SJC gold bar price

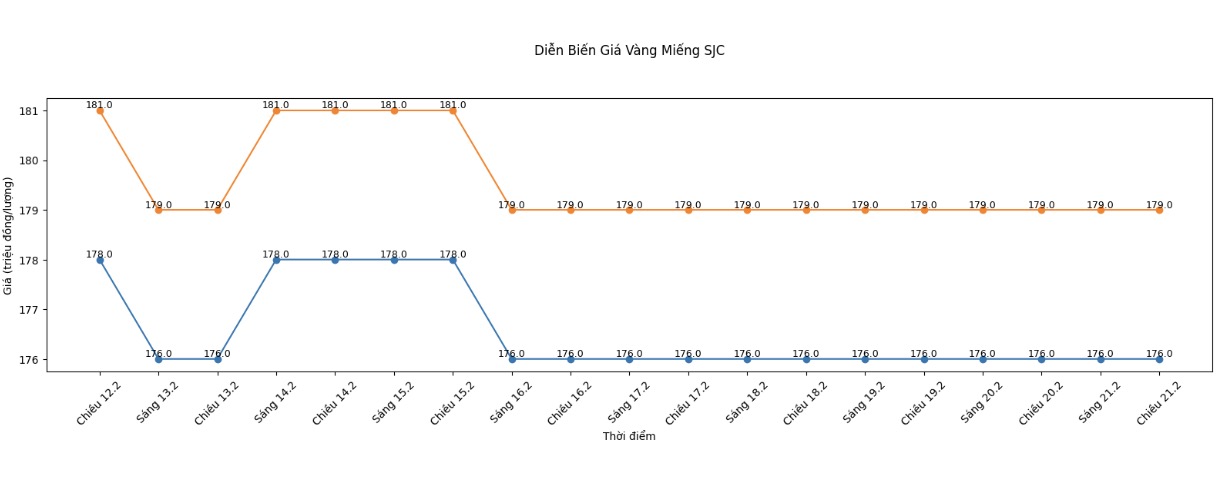

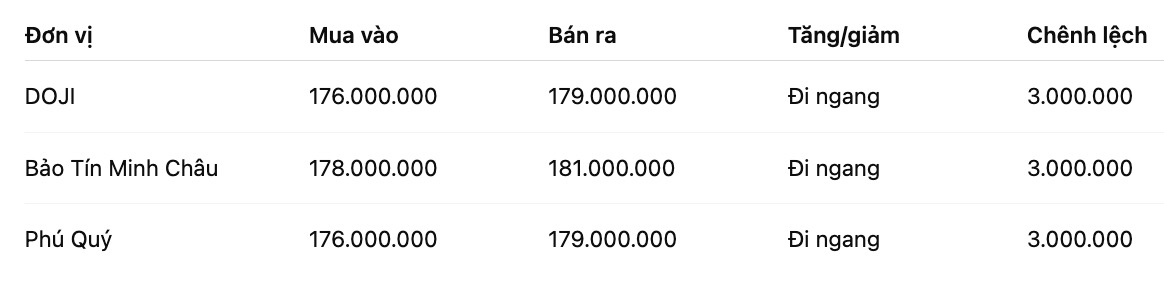

As of 5:00 PM, SJC gold bar prices were listed by DOJI Group at 176-179 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at 178-181 million VND/tael (buying - selling), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 176-179 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

9999 gold ring price

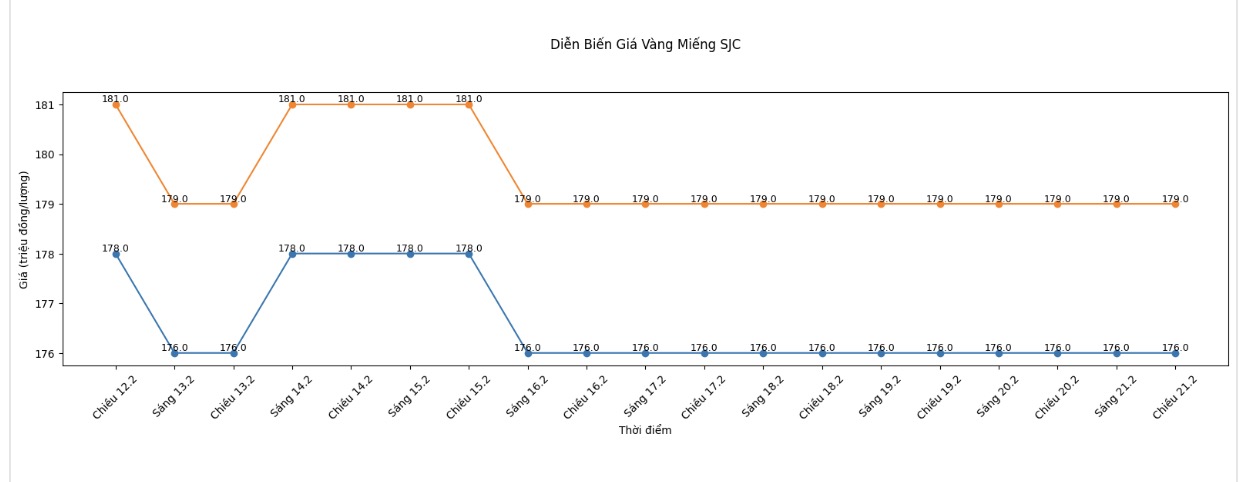

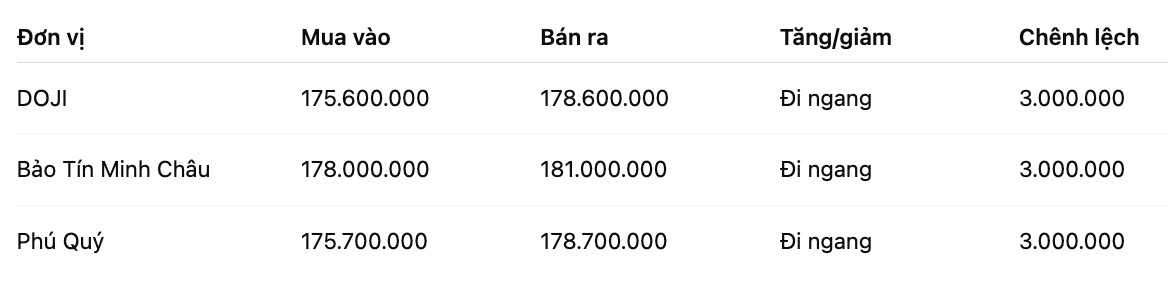

As of 5:00 PM, DOJI Group listed the price of gold rings at 175.6-178.6 million VND/tael (buying - selling), unchanged in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 178-181 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 175.7-178.7 million VND/tael (buying - selling), unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 3 million VND/tael, posing a risk of losses for investors.

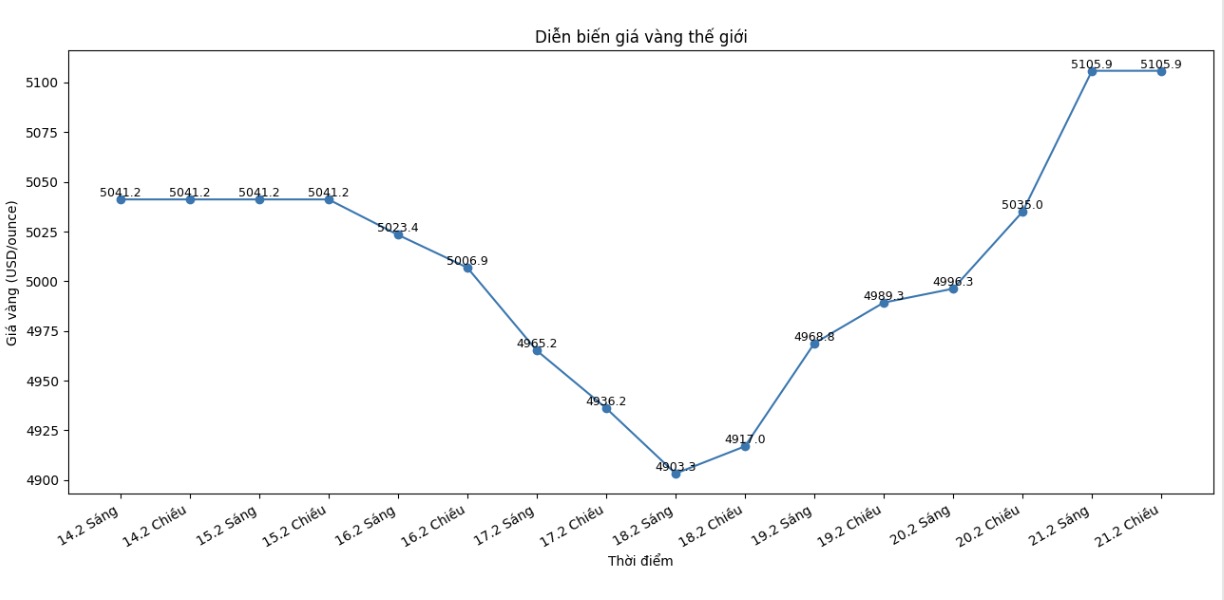

World gold price

At 5:00 PM, world gold prices were listed around the threshold of 5-105.9 USD/ounce; up 70.9 USD compared to the previous day.

Gold price forecast

After a stormy trading week, the gold market entered a new phase with a psychology of caution intertwined with expectations of price increases. Precious metals once weakened in the first sessions of the week due to a lack of buying power from Asia, especially when Chinese investors were on the Lunar New Year holiday. Selling pressure pushed spot gold prices down deeply, at times losing the 4,900 USD/ounce mark.

However, the situation quickly reversed when gold successfully tested the important support zone around 5,000 USD/ounce. The wave of increased geopolitical tensions at the end of the week triggered safe-haven demand, helping prices rebound strongly and approach 5,100 USD/ounce. This development shows that defensive cash flow is still ready to return when global risks escalate.

The latest weekly gold survey recorded a clear improvement in sentiment. Most Wall Street experts lean towards a scenario where prices continue to rise next week, while small investors maintain an optimistic trend for the third consecutive week. Many opinions suggest that if the 5,100 USD/ounce mark is decisively conquered, gold may expand its upward momentum in the short term.

Lukman Otunuga - senior analyst at FXTM said that investors are maintaining a high level of vigilance against tough statements from Washington regarding Iran. According to him, prolonged geopolitical instability may continue to play a supporting role for gold prices, especially when global financial markets experience risk avoidance sentiment.

From a more cautious perspective, Ole Hansen - Head of Commodity Strategy at Saxo Bank believes that gold's reaction in the past time has been relatively cautious. The fact that prices fluctuate around the 5,000 USD/ounce range reflects market skepticism about the possibility of escalating tensions into large-scale conflicts. According to him, gold needs more catalysts strong enough to form a sustainable upward trend.

Next week, the US economic data release schedule is quite sparse but still contains notable indicators such as Consumer confidence, number of unemployment claims and Production Price Index (PPI). In addition, the US President's State of the Union address is expected to create more fluctuations for the USD and bond yields - two factors that directly affect gold prices.

Analysts also noted that the reopening of the Chinese market after the holidays may bring new momentum in liquidity. In the context of geopolitical risks not cooling down, many forecasts suggest that gold still has the opportunity to maintain a positive trend, although the fluctuation range may continue to expand.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...