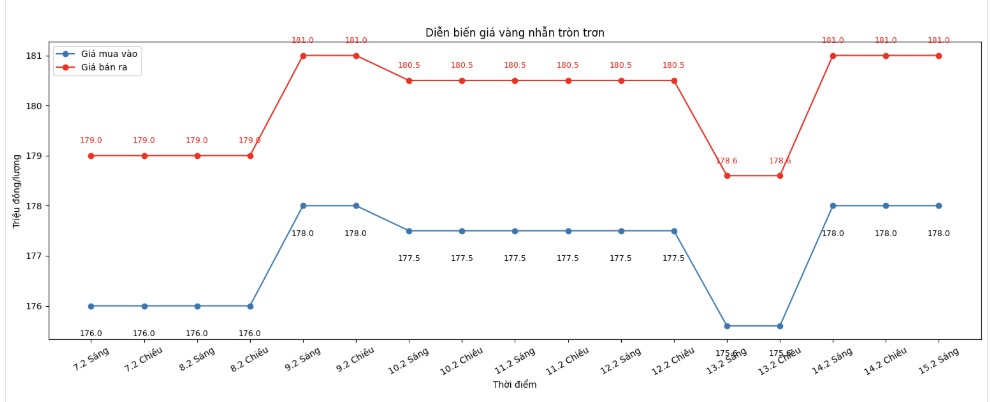

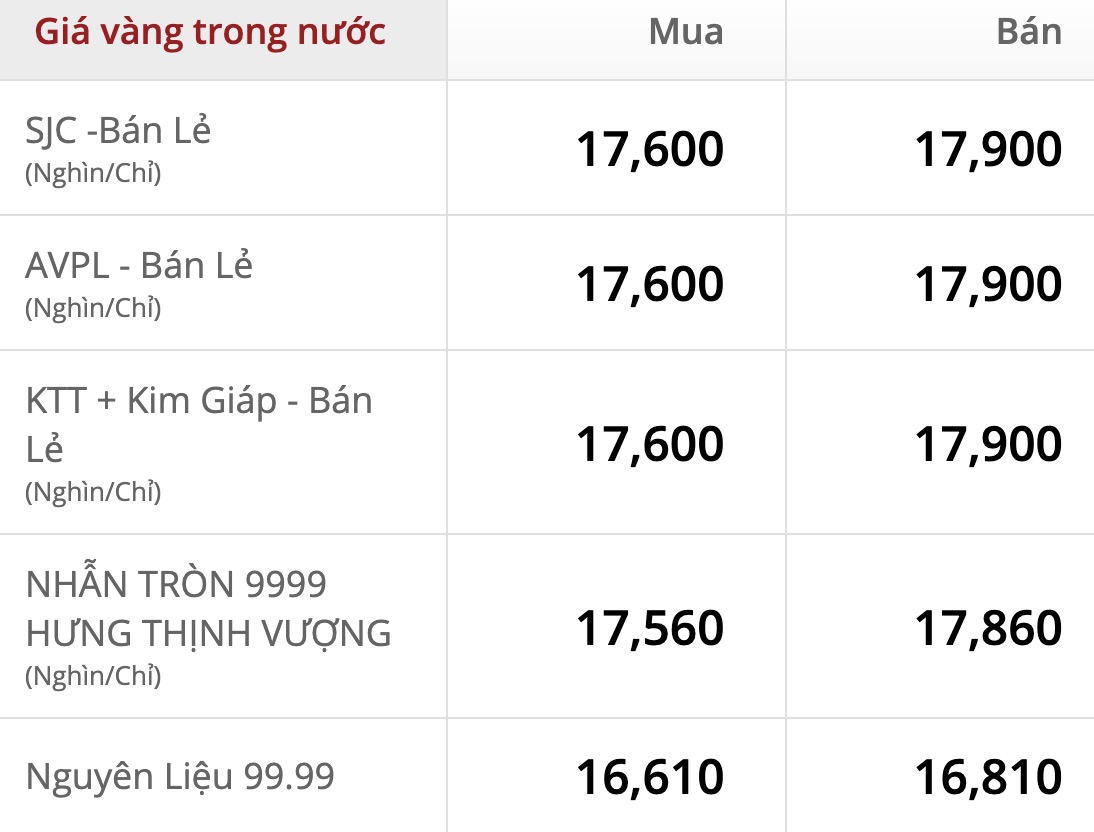

9999 gold ring price

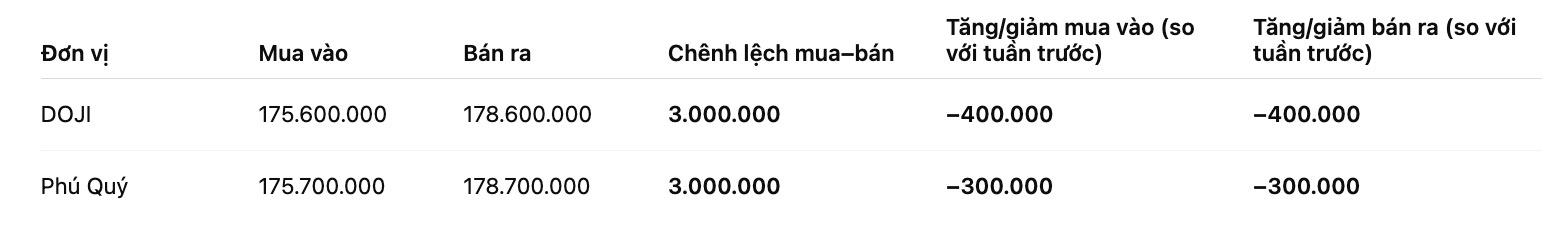

At the same time, DOJI Group listed the price of gold rings at 175.6-178.6 million VND/tael (buying - selling), down 400,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Jewelry Group listed the price of gold rings at the threshold of 175.7-178.7 million VND/tael (buying - selling), down 300,000 VND/tael in both directions compared to a week ago. The buying - selling difference is at 3 million VND/tael.

If buying gold rings on February 8th and selling them today (February 15th), buyers at DOJI will lose 3.4 million VND/tael, while the profit of gold ring buyers in Phu Quy is 3.3 million VND/tael.

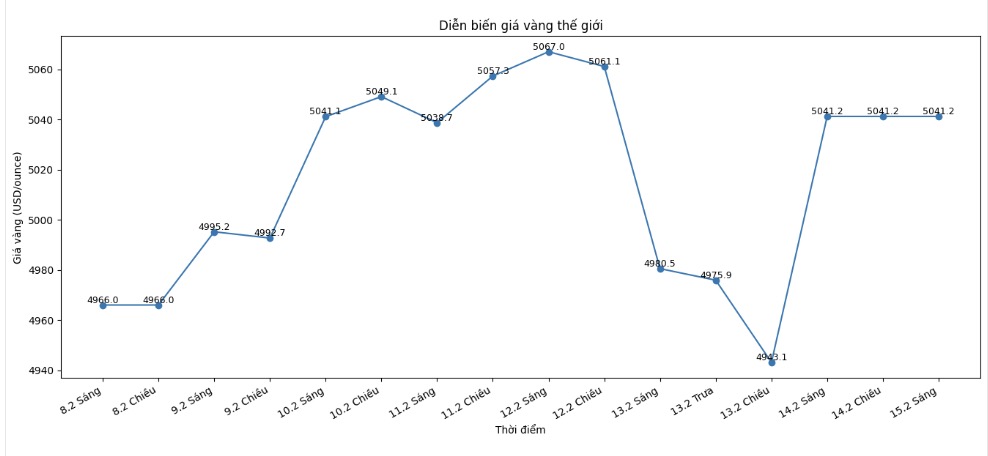

World gold price

Closing the weekly trading session, world gold prices were listed at 5,041.2 USD/ounce, up 75.2 USD compared to a week ago.

Gold price forecast

After a volatile trading week, international analysts entered the new week with a cautious attitude. The latest surveys show that views between experts and small investors continue to differ significantly. While many Wall Street analysts are cautious about short-term prospects, the Main Street group still leans towards a positive scenario, expecting precious metals to maintain their upward momentum.

Weekly gold surveys with 12 Wall Street experts recorded clear differentiation. About 1/3 of the opinions believe that gold prices may continue to challenge or exceed the 5,000 USD/ounce zone next week. However, 25% forecast price adjustment to decrease, and the rest assess increased - decreased risks as relatively balanced, believing that gold may enter an accumulation phase after strong fluctuations.

In the opposite direction, online surveys with individual investors show that optimistic sentiment prevails. Most participants expect gold prices to increase, while the forecast rate is down or sideways at a significantly lower level. This development reflects the confidence of small investors in the long-term trend, despite the shocking drops that appeared last week.

Notably, the next trading week is shortened as the US market is on Presidents' Day holiday on Monday. Liquidity may therefore be thinner than usual, increasing the possibility of small fluctuations creating a major price impact. At the same time, the holiday in China may also make cash flow on the precious metals market more cautious.

During the week, investors will closely monitor US economic data, from manufacturing surveys, durable goods orders, housing data to Q4 GDP and Core PCE index. The minutes of the Fed's January policy meeting are also expected to provide more signals about the interest rate roadmap - a factor that directly affects gold prices.

Mr. Michael Brown - senior market analyst at Pepperstone, said that the strong sell-off last weekend was an unusual development. According to him, although prices have partially recovered, the market is unlikely to return to stable status soon.

Sharing the same cautious view, Mr. Lukman Otunuga - senior analyst at FXTM, said that the 5,000 USD/ounce mark is still an important psychological threshold. If successfully surpassed, gold prices may move upwards to higher areas. Conversely, weakening below this mark may trigger short-term correction pressure.

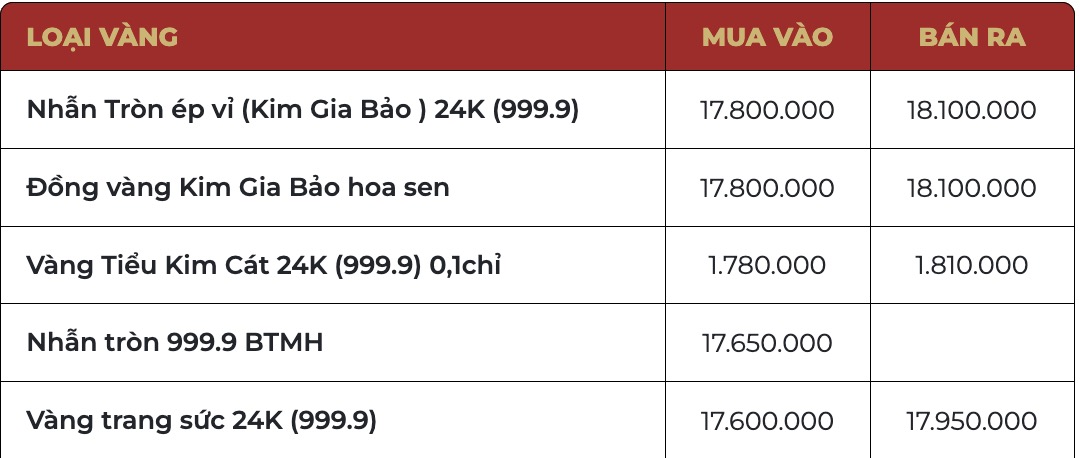

Below is the price update of some business units:

See more news related to gold prices HERE...