According to Christopher Lewis, gold is still attracting buying momentum as prices have decreased after the interest rate cut by the US Federal Reserve (FED). The technical picture still supports the uptrend, despite the fluctuations caused by central banks this week.

The gold market has created a bearish space at the opening of the trading session on Thursday, due to a slight profit-taking. I think the market has been very positive for a long time, so a slight correction is necessary, Lewis said.

He added: The Fed meeting has ended and initially seemed like the Fed would be tougher than expected, or at least tend to tighten. But now, the market is starting to adjust. And as usual, the first reaction of the market after the Fed's decision may not be accurate.

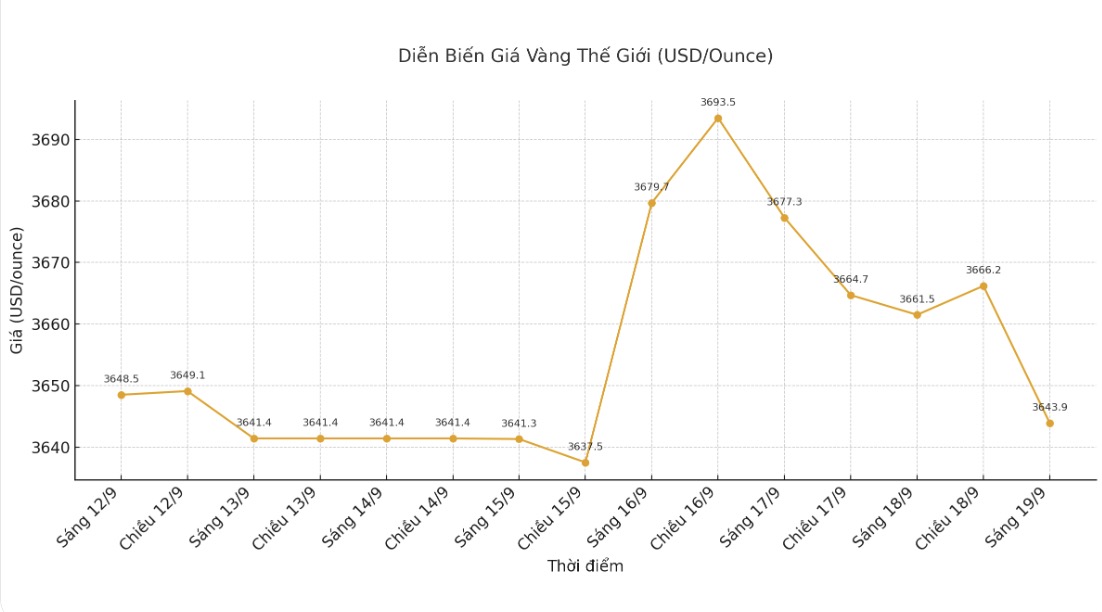

Lewis stressed that gold is still in a strong long-term uptrend: I think any correction at this point is a buying opportunity, with support around $3,650 and $3,600/ounce.

He predicted that the bullish target could be towards $3,800/ounce based on the previously broken trigon shift model, but it will take time to achieve.

I do not intend to sell fake gold. The market has been in a state of price increase for too long. Furthermore, central banks, especially the Fed, continuing to cut interest rates supports the idea of gold to increase higher.

Not to mention that central banks around the world continue to hoard gold and the geopolitical situation is still quite tense, which is also beneficial for gold - Lewis affirmed.

Sharing the same view, Jim Wyckoff - senior analyst at Kitco commented that both gold and silver had a good increase before, so the downward correction is predictable and could continue for a while. However, December gold buyers still have a solid advantage.

"Gold and silver prices fell sharply as the market saw strong profit-taking from short-term contract investors after the FOMC meeting and after gold set a new record, silver hit a 14-year high on Tuesday.

Both markets have had good up momentum before, so the downward adjustment is predicted and may continue for a while.

However, technically, December gold futures are still giving buyers a solid near-term advantage. The next upside target for buyers is to close above the strong resistance level of $3,800/ounce. In contrast, the short-term bearish target for the bears is to pull prices below the important technical support level of $3,600/ounce.

The first resistance level was seen at 3,700 USD/ounce and then at 3,715 USD/ounce. The first support level at today's bottom is $3,660.5 an ounce, then $3,650 an ounce," said Jim Wyckoff.

Gold has recovered from a session low of $3,630, recorded 15 minutes after the North American market opened. The last spot gold price was recorded at 3,640.25 USD/ounce, down 0.53% on the day.

See more news related to gold prices HERE...