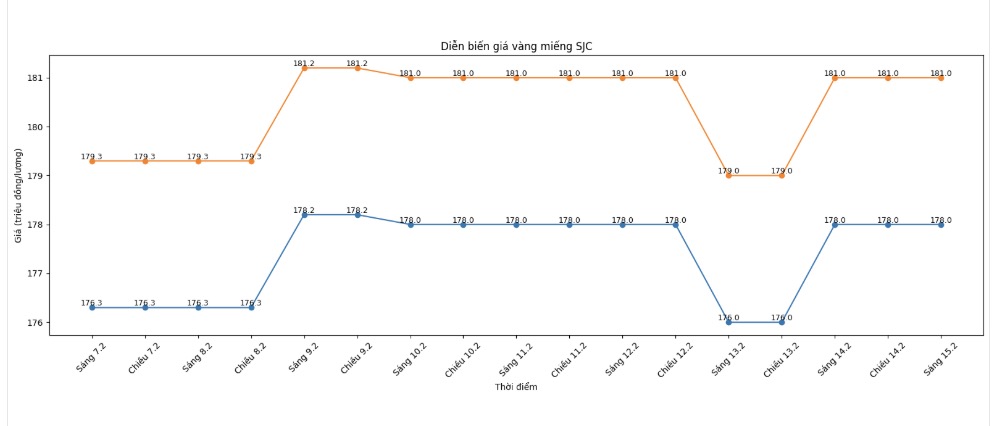

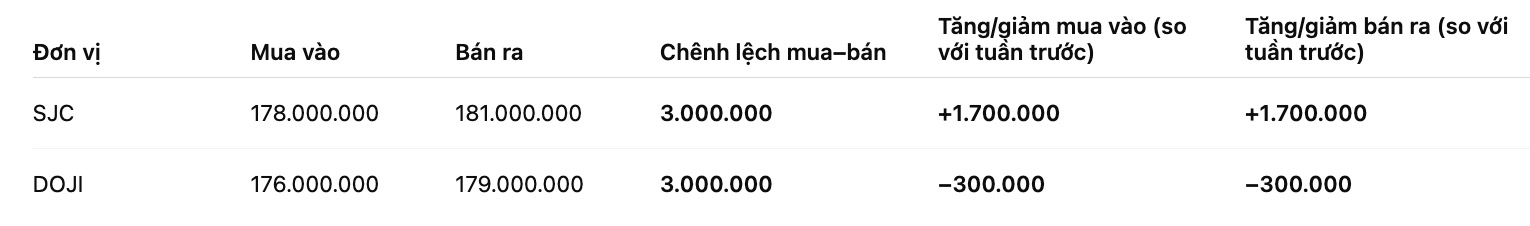

SJC gold bar price

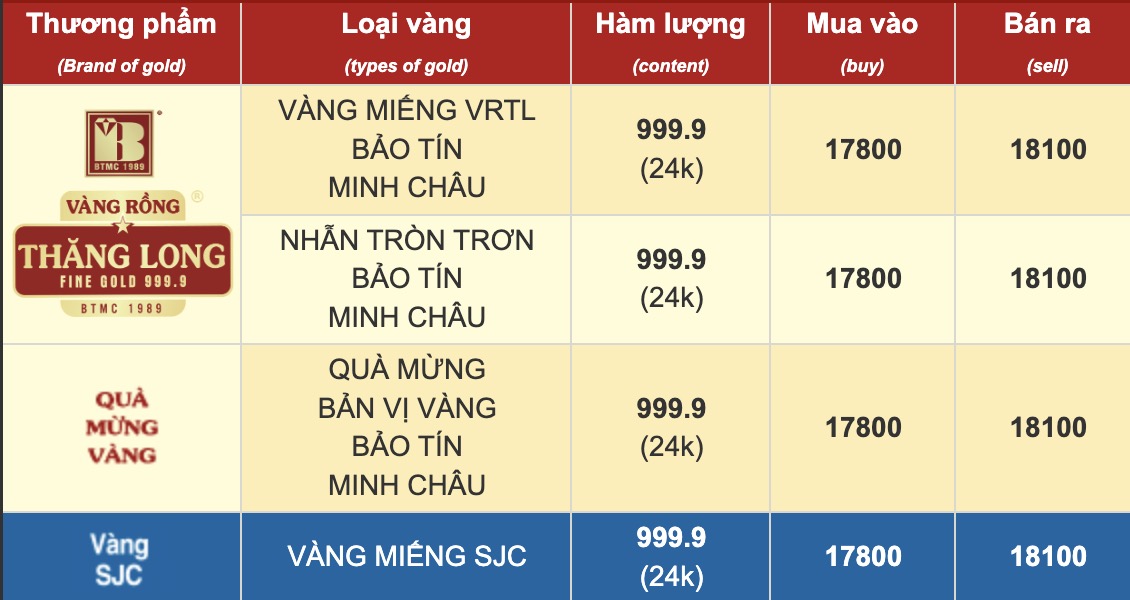

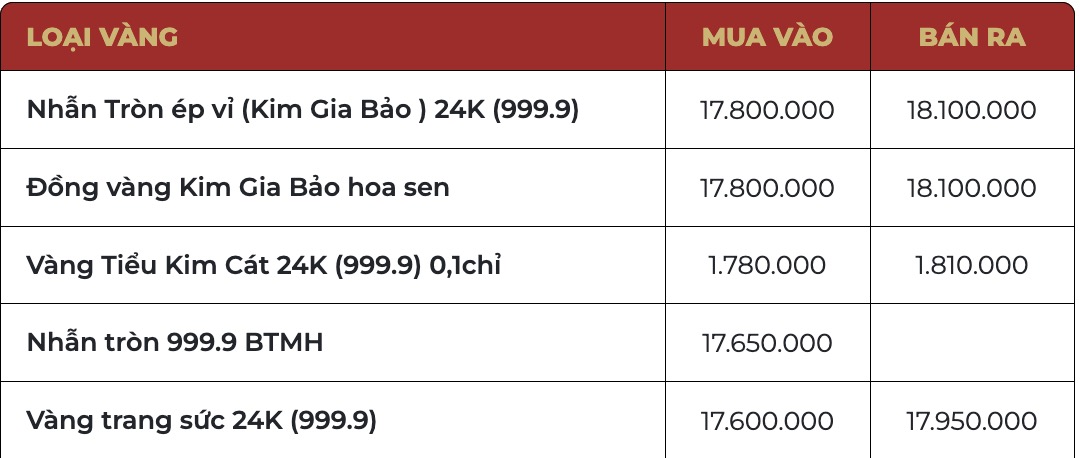

Closing the week's trading session, Saigon SJC Jewelry Company listed SJC gold prices at 178-181 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Compared to the closing session of last week (February 8th), the price of SJC gold bars at Saigon SJC Jewelry Company increased by 1.7 million VND/tael in both directions.

Meanwhile, DOJI listed SJC gold price at 176-179 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Compared to the closing session of last week (February 8), the price of SJC gold bars at DOJI decreased by 300,000 million VND/tael in both directions.

Thus, if buying SJC gold bars on February 8th and selling them on today's session (February 15th), buyers at Saigon SJC Jewelry Company will lose 1.3 million VND/tael; while the loss when buying at DOJI is 3.3 million VND/tael.

There is a large difference between business units due to the time of Tet Nguyen Dan holiday closure of the parties.

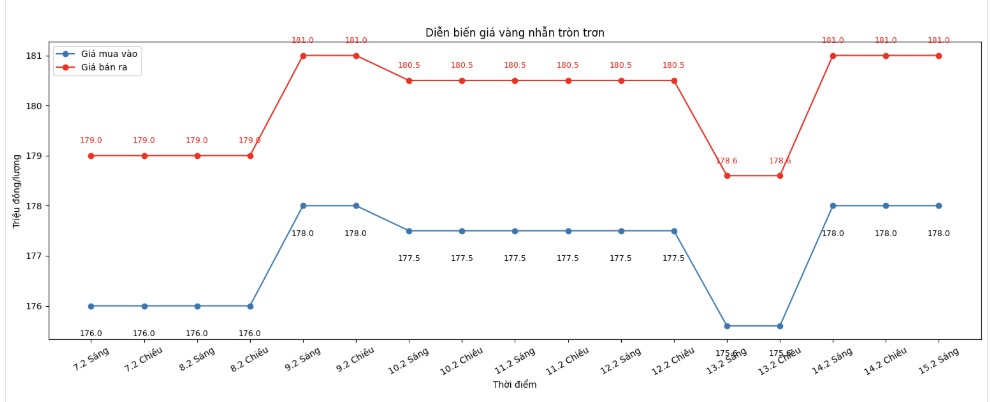

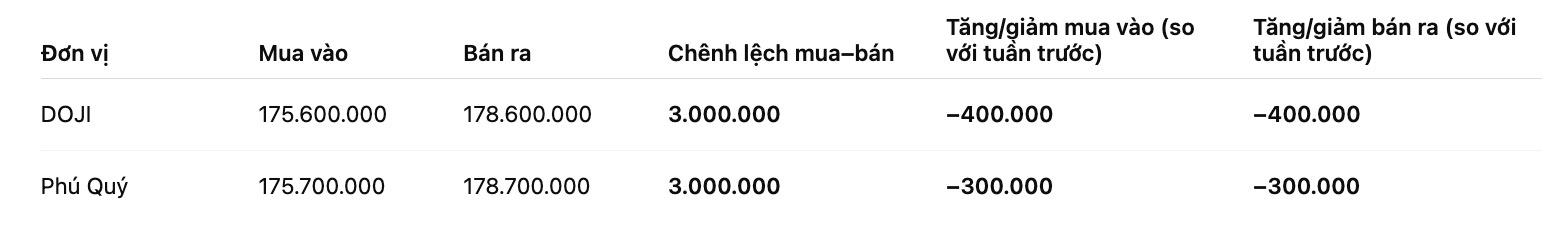

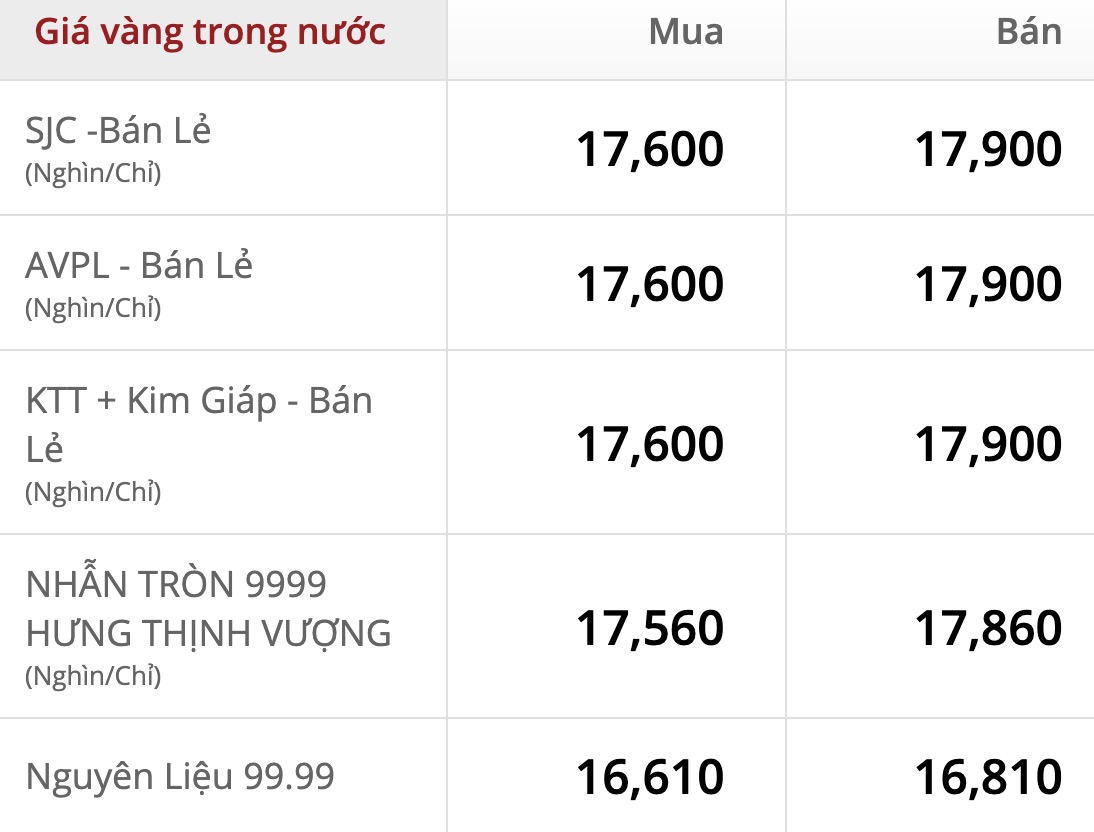

9999 gold ring price

At the same time, DOJI Group listed the price of gold rings at 175.6-178.6 million VND/tael (buying - selling), down 400,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Jewelry Group listed the price of gold rings at the threshold of 175.7-178.7 million VND/tael (buying - selling), down 300,000 VND/tael in both directions compared to a week ago. The buying - selling difference is at 3 million VND/tael.

If buying gold rings on February 8th and selling them today (February 15th), buyers at DOJI will lose 3.4 million VND/tael, while the profit of gold ring buyers in Phu Quy is 3.3 million VND/tael.

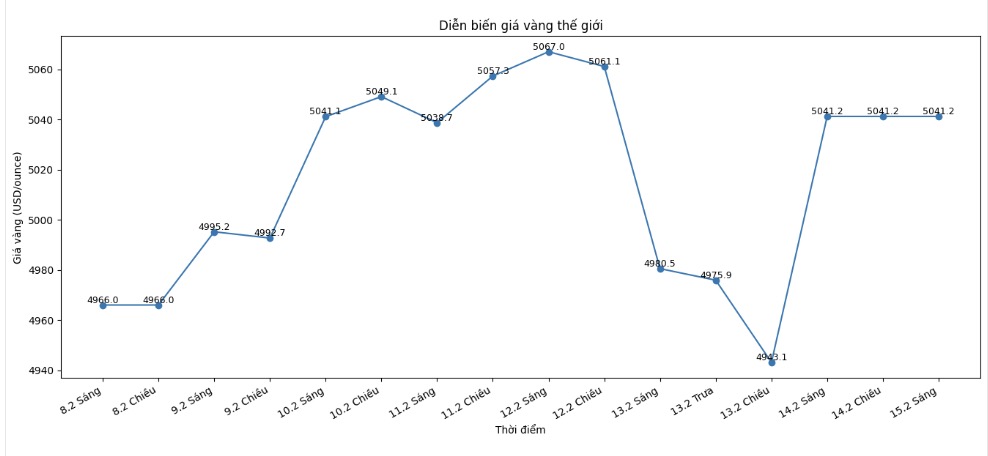

World gold price

Closing the weekly trading session, world gold prices were listed at 5,041.2 USD/ounce, up 75.2 USD compared to a week ago.

Gold price forecast

The latest weekly gold survey shows that the market sentiment picture continues to differentiate. While Wall Street experts lean towards cautious status after a week of strong fluctuations, small investors still maintain an optimistic view that prevails.

The survey with 12 Wall Street analysts recorded increased caution. Only 4 experts (33%) predict that gold prices may continue to conquer and maintain above the psychological threshold of 5,000 USD/ounce. 3 opinions (25%) believe that the precious metal is at risk of adjusting downwards. 5 experts (42%) believe that the risk of increase - decrease is quite balanced, gold is likely to continue to accumulate in a narrow range.

Kitco's online poll of 257 Main Street investors reflected more positive sentiment. Up to 163 people (63%) expect prices to increase next week. 52 opinions (20%) forecast weakening prices, while 42 investors (17%) believe gold may move sideways.

The upcoming trading week is forecast to have thin liquidity as the US market takes Presidents Day off on Monday, and Canada closes on Family Day. At the same time, the Lunar New Year holiday in China - the world's largest gold consuming market may make trading more sluggish.

Investors will focus on a series of important US economic data, including the Empire State manufacturing survey, durable goods orders, Housing Starts, Building Permits, Fed meeting minutes, number of unemployment claims, Pending Home Sales, preliminary manufacturing PMI and Q4 GDP estimates with Core PCE.

Mr. Michael Brown - senior market analyst at Pepperstone - said that the sharp decline last weekend was an unusual development due to the lack of a clear catalyst. According to him, although prices are gradually recovering, the market may need more time to accumulate before forming a new upward momentum.

Meanwhile, Mr. Lukman Otunuga - senior analyst at FXTM - believes that the 5,000 USD/ounce mark is still an important psychological barrier. If successfully breaking through, gold may head towards 5,050–5,100 USD/ounce. Conversely, losing this threshold could pull prices back to the 4,900 USD/ounce area.

Analysts assess that gold continues to be supported by expectations of the Fed reducing interest rates after US inflation cools down. However, according to the CME FedWatch tool, the possibility of policy easing before June is still not really clear. In that context, a sideways trend with strong fluctuations is considered a scenario with high probability in the short term.

Below are price updates on the websites of some business units:

See more news related to gold prices HERE...