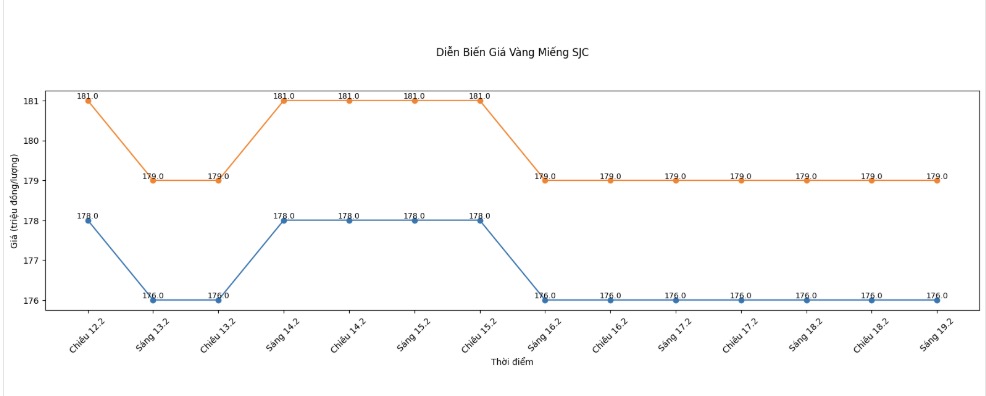

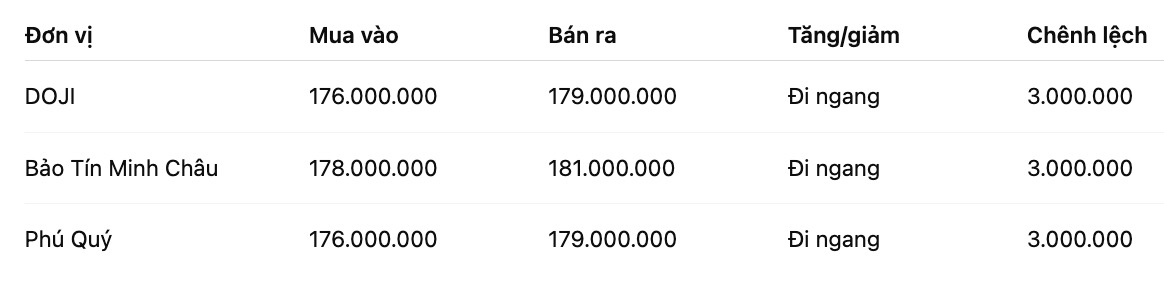

SJC gold bar price

As of 9:00 AM, SJC gold bar prices were listed by DOJI Group at 176-179 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at 178-181 million VND/tael (buying - selling), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 176-179 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

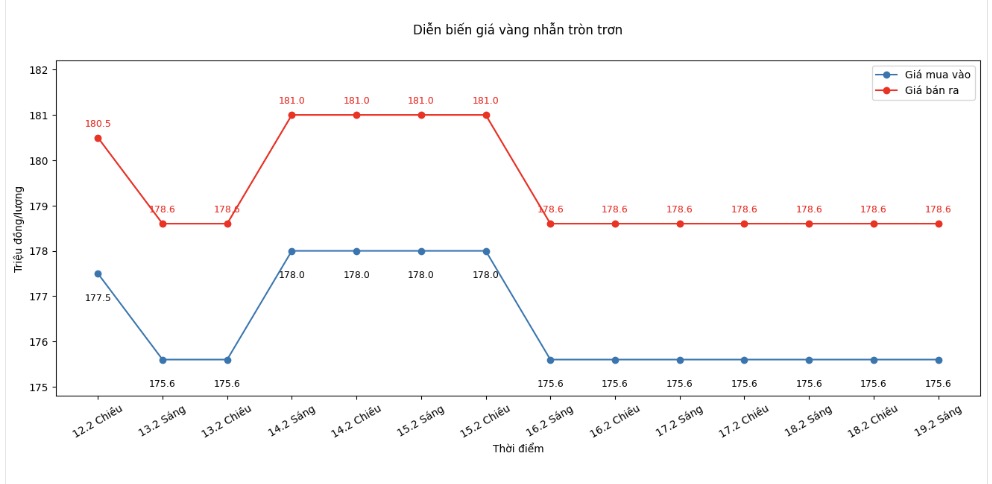

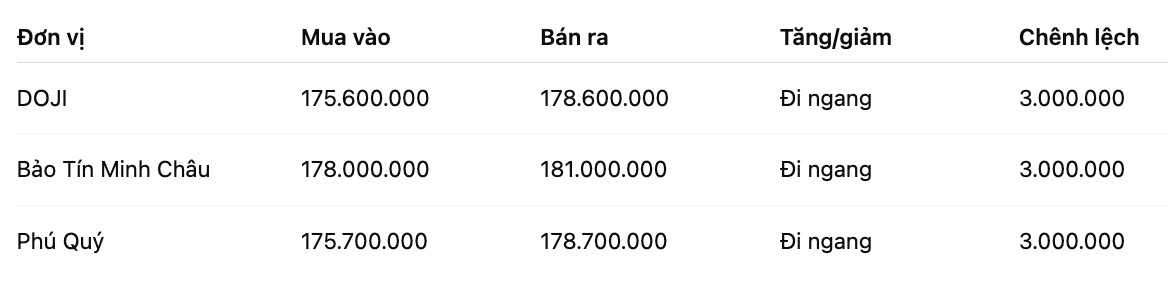

9999 gold ring price

As of 9:00 AM, DOJI Group listed the price of gold rings at 175.6-178.6 million VND/tael (buying - selling), unchanged in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 178-181 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 175.7-178.7 million VND/tael (buying - selling), unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 3 million VND/tael, posing a risk of losses for investors.

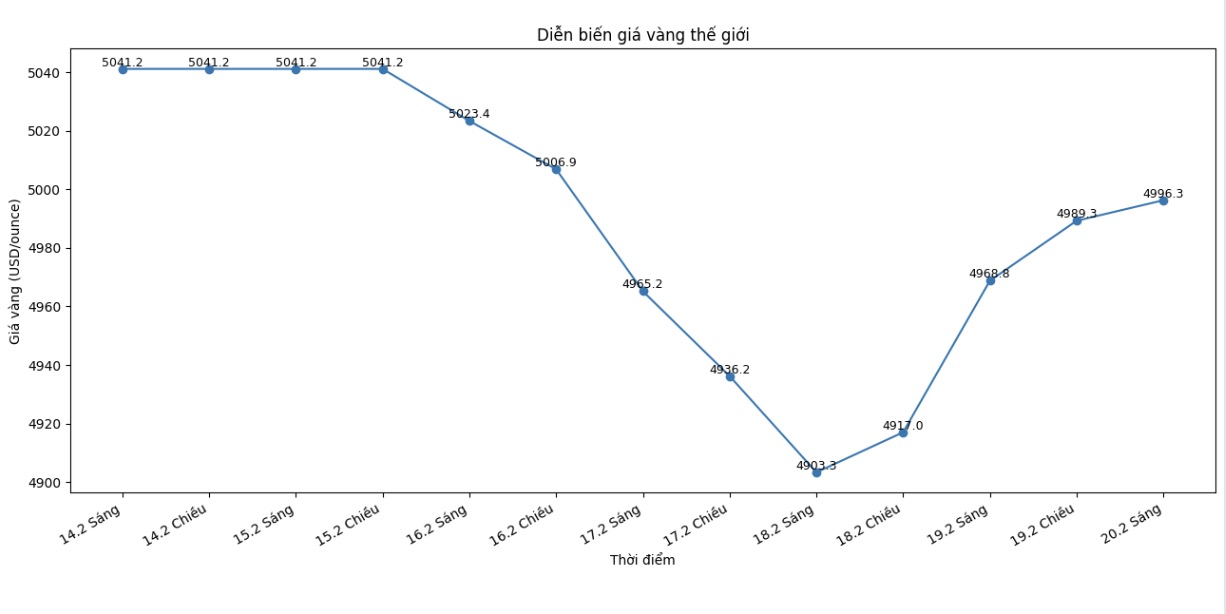

World gold price

At 8:53 AM, world gold prices were listed around the threshold of 4,996.3 USD/ounce, up 27.5 USD compared to the previous day.

Gold price forecast

Gold and silver prices are attracting attention as investor sentiment is strongly influenced by geopolitical developments. The focus now is US-Iran tensions, a factor creating unpredictable fluctuations in the precious metals market.

Meanwhile, in terms of monetary policy, the minutes of the January meeting of the Federal Open Market Committee (FOMC) showed a tougher stance than expected. Some members expressed concern about inflationary pressure and left open the possibility of further interest rate hikes if inflation has not cooled down to the target. The Fed's "hawkish" view often puts pressure on gold, as a high interest rate environment reduces the attractiveness of non-performing assets.

Technically, analysts believe that buyers on the April gold futures market are still trying to move towards the resistance zone of 5,250 USD/ounce. However, selling pressure may increase if the price slides below the support level of 4,670 USD/ounce.

Close resistance levels are currently around 5,074.4 USD/ounce and 5,100 USD/ounce, while the support zone is defined at 4,900 USD/ounce and 4,854.2 USD/ounce. The Wyckoff index at 6.5 shows that the short-term advantage still leans towards buyers, although the risk of correction cannot be ruled out.

External markets also sent noteworthy signals. The USD index maintained an upward trend, the yield of 10-year US Treasury bonds fluctuated nearly 4.1%, while crude oil prices rose sharply to around 66.50 USD/barrel - the highest level in many months. The combination of a strong USD, high yields and rising energy prices continues to create a volatile trading environment for precious metals.

From a longer perspective, some organizations still maintain a positive view. AuAg Funds' 2026 outlook report believes that the upward cycle of gold and silver prices is not over, with expectations that gold may exceed 6,000 USD/ounce this year. According to the analysis group, in the upward market, 20-30% corrections are common and "rebalancing" in nature.

However, Mr. Ross Norman - CEO of Metals Daily = noted that the precious metals market is still heavily influenced by speculative capital flows. He said that the "slow up, fast down" pattern continues to repeat, putting short-term investors at high risk. "Buyers have a basis for expectations thanks to the recovery rate, but sellers have not lost their advantage as macroeconomic factors are still unfavorable," Mr. Norman said.

In the context of many intertwined variables, investors should be cautious, manage risks tightly and avoid the mentality of chasing short-term fluctuations.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...