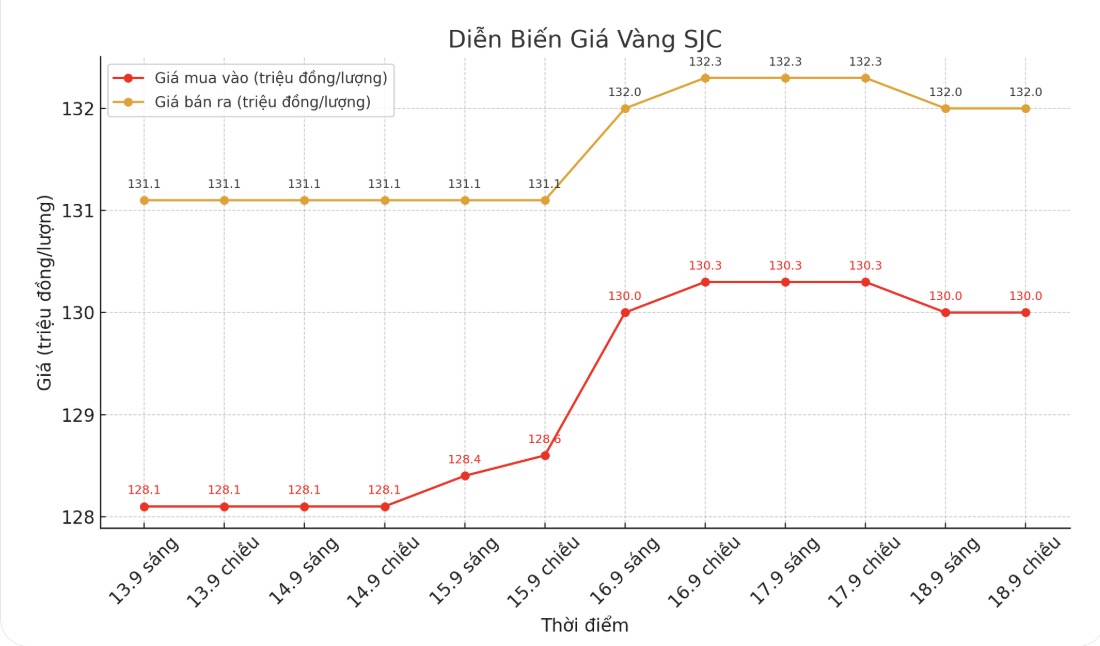

SJC gold bar price

As of 6:00 p.m., DOJI Group listed the price of SJC gold bars at VND130-132 million/tael (buy in - sell out), down VND300,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 130-132 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 129-131.7 million VND/tael (buy - sell), down 800,000 VND/tael for buying and down 600,000 VND/tael for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

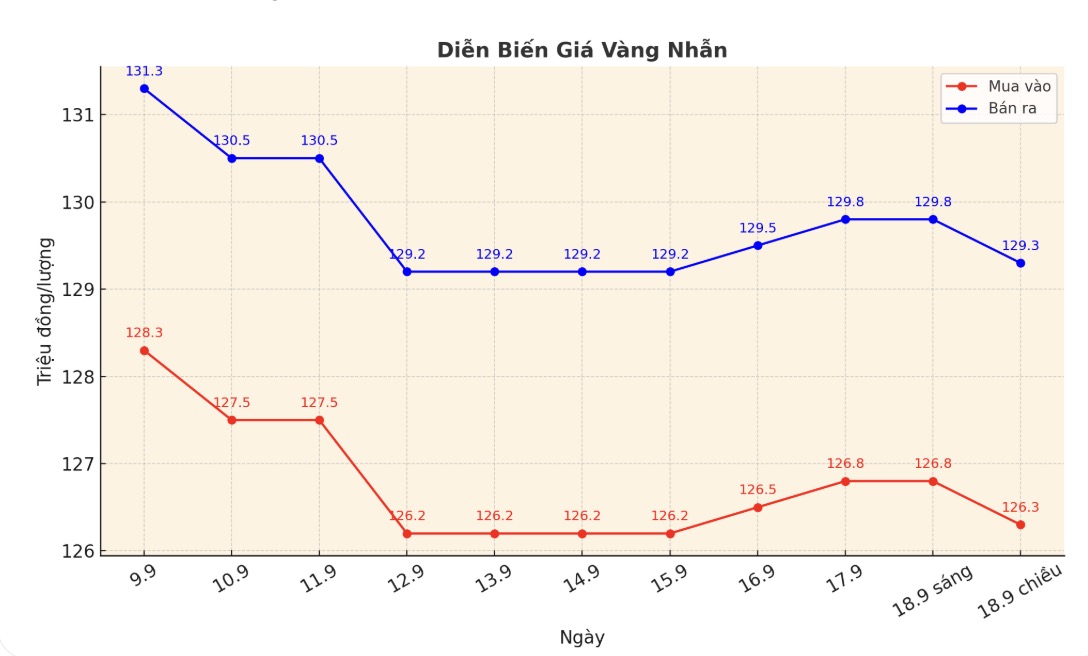

9999 gold ring price

As of 6:00 p.m., DOJI Group listed the price of gold rings at 126.3-129.3 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 127-130 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 126.2-129.2 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

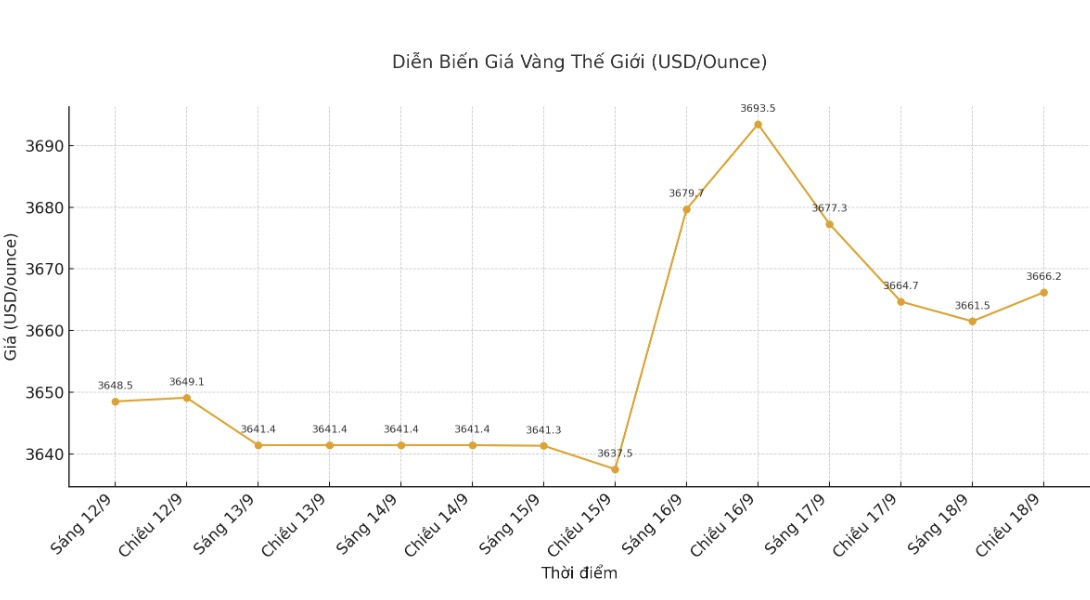

World gold price

The world gold price was listed at 5:50 p.m. at 3,666.2 USD/ounce.

Gold price forecast

World gold prices recovered in the trading session on Thursday, supported by a weakening USD, after the FED cut interest rates by 25 basis points and signaled a gradual easing roadmap for the rest of the year, thereby increasing the attractiveness of the precious metal.

The USD index fell back to near a two-month low, making gold cheaper for holders of other currencies. The yield on the 10-year US Treasury note also fell.

Fawad Razaqzada - market analyst at City Index and FOREX.com said: "The USD continues to weaken, supporting gold prices. This interest rate decision is somewhat dovish, because the statement or plot dot chart shows that there will be two more cuts this year.

The Fed cut interest rates by 25 basis points on Wednesday and said it will continue to cut borrowing costs for the rest of the year. Fed Chairman Jerome Powell described the move as a risk-off against a weakening labor market and said the agency would view each meeting on the interest rate outlook.

Gold - an unyielding safe haven asset, often has the advantage of a low interest rate environment. Golds rally is still holding steady and is likely to continue to record new records, said independent analyst Ross Norman.

According to CME Group's FedWatch tool, traders are now predicting a 90% chance of another 25 basis point rate cut at the October meeting.

ANZ Bank also forecasts gold will outperform in the early stages of the easing cycle, with demand for safe-haven assets driven by a challenging geopolitical context.

Despite high anchor prices, Societe Generale Investment Bank (SocGen) still increased the proportion of gold in its investment portfolio. SocGen analysts announced an adjustment to the quarterly multi-asset strategy portfolio. After about a year of holding the gold ratio at 7%, the bank has increased the gold ratio to 10% of the total portfolio.

This move comes with the withdrawal of all 3% of capital from the oil market - a position established before the third quarter of 2025.

The Fed loosens interest rates amid high inflation and difficulties in cutting rates. We strengthen protection by: i) increasing the share of gold to the maximum (+3 percentage points to 10%), making gold the only commodity in the portfolio; II) holding US bonds with inflation at a maximum of 5% the report stated.

SocGen said it has maintained a gold glut since the end of 2022. The bank forecasts gold prices to average around $3,825/ounce in the fourth quarter of 2025 and around $4,128/ounce in 2026.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...