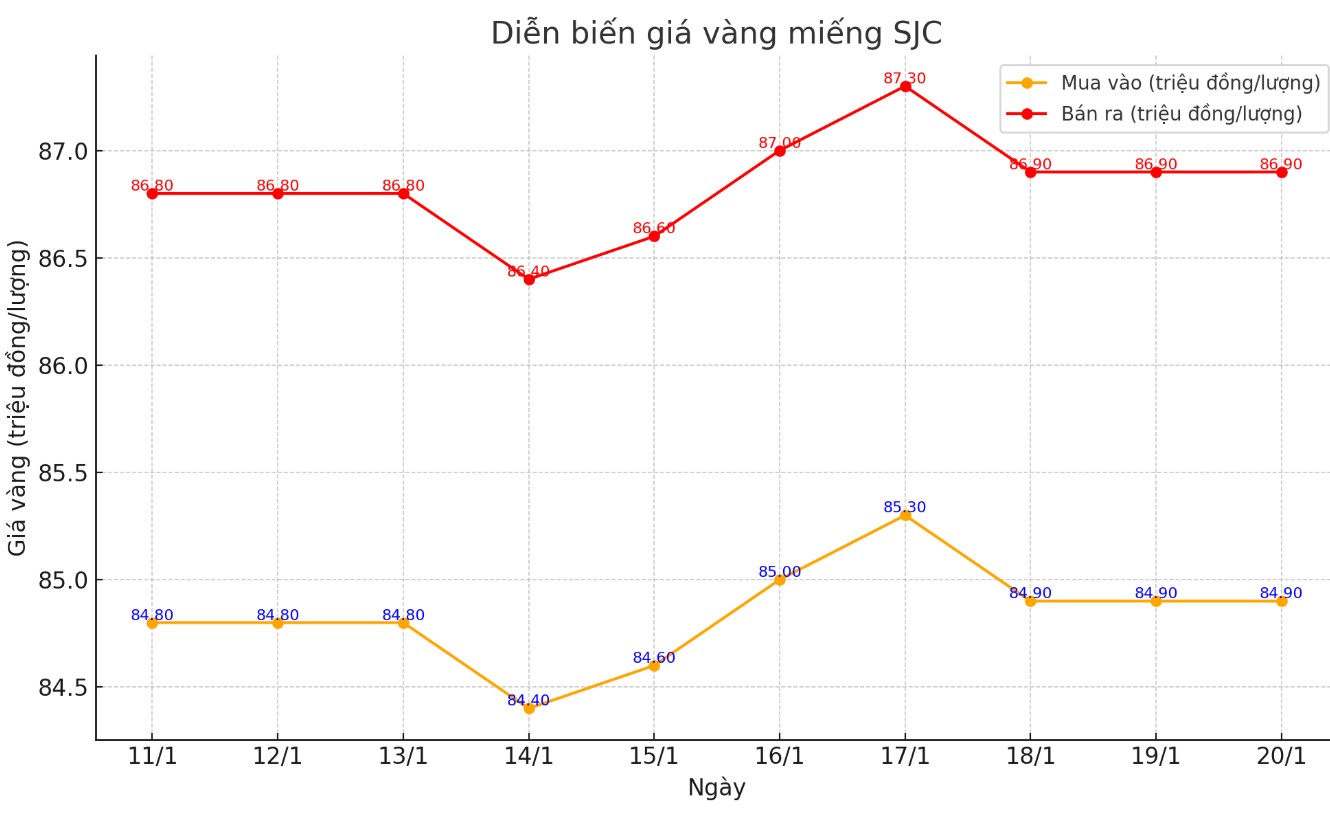

Update SJC gold price

As of 7:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND84.9-86.9 million/tael (buy - sell); both buying and selling prices remained unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 84.9-86.9 million VND/tael (buy - sell); keeping both buying and selling prices unchanged.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.9-86.9 million VND/tael (buy - sell); keeping both buying and selling prices unchanged.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

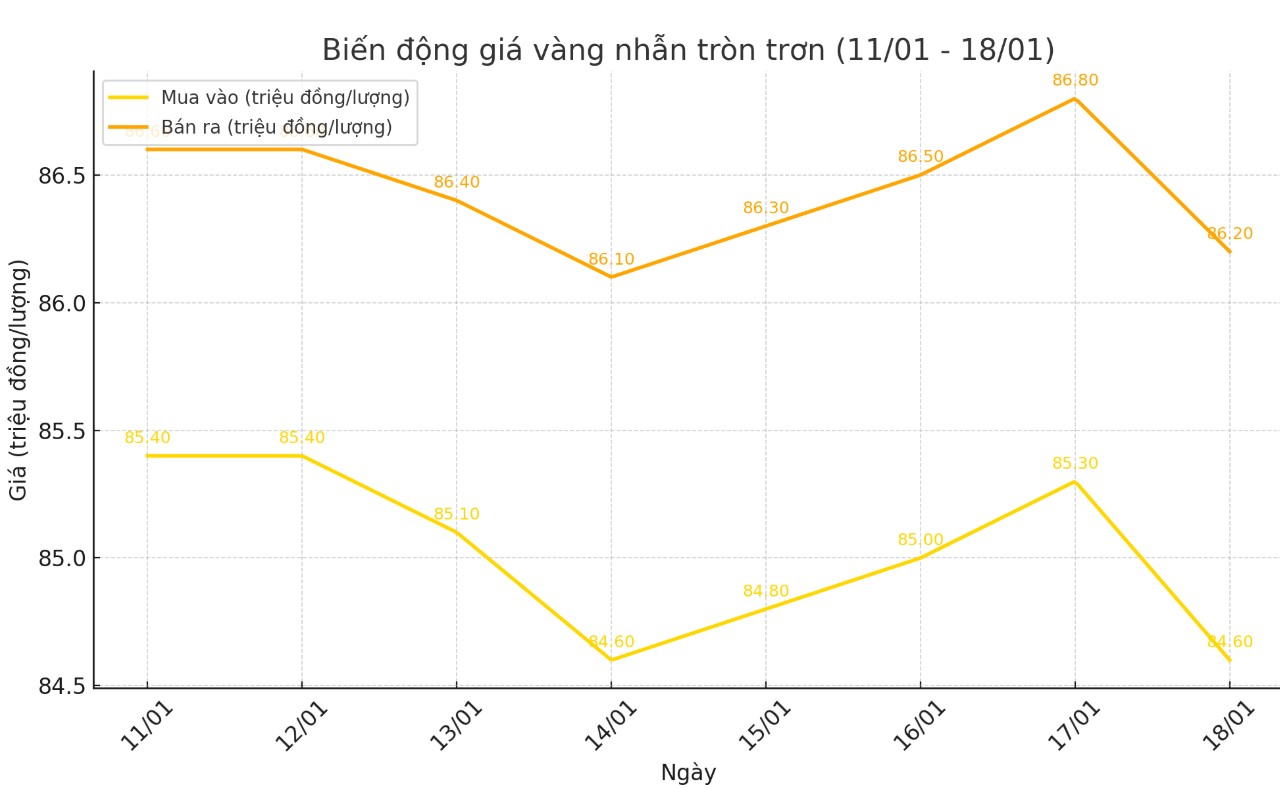

Price of round gold ring 9999

As of 7:00 p.m. today, the listed price of round gold rings is at 84-86 million VND/tael (buy - sell); down 200,000 VND/tael for both buying and selling compared to the closing price of yesterday's trading session.

Bao Tin Minh Chau listed the price of gold rings at 84.6-86.85 million VND/tael (buy - sell), down 300,000 VND/tael for buying and unchanged for selling compared to the close of yesterday's trading session.

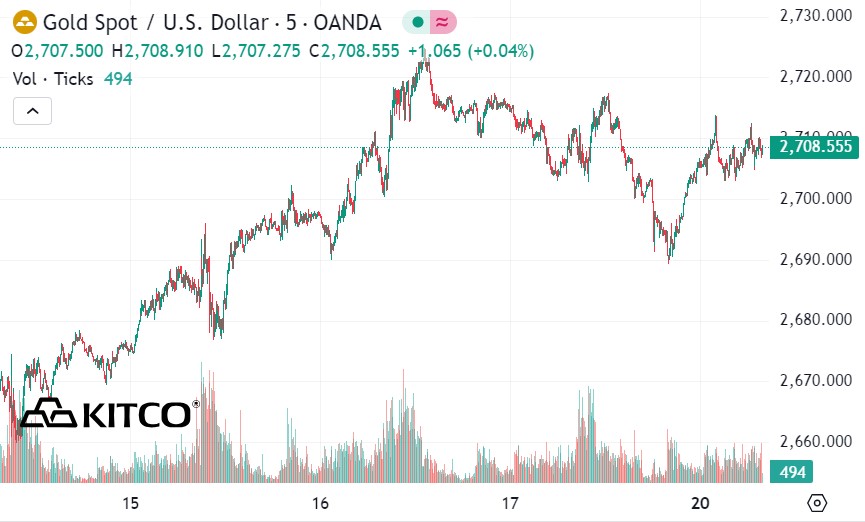

World gold price

As of 7:35 p.m., the world gold price listed on Kitco was at 2,708.5 USD/ounce, up 5.4 USD/ounce compared to the same time of the previous session.

Gold Price Forecast

World gold prices increased slightly in the context of the USD index decreasing. Recorded at 7:35 p.m. on January 20, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 108.940 points (down 0.24%).

Gold prices are facing a positive outlook as economic and geopolitical factors continue to support the precious metal's upward momentum. In an interview with Kitco News, Dr. Nomi Prins - geo-economic expert, author of the book "Permanent Distortion: How Financial Markets Abandoned the Real Economy Forever" - gave an optimistic assessment of the trend of gold.

Prins believes that gold prices are likely to rise sharply in 2025, with an expected peak of up to $4,000 an ounce. According to her, demand for gold from central banks around the world is one of the main factors driving the increase.

“Gold is a physical asset and is outside the control of any financial or monetary system established by humans. You cannot print or create it,” she stressed.

As the global economy faces many uncertainties, central banks have increased their gold purchases to protect assets against risks such as inflation and rising public debt.

In addition to its role as a hedge against inflation, gold is also seen as a safe haven during economic and geopolitical turmoil.

Economic Data to Watch This Week

Monday: US Presidential Inauguration, World Economic Forum Annual Meeting.

Thursday: US weekly jobless claims report.

Friday: S&P Flash PMI, US Existing Home Sales.

See more news related to gold prices HERE...