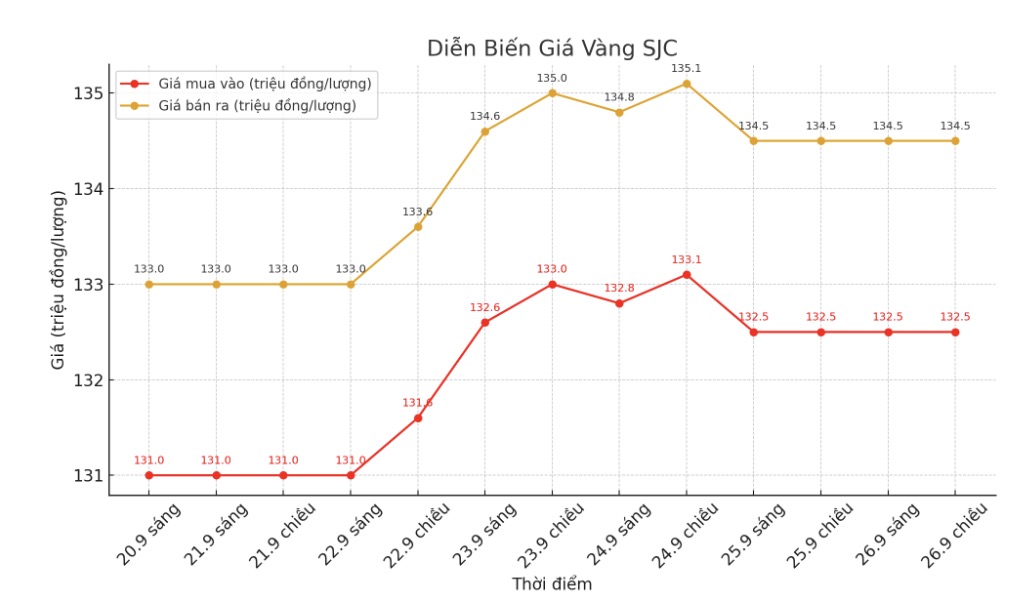

SJC gold bar price

As of 5:00 p.m., the price of SJC gold bars was listed by DOJI Group at 132.5-134.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 132.5-134.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 132-134.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.5 million VND/tael.

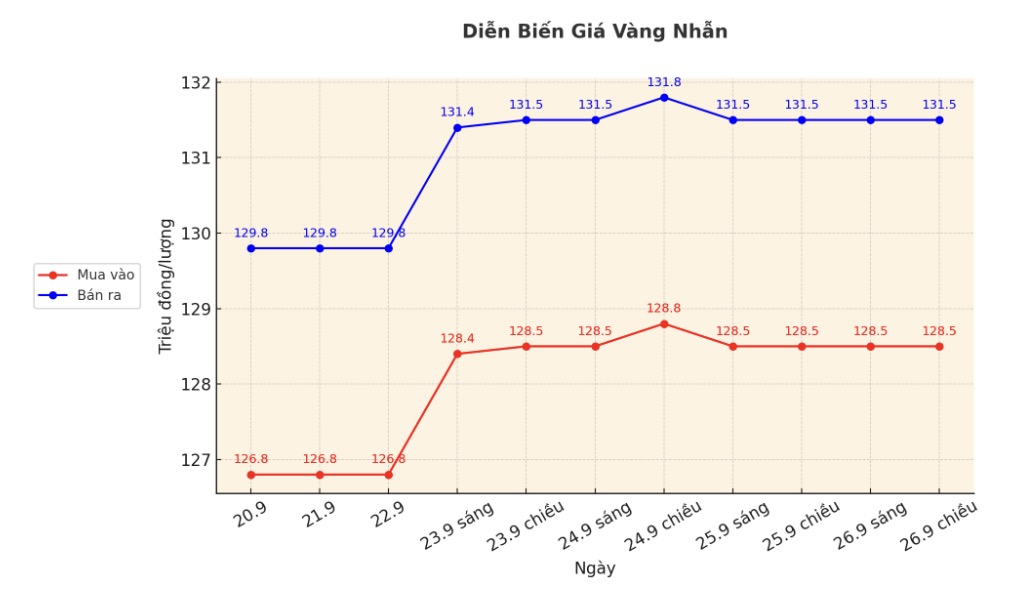

9999 gold ring price

As of 5:00 p.m., DOJI Group listed the price of gold rings at 128.5-131.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 129-132 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 128.5-131.5 million VND/tael (buy - sell), unchanged at 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

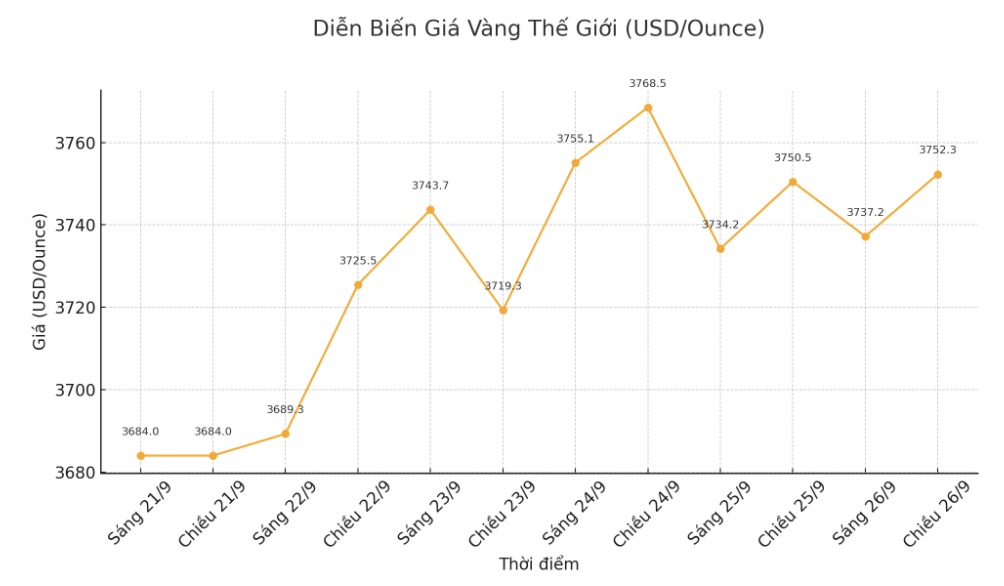

World gold price

The world gold price was listed at 5:07 p.m. at 3,752.3 USD/ounce, up 1.8 USD.

Gold price forecast

The gold market moved sideways in the trading session on September 26 (Vietnam time) as investors waited for important inflation data to be released during the day.

According to a Reuters survey, the US personal consumption expenditure (PCE) index - a favorite inflation measure of the US Federal Reserve (FED) - released at 7:30 p.m. Vietnam time, is expected to increase by 0.3% compared to the previous month and 2.7% compared to the same period.

According to CME Group's FedWatch tool, the market now predicts an 85% probability of the Fed cutting interest rates in October, down from 90% before the employment data was released. Gold is often rising in a low-interest- rate environment.

Han Tan - Head of Market Analysis at Nemo.money commented: "Gold is holding around the $3,700/ounce range thanks to the resilience of the US economy, thereby causing the FED's forecast to cut interest rates by the end of 2025 to decrease by 18 percentage points this week".

Bart Melek - CEO, Head of Global Commodity Strategy at TD Securities predicted that gold prices could reach $4,000/ounce in the short term as central banks, especially China and many emerging markets, will buy millions ofounces to increase their reserve ratio.

This is a great time for the precious metals industry. I have repeatedly asserted that the possibility of gold reaching $4,000/ounce is completely real.

Meanwhile, Stephen Innes - CEO of SPI Asset Management commented that the increase in gold is "historic and uncertain", reflecting "a deliberate global order rebalancing".

Gold is not only rising, but is breaking out strongly, making the $4,000/ounce mark clear, raising the increase from the beginning of the year to 45% and surpassing the record peak for inflation in 1980 - he wrote.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...