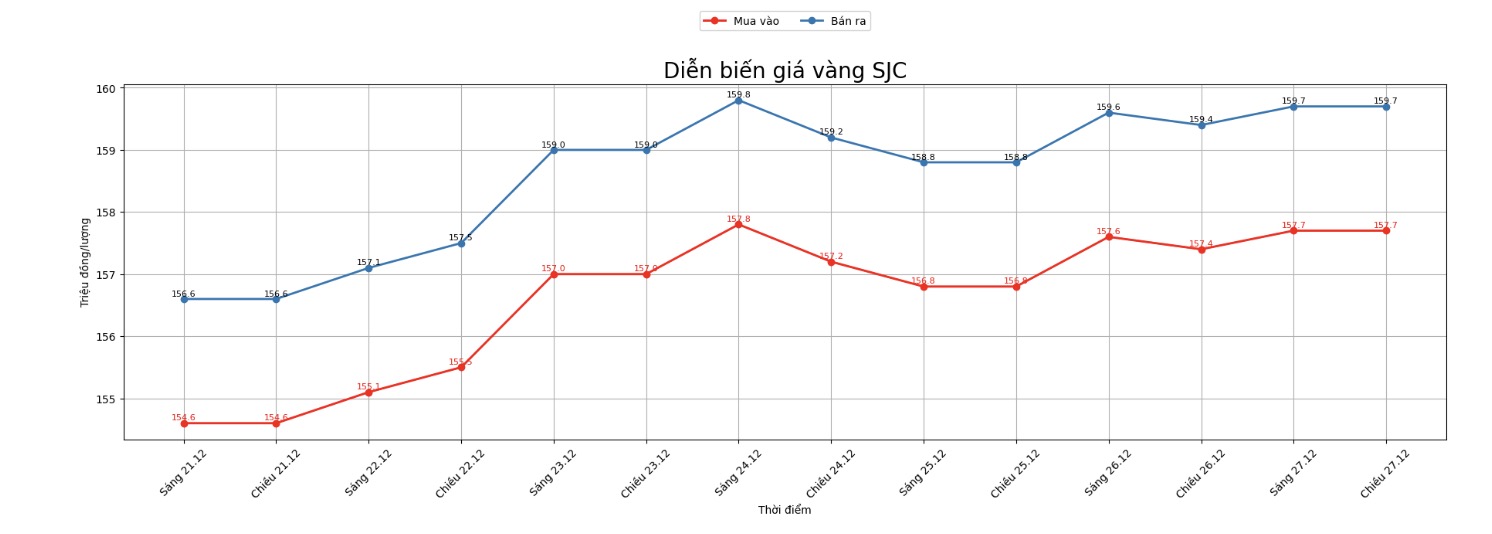

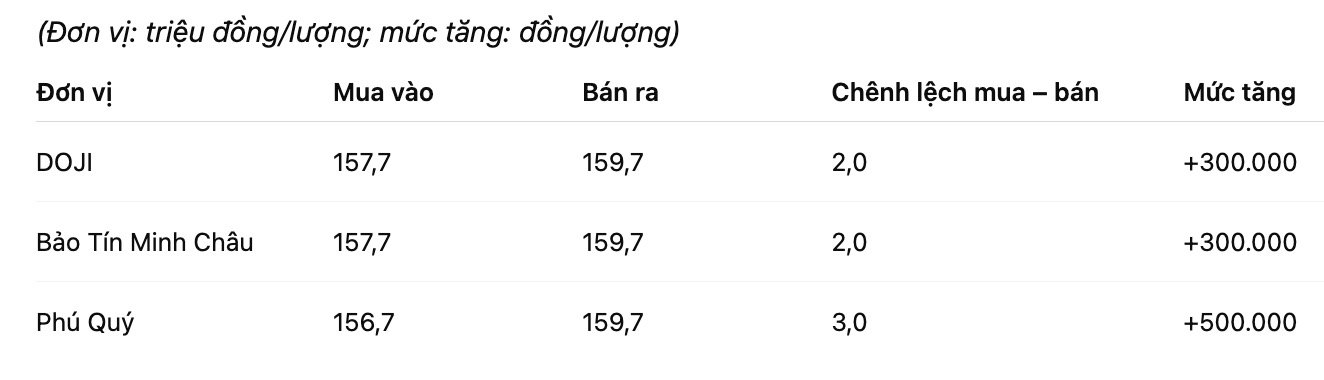

SJC gold bar price

As of 6:50 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 157.7-159.7 million VND/tael (buying - selling), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 157.7-159.7 million VND/tael (buying - selling), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at 156.7-159.7 million VND/tael (buying - selling), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

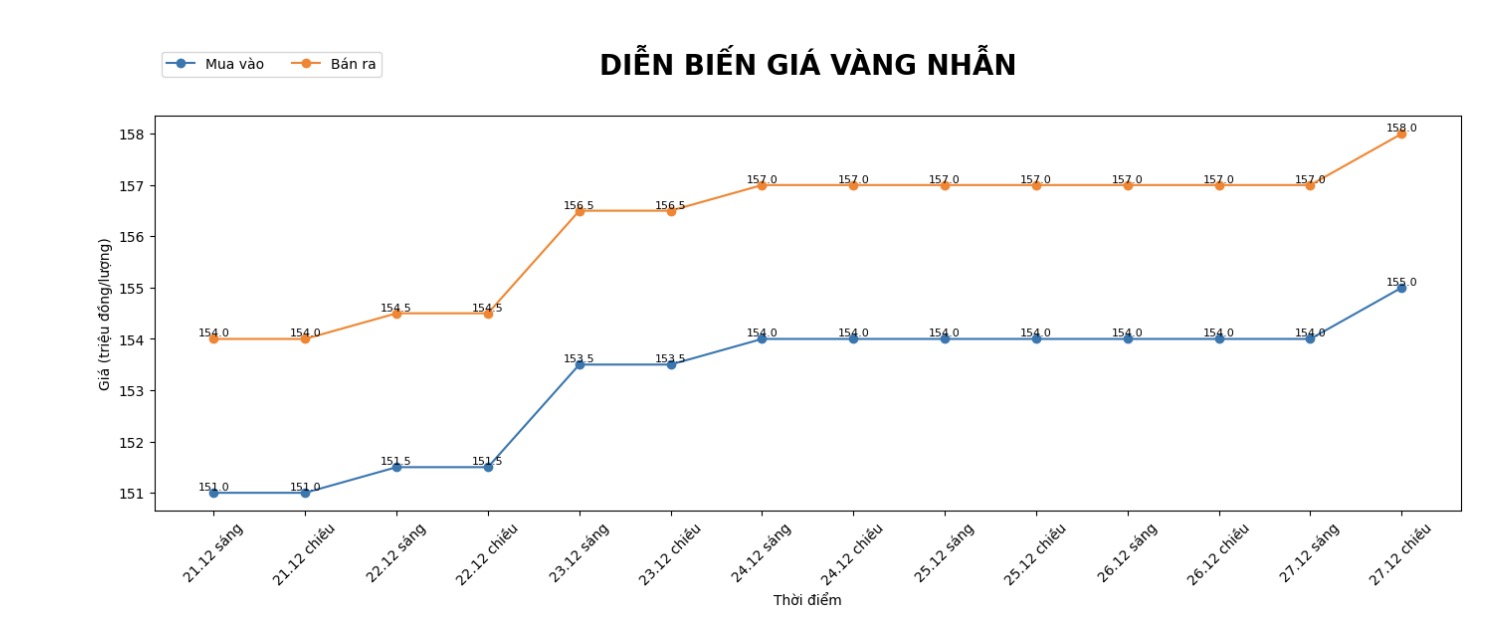

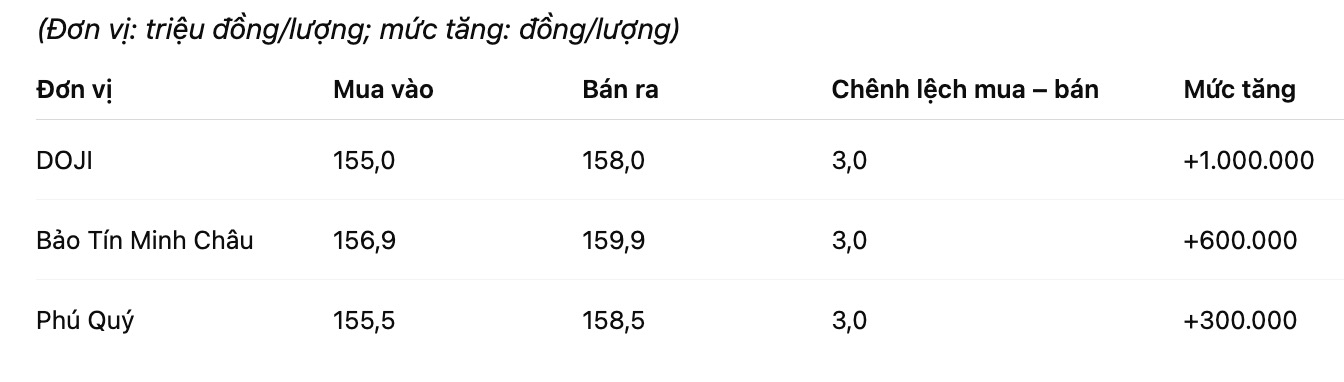

9999 gold ring price

As of 6:50 PM, DOJI Group listed the price of gold rings at 155-158 million VND/tael (buying - selling), an increase of 1 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 156.9-159.9 million VND/tael (buying - selling), an increase of 600,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 155.5-158.5 million VND/tael (buying - selling), an increase of 300,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

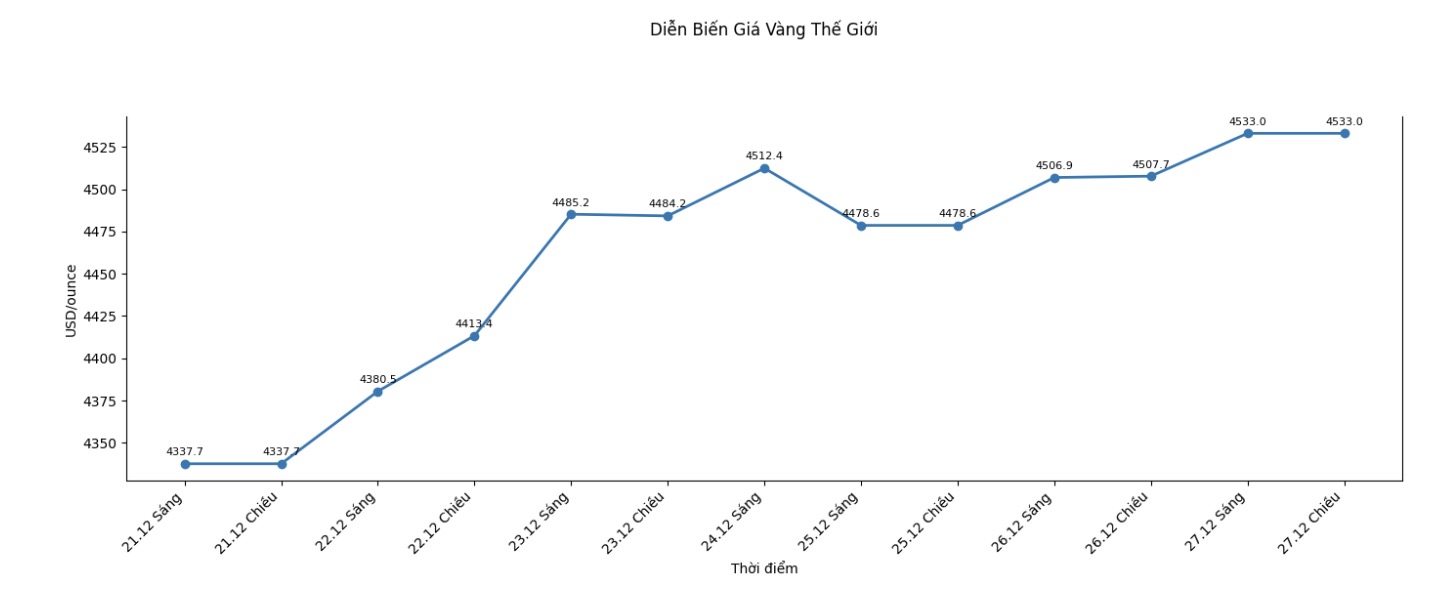

World gold price

World gold prices listed at 6:50 PM were at 4,533 USD/ounce, up 25.3 USD compared to the previous day.

Gold price forecast

Gold prices are considered the most attractive investment channel in the global commodity group and may continue to be bought by central banks.

According to commodity strategists at Goldman Sachs (a leading financial - investment banking group in the US, with a large influence in the global financial market), if private investors participate in asset diversification along with central banks, gold prices could even far exceed the base forecast of 4,900 USD/ounce.

We forecast that central banks will continue to buy gold strongly in 2026, averaging about 70 tons per month (nearly the average of 66 tons in the past 12 months, but 4 times higher than the level of 17 tons/month before 2022), and this factor will contribute about 14 percentage points to the forecast gold price increase until December 2026 for three reasons," experts analyzed.

First, the freeze of Russia's reserves in 2022 created a major turning point in how reserve managers in emerging economies perceive geopolitical risks.

Second, the proportion of gold reserves of many central banks in emerging markets, such as the People's Bank of China (PBoC), is still low compared to the global average, especially in the context of China's desire to internationalize the Renminbi. Third, surveys show that the central bank's demand for gold is at a record high.

Goldman Sachs also believes that their gold price forecast also contains increased risks if this asset diversification trend spreads to the private investor sector - which has caused investors and central banks to directly compete for gold supply, thereby contributing to the formation of a price-rising market that has lasted for many years.

Gold ETF funds currently account for only 0.17% of US private investors' financial portfolios, 6 basis points lower than the 2012 peak," Goldman Sachs said. "We estimate that every time the proportion of gold in US investors' financial portfolios increases by 1 basis point – due to buying more gold rather than price increases – gold prices will increase by about 1.4%.

In addition, Goldman Sachs emphasizes the "security" role of goods for investment portfolios in the current geopolitical context.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...