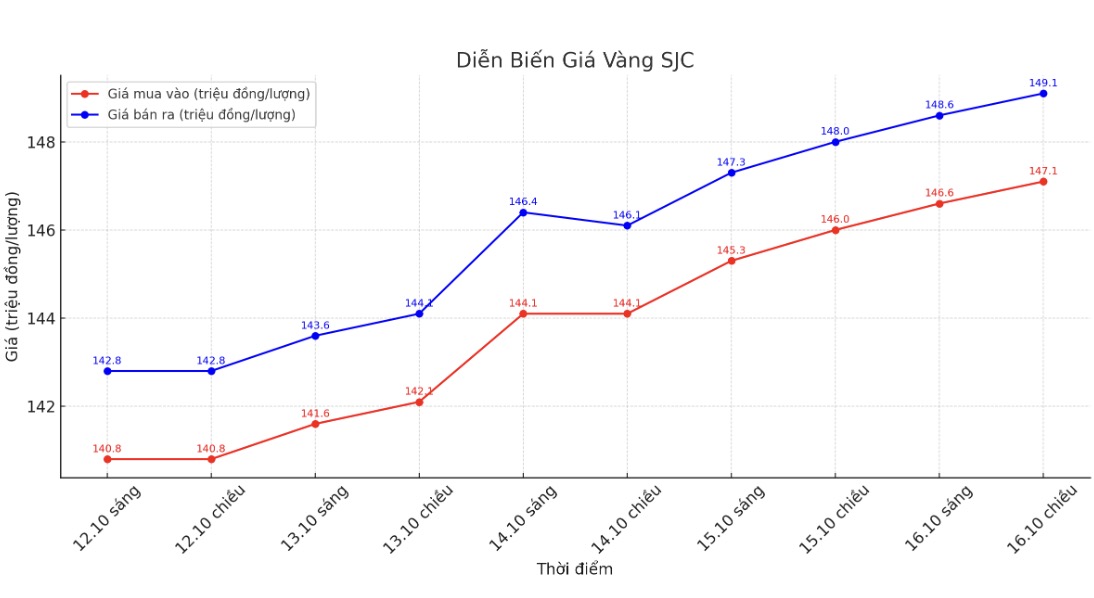

SJC gold bar price

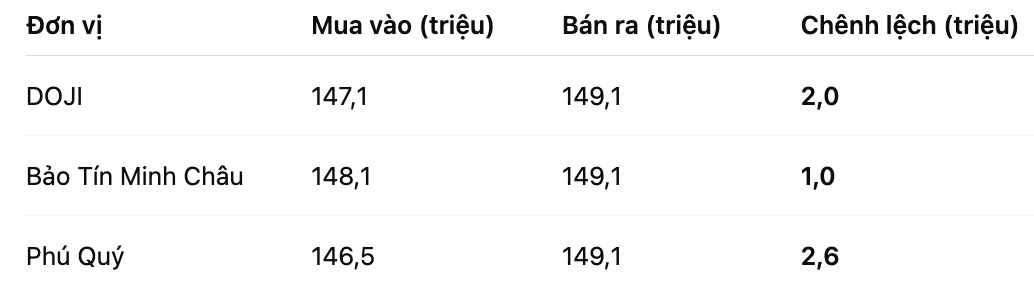

As of 5:30 p.m., DOJI Group listed the price of SJC gold bars at 147.1-149.1 million VND/tael (buy in - sell out), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 148.1-149.1 million VND/tael (buy - sell), an increase of 2.1 million VND/tael for buying and an increase of 1.1 million VND/tael for selling. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 146.5-149.1 million VND/tael (buy in - sell out), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling prices is at 2.6 million VND/tael.

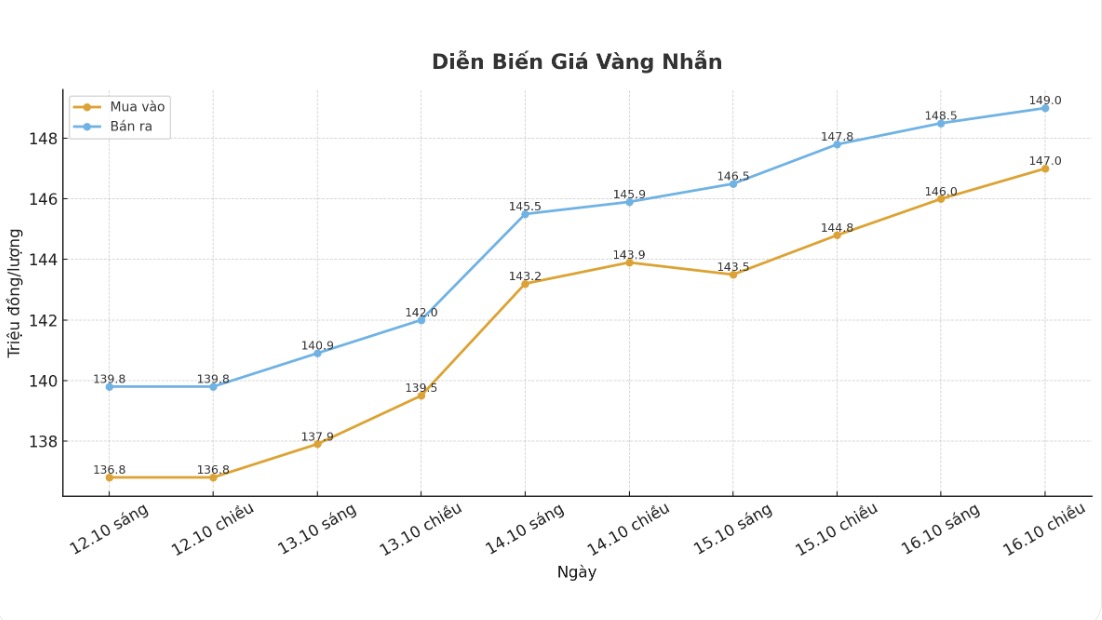

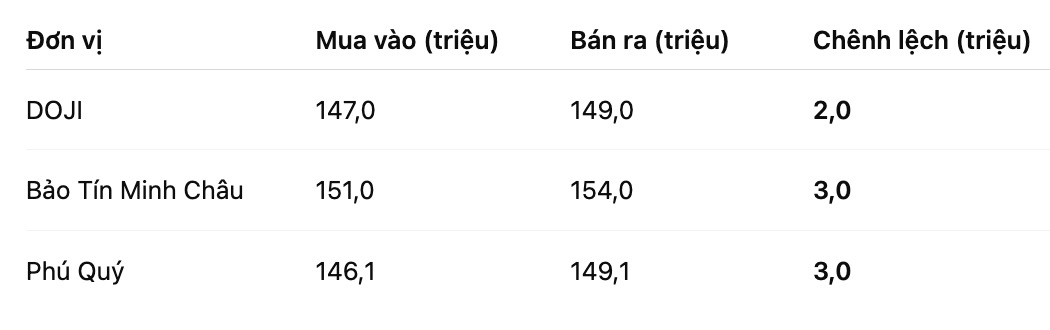

9999 gold ring price

As of 5:30 p.m., DOJI Group listed the price of gold rings at 147-149 million VND/tael (buy - sell), an increase of 2.2 million VND/tael for buying and an increase of 1.2 million VND/tael for selling. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 151-154 million VND/tael (buy - sell), an increase of 1.7 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 146.1-149.1 million VND/tael (buy - sell), an increase of 1.3 million VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

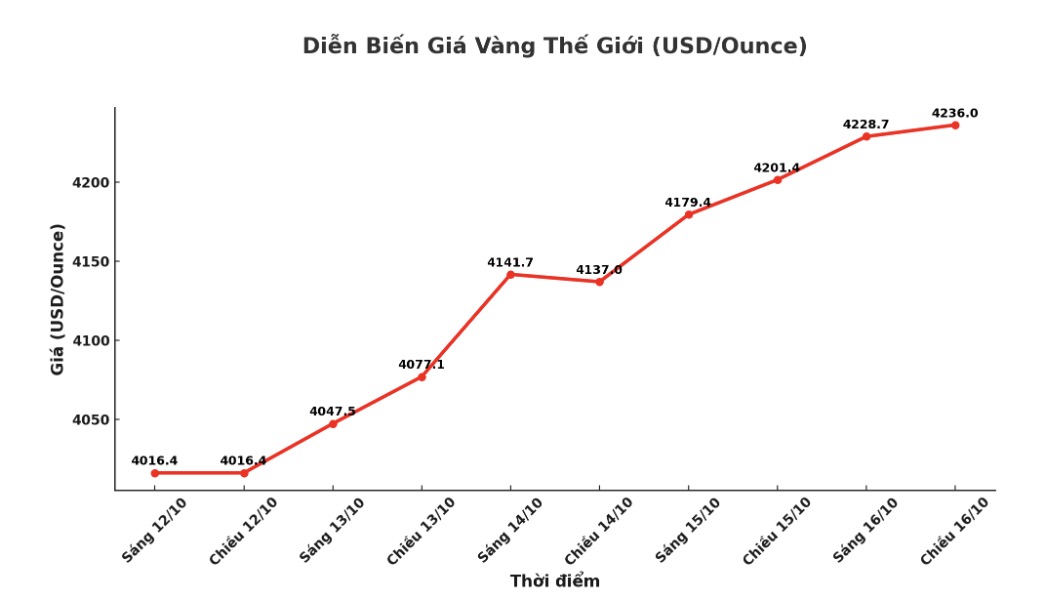

World gold price

The world gold price was listed at 5:42 p.m. at 4,236 USD/ounce, up 34.6 USD compared to a day ago.

Gold price forecast

In a recent interview with the press, Mr. John Merrill - Founder, Chairman and Investment Director of Tanglewood Total Wealth Management - said that gold currently accounts for about 12% of his investment portfolio, higher than the target of 10%.

Mr. Merrill said that he has been optimistic about gold since 2023, initially allocating only 5-6% of the portfolio. Over the past two years, he has repeatedly rebalanced his portfolio due to unprecedented strong gold prices. However, looking forward, he said that there is no reason to sell at this time.

We will continue to hold gold. Normally, we only rebalance at the end of the year, so we will review it at that time, whether the price increases or decreases, he said.

Even with a profit, Merrill has remained committed to maintaining a certain proportion of gold, as he believes, we will always own gold. I don't know how much that rate will be in the next 20 years, but we will definitely keep it, because nothing can replace gold."

According to Mr. Merrill, the biggest factor driving current gold demand is rising global public debt. Investors are looking to protect their assets as the world's legal currencies are gradually losing purchasing power. At the same time, the debt burden has made long-term Treasury bonds - once considered a safe haven asset - more risky.

We have realized since 2023 that there are new drivers for gold prices. Previously, we did not consider gold as a hedge against inflation, because history shows poor efficiency. But gold is a hedge against crises, and now it has become a hedge against currency, he said.

ANZ Bank has just forecast gold prices to reach 4,400 USD/ounce by the end of 2025, driven by increasing geopolitical, economic and financial instability, along with expectations that the US Federal Reserve (FED) will soon loosen monetary policy.

ANZ believes that gold prices may peak around $4,600/ounce in June 2026, then gradually decrease in the second half of 2026 when the FED ends the interest rate cut cycle and the picture of US economic growth as well as trade tariffs becomes clearer.

However, the bank also warned of downside risks, including the possibility of the Fed returning to a tougher stance or the US economy growing beyond expectations.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...