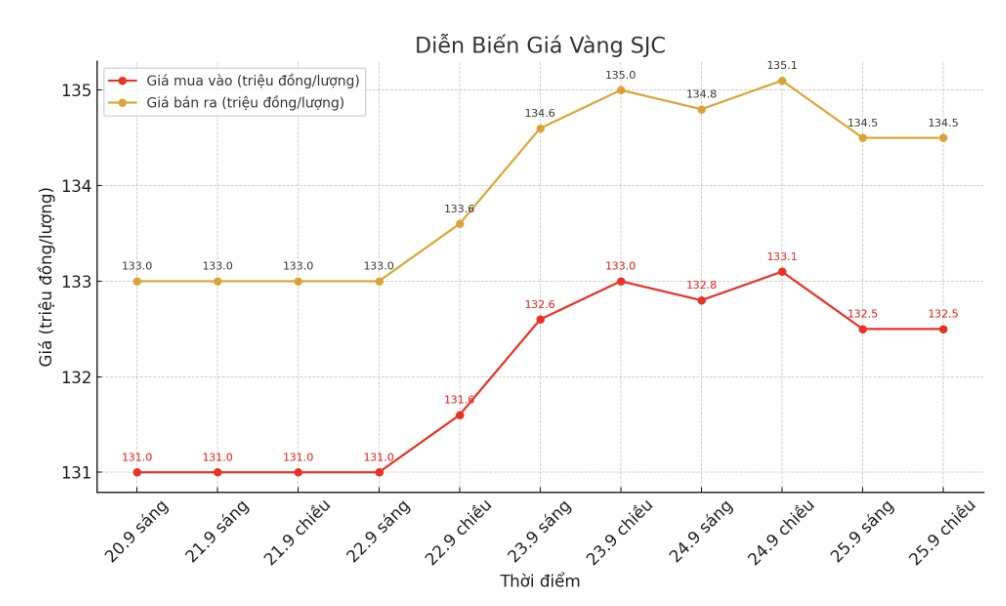

SJC gold bar price

As of 6:00 a.m. on September 26, the price of SJC gold bars was listed by DOJI Group at VND132.5-134.5 million/tael (buy in - sell out), down VND600,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 132.5-134.5 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 132-134.5 million VND/tael (buy in - sell out), down 600,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

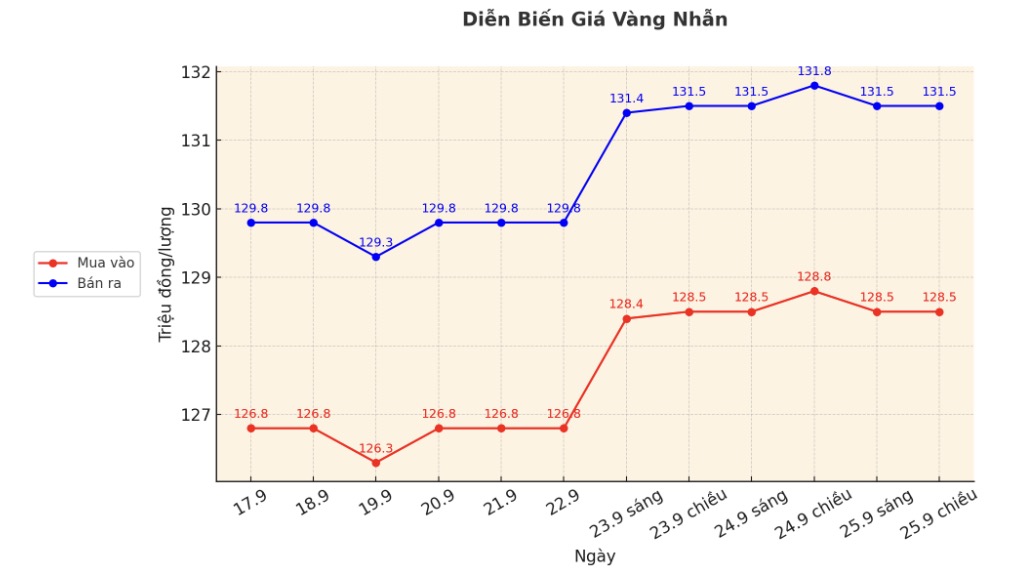

9999 gold ring price

As of 6:00 a.m. on September 26, DOJI Group listed the price of gold rings at 128.5-131.5 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 129-132 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 128.5-131.5 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

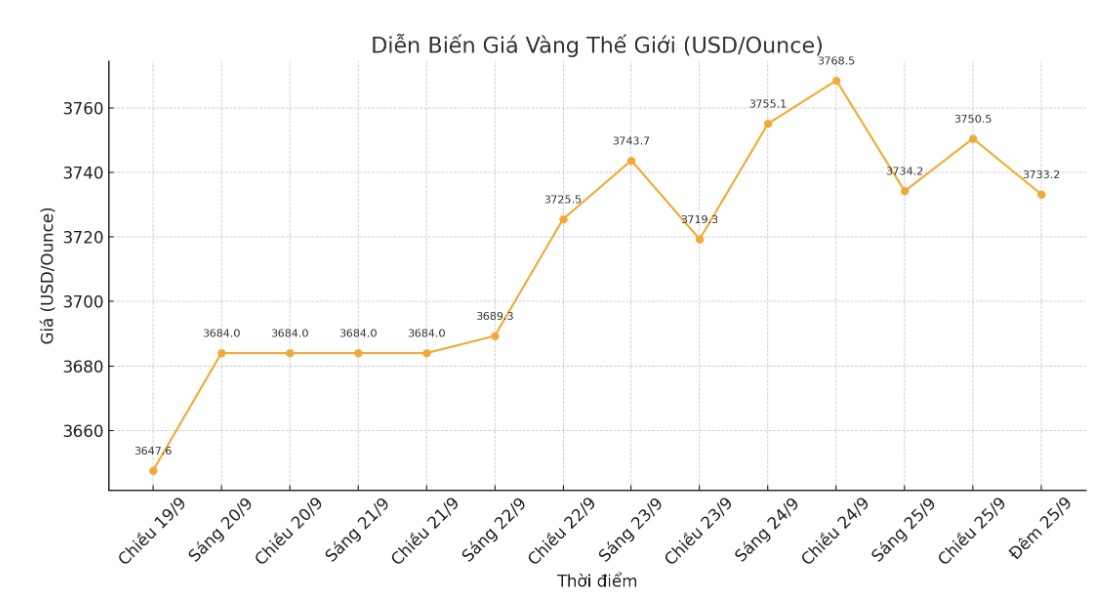

World gold price

The world gold price was listed at 10:10 on September 25 at 3,733.2 USD/ounce, down 27 USD/ounce.

Gold price forecast

World gold prices fell after the US economic report was more positive than expected, while silver prices increased sharply and set a new peak in 14 years.

The US GDP report for the second quarter just released showed an increase of 3.8% over the same period last year, higher than the market's forecast of 3.5%.

The PCE index on inflation in the GDP report was also slightly higher than expected. This GDP report is in the view of US "tailings" monetary policy makers and is somewhat at a disadvantage for precious metals.

Global stocks largely weakened last night. US stock indexes are expected to fall when the trading session in New York opens.

Despite the decline, world gold prices still receive positive forecasts from experts. Bart Melek - CEO, Head of Global Commodity Strategy at TD Securities predicted that gold prices could reach $4,000/ounce in the short term as central banks, especially China and many emerging markets, will buy millions ofounces to increase their reserve ratio.

This is a great time for the precious metals industry. I have repeatedly asserted that the possibility of gold reaching $4,000/ounce is completely real.

Meanwhile, Stephen Innes - CEO of SPI Asset Management commented that the increase in gold is "historic and uncertain", reflecting "a deliberate global order rebalancing".

Gold is not only rising, but is breaking out strongly, making the $4,000/ounce mark clear, raising the increase from the beginning of the year to 45% and surpassing the record peak for inflation in 1980 - he wrote.

According to Innes, the momentum this time is not only due to inflation, because the bond market has not issued any warning signals. Instead, gold is supported by central bank reserves, outflows and geopolitical defense needs, demonstrating systematic loss of confidence.

Technically, investors who are willing to increase their December gold contracts are still holding a strong advantage in the short term. The next target for buyers is to close the session above the solid resistance level of 3,900 USD/ounce. In contrast, the near target for the bears is to pull prices below the strong support level of $3,650/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...