Update SJC gold price

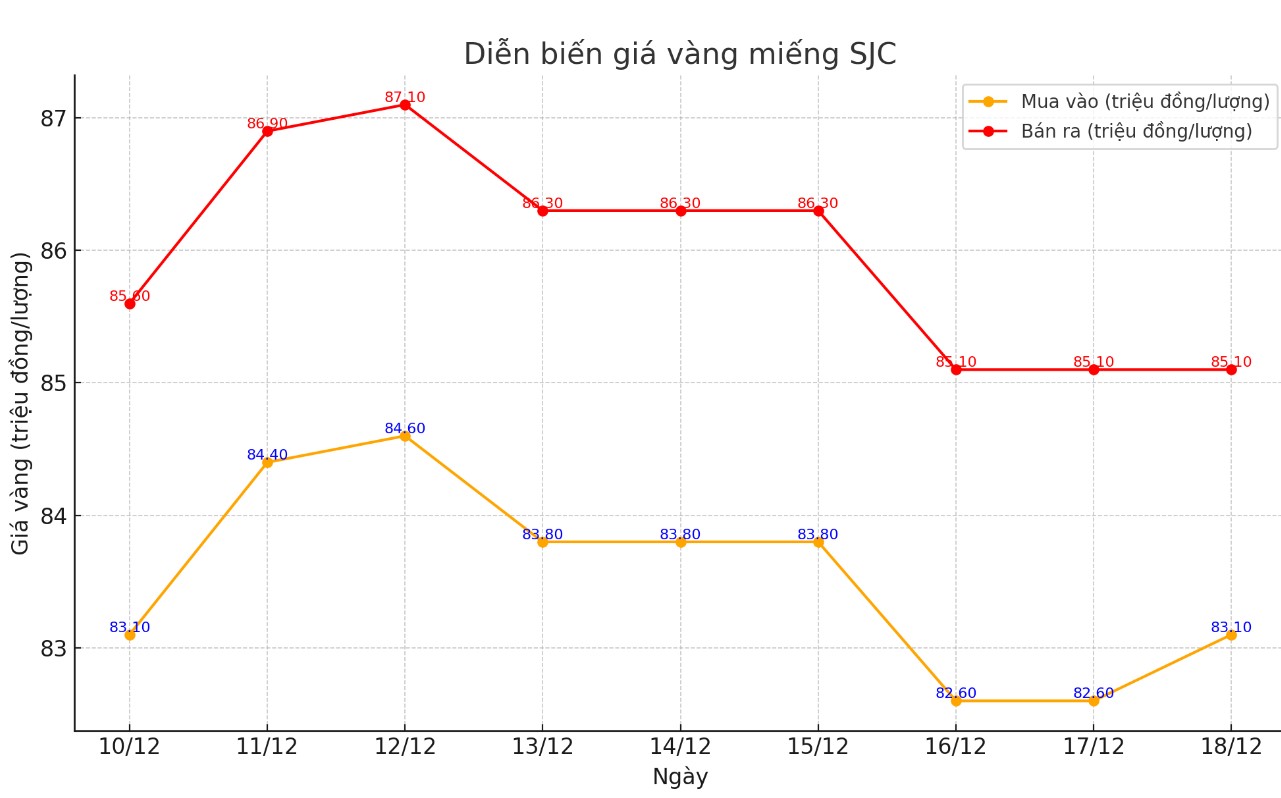

As of 5:50 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND83.1-85.1 million/tael (buy - sell); increased by VND500,000/tael for buying and remained unchanged for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 82.6-85.1 million VND/tael (buy - sell); unchanged in both directions.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 83.1-85.1 million VND/tael (buy - sell); increased 500,000 VND/tael for buying and kept the same for selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Price of round gold ring 9999

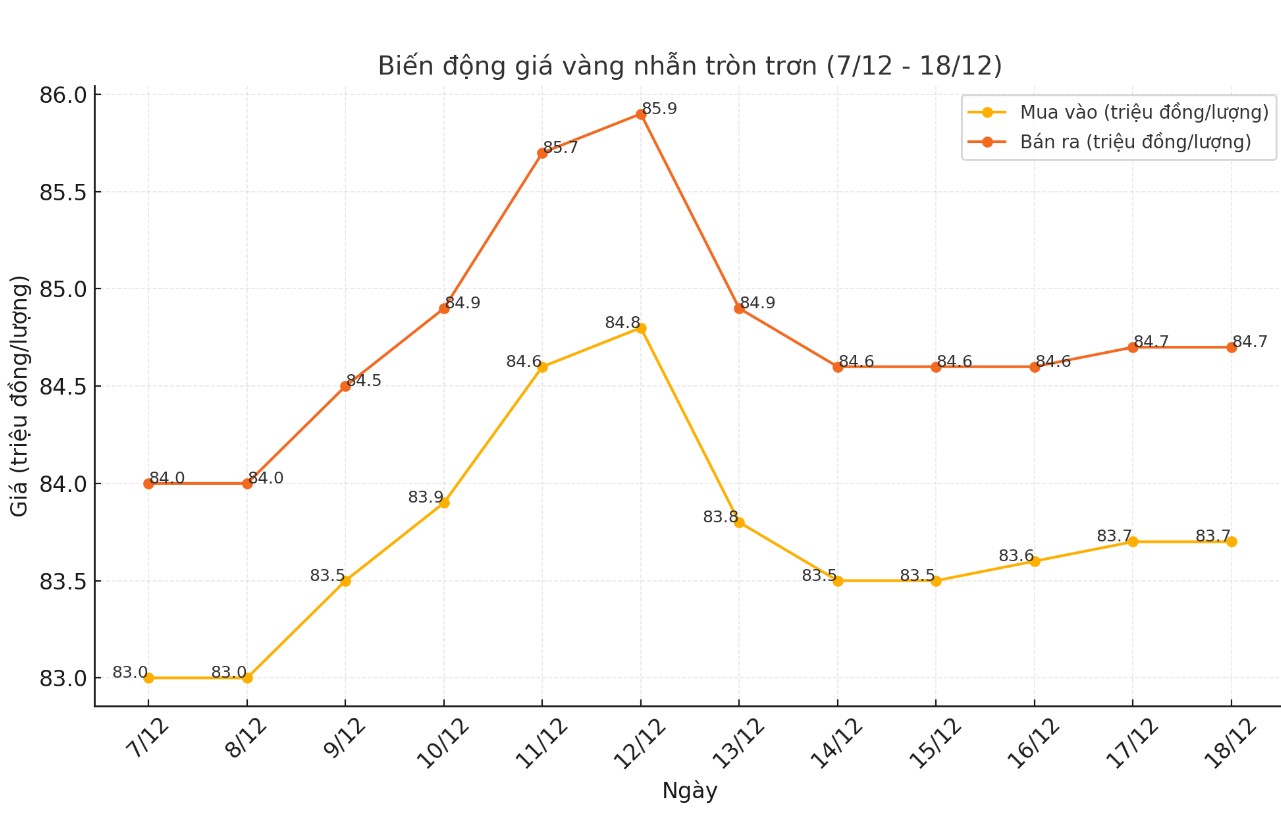

As of 5:50 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.7-84.7 million VND/tael (buy - sell); both buying and selling prices remain unchanged compared to the close of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 83.73-85.03 million VND/tael (buy - sell), keeping both buying and selling prices unchanged compared to the closing price of yesterday's trading session.

World gold price

As of 5:50 p.m., the world gold price listed on Kitco was at 2,648.1 USD/ounce, up 5.2 USD/ounce compared to the close of the previous trading session.

Gold Price Forecast

World gold prices increased slightly as the USD index decreased. Recorded at 5:50 p.m. on December 18, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 106.650 points (down 0.01%).

According to Reuters, the US Federal Reserve (FED) may cut interest rates on December 18 (local time), while giving a cautious monetary policy outlook in 2025.

The move, which some economists have called a “tightening rate cut,” would take the Fed’s policy rate to a range of 4.25% to 4.50%, one percentage point lower than in September when the central bank began easing policy after a period of tightening to control rising inflation from 2021.

But the pace and extent of rate cuts in 2025 remain uncertain. Inflation is already above the Fed’s 2% target, while the U.S. economy continues to grow faster than expected. And President-elect Donald Trump’s tariffs, immigration, and corporate tax policies could have unpredictable effects when he takes office in January.

Based on forecasts from September, Fed officials had expected another one-percentage-point cut, bringing interest rates to around 3.4% by the end of 2025. However, with inflation falling short of target and the impact of Mr. Trump’s election victory on November 5, investors now only expect a rate cut of around 0.5% next year.

The FED's move could have a strong impact on financial markets, especially gold prices.

A Fed rate cut typically weakens the US dollar, increasing the appeal of gold, an asset priced in US dollars. When the US dollar falls, gold becomes cheaper for investors using other currencies, stimulating demand. In particular, when bond yields fall and the opportunity cost of holding gold is lower, this precious metal attracts more market attention.

The Fed’s rate cut could stoke concerns about rising inflation. While inflation is currently above the Fed’s 2% target, the rate cut could signal to markets that the central bank is not doing enough to control prices. This could prompt investors to seek gold as a hedge against inflation.

“The Fed is likely to maintain its forecast for rate cuts through 2025, but will be increasingly cautious about the pace of cuts,” economists from TD Securities said ahead of the two-day meeting.

See more news related to gold prices HERE...