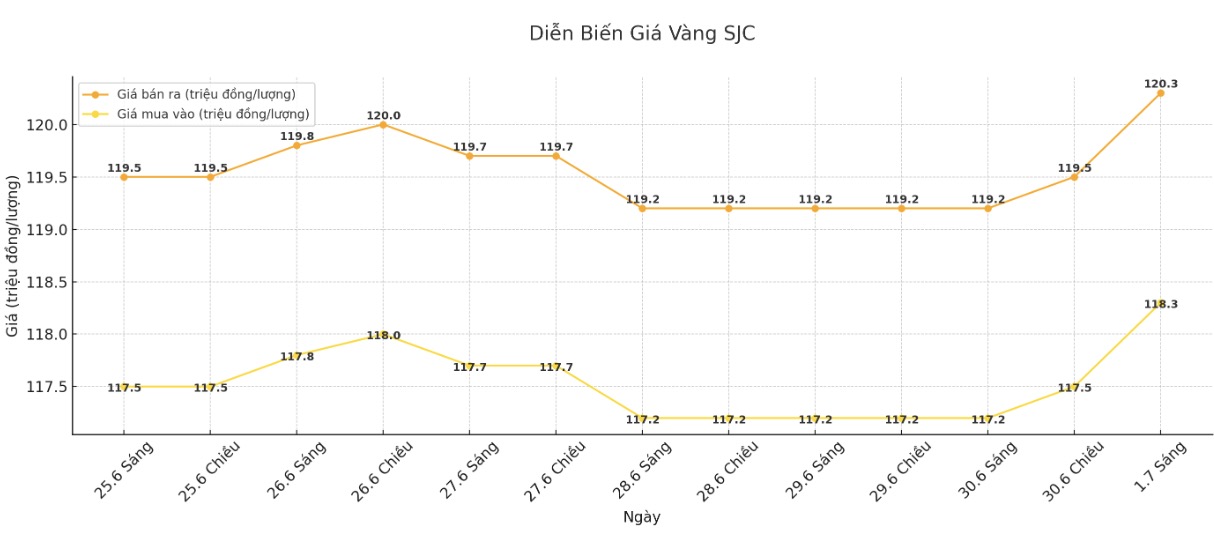

Updated SJC gold price

As of 8:50 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 118.3-120.3 million/tael (buy in - sell out), an increase of VND 1.1 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed the price of SJC gold bars at 118.3-120.3 million VND/tael (buy - sell), up 1.1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.3-120.3 million VND/tael (buy in - sell out), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Gemstone Group listed the price of SJC gold bars at 117.77-120.3 million VND/tael (buy - sell), an increase of 1.2 million VND/tael for buying and an increase of 1.1 million VND/tael for selling, the difference between buying and selling prices was at 2.6 million VND/tael.

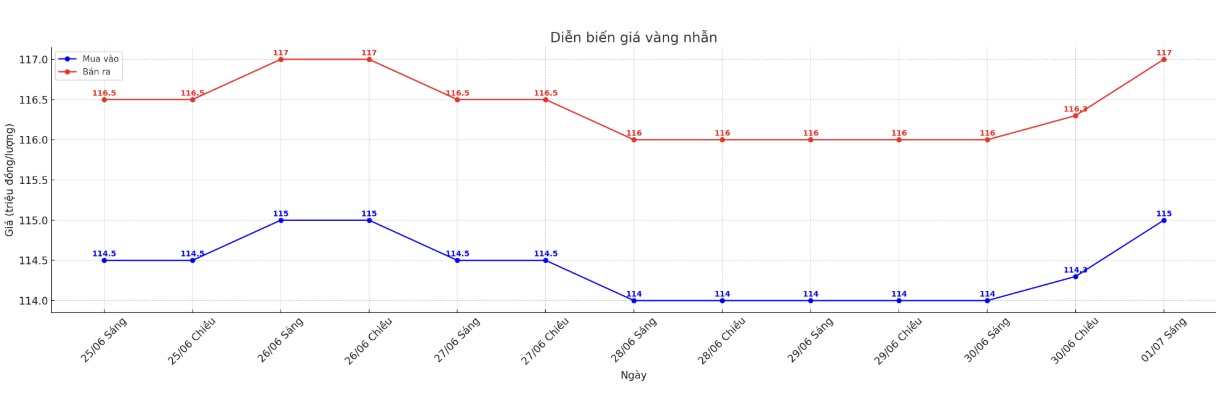

9999 round gold ring price

As of 8:50 a.m., DOJI Group listed the price of gold rings at 115-117 million VND/tael (buy in - sell out), an increase of 1 million VND/tael. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115-118 million VND/tael (buy - sell), an increase of 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.6-116.6 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

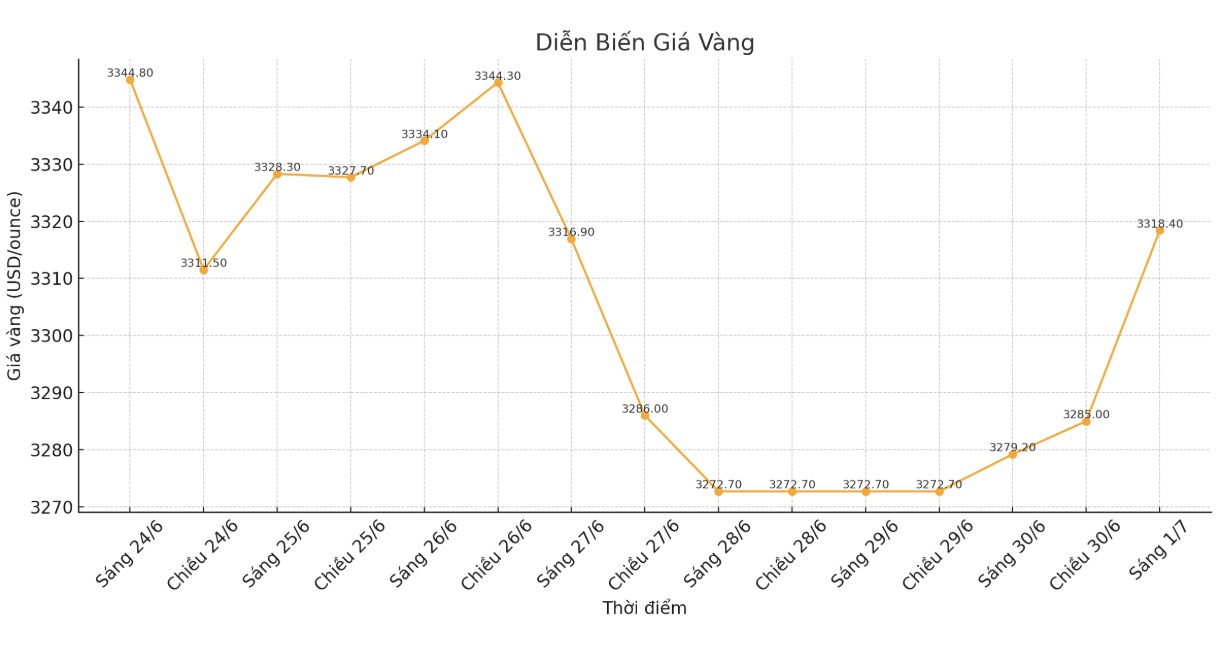

World gold price

At 8:50 a.m., the world gold price was listed around 3,318.4 USD/ounce, up to 39.2 USD/ounce compared to 1 day ago.

Gold price forecast

Alex Kuptsikevich - senior market analyst at FxPro - predicted that gold is likely to continue to adjust down in the short term. According to him, the weakening of the precious metal is clearly shown when prices penetrate the important technical support level of the 50-day moving average, around 3,324 USD/ounce, and are currently having difficulty maintaining above 3,300 USD/ounce.

The continued failure of gold prices in their efforts to overcome the $3,500 threshold further strengthens the downside scenario. Kuptsikevich said that tensions between Israel and Iran have cooled down, reducing safe-haven demand - a factor that played a key role in the previous increase.

He said that the price range from $3,100 to $3,400 is still the main range but technical signals are leaning towards the negative. In the context of the dominance of the selling side and the weakening of momentum, gold is expected to continue to be under downward pressure in the short term.

On the other hand, Naeem Aslam - Investment Director at Zaye Capital Markets - maintains a positive view on gold, especially as the USD continues to decline. Aslam said many investors believe the greenback is in a weak trend and interest rates could fall further, creating favorable conditions for gold.

I think any other decline in the US dollar is a clear opportunity to buy gold, Aslam said. However, he also noted that risk-off sentiment is returning to the market, which could limit gold's strong recovery potential during a period without prominent geopolitical tensions.

According to Mr. Joseph Wu - Vice Chairman and portfolio manager at RBC Wealth Management, since the long-standing back-and-forth relationship between gold and real interest rates was broken, gold price fluctuations have been increasingly dominated by other drivers.

Mr. Wu said that clearly identifying which factors determine gold prices is always difficult. However, for the past 25 years, there has been a relationship that has been quite stable that is, gold prices have often fluctuated in the opposite direction to real interest rates, he said.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...