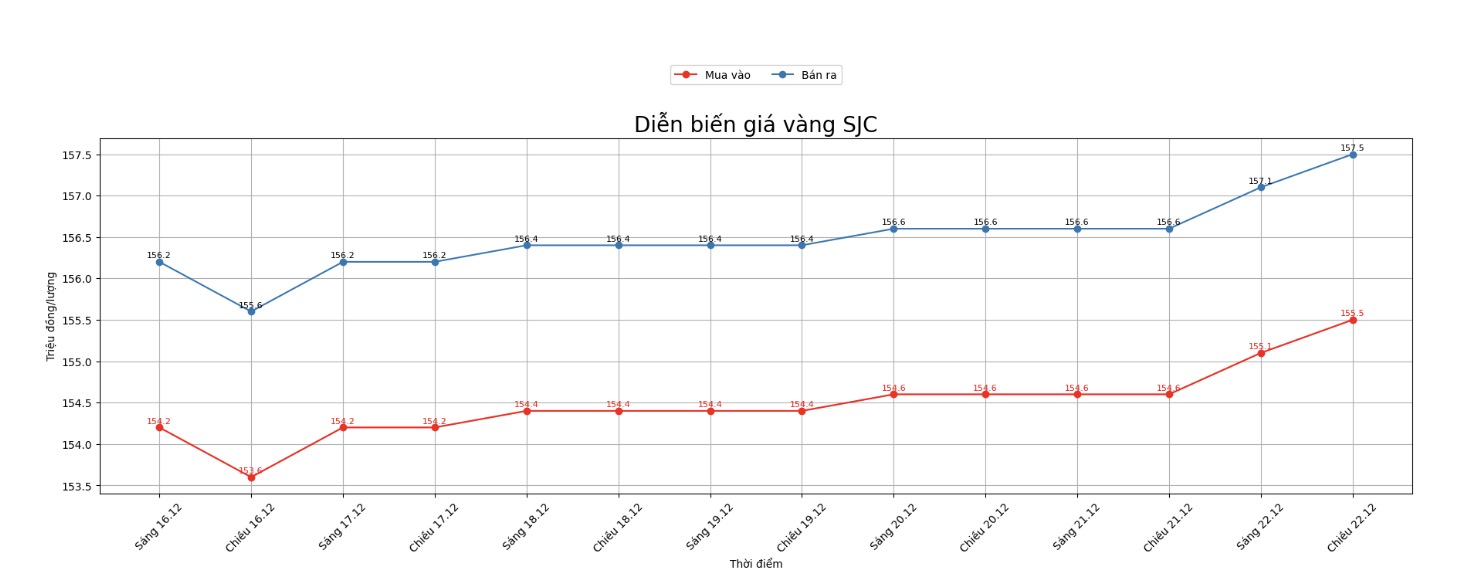

SJC gold bar price

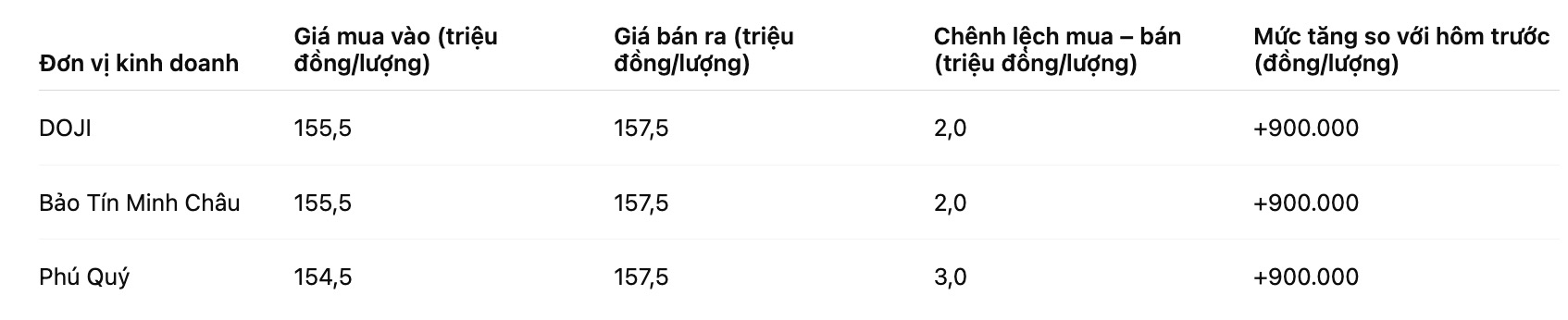

As of 5:05 p.m., DOJI Group listed the price of SJC gold bars at VND155.5-157.5 million/tael (buy in - sell out), an increase of VND900,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 155.5-157.5 million VND/tael (buy - sell), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 154.5-157.5 million VND/tael (buy - sell), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

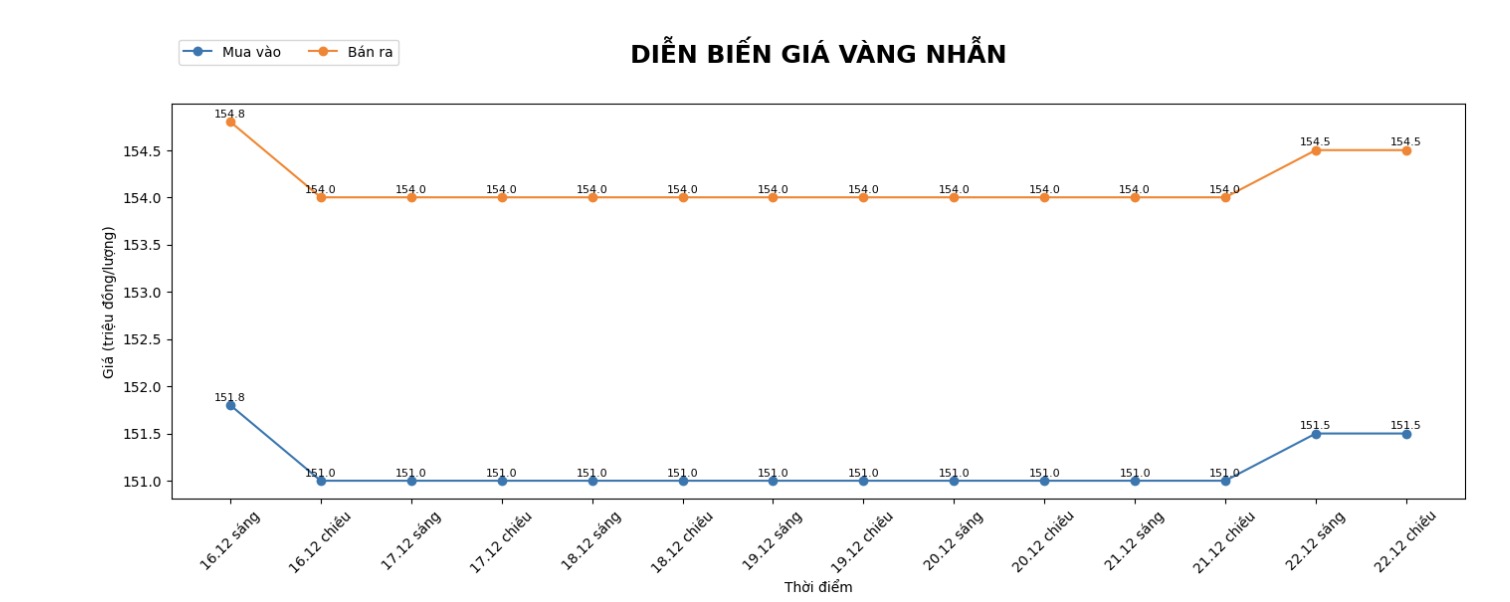

9999 gold ring price

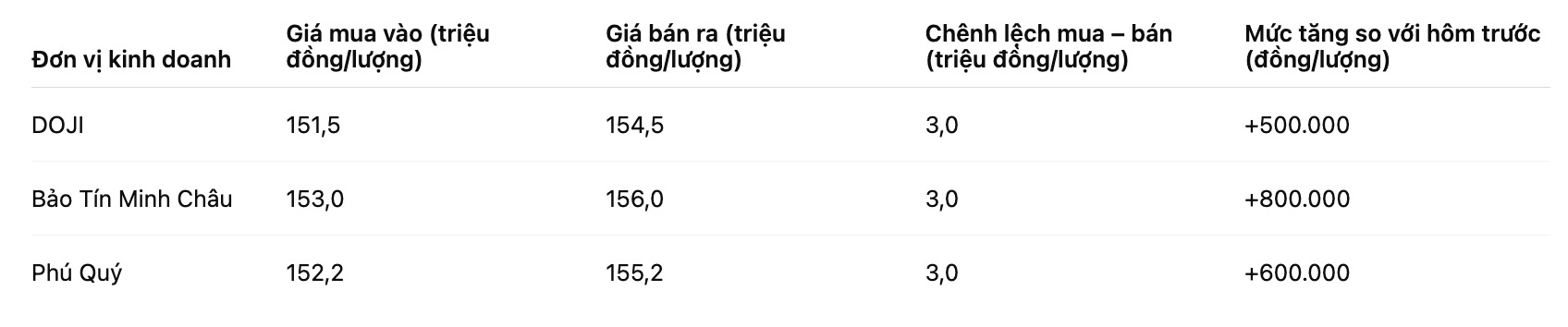

As of 5:05 p.m., DOJI Group listed the price of gold rings at 151.5-154.5 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 153-156 million VND/tael (buy - sell), an increase of 800,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 152.2-155.2 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

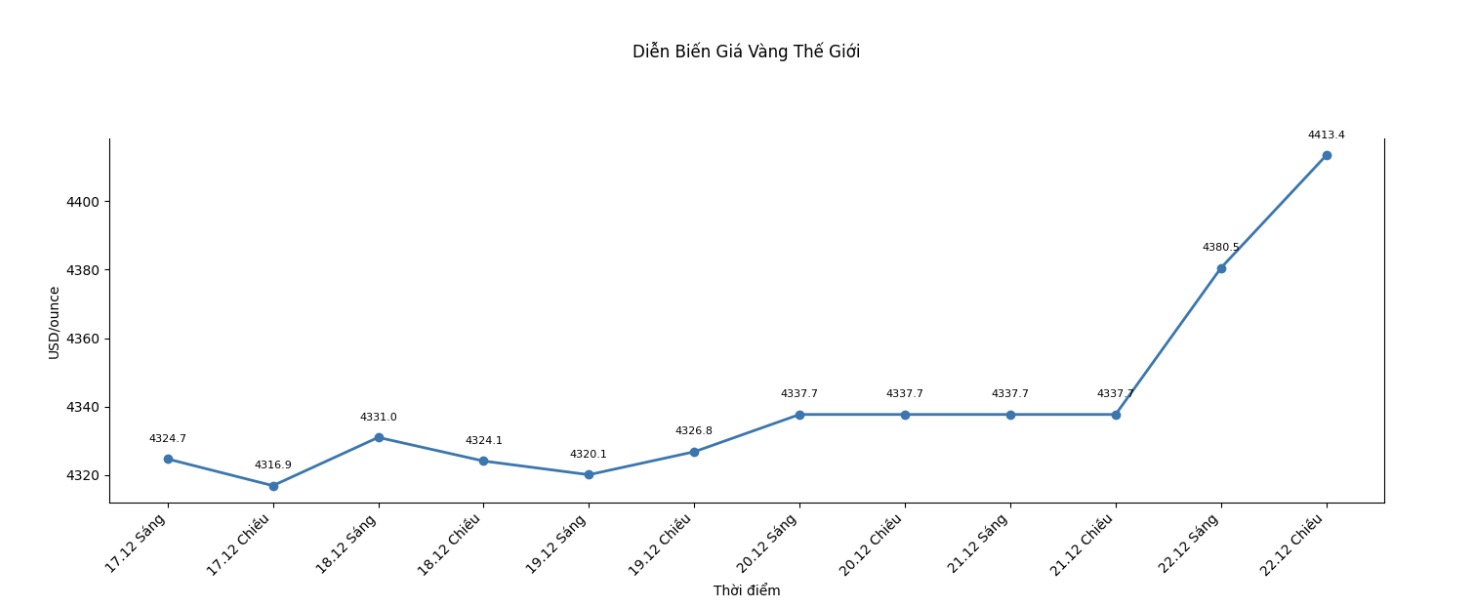

World gold price

The world gold price was listed at 5:05 p.m., at 4,413.4 USD/ounce, up 10.9 USD compared to a day ago.

Gold price forecast

According to The Times of India, spot gold prices have skyrocketed after new economic data showed that the US labor market continues to weaken, while cooling inflation has reinforced expectations that the US Federal Reserve (Fed) will continue to loosen monetary policy.

This rally has pushed gold prices above the old peak of $4,381.52 an ounce set in October. The Fed had previously made a 0.25 percentage point interest rate cut last week, raising expectations for further easing.

Investors are now betting on the possibility of the US having two interest rate cuts in 2026, thereby increasing the attractiveness of non-yielding assets such as gold.

Gold - which is considered a risk-off channel during the uncertain period - has increased by about 67% since the beginning of the year. The price increase is driven by prolonged geopolitical and trade tensions, strong buying from central banks, and expectations of lower interest rates next year. In addition, the weak USD index also supports gold prices by making the precious metal cheaper for overseas buyers.

The upward trend of global gold is also reflected in the domestic market. Last week, MCX gold futures increased by 574 rupees, equivalent to 0.43%, to a record high of 135,590 rupees/10 grams in the session on Thursday. This is the fourth consecutive week of increase and brings gold closer to the 12th consecutive month of increase.

Explaining gold's rally last week, Prathamesh Mallya, an expert at Angel One, said: "A weak US dollar, a dovish Fed stance and lower inflation data in the US have created momentum for gold prices in recent times."

While gold recorded a strong increase, silver prices also performed more positively. Last weekend, silver prices increased by 8.08%, reaching a record high of 208,603 rupees/kg. Since the beginning of the year, silver has increased by more than 130%, supported by strong capital flows into ETFs and concerns related to "carry trade" of the Yen in the context of the Bank of Japan possibly raising interest rates.

In the coming time, experts are still optimistic about both gold and silver, but warn of the possibility of short-term corrections. Mr. Pranav Mer said that silver prices may still have room to increase, but the risk - profit level is in a high state.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...