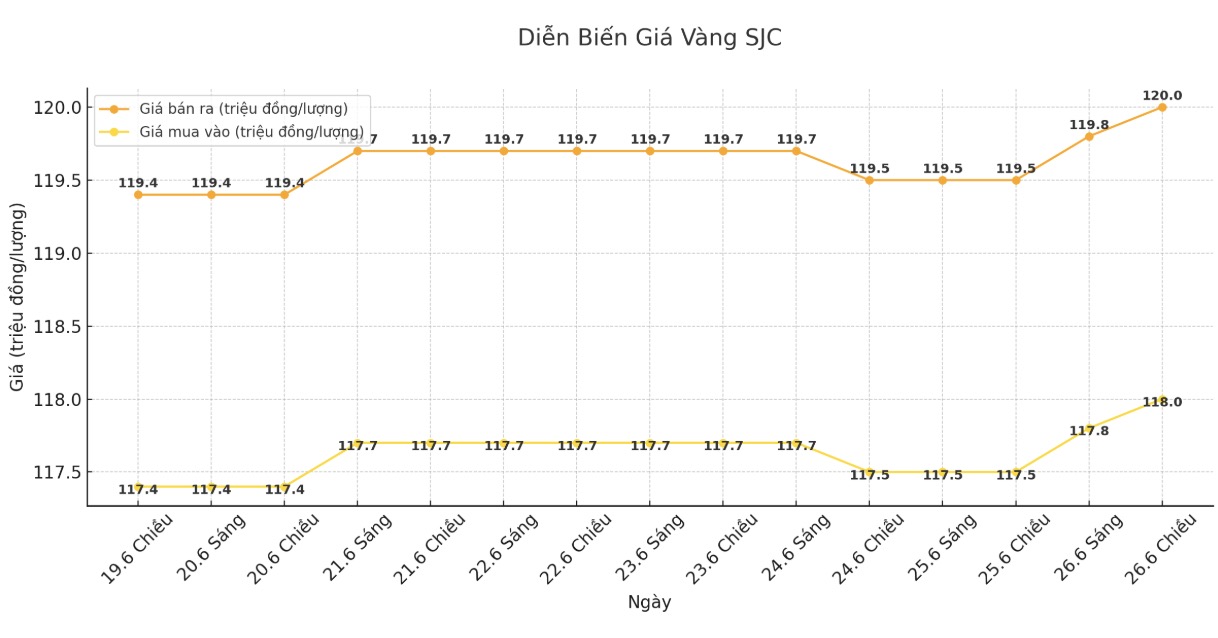

SJC gold bar price

As of 5:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND118-120 million/tael (buy in - sell out); increased by VND500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 118-120 million VND/tael (buy - sell); increased by 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118-120 million VND/tael (buy in - sell out); increased by 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117.2-120 million VND/tael (buy - sell); increased by 400,000 VND/tael for buying and increased by 500,000 VND/tael for selling. The difference between buying and selling prices is at 2.8 million VND/tael.

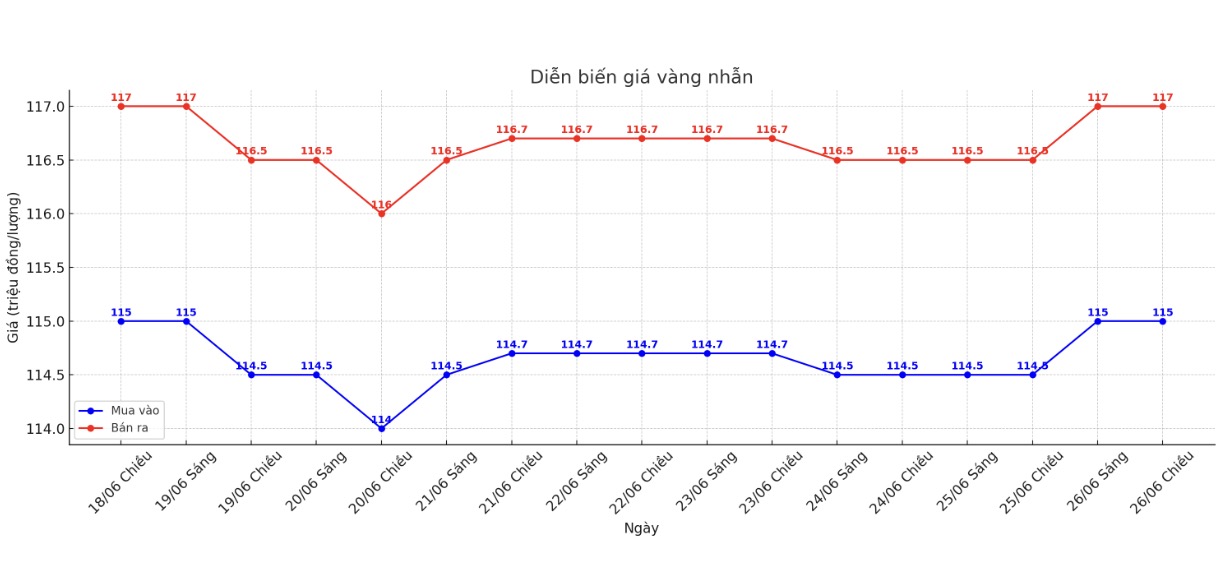

9999 gold ring price

As of 6:18 p.m., DOJI Group listed the price of gold rings at 115-117 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115-118 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.8-116.8 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

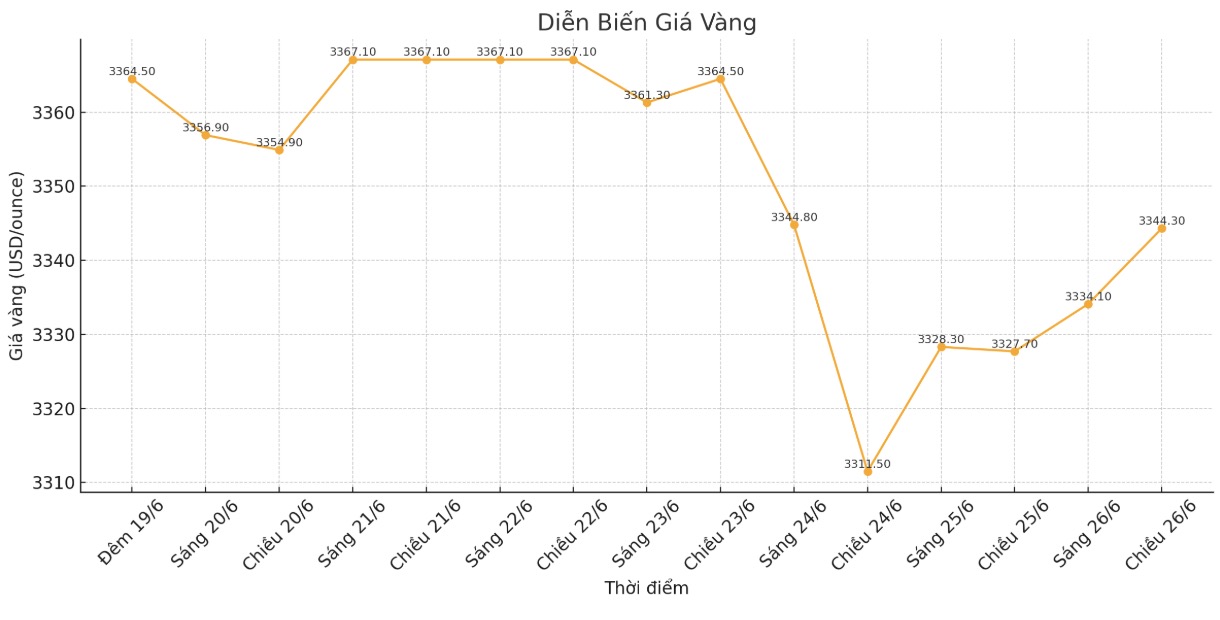

World gold price

The world gold price was listed at 5:10 p.m. at 3,338.5 USD/ounce, up 10.8 USD.

Gold price forecast

Gold prices are supported by a weakening USD and increased concerns after the news that US President Donald Trump is considering replacing US Federal Reserve Chairman Jerome Powell in September or October.

Investors are concerned about the Fed's independent future, boosting demand for gold - a safe-haven asset. The Dollar Index fell to its lowest level since March 2022, making gold more attractive to buyers holding other currencies.

Expert Tim Waterer - Director of Market Analysis at KCM Trade - commented: "Mr. Trump clearly wants a more dovish Fed Chairman. The increased possibility of the Fed cutting interest rates more aggressively has weakened the USD.

On June 26, Donald Trump publicly called Mr. Powell "bad guy" and revealed that he was considering 3 or 4 replacement candidates. Some newspapers have reported that Mr. Trump is even considering announcing Mr. Powell's successor in September or October.

The market is closely monitoring the US GDP report released on the day and personal consumption expenditure (PCE) data on June 28 to assess the possibility of the FED cutting interest rates.

In addition, a ceasefire between Israel and Iran remains in place, with Trump praising the quick end of the 12-day conflict at a NATO summit and saying he will seek a commitment from Iran to abandon the nuclear program in upcoming negotiations.

Although gold prices have recovered, in a recent interview, Mr. Daniel Pavilonis - senior market strategist at RJO Futures - commented that currently, all the momentum and potential in the market, which are often driven by gold, are not enough to bring this precious metal to new heights.

Therefore, he believes that the current path is more weak, gold prices could reach 2,900 USD/ounce if things do not escalate in the Middle East.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...