Helen Amos - Managing Director and commodity analyst at BMO Equity Research - believes that gold price prospects are being strengthened as a series of recent geopolitical instability has caused the market to shift from a fundamental scenario to an upward scenario.

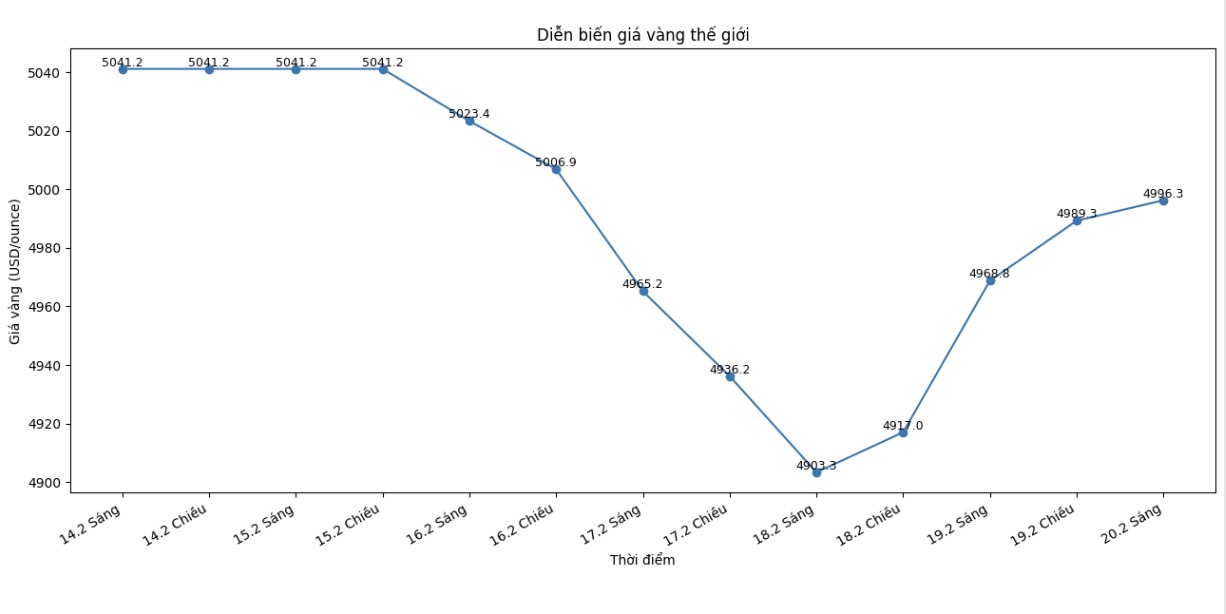

In an exchange with BNN Bloomberg, she said that although gold prices have undergone many fluctuations, this precious metal has continuously found a solid support zone after each correction, reflecting that investment demand is still maintained positively.

According to Amos, BMO (one of the largest and oldest banks in Canada) continues to recommend investors maintain their presence in the metal and mining groups, in which gold and copper are considered two prominent options.

She emphasized that the market is witnessing the resonance of many supporting factors, from growth momentum in emerging economies, the trend of deglobalization, to the downward trend of dependence on the USD. In addition, cash flow from individual and institutional investors still plays an important role in maintaining the upward momentum of gold prices.

BMO builds forecasts based on a reversal model, combining variables such as the central bank's gold buying demand, ETF capital flows, USD index and US 10-year TIPS yields.

When assuming that investment demand and central bank buying activity remain at levels equivalent to or higher than the early stages of US President Donald Trump's second term, the model shows that gold prices are likely to approach the $6,500/oz mark by the end of 2026, even heading towards higher levels in 2027.

However, Amos noted that the basic scenario that BMO put forward from December once leaned towards the possibility of gold prices adjusting down in the first few months of the year.

However, the actual developments in January with many geopolitical "hot spots", including tensions related to Venezuela, Greenland and concerns about the independence of the US Federal Reserve, have made market risks lean more towards price increases.

For silver, BMO is more cautious. Amos assesses that silver is still heavily industrial metal, while the material supply and demand balance is showing signs of easing.

She said that the previous hot increase period was partly affected by speculation and options trading, but this strong fluctuation did not help strengthen the "safe haven" role of silver like gold. In that context, BMO recommends that investors carefully consider risks when approaching the silver market in the short term.

See more news related to gold prices HERE...