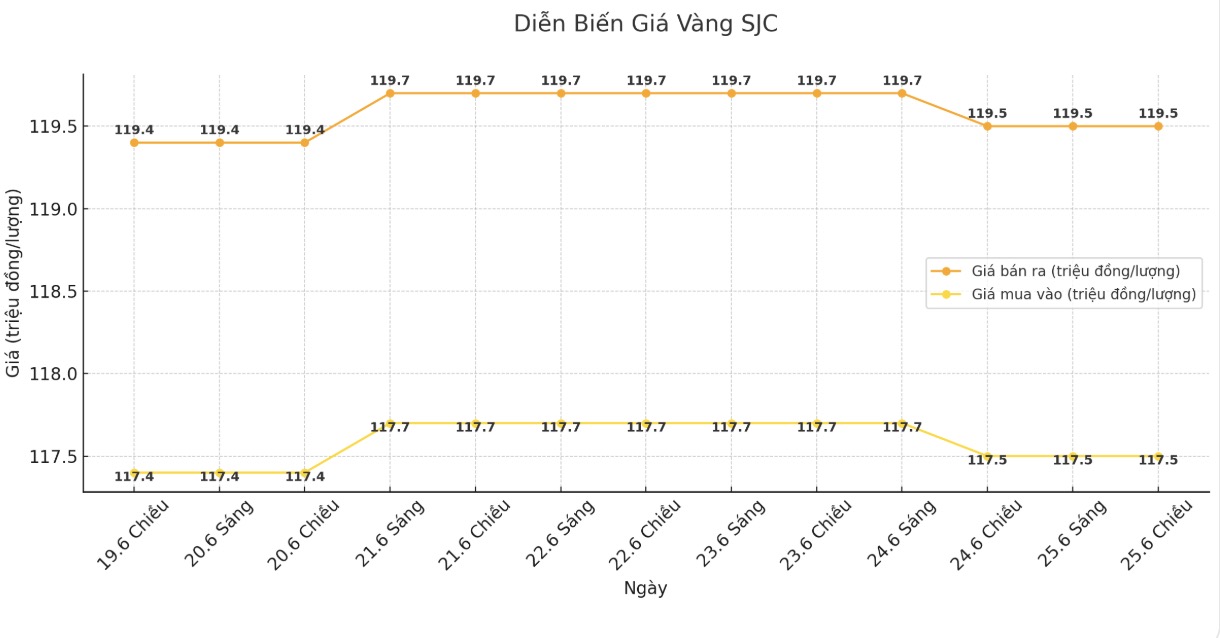

SJC gold bar price

As of 6:00 a.m. on June 26, the price of SJC gold bars was listed by Saigon Jewelry Company at VND117.5-112.5 million/tael (buy in - sell out); unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 117.5-111.5 million VND/tael (buy in - sell out); unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at the listed price of 117.5-111.5 million VND/tael (buy in - sell out); unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 116.8-111.5 million VND/tael (buy - sell); down 200,000 VND/tael for buying and kept the same for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

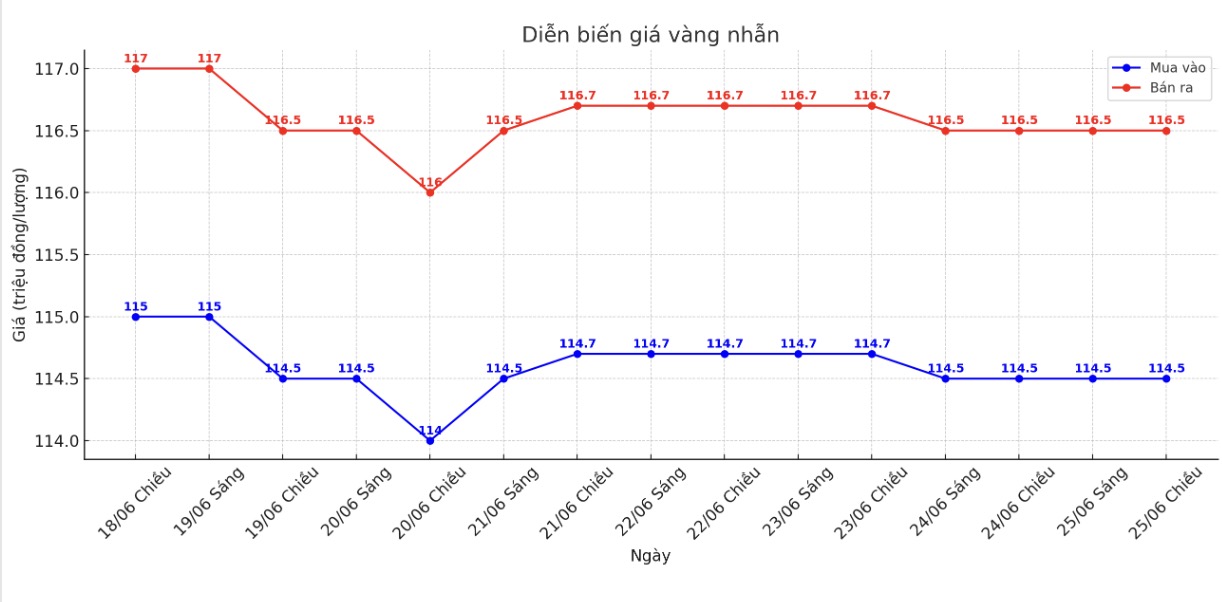

9999 gold ring price

As of 6:00 a.m. on June 26, DOJI Group listed the price of gold rings at VND 114.5-116.5 million/tael (buy in - sell out), an increase of VND 500,000/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.5-117.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.3-116.3 million VND/tael (buy in - sell out), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

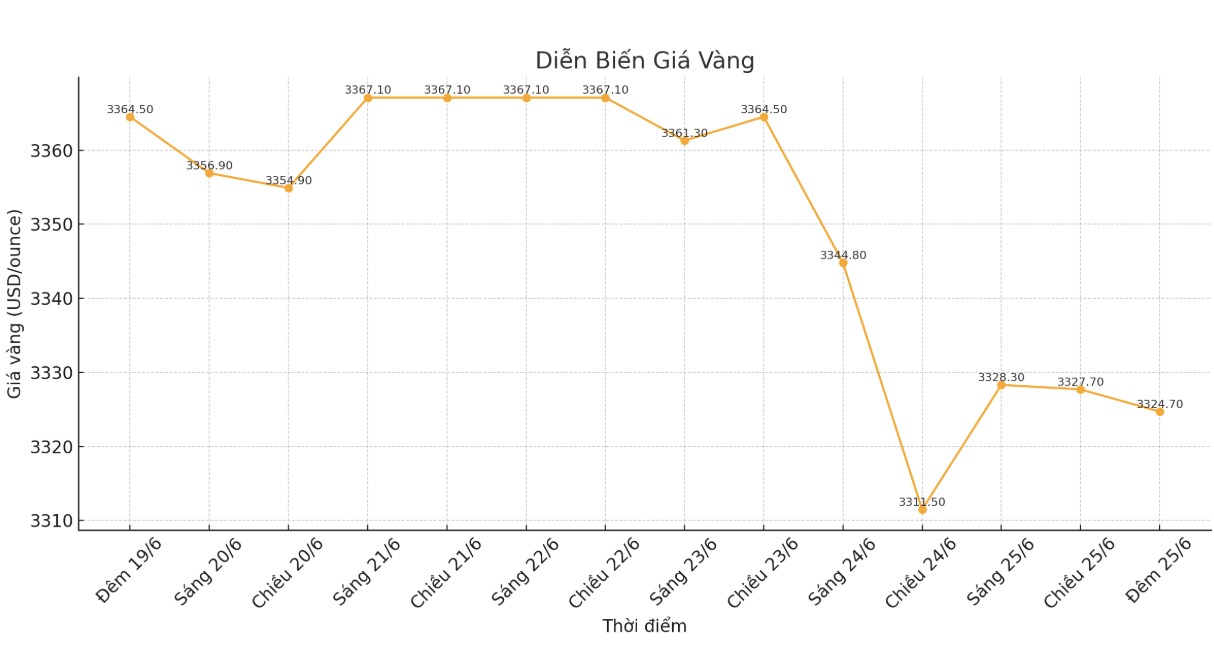

World gold price

The world gold price listed at 22:50 on June 25 was listed at 3,324.7 USD/ounce.

Gold price forecast

Gold prices are struggling as geopolitical tensions in the Middle East cool down, but concerns about the fragility of the ceasefire between Israel and Iran remain.

August gold contract increased by 7 USD to 3,340.9 USD/ounce, while July silver increased by 0.058 USD to 35.79 USD/ounce.

The risk of a midweek taste is average. Some recent reports say the US airstrike on Iran's nuclear facilities has only delayed the country's nuclear weapons program by 3 to 6 months. The Donald Trump administration has denied the information.

Complex geopolitical developments this week overshadowed negative data on US consumer confidence in June.

David Morrison - an expert at Trade Nation commented: "It is necessary to remember that the US-China trade problem has not been resolved. Chinese Premier Li Qiang spoke in a cautious tone, calling on world leaders not to let trade disputes get overly politicized. This statement shows that although the current focus is on a ceasefire between Israel and Iran, many other simmering tensions continue to exist on the surface.

The Asian and European stock markets last night had mixed developments, mostly with slight increases. US stock indexes are expected to open slightly in fluctuations in today's session in New York.

Technically, August gold buyers still dominated in the short term, but there are signs of weakening. The next target for buyers is to close above the strong resistance level of 3,476.3 USD/ounce. Meanwhile, the sellers aim to push prices below the solid technical support level of $3,300/ounce.

The most recent resistance was a high of $3,385/ounce on Tuesday, followed by $3,400/ounce. The first support was a weekly low of $3,308.30 per ounce, followed by $3,300 per ounce.

For important outside markets, the USD index is strengthening. WTI crude oil prices on Nymex increased slightly, trading around 65 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.293%.

Economic data to watch this week

Thursday: Weekly jobless claims, long-term US orders, final Q1/2025 GDP, Waiting for sale house transactions.

Friday: US PCE core inflation.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...