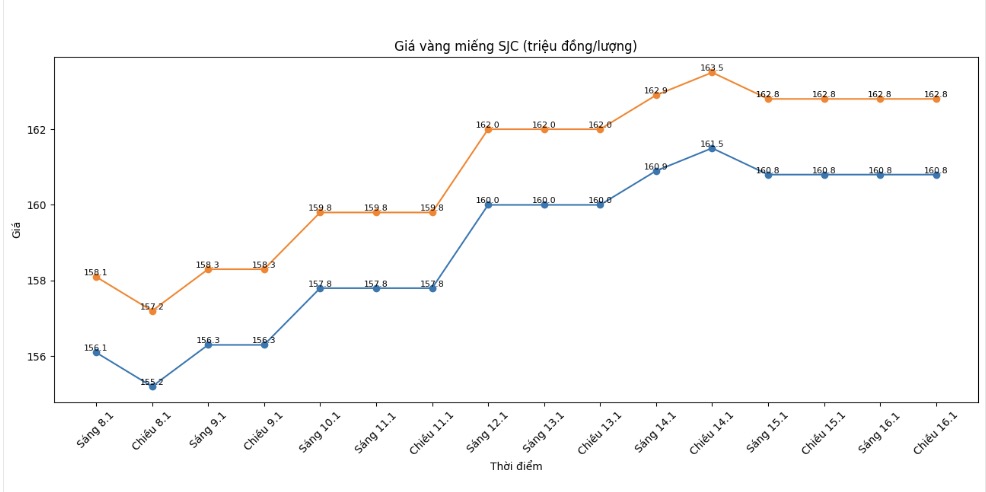

SJC gold bar price

As of 8:15 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 160.8-162.8 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at the threshold of 160.8-162.8 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at 160-162.8 million VND/tael (buying - selling), going sideways in both directions. The buying - selling price difference is at 2.8 million VND/tael.

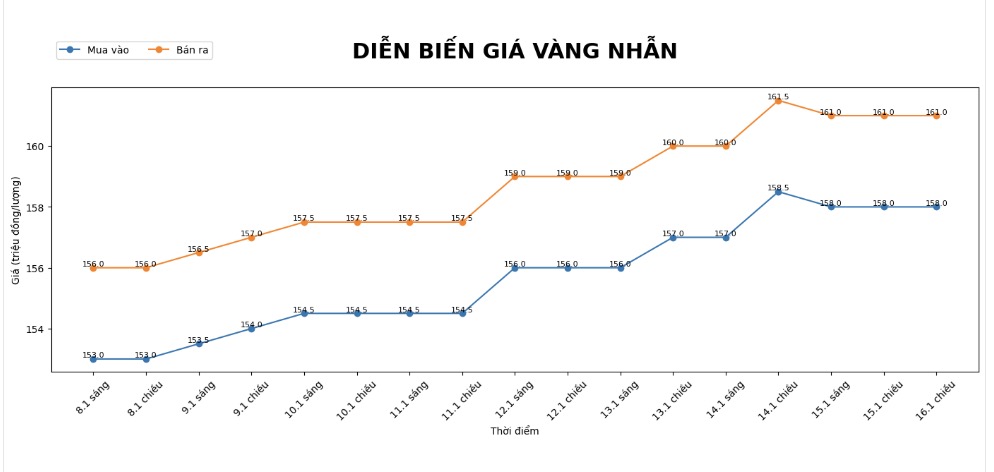

9999 gold ring price

As of 8:15 PM, DOJI Group listed the price of gold rings at the threshold of 158-161 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 1598.8-162.8 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at the threshold of 158-161 million VND/tael (buying - selling), unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

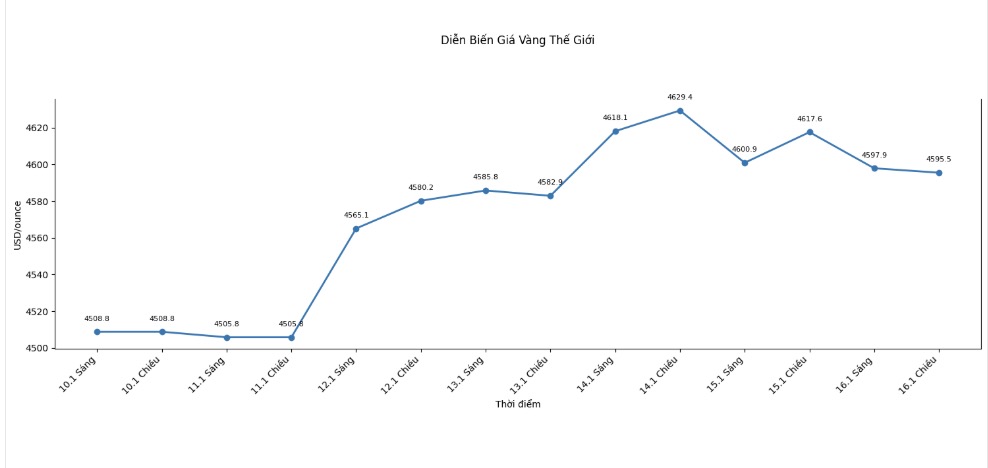

World gold price

At 8:15 PM, the world gold price was listed around the threshold of 4,595.5 USD/ounce, down 22.1 USD compared to the previous day.

Gold price forecast

Gold and silver markets continued to have another week of positive trading, as both precious metals set new all-time highs. However, before the three-day holiday in the US, short-term futures traders are "closing books", realizing profits, causing prices to bear downward pressure.

In addition, at the end of this week, risk avoidance sentiment in the general market also showed signs of cooling down. Gold for February delivery closed the nearest session down 9 USD, down to 4,614.70 USD/ounce. Silver for March delivery fell 1,667 USD, down to 90.675 USD/ounce.

The USD index (USDX) on Thursday hit a 6-week high and is currently sideways in early trading today. USDX is on an upward trend for the third consecutive week, in the context that positive US economic data reduces expectations that the US Federal Reserve (Fed) will continue to cut interest rates.

The number of weekly unemployment claims is much lower than forecast, showing that the labor market remains stable; at the same time, some production surveys also exceed expectations. Many Fed officials also emphasized the signs of labor market stability and warned of potential inflation risks.

Chairman of the Kansas City Federal Reserve - Mr. Jeff Schmid, said that US interest rates should be maintained at a level that still creates some pressure on the economy, thereby helping inflation continue to cool down.

Speaking on Thursday, Mr. Schmid said that he does not believe that further interest rate cuts will help overcome the "flashes" in the labor market, which he believes are stemming from structural factors. He also mentioned the independence and federal model of the Fed, saying that the decentralization system allows for the existence of different views on monetary policy and that is a strength.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...