SJC gold bar price

As of 5:30 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 118.7/20.7 million VND/tael (buy in - sell out); increased by 1.2 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 118.7 - 20.7 million VND/tael (buy - sell); increased by 1.2 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.7-120.7 million VND/tael (buy in - sell out); increased by 1.2 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.1-120.7 million VND/tael (buy - sell); increased by 1.3 million VND/tael for buying and increased by 1.2 million VND/tael for selling. The difference between buying and selling prices is at 2.6 million VND/tael.

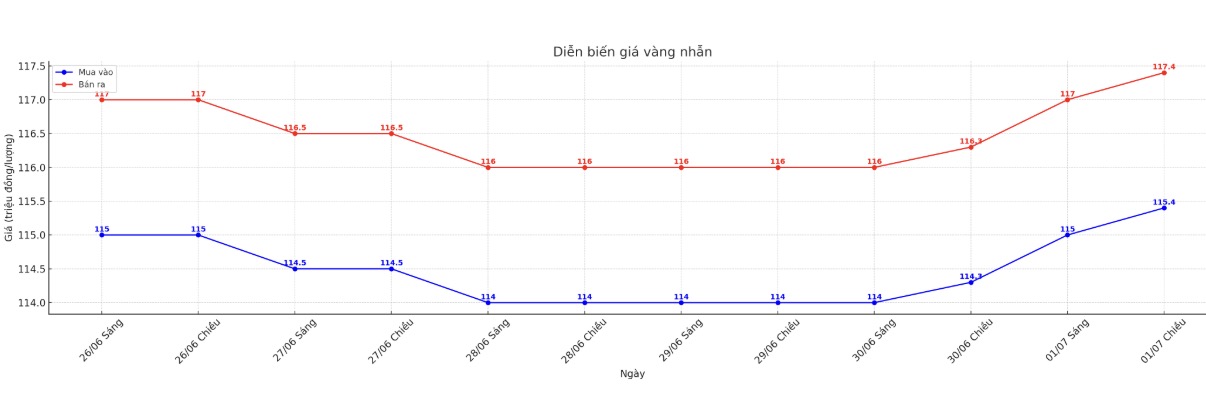

9999 gold ring price

As of 5:30 p.m., DOJI Group listed the price of gold rings at 115.4-117.4 million VND/tael (buy - sell), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.5-118.5 million VND/tael (buy - sell), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.3-117.3 million VND/tael (buy in - sell out), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

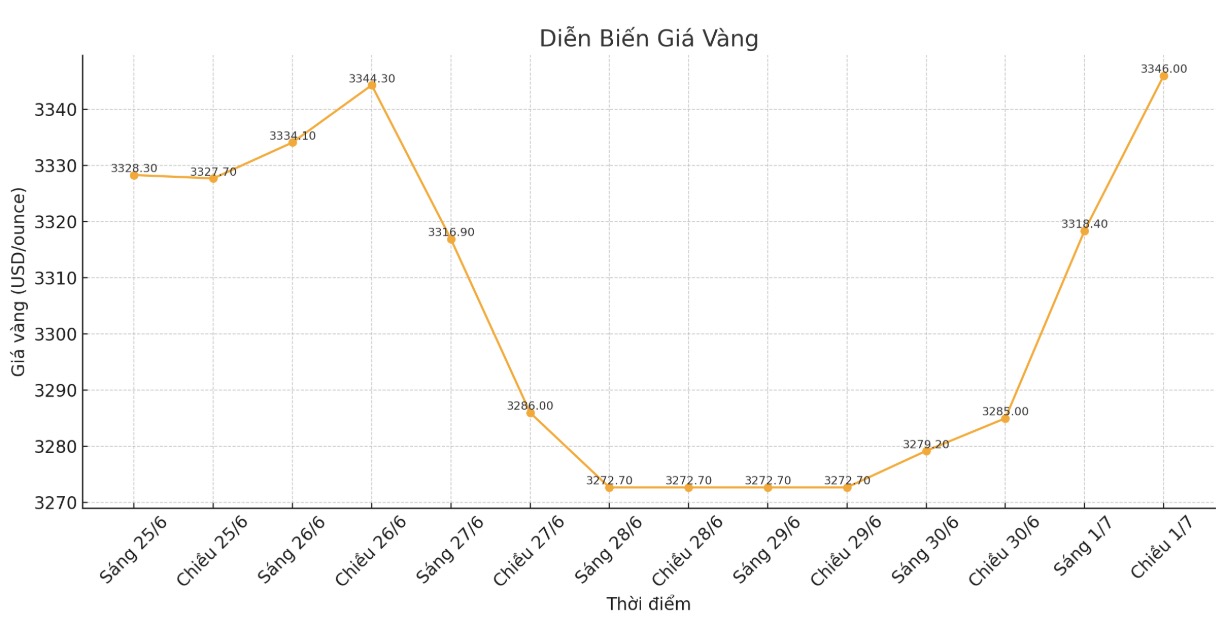

World gold price

The world gold price was listed at 5:30 p.m. at 3,346 USD/ounce, up sharply by 61 USD.

Gold price forecast

Gold prices have increased sharply as the US dollar has weakened and uncertainty about trade agreements has increased ahead of the deadline of July 9 by US President Donald Trump. Expectations of the US Federal Reserve (FED) cutting interest rates also further supported the price of precious metals.

A weaker US dollar and concerns about the impact of Trumps failure to extend the deadline are supporting gold prices at the moment, said Nicholas Frappell, global director of held market segment at ABC Refinery.

The US dollar index (.DXY) has fallen to its lowest level in more than three years, making gold cheaper for holders of other currencies.

Trump expressed his disappointment with the US-Japan trade talks on Monday, while Finance Secretary Scott Bessent warned that countries could face much higher tariffs.

The tax rates, announced on April 2, are expected to take effect from July 9 after a 30-day postponement by Trump to create time for bilateral negotiations.

Meanwhile, Mr. Trump continued to increase pressure to call for a rate cut, when he sent Fed Chairman Jerome Powell a list of interest rates of major central banks in the world with a handwritten note saying that US interest rates should be between 0.5% for Japan and 1.75% for Denmark.

The call for a rate cut is also affecting the market, although I was a bit surprised that the market is so optimistic about the possibility of a rate cut, Frappell added.

Low interest rates make gold more attractive by reducing holding costs.

Goldman Sachs now expects the Fed to cut rates three times this year, starting in September, up from the previous forecast of just one in December, citing the impact of tariffs at the minimum level and a weakening labor market.

Investors are closely monitoring US employment reports this trading week, with government salary table data due out on Thursday.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...