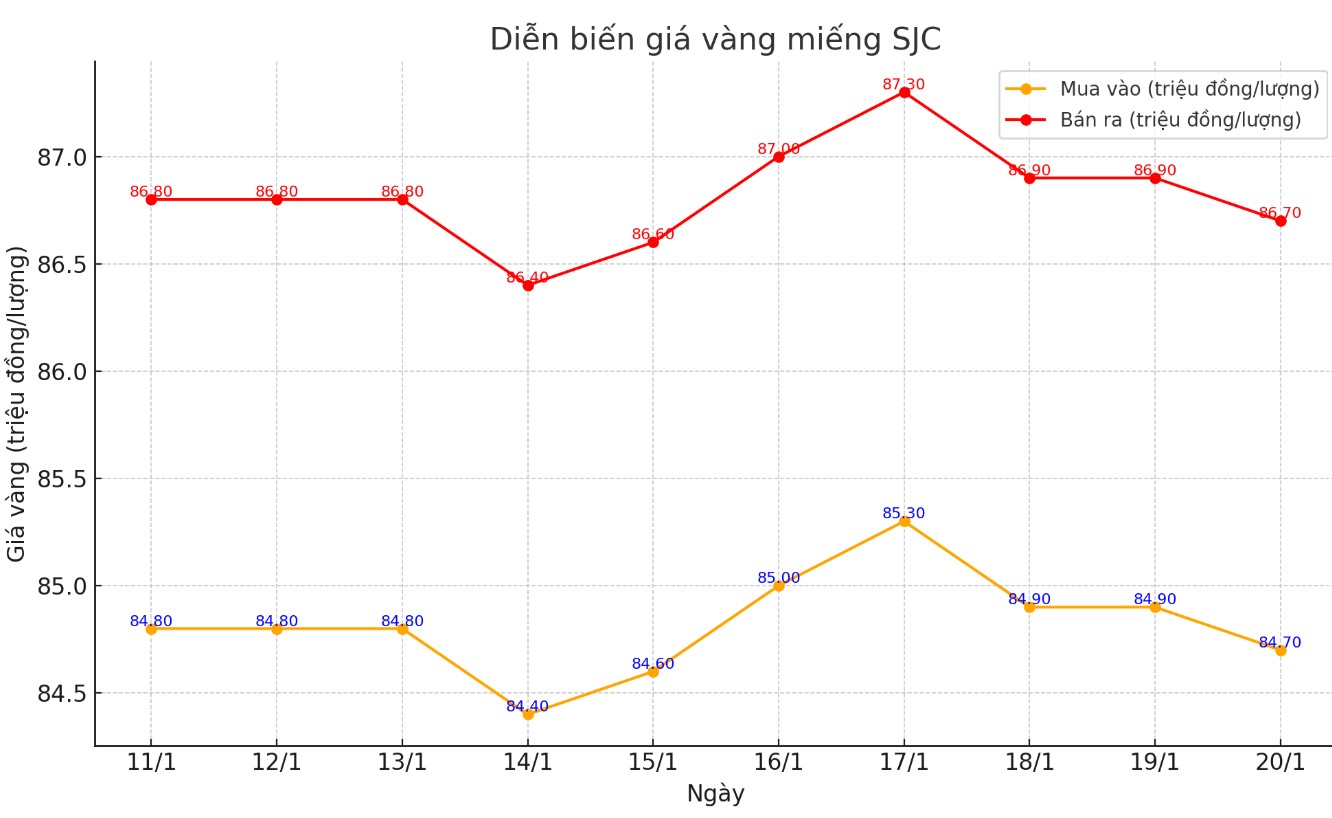

Update SJC gold price

As of 11:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND84.9-86.9 million/tael (buy - sell); both buying and selling prices remained unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 84.7-86.7 million VND/tael (buy - sell); down 200,000 VND/tael for both buying and selling.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.7-86.7 million VND/tael (buy - sell); down 200,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

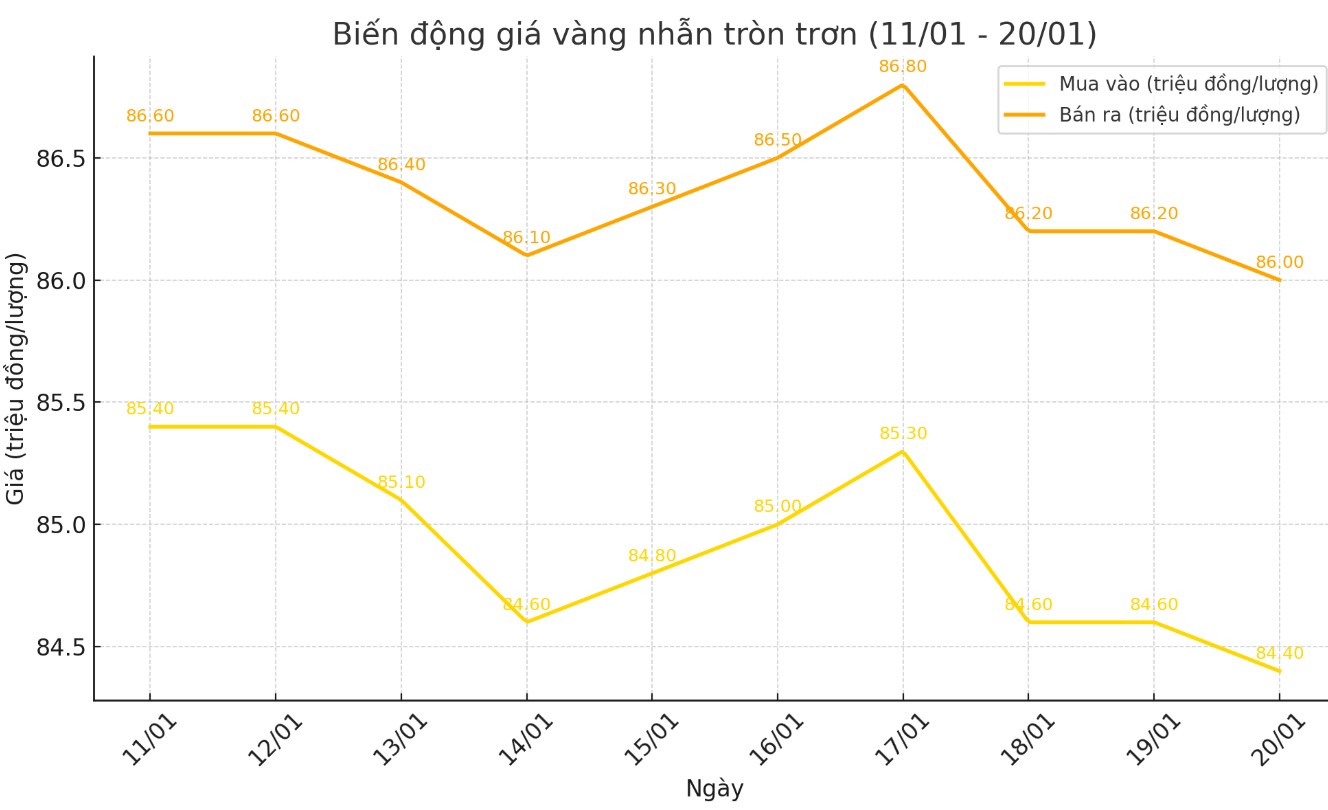

Price of round gold ring 9999

As of 11:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.4-86 million VND/tael (buy - sell); down 200,000 VND/tael for both buying and selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 84.4-86.85 million VND/tael (buy - sell), down 650,000 VND/tael for buying and unchanged for selling compared to early this morning.

World gold price

As of 8:30 a.m., the world gold price listed on Kitco was at 2,693 USD/ounce, down 10.1 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fluctuated sharply as the USD increased. Recorded at 9:00 a.m. on January 20, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 109.140 points (down 0.05%).

Commenting on the short-term price of gold on Kitco, many experts gave quite positive forecasts. James Stanley - senior market strategist at Forex.com - said: "I still lean bullish, although there is a possibility of a correction. Gold prices have just broken out of the triangle pattern that has formed over the past few months.

Spot gold is testing resistance at $2,721/oz. This level has resulted in two strong reactions and this week it was the third. However, I think a slight correction to a higher low could be attractive for a continuation of the trend at this point."

Jesse Colombo, an independent precious metals analyst and creator of the BubbleBubble report, said gold’s gains against other currencies are a sign of what investors should expect, and he sees the precious metal potentially hitting a record high above $2,800 an ounce in the short term.

Colombo noted that gold's major resistance level remains at $3,000 an ounce, with many experts predicting the precious metal could reach that target in the second half of this year.

“Gold has been resting for the past two months, but now the market is accumulating a lot of potential energy,” he said. “I am very excited about the potential of gold.”

Colombo said that gold’s rise ahead of Trump’s inauguration was not unexpected. He pointed out that if the new US president starts a trade war with tariffs, the global economy will be in trouble. This could lead to higher prices for global consumers and weaker economic activity, creating a stagflationary environment, which is positive for gold.

On the other hand, Carsten Fritsch - Precious Metals Analyst at Commerzbank - commented that gold could face difficulties this week if the USD recovers from current support levels.

“It is worth noting that the previous rally in the US dollar and the sharp rise in yields did not put pressure on gold prices. Therefore, we can say that this was an asymmetric market reaction. But such episodes are usually short-lived. We are skeptical about gold’s ability to maintain its current highs. This would require further increases in rate cut expectations, a weaker US dollar and further declines in bond yields,” he said.

Economic Data to Watch This Week

Monday: US Presidential Inauguration, World Economic Forum Annual Meeting

Thursday: US weekly jobless claims report

Friday: S&P Flash PMI, US Existing Home Sales

See more news related to gold prices HERE...