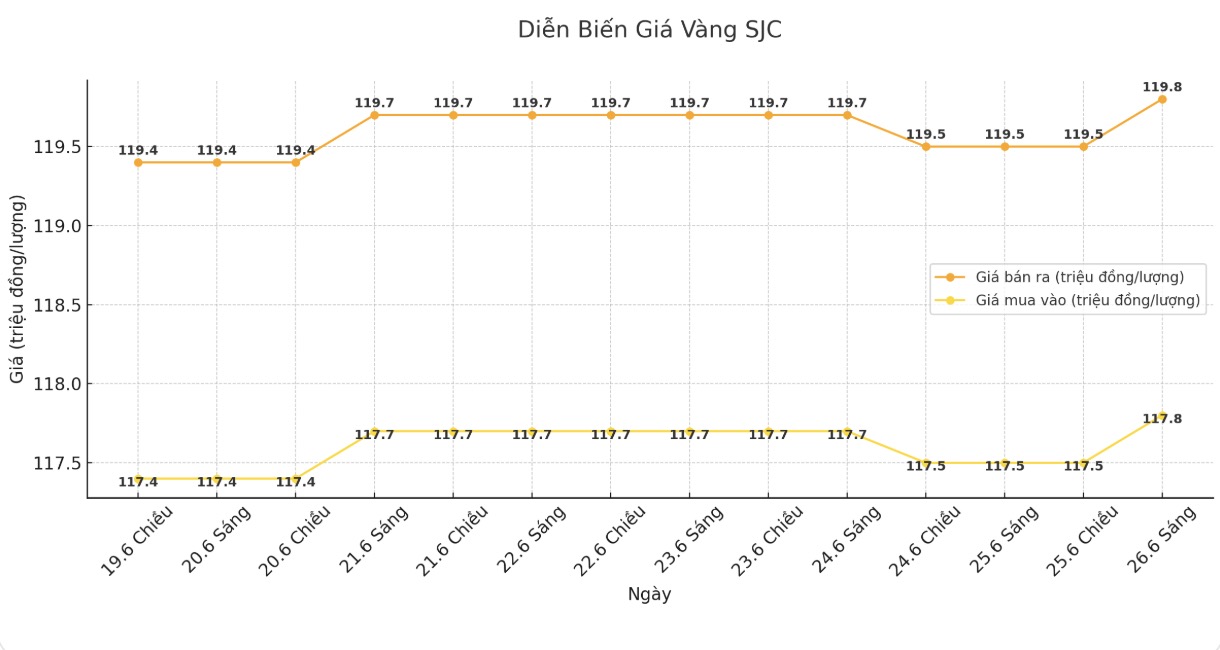

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.8 - 119.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed the price of SJC gold bars at 117.8 - 119.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.8 - 119.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 117 - 119.8 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and an increase of 300,000 VND/tael for selling. The difference between buying and selling prices is at 2.8 million VND/tael.

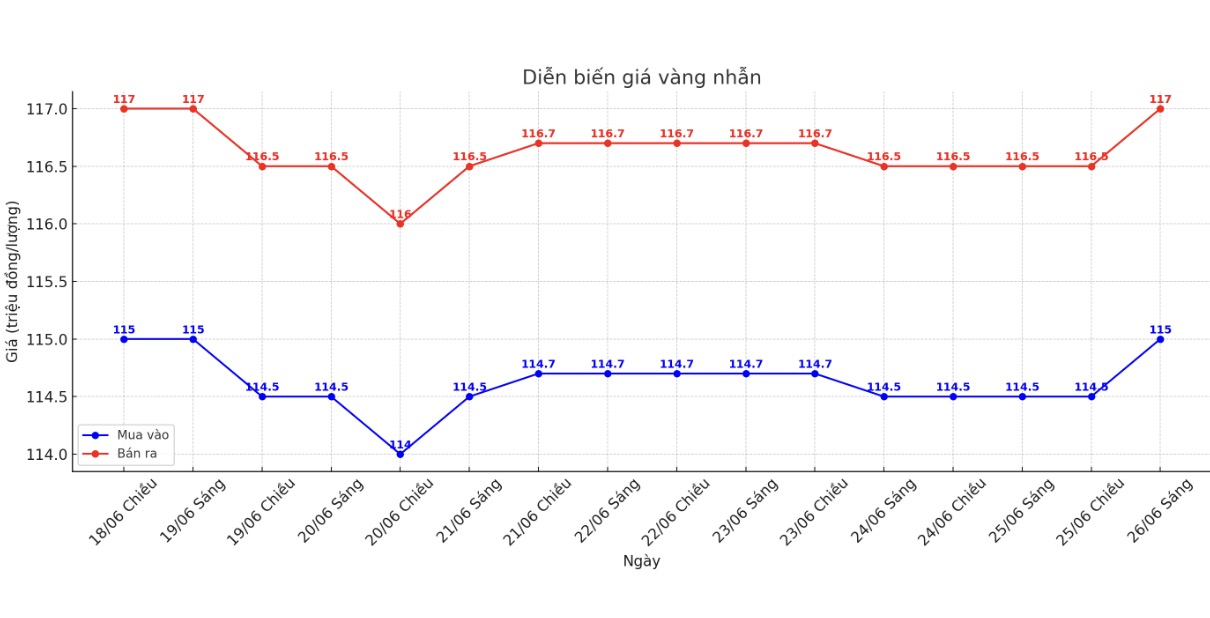

9999 round gold ring price

As of 9:00 a.m., DOJI Group listed the price of gold rings at 115 - 117 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115 - 118 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.7 - 116.7 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

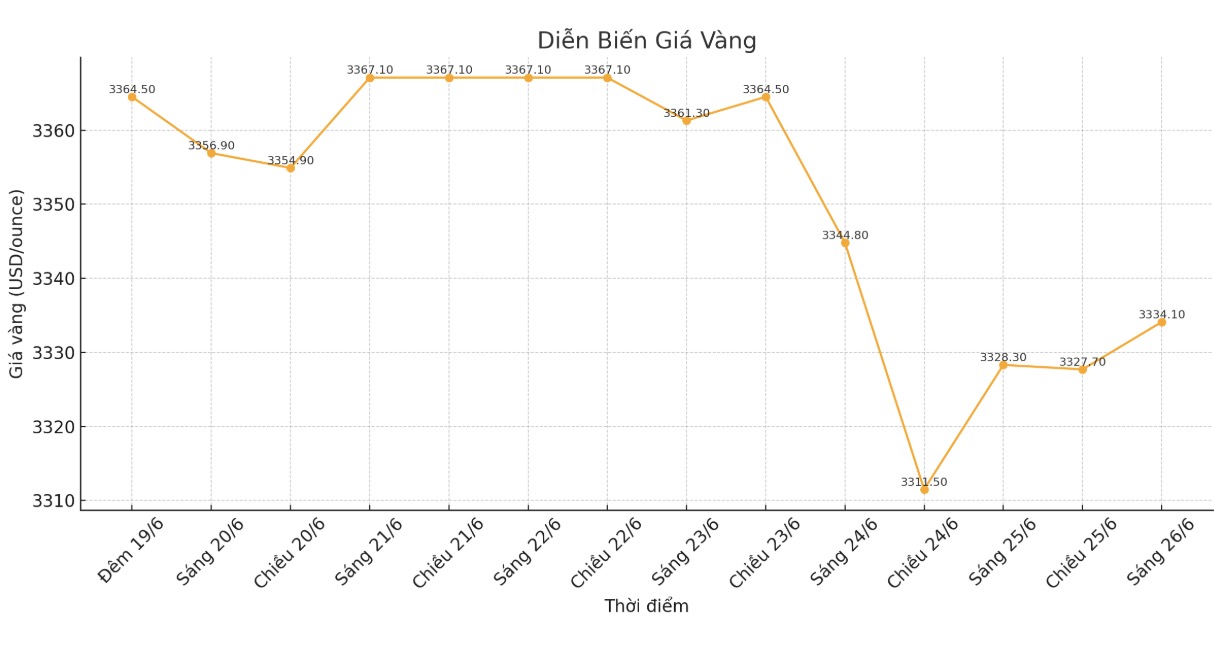

World gold price

At 9:35 a.m., the world gold price was listed around 3,334.1 USD/ounce, up 5.8 USD compared to 1 day ago.

Gold price forecast

The continued signing of the ceasefire between Israel and Iran has significantly reduced safe-haven demand, as both countries continue to commit to the deal, despite clashes near the effective date of the ceasefire.

However, gold prices have not only not decreased but also increased, surpassing the weakening of the USD, showing that buying pressure from institutional and individual investors is still very strong.

A sharp decline in US new home sales shows that the prolonged stagnation of the real estate market partly supports gold.

According to the report released on Wednesday by the US Bureau of Population and the Department of Housing and Urban Development, new home sales last month fell nearly 14%, down to a seasonal adjustment of 623,000 units/year, from a adjustment of 722,000 units in April.

Compared to May 2024, new home sales have decreased by 6.3%.

Typically, falling new home sales in the US are seen as a signal that the economy is slowing down, which could increase demand for shelter for safe-haven assets such as gold. In the context of increasing concerns about recession, investors are often looking to gold as a channel to preserve value.

Currently, investors are shifting to monitor interest rate policy from the US Federal Reserve (FED).

The focus now is Fed Chairman Jerome Powell's National Assembly hearing, especially his second hearing before the Senate Banking Committee after presenting it to the House Financial Services Committee. From these hearings, investors are shaping expectations for interest rate policy, with the probability of the Fed cutting interest rates at the July meeting currently at 24.8%, according to CME's FedWatch tool.

Mr. Powell's cautious view is creating a complex investment landscape. He stressed the need to fully assess the economic impact of tax policies before deciding to cut interest rates, which is in contradiction to the stronger easing desire from the Donald Trump administration. Several Republican Senators, such as Moreno of Ohio, have questioned the Fed about the political nature of their analytical approach.

Mr. Powell also noted that new tariffs could push up consumer prices and reduce economic activity. However, he also said that this inflationary pressure may be temporary, depending on the actual scope of tax policies.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...