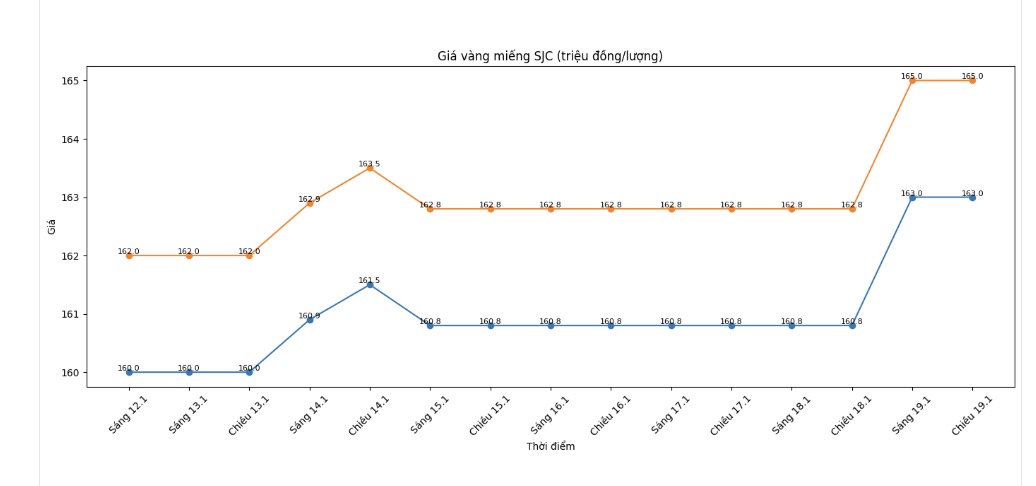

SJC gold bar price

As of 7:00 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 163-165 million VND/tael (buying - selling), an increase of 2.2 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 163-165 million VND/tael (buying - selling), an increase of 2.2 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at the threshold of 162-165 million VND/tael (buying - selling), an increase of 2 million VND/tael on the buying side and an increase of 2.2 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

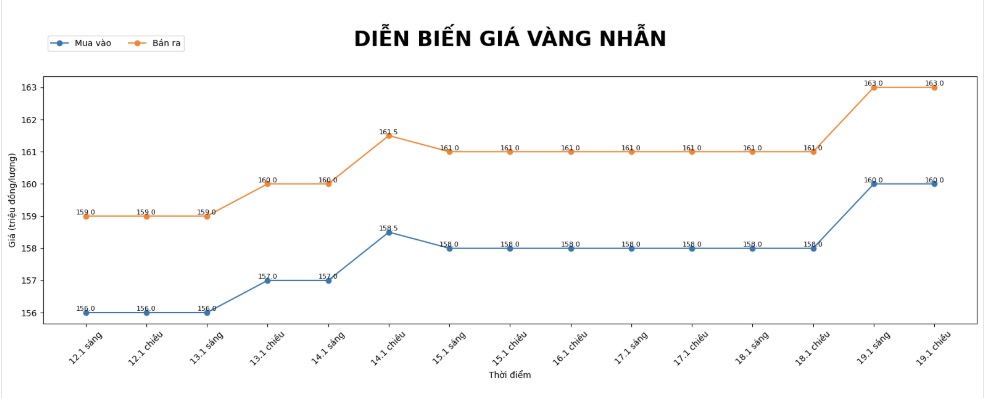

9999 gold ring price

As of 5:15 PM, DOJI Group listed the price of gold rings at 160-163 million VND/tael (buying - selling), an increase of 2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 161.5-164.5 million VND/tael (buying - selling), an increase of 1.7 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 160-163 million VND/tael (buying - selling), an increase of 2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

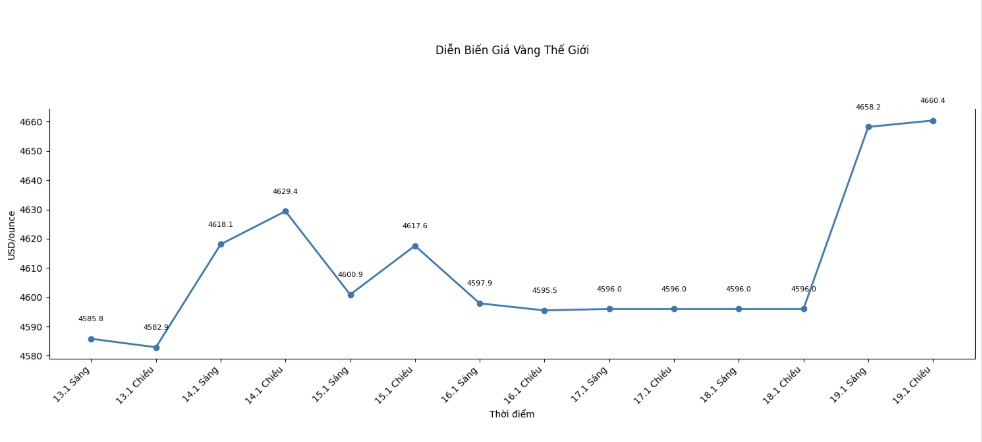

World gold price

At 7:00 PM, the world gold price was listed around the threshold of 4,660.4 USD/ounce, up 64.4 USD compared to the previous day.

Gold price forecast

In the context of domestic and world gold prices simultaneously setting new highs, the prospects for precious metals in the coming time continue to receive many positive assessments. However, along with the expectation of price increases are warnings about adjustment risks as the market has experienced a prolonged period of hot increases.

According to international analysts, the main driving force supporting gold prices still comes from the unstable global economic and political environment. Budget deficits in major economies, geopolitical tensions showing no signs of cooling down, and the possibility of the USD weakening in the medium term continue to make gold considered a safe haven. In addition, the demand for gold purchases from central banks, especially in Asia, is still maintained at a high level to diversify foreign exchange reserves.

Many major financial institutions forecast that gold prices in 2026 may increase by another 15-20% compared to the end of 2025, bringing the average price level to around the threshold of 5,100-5,200 USD/ounce. Some viewpoints are even more optimistic, believing that this precious metal has not ended its long-term upward cycle, especially when inflation-inducing loose monetary policies may return.

From a technical perspective, Mr. Darin Newsom – senior market analyst at Barchart.com – said that current short-term corrections are only normal in a major uptrend.

According to him, cash flow has not yet left the gold market and each rapid price drop usually triggers buying momentum to return not long after.

Tensions only really change when capital flow reverses, and that has not happened with gold yet," Mr. Newsom emphasized.

Sharing the same view, Mr. James Stanley - market strategist at Forex.com - said that recent strong fluctuations mainly stem from short-term profit-taking activities. According to him, in a market that has increased sharply for many years, the appearance of retreats is inevitable, but this may also be an opportunity for buyers to participate in a more reasonable price range.

However, the history of the gold market shows that a deep correction scenario cannot be ruled out if the excitement is pushed too high. Therefore, investors need to be cautious with leverage, closely monitor macroeconomic developments and allocate portfolios reasonably, instead of chasing the psychology of "fear of missing out" when prices are already in the high zone.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...